Knowledge is key to enhancing your ad sales, the more you know about your prospect’s purchasing patterns, the more powerful your pitch. Are your prospects purchasing print, digital or cross-platform packages? Learn how the B2B ad sales industry trending.

A lot has been made of print as a dying industry, and with print spend down 20% year-over-year in Q1 2017, the numbers show diminishing power. But B2B print still holds a big piece of the ad budgets with $9.75 billion spent in print for 2016.

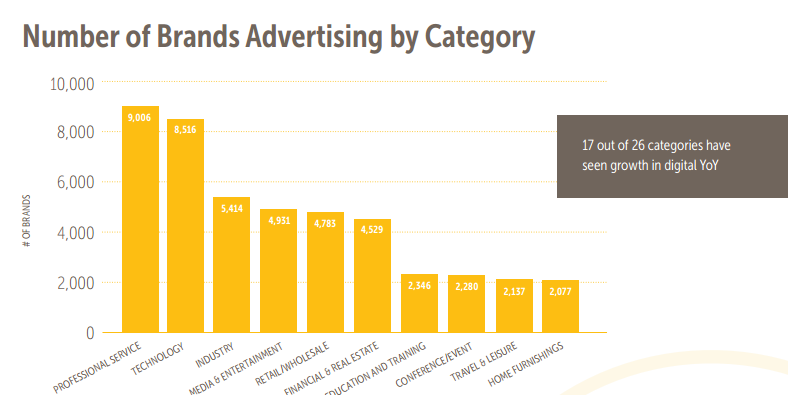

Print and digital are on divergent paths, while 24 out of 26 categories saw fewer brands advertising in 2016 compared to the previous year, 17 out of 26 categories saw an increase in number of brands advertising. Brands are becoming more cost-conscious with targeted campaigns on fewer sites/properties that reduce ad waste. The heavyweight print advertisers have reduced the number of publications they place in and the number of brands running print advertisements is down 10%.

Nonetheless, we would be remiss not to discuss where ad dollars are shifting—to the digital space.

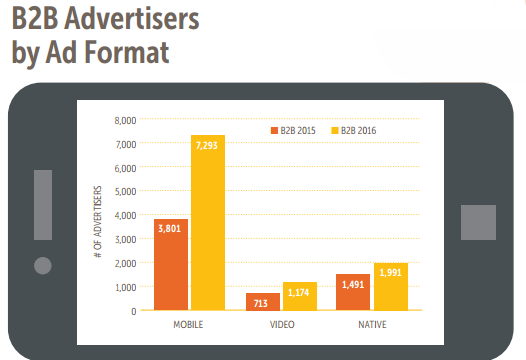

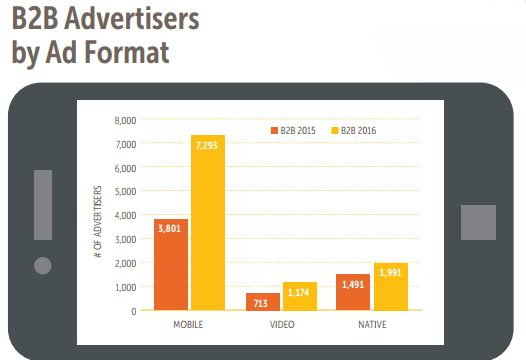

In contrast, digital is up across the board in Q1 2017 compared to the same period last year. The biggest shift occurred in high-CPM placements, native advertisers are up 17%, video advertisers are up 36%, and email advertisers are up 13%. Furthermore, of the 53,620 advertisers that ran digital ads in 2016, 61% of those did not run print.

With print advertisers running in fewer and fewer publications, it is increasingly likely that industry leaders will eat up more market share, while smaller publications miss out. It would behoove these publishers to engage proactively with industry trends. Rather than continue to duke it out for a dwindling share in print, why not utilize those resources to expand digital offerings? This would allow publishers to begin building lasting relationships in an expanding digital market.

For a more detailed look into top B2B categories in B2B in video, mobile, programmatic and native, download our What’s Trending in B2B report.