Restaurants and bar closures have upended the industry’s supply chains. Even the largest of brands have been affected.

Take Coca-Cola, for example. Many people think of Coca-Cola, with more than 500 worldwide brands, as a consumer brand.

Many consumers enjoy its products — Coke, Dasani Water and Gatorade — at home. In fact, when people were ordered to shelter in place, sales spiked (although they have since leveled off), so that was good news? No.

Almost half of all of Coca-Cola’s sales worldwide come from restaurants, bars, movie theaters, and sporting events. Coca-Cola’s total volume was down 25% in April due to the sudden halt of normal social activity.

Coca-Cola is not alone. Many other B2B restaurant and bar suppliers are struggling to redirect their business and get products in the hands of customers.

This led to an initial drop in online advertising, but we have seen early signs of recovery. How will B2B restaurant supply chains move forward?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Restaurant and B2B Supply Chains Struggle

The first to feel the weight of the coronavirus pandemic in the restaurant industry were customer-facing workers and owners. While many restaurant owners tried to rely on take-out orders and delivery, many were forced to close temporarily or for good.

But the pain goes deeper.

The complex restaurant B2B supply chain industry — made up of fishermen, farmers, bakers, florists and more — has seen dramatic cuts. The exact size of this market is unknown, but it is estimated that independent restaurants spend anywhere between 20-35% of their revenue on supplies. Many of these supply businesses have temporarily closed. Others are trying to get their products directly into the hands of consumers.

Farmers have been hit particularly hard. There is zero demand for the acres of product they worked on for months. Instead, farmers are plowing acres of crop while taking a complete loss. This has led to a devastating amount of food waste, even while many Americans and individuals around the world go hungry.

MediaRadar Insights

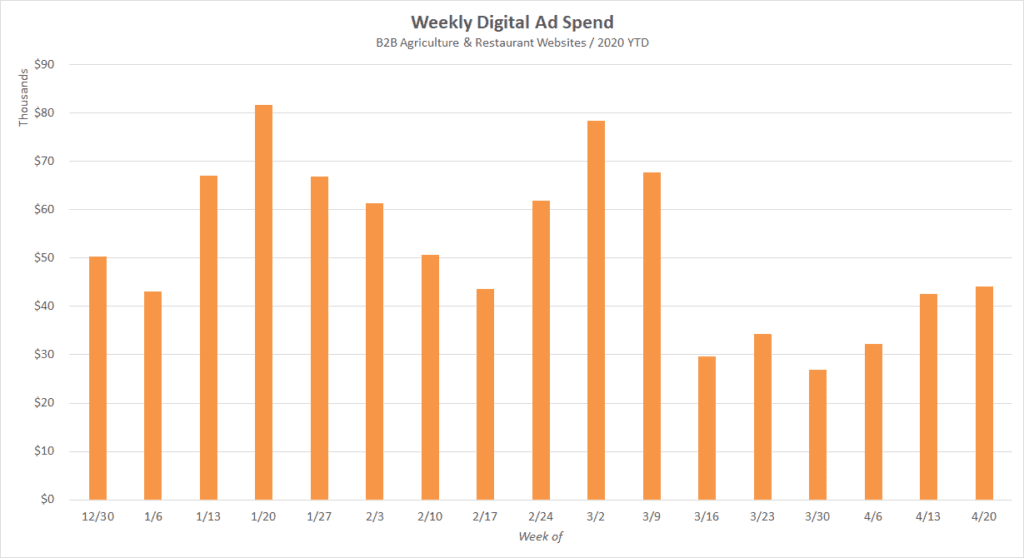

The weekly digital ad spend of B2B agriculture and restaurant websites is in line with the hit the industry took.

When we analyzed a sample of over 40 B2B websites, we saw spend fall off the week of March 16. Spend dropped by more than the previous week in response to the massive closures of restaurants.

The number of brands advertising on these websites also decreased. Last week (starting April 20th), over 300 brands were advertising. This was 12% less than two months ago.

While the number of advertisers is down, there is hope. Ad spend bottomed out the week of March 30th and has been increasing week-over-week. Hopefully, this trend reflects a positive change in the industry.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.