The streaming wars are never dull. As we enter a season of new ad-supported streaming services, bundles, and steep discounts, OTT companies need to get their name and promotions out in front of audiences. How much are OTT brands spending on advertising and across which formats?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Streaming Competition Grows Stronger, Forcing Services to Expand Advertising Reach

The new Paramount+ launches this week, adding another megaforce to the streaming landscape. With over 20,000 pieces of content to choose from, consumers who’ve rewatched all their favorite Netflix, Amazon Prime Video, or Peacock shows, might be tempted to sign up for yet another streaming service.

If their pockets are stretched thin for paying for other subscriptions, they’ll be happy to learn that Paramount+ has an subsidized ad-supported tier, in addition to the premium tier.

Paramount+ isn’t the only new service on the scene.

Discovery+ was released on January 4th, with ad-supported and ad-free tiers. Discovery+ offers niche, non-scripted content. The company has a different long-term strategy than other services. It sees itself as a complement to “Tier A” providers—i.e. Netflix, Amazon Prime Video, Disney+, etc.—rather than a direct competitor.

At the same time, Disney+ is appealing to a larger audience in international markets by adding more adult programming (under the new brand Star).

As content powerhouses enter the scene or expand, companies have been slashing prices, offering bundles, and heavily promoting themselves.

“If you’re ad-supported, you have to be very big and very broad to be successful,” explained Starz CEO Jeff Hirsch to CNBC. Because the price of digital advertising is cheap compared to TV, ad-supported OTT services (who are transforming a TV product into an online one) need to significantly increase their user base to hit profit benchmarks. To do that, they’re advertising—a lot. And especially on TV.

“You saw the power of TV advertising during the Super Bowl,” continued Hirsch. “All of these media companies were running commercials for their streaming services on television.”

MediaRadar Insights

So, just how much are they spending?

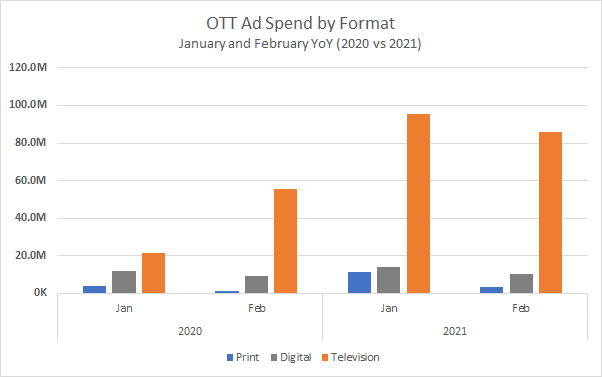

In January and February of 2021, OTT companies spent $223mm in across national tv, print and digital formats. This is up 116%, compared to January and February of 2020.

Television continues to be the heavily favored format 2021, accounting for 83% of ad spend.

In January-February of 2021, the top 5 OTT advertisers were:

- Discovery+

- Paramount+

- Hulu

- Disney+

- Peacock

4 out of these top 5 brands were launched within the last year and a half (with Paramount+ scheduled to be launched this week). These companies made up 76% ($164.4mm) of OTT ad spend in January and February.

This increase in ad spend reflects the tight competition for larger audiences as services launch, expand, or offer promotions to lock customers in.

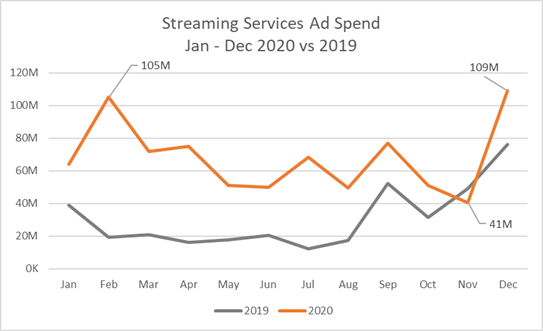

In 2020, ad spend by OTT companies decreased at the beginning of March (due to the pandemic). Though spend wasn’t consistent throughout the year, spend only dipped below 2019 levels once in November, for a very short period of time. It then increased dramatically in December, in advance of large launches.

OTT spent over $890mm in ad sales in 2020. Overall, print fell just 5%, but monthly print ad sales fell 37% YoY. However, since the digital and television formats increased 147%, the decline in print ads did not heavily impact the overall spend.

Of the 5 new streaming services launched slightly before or during 2020 (Disney+, AppleTv+, HBO Max, Peacock, and Quibi), 4 were in the top 10 advertisers of 2020.

(Note: Though Quibi ranked in the top 10 advertisers of 2020, they stopped purchasing ad space by mid-September, and announced their closure in October).

In 2020, the top 5 OTT advertisers were:

- CBS All Access (now Paramount+)

- Hulu

- Disney+

- Amazon Prime Video

- Discovery+

Other than the CBS All Access revamp, the top advertisers haven’t changed over the last two months.

For contacts to these brands and their advertising agencies, or data to form a perfect pitch, try a custom demo of MediaRadar.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.