If you think you’ve been hearing about OTT a lot lately, you’re probably right. The COVID-19 pandemic has served as a catalyst for extreme growth in the popularity of OTT entertainment and advertising.

Hopefully, the virus will soon lose prominence and disappear from the global scene. OTT, though, seems here to stay.

As the shift to OTT gains momentum, advertisers are responding. How many brands are now advertising on OTT but not TV, and how many are taking advantage of both?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

OTT is an ongoing (and largely successful) experiment

At the start of 2020, industry experts knew that a shift in advertising practices was coming. OTT content was drawing viewers at a faster rate than it was driving advertising dollars, an imbalance that was sure to right itself.

As the shift drew nearer, OTT platforms experimented with new ad spaces in an attempt to appeal to both viewers and brands, though with mixed results.

“If there’s an ad experience that makes advertisers happy, allows the platform to further monetize itself, and consumers are down with it and finding utility from it, it certainly sounds like it could be a win, win, win,” says Bill Durrant of Exverus Media.

Because OTT is such a new advertising outlet, there’s a lot of experimentation to be done before platforms, advertisers, and consumers decide what will stick around. For the time being, just getting in the game may be the way to go. Anything done in the OTT space can be viewed as a learning opportunity.

The lockdowns and stay-at-home orders mandated to help slow the spread of COVID-19 provided the perfect opportunity to test out these new methods as audiences flocked to online streaming services.

In Q2 of 2020 alone, ad revenue from CTV increased by slightly more than 25%—a significant feat in a time when many markets were plummeting.

This revenue increase was driven by the quickly-rising number of subscribers on most platforms. Netflix alone gained 15.7 million paid subscribers in Q1 of 2020, with other platforms—including Disney+, Hulu, and HBO Max, and Amazon Prime Video—seeing similar trends.

It’s not only the number of people watching that’s increasing, either. The time spent per user on these streaming sites is projected to increase by at least 23% in 2020.

MediaRadar Insights

Methodology

We analyzed data from a dataset containing only four channels: ESPN, Bravo, Fox News, and TBS. These were chosen in order to get a wide view of the OTT landscape as these channels draw different audiences. In the future, this information will be available for over 23 channels.

Findings

There are 118 thousand unique brands that advertise on OTT.

21 thousand of them—or 18%—are exclusive to OTT, while the remaining 97 thousand brands also buy ad space on linear television.

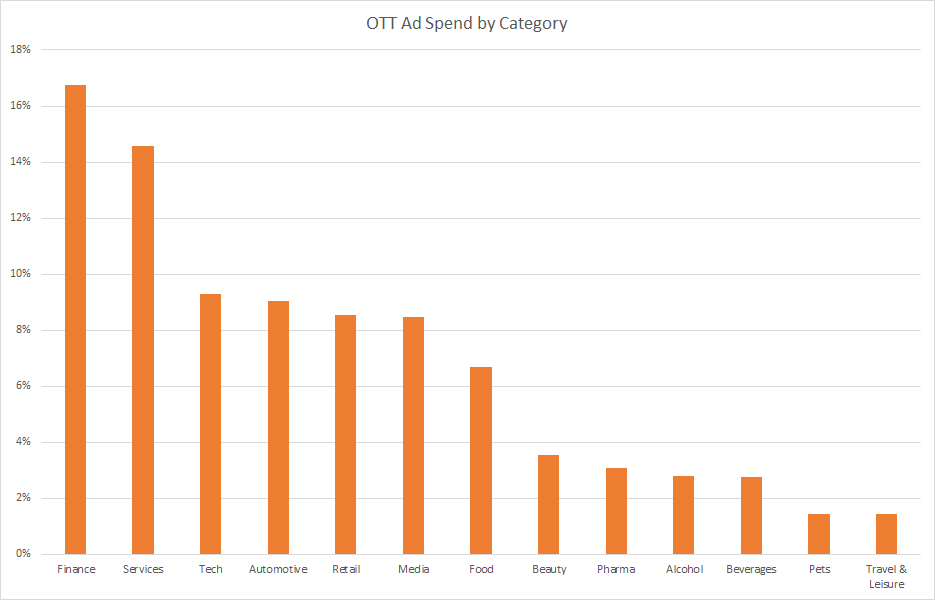

Of those brands that only advertise on OTT channels, 17% of the space is taken up by those in the finance category. For example, brands such as Clutter, Inc. and E*Trade Securities Brokerage Account buy ad space on OTT platforms but not on the corresponding networks on linear TV.

Though there is a great deal of experimentation going on in this format, there are overlapping trends. Specifically, when the ad format mimics linear TV formatting (i.e. a video break in the show), OTT advertisers tend to advertise individual items or products. Advertisers have promoted specific products on linear TV for years, but it is now proving more effective to promote items on OTT because of targeting features.

OTT advertising is in its beginning stages. We’ll continue watching how traditional TV advertisers adopt OTT as a new layer to their media mix or migrate over completely.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.