If you’ve been keeping up with our latest blog posts, you know that we’ve been sharing how the ad industry is being impacted by coronavirus.

Travel ad spending dropped suddenly. Trade show cancellations are snowballing. Meanwhile, streaming services are ramping up.

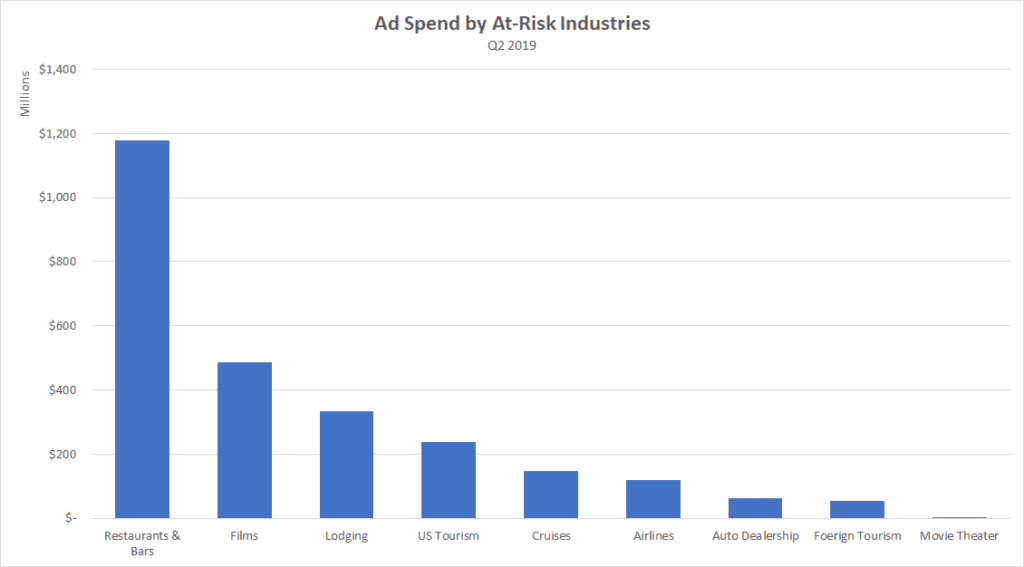

While all business is affected by this pandemic, some industries are getting the short end of the stick more than others. We took a look at “at-risk” industry ad spending from last year. This gives us some insight into the money that is at stake over the next few months.

We encourage you to subscribe to our Blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

“At-risk” industry spend in Q2 of last year

As we approach Q2, we know that advertising spending is going to look dramatically different than it did last year.

Last year, in Q2 alone, more than $31B was spent on advertising across all media formats. Over 205k unique brands ran ads.

When looking at industries that spent on advertising, we can identify the industries that now appear to be the most “at-risk” due to this virus.

At-risk industries include:

- Restaurants

- Films

- Lodging

- US Tourism

- Cruises

- Airlines

- Auto Dealerships

- Foreign Tourism

- Movie Theaters

Made up of 12.5K brands, the at-risk industries spent $2.6B on ads.

By far, the largest spenders were restaurants and bars. This category saw 4.5k brands spend almost $1.2B.

Now, as dine-in restaurants and bars are being ordered to close across the US, they are facing extreme hardship. This crisis will completely change how restaurants do business, and how they promote products.

A look at restaurant ad spend

While restaurants spent $1.2B in Q2 of last year, most of those dollars did not come from local mom and pop shops: 91% of the spend came from major chains.

Restaurants like McDonald’s, Burger King and Taco Bell are not immune to the impact of coronavirus, but are not the ones going under. Instead, Charley Grant at the Wall Street Journal predicts they are likely to take up even more of the market share as they pivot and have greater ability to rebound in a less-saturated market.

McDonald’s has already closed its dining rooms and moved all services to delivery. Other major chains have done likewise. Chains that were already set-up for delivery services (i.e. Dominoes) are expected to do well as we ride this out. Consumer behavior hasn’t changed, and people are likely going to want something to lighten up their cooking load and bring them comfort in such harrowing times.

We have not yet seen any shifts in ad buying behavior week-over-week from major chains and it is unclear how these companies will respond in the future.

Will they stay on track with advertising to promote delivery options, or perhaps to take up even more market share? Time will tell.

Travel industry ads are looking grim

Lodging, US Tourism, Cruises, and Airlines certainly have a bleaker outlook.

While restaurants can temporarily pivot to take-out and delivery, these industries are facing true hardships. In Q2 last year they combined for nearly $850M in ad spend.

In terms of companies that are removing ad spend, we will be watching airlines in particular. During Q2 last year 72% of their budgets were spent on digital ads. Digital is bought (and likely, cancelled) with the shortest notice compared to TV and print.

So far, the travel industry has quickly reduced its ad spend. Spending cuts started in mid-February. Comparing the first week of February to the first week of March, we saw a decrease in ad spend by 30%.

Specific TV events

We will continue to monitor specific events that bring in significant ad revenue, like sports events for example.

On March 11, after one player on the Utah Jazz tested positive for coronavirus, the NBA announced that it would be suspending the rest of the season.

During Q2 last year (when playoffs took place), the games brought in $689M in total TV ad spend. This will be by far the biggest hit, as it is almost double the ad revenue generated by the other three sports games in Q2 combined.

Almost all major sports have been suspended or cancelled around the world, except for the most obvious sporting event of the year: the Olympics. The Olympics, scheduled to start July 24, have not yet been cancelled.

Only time will tell how much money is left on the table for advertisers to spend, which industries will increase their spending and which will proceed more conservatively.

Keep track of how coronavirus is impacting advertising. Subscribe to our blog to get the most recent ad data and trends.