While there is still much left in the air as far as COVID-19’s total impact on American life, one thing is certain: we certainly won’t be seeing professional sports any time soon.

The NBA and NHL both put their seasons on pause in early March. The MLB cancelled the remainder of Spring Training and delayed opening day. While sports leagues, athletes and fans hope for the seasons to start again, it seems that it will be a while.

The most recent reports from all three leagues suggest that the sports will not resume until at least June.

During this time, the NBA & NHL typically wrap up their seasons and move into the playoffs. At the same time, the MLB official season begins. That is a significant window of ad opportunity left empty.

To understand the impact of these cancellations on advertising, we analyzed the time-frame we currently suspect will be without sports (Mar-May) from previous years.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Advertising on Professional Sports Networks

We broke our research down into the brands and industries that advertise across all three sports, and the total breakdown of revenue.

Advertisers

Between March and May of last year, over 900 different companies advertised during a TV broadcast of a professional sport. From that large range of brands, we can identify the main advertisers and industries.

In 2019, these top 5 advertisers bought ads in broadcasts for all three sports:

- AT&T

- An-Bev

- Hyundai

- Pepsi

- Geico

Between March and May, these five spenders collectively bought $147M worth of advertisements on sports broadcasts across all three professional leagues.

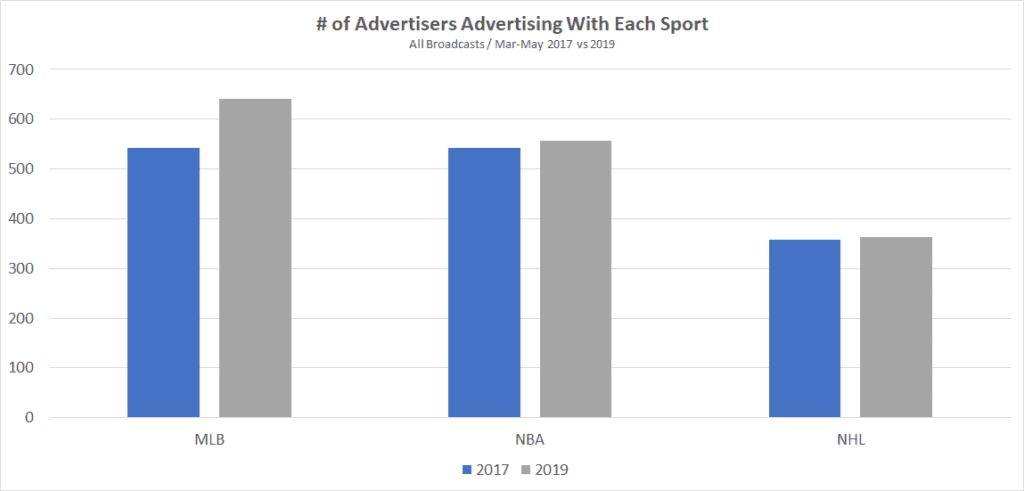

The MLB saw the most advertisers and had also seen the most growth in the number of brands advertising during the games with a 18% increase since 2017.

Industries

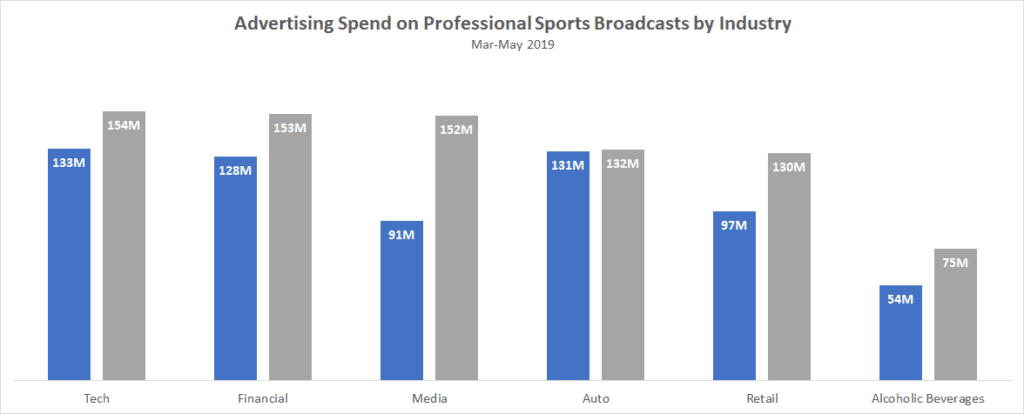

Looking across all three sports in 2019, 6 industries account for nearly 80% of the advertising spend.

Of them, tech is the largest buyer of advertising dollars, just like it was in 2017. In particular, cell phone providers like AT&T and Verizon are some of the main advertisers we see.

Automotive, however, has slid from 2nd to 4th as the largest advertising industry in the two-year span. Automotive companies held their investments steady while others boosted their spending. (There is more to that story. Details on automotive’s shifting advertising can be found here).

Total Advertising Spend During Play-off Season

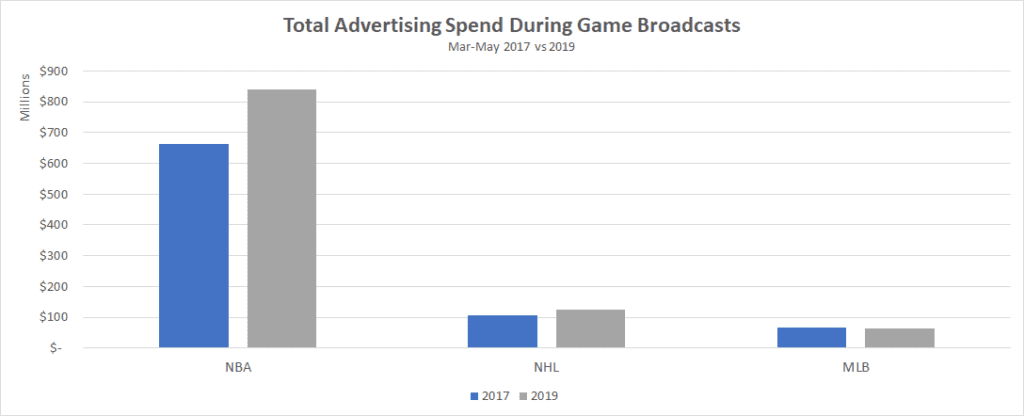

Combined, the three sports account for over $1B in advertising spend during the time frame.

Broadcasters feel the suspension of NBA games the most. Last year, during the month of Mar-May NBA broadcasts, the NBA generated $839M in ad revenue. Each playoff game through the conference finals (which ended 5/25) averaged 3.95M viewers.

Behind the NBA is the NHL. The majority of its playoffs occur in the same window of time. In 2019, the broadcasts of NHL games brought in over $120M in ad dollars for the broadcasters.

The MLB, meanwhile, brings in over $60M in the first couple of months of the season. The notable difference in ad revenue is due to the fact that the season is just getting started with early season games, rather than playoffs.

It is still unclear what sports networks will do to fill the massive void of live sports for the next few months. We will continue to monitor ad spending and trends as the coronavirus unfolds.

There is more data to come. Subscribe to our blog for the latest updates.