Reading the press, you would believe people are holed up in their apartments, hoarding and “hunkering down” for the apocalypse, not spending any of their disposable income.

But Amazon’s announcement that demand is so high that they need to hire 100,000 immediately, plus giving everyone a temporary raise, dismantles that image. What is really happening?

Amazon started only accepting essential supplies into their warehouses — and asked customers buying non-essential items to choose the ‘No-Rush’ delivery option. In India, Amazon stopped selling non-essential items all-together.

But, at the same time, Amazon has allegedly placed large orders for retail products outside of the realm of groceries and hand sanitizer.

It may be a chaotic rush to meet the demands of coronavirus now, but it appears that Amazon is looking to take up market share once things get back to normal.

For Amazon, business is full steam ahead. But how are other eCommerce companies responding to consumers staying at home?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

What does coronavirus mean for eCommerce?

Companies with eCommerce sites need to be aggressive in the market right now. It’s good for business (many on Wall Street are pegging eCommerce as a winning category during this time). More importantly, it’s good for the economy.

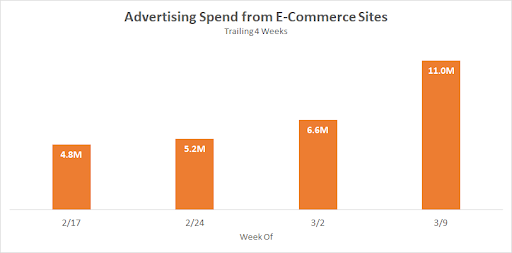

And it seems so is the rest of the eCommerce market. Over the past month we have seen eCommerce sites like Amazon, but also companies like Zulily and Overstock.com, continually increase their advertising spend, more than doubling it in the span of a month:

Companies like Walmart and Target are currently experiencing high demand for essential items, just like Amazon.

But we are seeing curious surges in non-essential shopping. Take for example:

- Alcohol: The alcohol delivery platform Drizly reported that sales from new customers increased by 500% and sales from repeat customers increased by 125% over the last few weeks.

- Lounge wear: As more people work from home, they are buying comfier clothes online. Sold-out tracksuits rose 36% from January 1 through March 16 (compared to the same period last year) and the number of sold-out sweatpants increased by 39%.

- Electronics: Best Buy is seeing an increased demand for remote work products and freezers to store food for long periods of time. They have closed entrance to their brick-and-mortar stores, to be replaced with curbside pickup and home shipments.

- Retail: In China, Nike has stated that online orders have offset losses due to coronavirus and the company is already seeing a rebound. This gives hope to other brands who already offer online shopping.

It is too soon to tell exactly how coronavirus will affect eCommerce. At large, consumers have their minds on buying essential items and managing their fears of an economic depression.

But some eCommerce stores are set up to benefit from cooped up consumers who will eventually need or want to buy products other than groceries.

Over the coming weeks, we will be highlighting companies and categories who are adjusting their advertising in response to the new, yet temporary, normal. While many businesses will face hardship in this difficult time, others, like streaming services, may see their business grow as a result.

These are interesting times indeed. Stay tuned. Subscribe to MediaRadar’s blog for daily updates surrounding the advertising industry’s response to COVID-19.