What do an interior design magazine and an online sampling platform have in common?

They have the same audience, for starters.

Last month, Folio Magazine published a compelling piece on how one magazine mogul, in particular, has successfully disrupted its business model — and why other B2B publications might consider doing the same.

“We wanted to build an ecosystem of revenue streams that would help carry us through the ups and downs of economies and through what was this on-coming digital revolution,” Adam Sandow explains to Folio.

The article profiles Sandow’s foray into these disparate revenue streams, including everything from branded content studios to newsstand distribution networks.

Why B2B Publishers Are Switching Things Up

All publishers are facing the wrath of the economy’s ebbs and flow, not just those in B2B.

Here’s proof: The New York Times Company saw digital ad revenues drop by 2.4% in Q2 2022. Yes, that New York Times.

Other publishers are feeling it, too.

Mel Magazine laid off its entire staff, while Vox Media let go of 39 employees across sales, editorial, and recruiting.

Vox Media CEO, Jim Bankoff, said: “Supply chain issues reducing marketing and advertising budgets across industries and economic pressures [are] changing the ways that consumers spend. Our aim is to get ahead of greater uncertainty by making difficult but important decisions.”

Even Meta is stepping away from news and opting not to renew deals with publishers.

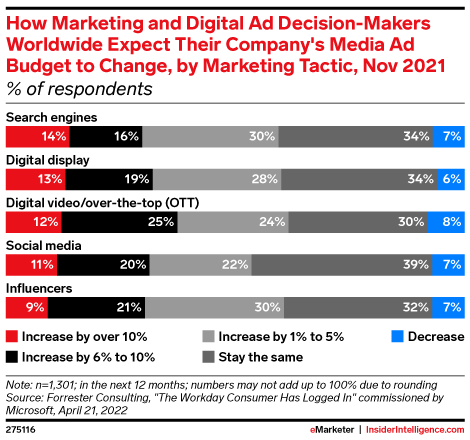

It’s not just the economy putting publishers between a rock and a hard place. Advertisers are simply moving their ad dollars elsewhere in search of more performance and efficiency. For these reasons, publishers, including those in B2B will continue to look for new revenue streams, including branded content studios and subscriber data.

B2B Publishers Embrace Branded Content Studios

Branded content studios are in-house services offered by publications, big and small, allowing brands to create native-like ads that engage the publication’s audience—and a fresh revenue stream.

According to Digiday’s Olivia Morley, content packages at Business Journals, which has a branded content studio, go anywhere between $5k and $70k.

Not only do branded content studios give B2B publishers a way to generate revenue, but they also give advertisers a way to connect with niche audiences natively and authentically, which is key considering 68% of consumers trust native ads seen in an editorial context (compared to 55% for ads on social media).

Examples of branded content studios

Here’s a good example of a branded content studio: Fast Company published a video and article showing how Pzifer uses data, AI and ML technology. At the same time, The Wall Street Journal partnered with Slack to launch a campaign that included case studies and ‘how-to’ articles designed to “spark conversation around collaboration and enterprise operations.”

Here are a few more examples:

- The Trust (The Wall Street Journal and Barron’s platforms)

- FastCo. Works

- The Business Journals Content Studio

- Bloomberg Media Group

- Forbes Content & Design Studio

Branded content studios aren’t the only way B2B publishers are driving revenue. Arguably the more impactful one comes in the form of subscriber (first-party) data.

Subscriber data for the win

Retailers have made one thing abundantly clear: First-party data reigns supreme. The explosive growth of retail media networks proves that.

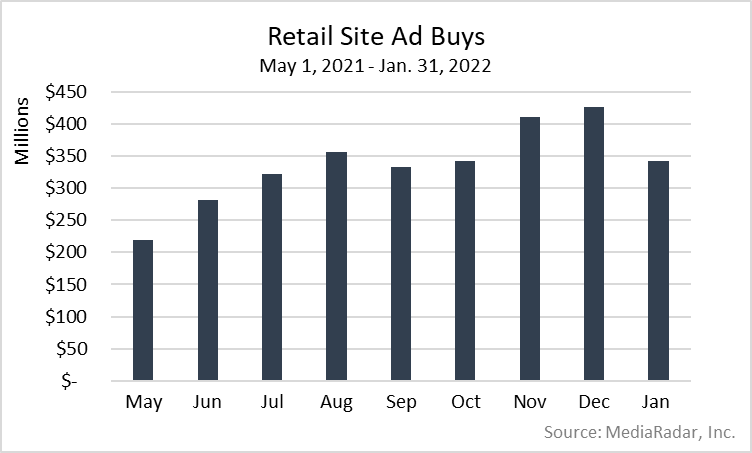

According to MediaRadar data, more than 23.5 thousand companies (approximately 38 thousand brands) bought ads on retail media networks between May 1, 2021 and January 31, 2022.

Amazon ushered in the retail media craze, but other big names have quickly followed, including Walmart and Target; eMarketer predicted that Walmart would net $2.22 billion in ad revenue in 2022.

The Home Depot and Wayfair have also opened their doors to give advertisers access to their first-party data. Even TripAdvisor is getting in on the action, making it clear that retail media networks aren’t confined to retailers.

In reality, anyone with first-party data can get in on the party, including B2B publishers.

The New York Times, for example, is approaching 10 million paid subscribers. Meanwhile, Bloomberg has more than around 370 thousand. Finally, Forbes reaches around 150 million people across platforms.

All of these publications—and more—have massive addressable audiences. Even better, they have data on most of them, which offers advertisers a direct line between themselves and incredibly niche audiences.

For the B2B publications, it offers a valuable revenue stream when they need it most.

For more insights, sign up for MediaRadar’s blog here.