Travel was one of the first industries to get hit by the pandemic—especially business travel.

Now, flights are starting to take off again. American recently announced that its July flight schedule was the strongest it’s been since March—but tickets were purchased mostly for leisure, not business.

Events have shifted online and virtual meetings have become the norm. Without a vaccine, business travel will be slow to rebound—how are travel brands adjusting to this reality?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Virtual meetings reshape business travel

A recent Uniglobe study found that virtual meetings are becoming part of the makeup of corporate life.

Thirty percent of participants said “they expect up to 25% of their travel to move to virtual meetings even if a vaccine is broadly available,” while 26% said that number would fall between 25-50%.

More than half of respondents believed that a significant chunk of the meetings and events they previously attended would be virtual even in a post-COVID world.

Many executives and employees have reported that video conferences are just as effective as face-to-face meetings. Plus, virtual calls reduce the travel costs and time devoted to making in-person deals. Virtual meetings may never fully replace the relationships built in person, but they are becoming more normal.

This is likely to make executives more selective when choosing which business trips are worth the costs, including time away from family and the office.

Travel brands are taking notices of this sweeping change.

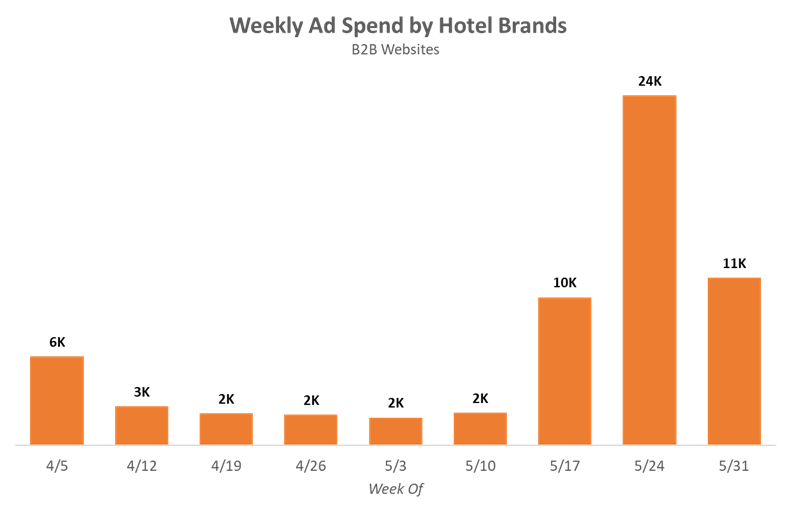

MediaRadar data shows that, prior to the pandemic, travel brands averaged just over $275 thousand on B2B websites tailored to business travelers. Since COVID-19 began, the average weekly ad spend has fallen to under $20 thousand.

Hotels see a glimpse of recovery from domestic business meetings

Hotels are seeing glimpses of recovery among domestic travelers, especially via car-travel. Right now, traffic is mostly coming from leisure and local business travelers.

Even though the business travel sector will struggle with the lack of full-scale conferences, domestic business meetings and hybrid-events may help supplement losses.

InterContinental Hotels Group CEO Keith Barr reported that drive-to markets are getting better every week. Similarly, Mark Hoplamazian, Hyatt Hotels Corp. president and CEO, said that the volume of planned business meetings later in the year and early next year are increasing, especially with the availability of hybrid meetings.

Over the past three weeks, hotel brands have accounted for 55% of all B2B travel advertising. During the same period last year, they accounted for only 13%.

For four consecutive weeks, the average weekly ad spend by hotel brands was two thousand dollars. Now, it is climbing back up. It spiked the week of May 24th and came back down to eleven thousand dollars the following week.

Even though virtual meetings are effective, many business people miss the travel and in-person experience of deals and problem solving. It appears that hotels are trying to tap into that feeling—the creative across brands is positive, emphasizing wellness and lovable experiences.

International travel will be slower to recover

The Global Business Travel Association polled members in June and found that 60% believed that employees would start traveling within the next three months. Only 24% said they thought international trips would resume during the same time frame.

One creative solution for international business travel may be “travel bubbles,” or countries agreeing to allow certain travelers to bypass strict quarantine measures. This could require travelers to get tested for coronavirus within forty-eight hours of boarding planes and be subject to tracking.

The details have yet to be ironed out, and other countries are nervous about the rising number of cases in the U.S.

“There’s a concern around ensuring the corridor is kept whole. If you fly into Washington, the UK and U.S. wouldn’t want you to visit New York for the day,” explains Vice President of SITA Jeremy Springall. “The risk profile of London-Washington is manageable, but if you start traveling around the U.S., it rises, so we’ll need some way of managing people’s travel once they get to the destination, to make sure this arrangement works.”

U.S. travelers are still banned from many regions, including Europe. Until there are systems, policies and technology in place, international business travel will be limited.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.