People are not socializing at work, events or restaurants — but they still want to feel good at home.

While other consumer products suffer during times of recession, beauty products tend to be quite resilient. You can call it the ‘Lipstick Index’ or a passion for self-care — people love to treat themselves. COVID-19 hasn’t stopped that.

Of course, many things have changed in this industry. Foot traffic purchases are down, while eCommerce shopping is up. Luxury lines are offering uncommon promotions, while other lines are shifting to cleaners and hand sanitizers. And just like toilet paper, hoarding beauty products is a real thing.

Here, we break down what that means for the ad numbers.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

The Durability of the Global Beauty Industry

According to researchers at McKinsey, the global beauty industry — made up of skin care, color cosmetics, hair care, fragrances and personal care — generates $500 billion in annual sales.

Historically, the industry has been resilient during times of economic downturn. In the 2008 recession, the industry experienced a small dip in revenue but rebounded fully by 2010.

During the 2001 recession, there was an uptick for some products, notably lipstick. The ‘Lipstick Index,’ coined by Leonard Lauder, theorizes that consumers forgo expensive luxury items and instead by small, more affordable products that bring them joy.

Consumers are loyal to their beauty products.

In China, the beauty industry has already made a great rebound from its first quarter.

Skincare in particular is doing well among consumers. Brands such as Tula are seeing sales spike dramatically. Tula reported a 400% increase in April sales YoY. Skincare panic buying has become a trend and is discussed in online enthusiast groups, like SkincareAddicts on Reddit.

“I was extra worried about this, so I stocked up. Some people got toilet paper, I got hyaluronic acid,” wrote one commenter.

Do-it-Yourself products are also up. With no barber or salon to turn to, people are learning how to cut their own hair. Sales of hair clippers and trimmers in the US were up 241% in March compared to January.

People also continue to buy more soap and body wash products. Sales in this category have gone up 7.5% in the US, and the rise of luxury hand soaps in the UK have gone up 102%. As people wash their hands more, they want something that will not leave their hands feeling dry.

As we will see below, advertising in this category has shot up significantly.

MediaRadar Insights

With these new grooming trends, we took a look at the advertising numbers.

The average weekly skincare ad spend is up 15% since COVID began (the week of March 9th through the week of April 27th, compared to 8 weeks prior).

Top spenders include:

- Dove (+87%)

- Neutragena (+53%)

- Cetaphil (+18%)

- Anti-Aging skincare is doing particularly well. YTD ad spend is up 48% YoY.

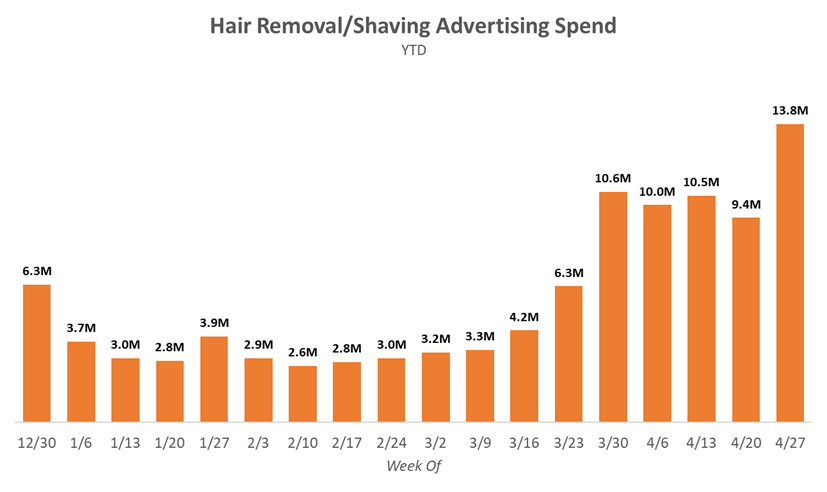

When we took a look at the shaving and razors category, we found that the average weekly ad spend is up nearly 3x (with the same time frame as above).

Top advertisers include:

- Finishing Touch Flawless

- Gillette Razors

- MicroTouch

- Gillette Venus

- Bell + Howell TacShaver

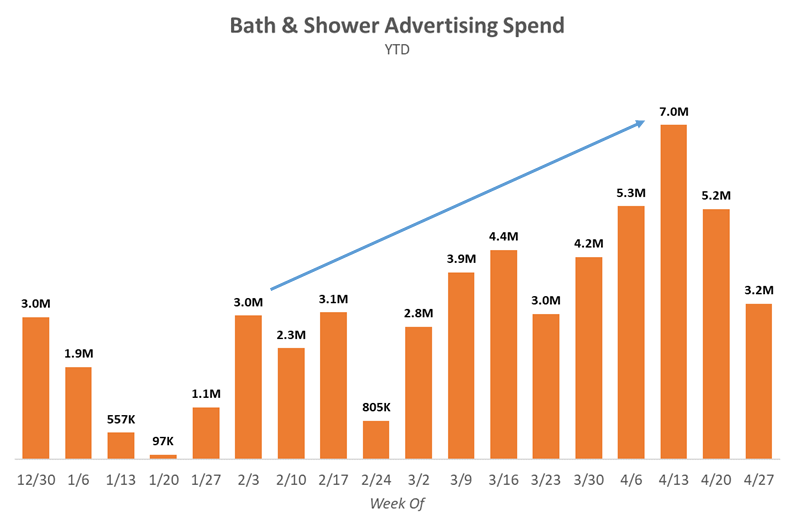

Diving into bath and shower products (i.e. hand soap, body wash, sanitizer), our data shows that the average weekly ad spend is up 2.5X since COVID-19 began to take its toll.

When we look at the individual products, we see who is spending the most:

- Sanitizer is up 170x

- Soap (+205%)

- Bodywash (+149%)

Sanitizer is up the most by a long shot, as people try to stay safe and healthy. COVID-19 has impacted our grooming habits, just like it has touched everything else. We will continue to monitor how advertisers engage with their customers during this time.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.