A Fall NBA, empty talk show audiences, and quarantined reality TV stars are a far cry from the normal fall television lineup. Thanks to the pandemic, however, that’s exactly what audiences are seeing.

As TV content changed this year, so too did advertising. Though spending has increased since the height of the pandemic, it’s not quite back to normal.

For a breakdown of ad spending across Sports, News, and Entertainment TV, keep reading.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Covid Causes Content Changes

Networks say that scripted programming will be ready by November—but leaders aren’t 100% certain.

“Everything is moved around,” says Jeff Bader, NBC’s president of program planning, strategy and research.

Bader is referring to programming schedules that look far different than they would in a pandemic‐free year. For example, most scripted shows stopped filming in March and are only just starting up again, leading to a shortage of new shows set to debut this fall.

Cancelled sports mean an excess of sports coverage vying for screen time and viewership, while a lack of new programming necessitates rebroadcasts of older shows. Some reality tv can be filmed in quarantine, while many talk shows can be produced without an audience.

Uncertainty causes ad revenue to plummet

The spread of COVID-19 starting in March caused a deep trough in ad revenue in Q2 for many major media companies, including Disney, Fox, AMC Networks, Comcast, AT&T, ViacomCBS and Discovery.

It makes sense that with success and viewership uncertain for fall, already cash‐strapped advertisers wouldn’t choose to place their money somewhere with uncertain return.

Overall U.S. upfront ad spending will drop 27.1% in the 2020‐2021 season. Before the start of the pandemic, it was estimated that the industry would see a 1.8% growth during the same time period.

While industry experts expect spend to increase again as time goes on, this could be a slow growth as networks adjust to new filming requirements and advertisers redistribute spend between broadcast tv, streaming platforms, and other advertising avenues.

MediaRadar Insights: Why is TV Down in September?

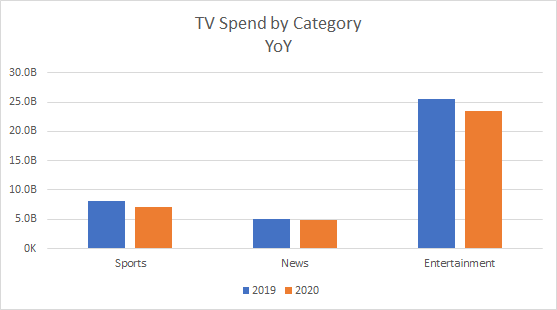

Overall, TV spend is down 9% year-over-year (YoY), from $38.6 billion in 2019 to $35.29 billion in 2020. With the chaos throughout the year and the light Fall programming, the dip makes sense.

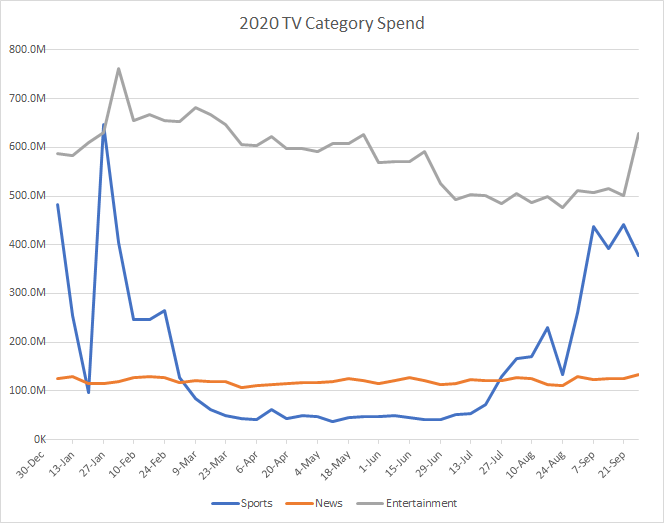

For a more clear understanding of which networks were impacted most, we organized our analysis into three groups: Sports, News, and Entertainment.

When looking at the dollar amount, we can see that sports dropped the most with the season cancellations during summer.

However, it began to immediately rise when sports returned and the NFL kicked off its season. Entertainment also dropped, though not as suddenly, and is now increasing. News remained stable.

Here we see how the categories have performed overall YoY.

Sports

Sports are now running—but some are still significantly affected by the disruptions caused by COVID.

The NFL and Pro Football ad revenue is steady year over year, but college football has seen changes. Two major conferences aren’t playing at all, and those that are playing are often subject to strange schedules that make viewership more difficult.

Overall, college football saw a 41% decrease in ad revenue YoY for September.

News

News is not the largest ad category of the three by spend, but it is the most stable. This makes sense in a tense election year marked by racial protests and pandemic‐related updates. More people watched TV news this year, giving advertisers reason to continue partnering with these networks.

The stability is evident when you compare the changes between news and sports. News ad spend decreased only 4% YoY and never decreased by more than 19% at its lowest point. Sports, on the other hand, fell as much as 93% and sits at a 13% decrease overall.

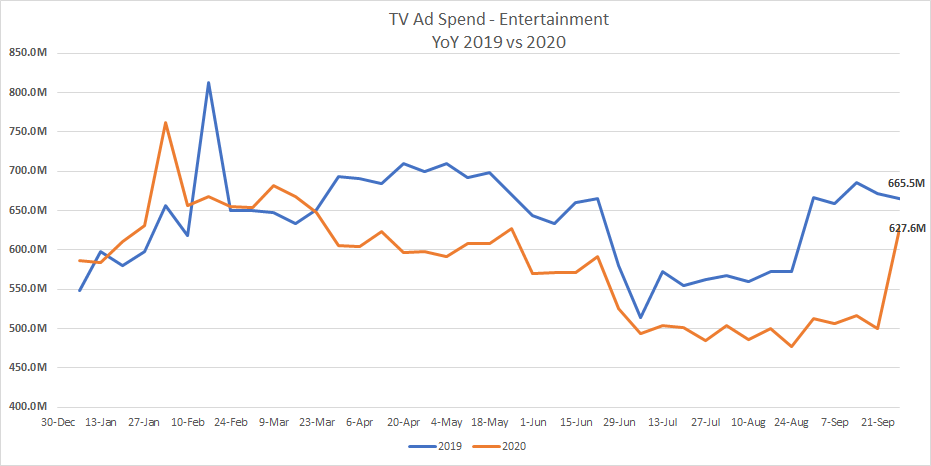

Entertainment

Entertainment decreased by 25% at its lowest point, but has fallen only 8% overall YoY. Though spending is down, it does follow the seasonal spending patterns fairly closely.

Ad spend for sitcoms alone decreased by 25%, accompanied by a 24% decrease in comedy, a 15% decrease in reality shows, and a whopping 36% decrease in drama and action shows.

As networks continue to find creative ways to fill the screen, we’ll analyze the data to see if advertising returns to normal levels. The TV industry isn’t out of the woods yet, and will continue competing with other advertising channels.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.