The auto industry is grabbing headlines as it navigates major industry changes.

The electric-vehicle revolution remains strong. Tesla actually sold more cars than BMW in 2021.

The COVID-19 pandemic also caused some shifts, albeit temporarily. During the pandemic, used car prices boomed. Now, they’re coming back down to earth.

The CEO of Ford even endorsed the idea of selling cars online, similar to Tesla.

Combine that with fierce competition, and auto advertisers are under more pressure than ever to get consumers into their showrooms (proverbial or otherwise).

So, how are they spending on programmatic advertising?

Let’s find out.

Automotive Programmatic Advertising Is All Over the Road

Automotive advertisers have been riding a rollercoaster for some time now.

In 2019, the number of advertisers buying programmatic ads remained flat. (2,372 brands in 2019 vs. 2,381 brands in 2018). Car sales were down in 2019, but brands sold more than 17mm cars.

At the time, SUV brands made up the largest type of car category to spend on programmatic ads, accounting for 26% of spending. Meanwhile, pickup trucks made up 12% of programmatic ad spend, followed by sedans at 10%.

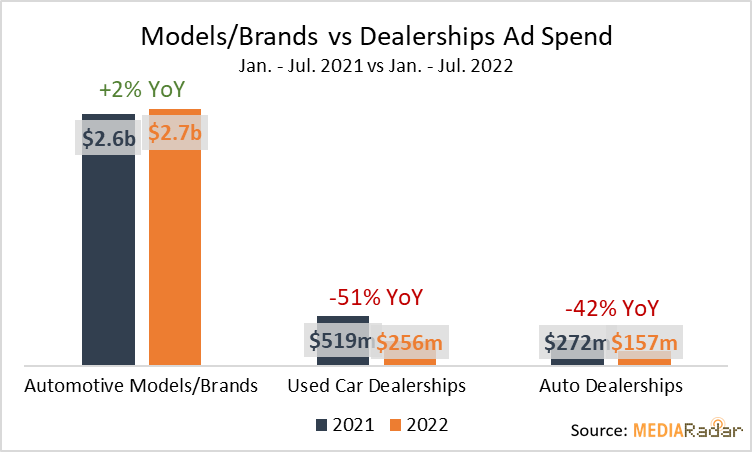

Between July 2021 and July 2022, automotive brand/model advertisers spent $2.7b, up 2% from the year before (on all media formats).

Of late, the auto advertisers taking the biggest hit came from dealerships (used cars and auto). Used car dealerships decreased spending by 51% YoY, while auto dealerships did the same by 42%.

While much of these decreases came from reduced TV spending, they indicate how advertisers will spend in 2023. If auto advertisers see their budgets drop in light of an unstable market, programmatic ad spending will likely tick up as they look to maximize every ad dollar, something traditional ad formats simply can’t offer.

Even more telling of how automotive advertisers will spend on programmatic ads in 2023 is their behavior toward the end of 2022.

According to MediaRadar data, automotive advertisers increased spending by more than 15% WoW (December 12, 2022 vs. December 5, 2022), hovering around $100mm. Import autos, pickup trucks, and SUVs were the top models advertised.

As inventory levels return and prices come back to a level consumers can stomach, it seems likely that programmatic advertising will follow. That said, the recession will certainly impact car buying, which will, of course, impact the amount automotive advertisers can justify spending.

Which Auto Advertisers Will Spend in 2023?

The state of automotive advertising is clearly on shaky ground, but we can conclude which of these advertisers are likely to spend in 2023.

The lion’s share of the spending will undoubtedly come from auto models and brands (like it has in the past). However, expect to see the continued emergence from advertisers in a few pockets of the market: electric vehicles and anything related to travel.

Electric vehicle advertising is a no-brainer. Electric vehicles are slowly gaining mainstream status. Ad spending from Hyundai, General Motors, and Lucid Motors will follow. If Tesla sticks to its historical ad strategy, it won’t be among those digging into their wallets.

Advertisers who fall into travel-related segments—think RVs—will likely spend, too, as people eagerly hit the road for the first time in years.

For more insights, sign up for MediaRadar’s blog here.