Canada and the US have a longstanding rapport in many ways, not least because of their neighborly trade practices.

The two economies are highly interlaced — with many enterprises working in both countries.

Last month, we published our trend report on the state of B2B advertising in Canada and the US. While we found many similarities in B2B ad spending in the US and Canada, there are also apparent differences.

For example, professional services, wholesalers, travel, and auto make up a larger share of B2B advertising in Canada. In the US, on the other hand, industrial, tech, and public service companies account for a higher share of B2B ad spend.

Inspired by the differences, we took a look at how consumer advertising in the two countries stacked up.

The differences between US and Canadian consumer ads are even more striking than B2B trends.

Top 10 Industries Buying Consumer Ad Space Online & In Print

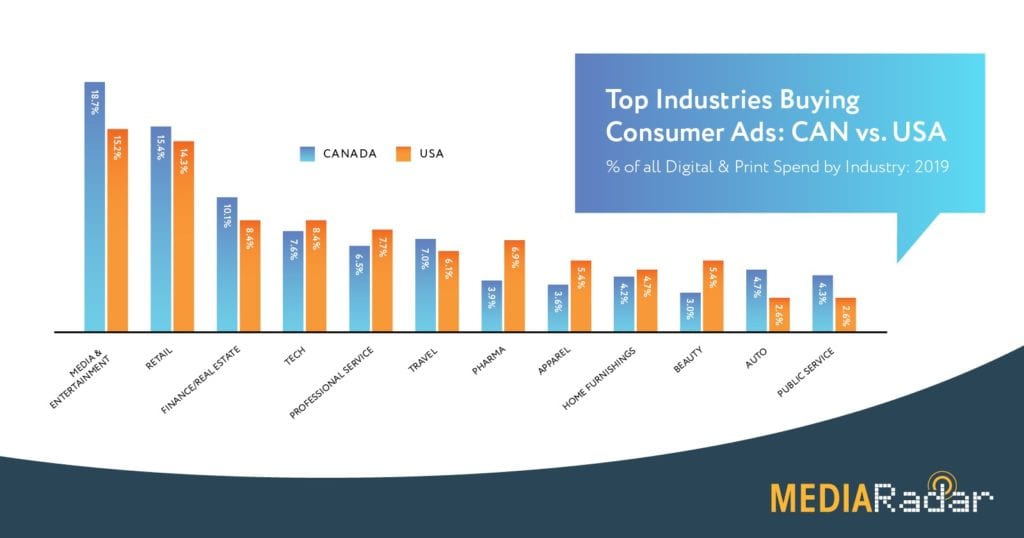

When we compare the top US and Canada industries spending on consumer ads, we see key differences:

- Media & Entertainment accounts for almost 1/5th of advertising dollars spent in Canadian consumer print and websites

- Media & Entertainment similarly constitutes the largest industry buying consumer ads in the US, but 4% less than Canada

- The US sees more spending on categories like Tech, Pharma, Apparel, & Beauty.

- Outside of Media & Entertainment, Canada sees a larger portion of their ad spend coming from the Retail, Finance/Real Estate, Auto, and Public Service Industries.

The takeaway here is that the major industries — Media & Entertainment and Retail — make up the biggest spenders in consumer ads across the border. Other industries differ in more significant ways.

Top 10 Print Advertisers in Canada and the US

The top 10 print advertisers are almost completely different between the two countries. The two exceptions are L’Oreal and P&G.

L’Oreal and P&G are the two highest spending print advertisers in the US. In Canada, they rank fifth and sixth.

Canadian companies take out more ads in Canadain specific publications. Hudson’s Bay, Bell Canada, Mogo Finance, Lee Valley and Air Canada are all based in Canada.

Hudson’s Bay, Canada’s largest retailer, was the #1 print advertiser in the country in 2019.

Many of the top US companies are multinational corporations. Aside from Target, Geico and Kohl’s, the top advertisers represent global corporations..

L’Oreal is the top print advertiser in the US.

Top 10 Online Advertisers in US and Canada

The top online advertisers among Canadian and US consumer sites are also divided, with only three advertisers appearing on both lists:

- Amazon outranks all other online advertisers in both countries.

- Microsoft ranks eighth in Canada and fourth in the US.

- Best Buy comes in at number 9 in Canada, compared to number 8 in the US.

Online advertisers in both regions are likely to use the various digital ad formats at similar rates.

US sites are slightly more likely to see their advertisers buying display ads (with 90% doing so), whereas Canadian sites see 0.5% more of their advertisers buying native ads.

Only 14% of the consumer-facing advertisers advertised in both countries in 2019. Rather, most companies stick with one country or the other.

While there is overlap, advertisers take different approaches in the two neighboring countries.