We thought that OTT would be the place for direct-to-consumer (DTC) brands to actively advertise in 2020. People were streaming ceaselessly, shopping online, and, even before COVID, brands were flocking to OTT.

However, the data suggests that DTC brands had other plans. Where did they funnel their advertising dollars instead?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

In Face of Tight Competition, DTC Brands Increased Their Online Advertising

With the increase in online shopping during COVID, it only made sense that DTC brands would see a surge in purchases. Companies like Chewy, Casper, and Wayfair saw revenues rise at the beginning of the pandemic. However, analysts say that profits were cut by raising prices of online customer acquisition—aka advertising.

Online ad prices dropped at the beginning of the pandemic, but they returned to pre-COVID levels quickly. And the costly thing for these brands is that many DTC industries are saturated markets.

Tyler Higgins, leader of the retail practice at global management consultancy AArete, explained to Retail Dive, that when a consumer clicks or searches for a mattress brand, “all of a sudden they’re getting mattress ads from three or four different brands.”

It’s true—our data backs it up. Between January and November of 2020, there were 2,517 DTC brands placing ads online. This is up 44% from the 1,732 DTC brands placing ads in 2019 in the same period.

As the holidays rolled around, even more brands placed online ads. In November 2020 alone, there were 1,308 DTC brands advertising, which is more than any other individual month in 2020.

Our current data doesn’t currently include December numbers, but based on the current trajectory, we estimate that DTC brands spent roughly $1 billion by the end of the year.

Considering that DTC spend was depressed in the earlier part of the pandemic, this hints that the overall DTC advertising market is growing. OTT-specific spend from DTC brands, though, is a different story.

DTC Brands Cut Back on OTT, While Others Jumped In

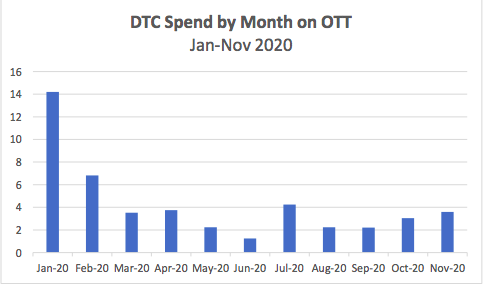

At the beginning of the year, pre-pandemic, DTC brands were each spending an average of $152 thousand a month on OTT advertising. We expected to see continued active spending in OTT through the year—however, this was not the case. By November, the average for spending per brand dropped to $50 thousand.

These cuts led to a significant drop in total spend, from $14 million in January to only $3.5 million in November.

We want to note: the decreases in spending were not coming from a select few industries or leading brands. They were spread across the board. The top 5 DTC brands in OTT, for example, followed the same trend as the full population of DTC brands, meaning that this low average can’t be blamed solely on smaller DTC brands.

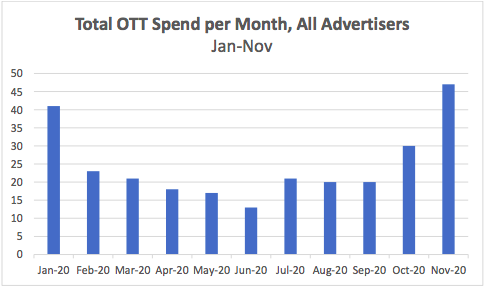

This significant drop in spending is surprising because in January, DTC brands made up a whopping 35% of all OTT spend. And over the course of the year, OTT spend declined every consecutive month. By November, DTC spending made up just 8% of total OTT spend.

At the same time, both overall OTT spending and overall DTC spend sharply increased at the end of the year. October and November sales on OTT channels were double any prior month since February 2020.

While DTC brands pulled dollars out of OTT, other companies started pouring theirs in. At the same time, DTC brands were still spending more, just on other digital channels. Digital spend from DTC brands increased 22% between January and November 2020.

As 2021 progresses and the economy finds its footing, DTC may begin investing more in the OTT space again. But for now, it appears that their advertising budgets are being funneled elsewhere.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.