Google’s announcement that the company would definitely steer away from individualized ad targeting sent the industry scrambling.

Some leaders have said they’ve been preparing for something like this for a decade, while others are indignant. They argue that this move makes Google’s outsized grip on ad revenue even stronger.

Even though the future of the ad tech industry remains uncertain, advertisers are spending heavily on programmatic. The industries who spend the most on programmatic will need their ad tech vendors to come out strong from this season of change.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Google’s update feeds into a consolidating market

The Google announcement has made analysts question the relationship between consumer privacy and market dominance.

KeyBanc analysts put it this way: the move “clearly [would] favor Google over the open Internet, and poses an interesting dilemma for regulators — how should consumer privacy be balanced against market power?”

Any move Google makes clearly affects the entire ad tech ecosystem, and without government intervention, they’ll not make a move that will cut into revenue, even if the policy is made in the name of consumer privacy.

It is still unclear how this will affect Criteo, The Trade Desk, and LiveRamp. Google hasn’t clarified if it will restrict outside alternate identifiers, like the Unified ID 2.0. But it has criticized these solutions in the past.

With no definitive road map, the industry is going through a shakeout.

Major companies are getting stronger and smaller companies are consolidating. Recent mergers and acquisitions include: Magnite and Spotx, Smart Adserver and Capital Croissance, Liveramp and Datafleets, District M and Sharethrough. And Viant went public in February.

“The ad tech market…is inherently suited for a small number of behemoth winners — with independents/startups operating on the fringes until they get bought by the leaders,” said Ruben Schreurs, group chief product officer at Ebiquity, to Digiday.

It’s a hot market—but it’s unclear how long all this investment activity will last. Which industries depend most on their ad tech partners coming out as winners?

MediaRadar Insights

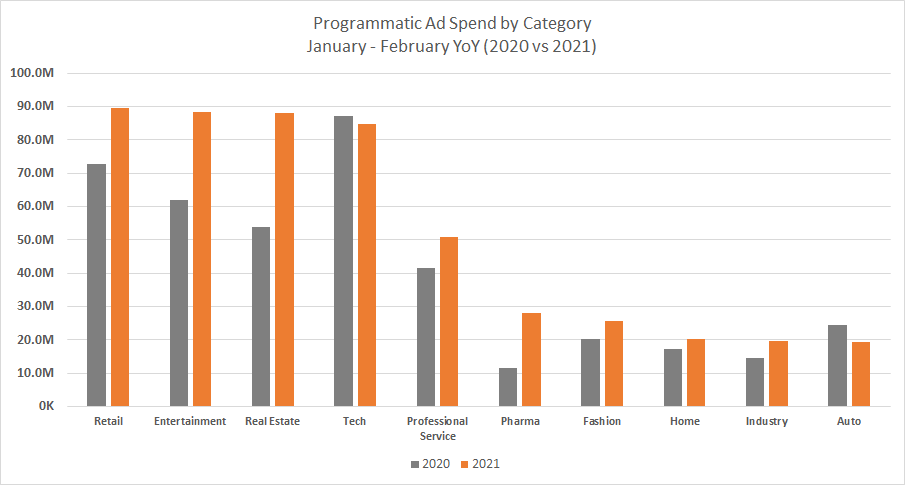

In January and February of 2021, there were 81k brands spending $702mm in programmatic ad spend.

This is a 65% increase in the number of brands and a 29% increase in ad spend over 2020, where 49k brands spent $543m in the digital programmatic space. This is likely due to brands needing to see more return during the pandemic, and embracing programmatic as a central part of their media buying.

The top four categories in 2021 are Retail, Entertainment, Real Estate, and Technology. They account for 14% of ad spend each.

This is a slight change from 2020 where Tech was the leading category, and the Real Estate and Entertainment categories had smaller spend. Real Estate is going through a frenzy, making the significant increase in programmatic advertising understandable.

In the smaller categories, Pharma more than doubled its ad spend, due in large part to campaigns from Vicks Nyquil and Dayquil campaigns. Their spend accounted for 17% of ad spend in the Pharma category over the past two months.

As brands ride out this phase of ad tech consolidation, we’ll keep you updated on notable spending trends.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.