House lawmakers on both sides of the aisle are trying to slow down ‘Big Tech.’

After a marathon of debating five new bills that would create huge changes in antitrust law, the House Judiciary Committee advanced the legislation this morning.

Will these new bills change the way that “Big Tech” brands invest into programmatic?

Current growth trends suggest no, but summer and early fall months will give us a better picture of their effect.

How will these new bills affect big tech?

Though their names weren’t explicitly mentioned, house leaders designed six bills to break up four of the biggest companies in tech: Google, Apple, Amazon, and Facebook.

The antitrust bills would make it harder for these companies to use their dominance in one field to take over another. One of the bills focused on increasing regulation of mergers and another would raise fees for mergers to bring in more money for antitrust enforcement agencies.

Additionally, one bill would bar self-preference practices (e.g. Google preferring Google reviews over Yelp). And when it comes to data, these companies will have to make changes to increase interoperability.

If these bills pass in the House and the Senate, they would change the Internet as we know it.

Many question if it actually would help consumers and small businesses—or just punish the companies that we all depend on. Leaders aren’t letting these bills move through the government without having that conversation.

“As many groups and companies have observed, the bills would require us to degrade our services and prevent us from offering important features used by hundreds of millions of Americans,” said Google VP of government affairs and public policy Mark Isakowitz.

Even though ‘anti-big tech’ sentiment runs through Democratic and Republican lines of thought (for different reasons), this will be a very long process.

Yesterday representatives debated five bills for over twenty hours, and they still have one more to go: The Ending Platform Monopolies Act, which could be one of the most impactful bills. It would prevent companies from selling their own product lines on their platforms. For example, Amazon probably wouldn’t be able to sell its own toilet paper on Amazon.

The bottom line: These bills will still undergo changes, and even if they do pass, big tech will still be big—just not as big.

MediaRadar Insights

Tech companies were the biggest buyers of programmatic advertising during the pandemic. However, they were surpassed by three other categories at the beginning of 2021. This was due to increasing spend from other categories, rather than decreasing spending from tech. Spending from this category has remained fairly stable.

For the purposes of this analysis, we examined spending from 14 technology corporations that are typically categorized as ‘Big Tech’: Amazon, Apple, Microsoft, Google, Facebook, IBM, Tencent, Intel Adobe, Samsung, Salesforce, Huawei, Oracle, Cisco, and Dell.

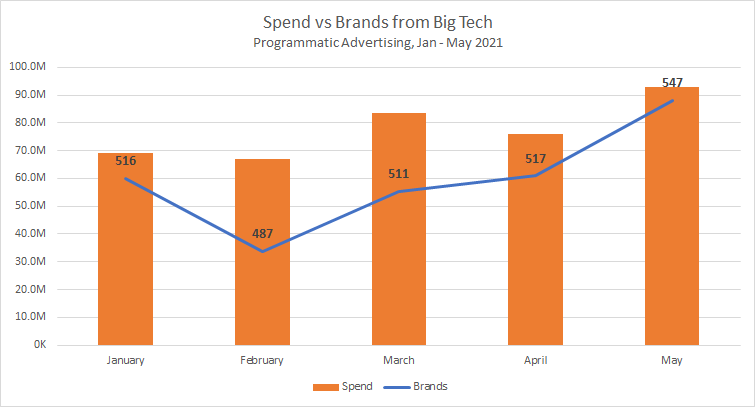

Activity from large tech brands hasn’t changed significantly between January – May, but there is annual growth.

On average, these companies have collectively spent $77mm per month in 2021. They advertise anywhere from 6 to 62 subsidiary brands, with an average of 33 brands.

The largest amount of programmatic spend we’ve seen from this group in 2021 occurred in May, when they collectively spent $92.9mm. This was an increase of 17% year-over-year. There were 103 more subsidiary brands advertising in May 2021 (a 23% increase).

While 17% growth YoY is a significant amount, the fact that subsidiary brands also grew at a rate of 23% YoY indicates that these companies may not be spending more on programmatic necessarily, but are changing the ad strategies of their subsidiary brands.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.