Long gone are the days when Hulu, Amazon, and Netflix dominated the OTT space.

The streaming wars have intensified over the past several years with the launches of Disney+ in 2019 and both Peacock and HBO Max in 2020.

By 2027, the number of OTT users is expected to amount to 4,216.3m, while user penetration will surpass 45% in 2023 and 53% by 2027.

Unsurprisingly, advertisers have noticed—and will continue to do so, with OTT and video revenue expected to reach more than $242b by 2028.

But what, exactly, is programmatic OTT, and why is it a must-have for brands

What is Programmatic OTT?

Programmatic OTT, at its core, can be understood by breaking down its two parts: programmatic and OTT.

- Programmatic advertising refers to the practice of selling ad inventory in real time via automated bidding. The technology determines the suitability of an ad for a slot based on such factors as demographic, behavior, and cookie data.

- OTT advertising refers to ad content delivered to audiences through streaming services or devices. The benefit of these ads is that they bypass the TV providers that have traditionally controlled the advertising scene.

Combining these two definitions, programmatic OTT involves the real-time, automated buying and selling of ad space within streaming platforms like Hulu, HBO Max, and Disney+ or on specific devices (such as connected TVs). These can include programmatic video ads (primarily of the pre-roll and mid-roll variety), banner ads, and an ever-growing list of options.

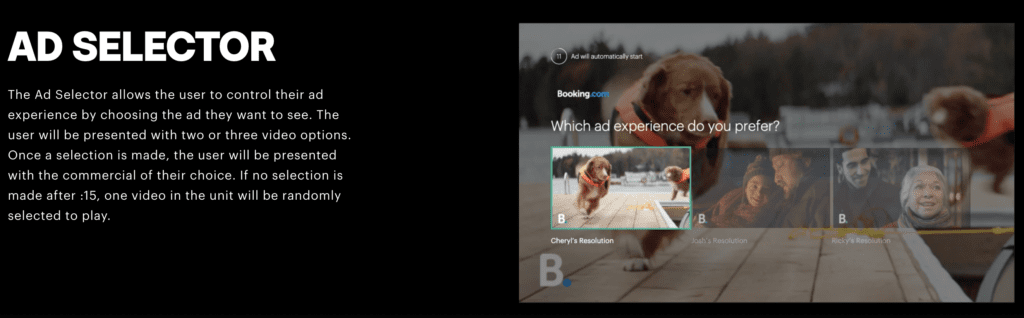

For example, Hulu’s Ad Selector allows users to choose the ad they want to see.

Why is Programmatic OTT an Important Channel for Brands in 2023?

Advertising across OTT is important because viewers are increasingly less tied to cable TV and instead stream content online.

In fact, recent data indicated that the number of pay TV households in the U.S. would stand at around 68.5mm by the end of 2022. By 2026, that figure is expected to drop to less than 60mm.

Cord-cutting isn’t losing steam either, especially in the wake of streaming’s explosive growth during the COVID-19 pandemic; global streaming subscriptions topped 1b in 2020.

The top ad-supported OTT platforms by users

- The Walt Disney Company (Disney owns a controlling stake in Hulu) reported that Hulu had 48mm paid subscribers, up from 45.3mm in the corresponding quarter of 2022. Hulu’s annual revenue was $10.7b in 2022, up from $9.6b in 2021.

- Netflix reported nearly 231mm paid subscribers worldwide as of Q4 2022. In the third quarter of 2022, Netflix’s total revenue was nearly $8b, up from about $7.5b in Q3 2021.

- Disney+ had nearly 162mm global subscribers as of Q1 2023. While that’s down by 2.4mm from the previous quarter, new (but not new) CEO, Bob Iger, said that “significant transformation” is underway.

- HBO Max (and HBO) subscriber base grew to 76.8mm subscribers in Q1 2022, up by 3mm QoQ.

OTT isn’t merely catching advertisers’ eyes because usage is booming. Sure, that helps, but data is a greater forcing factor pushing ad dollars to OTT.

With Google set to sunset third-party cookies by 2024, advertisers must find equally impactful ways to get in front of their target audiences. They can do that with OTT advertising, given these ecosystems rely on first-party data, not the third-party variety that’s been under pressure for years.

They must also reach younger audiences as Millennials and Generation Z focus on new ecosystems like OTT, TikTok and Instagram.

A survey conducted in 2022 found that most CTV viewers were between the ages of 18 and 34 years old, with nearly two-thirds of respondents. Meanwhile, just 24% were older than 55.

So, if advertisers want to reach the generations with buying power—millennial spending sits at just over $65b, while Generation Z is at almost $100b—they have to move away from traditional TV and to its futuristic sibling, OTT.

Bigger Players Change the Landscape of OTT Advertising

Though Hulu, Roku, and Amazon dominate the programmatic OTT ad scene, larger players are coming up strong in ad-supported OTT—even if they are late to the game. This will change how advertisers approach programmatic vs. upfront purchases.

Peacock, for example, launched in 2020 and has already amassed 18mm subscribers.

Peacock offers a free, ad-supported tier, unlike other major platforms with massive content libraries—like Disney+ and Netflix. Watching classics like, The Office and Parks and Rec, costs viewers nothing except for less than five minutes of advertisements per hour—a cost many viewers are willing to pay.

Peacock is currently targeting big-name advertisers willing to pay a premium for custom units—but is navigating uncharted territory.

Currently, advertisers are happy with the granular measurement of performance attribution, sharing anonymized device IDs with brands and impression-level information such as region or time of day. However, brands and publishers are negotiating what ad impressions are worth, how secure upfront placements are, and other questions about this new form of advertising.

Meanwhile, HBO Max launched an ad-supported tier in the spring of 2022. At the time, they asked advertisers to spend at least $250,000 per quarter.

The biggest splash in OTT advertising of late came from Netflix, which released an ad-supported tier after years of shunning the model. A declining user base and pressure from the market pushed the industry giant over the edge.

The results?

AVOD has helped grow Netflix’s profitability in the short term, with the company reporting 7.7mm net-new subscribers in Q4, representing a 4% year-over-year increase in paid memberships.

That said, independent research found that few new users are opting for Netflix’s ad-supported tier. In November 2022, about 9% of Netflix’s sign-ups were for the ad-supported package.

By comparison, when HBO Max launched its ad-supported option in June 2021, 15% of the streamer’s U.S. sign-ups that month was for HBO Max With Ads.

OTT Advertising Set to Surge in 2023

Despite the meteoric rise of OTT, gaining market share isn’t a sure thing—ask Quibi.

After six months, Quibi announced that it would officially sell its assets and shut down. This was a sobering situation for Quibi’s Blue Chip sponsors, including Progressive, T-Mobile, Google, and Taco Bell, who committed more than $150mm to secure ad placements.

That’s not going to stop advertisers, though. While there are many questions and doubts, programmatic OTT sales haven’t slowed much.

Digiday’s Sahil Patel states, “It’s clear there is another, messier battle still looming in streaming video: the battle for the $70 billion that still goes toward TV advertising.”

For more insights, sign up for MediaRadar’s blog here.