While it’s important for publishers to understand header bidding, it’s just as important that they understand how to make it work for them.

In our previous posts, we simplified the process of programmatic advertising.

We covered the process of waterfalling and moved through the innovation of header bidding.

After reading our previous posts, you might think: “All of this talk of price floors… But how do I know what my price floor should actually be?”

That’s an important question.

Header bidding is innovative, but only if publishers can implement it correctly and maximize their return.

To do that, they need to understand the price floor, why it’s important, and, most importantly, how to set the right one for their ad inventory.

What Does Price Floor Mean?

A price floor is the lowest price or cost per impression (CPM) for which an ad can be sold via an ad exchange. A price floor ensures advertisers can’t purchase ads below their value and ensures publishers can generate revenue from their available real estate.

A price floor in advertising is similar to a minimum wage in that someone cannot be paid below the legal amount determined by the state and federal government.

How to Set a Price Floor for Your Ad Inventory

Setting your price floor is one of the most difficult parts of implementing header bidding, i.e., a programmatic technique allowing publishers to offer ad inventory to multiple ad exchanges before making the call to ad servers.

It can be difficult because they’re deciding their worth, which is not a comment on existentialism but ad inventory.

The best way to start is to observe their peers (remember… ad inventory…).

Study the publishers most closely related.

What are they charging for their ad space?

It may seem obvious, but price floors vary across different audience demographics as well as the inventory itself, so it’s important to use competitor numbers to stay within realistic parameters.

For example, a high-impact ad at the top of the page will likely warrant a higher price floor than an ad in the sidebar or at the bottom.

It’s also important to use competitor numbers to avoid undervaluing the inventory. This will also help publishers determine if they increase their price floor. With publisher ad revenue going down, undervaluing their inventory is a strategic—albeit unintended—mistake that can cost publishers millions.

Determining the price floor means determining the value of the audience.

As advertisers continue to seek more targeted audiences, the ad space in front of audiences becomes more valuable. This means that publishers with niche, hyper-targeted audiences can charge a premium for their ad inventory.

For example, a niche gaming website would likely attract droves gaming advertisers willing to deal with a higher price floor than they would on a more generalized website that doesn’t align as well with their audience.

That said, a big publisher—think The New York Times—can set a high price floor simply due to its reach and authority; advertisers know they’re paying a premium, but they’re willing to do so to reach millions of active readers.

So then, how can publishers use that competitor data to create the optimal price floor?

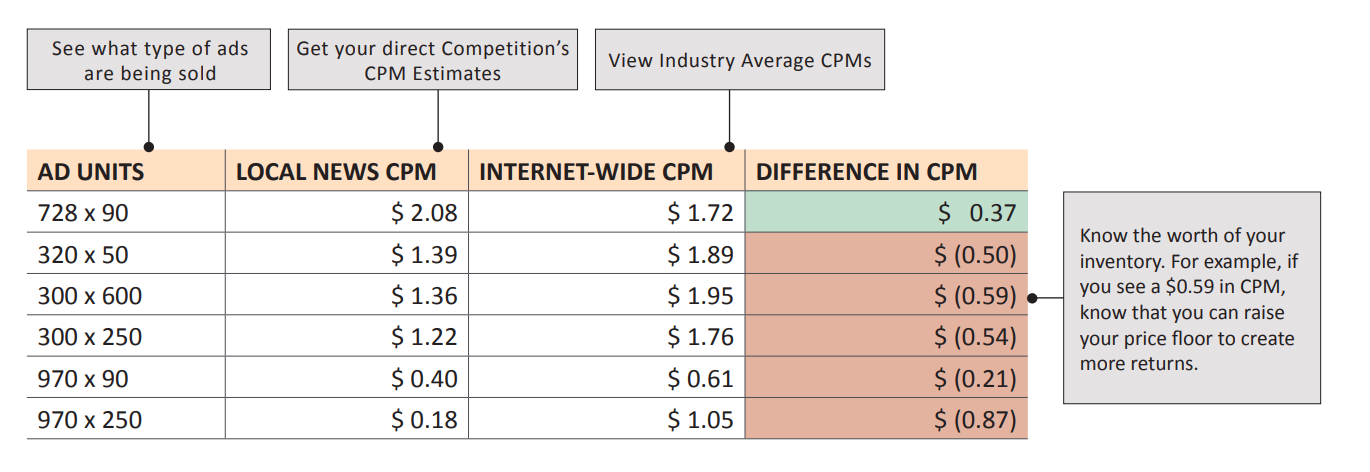

Consider the following example for a Regional News Website:

First, see what type of ads are being sold by the competitors, e.g., 728×90, 320×50, etc.

For each type of ad, publishers should observe the internet-wide average CPM and compare it to their competitor’s average CPM.

The answer lies in the difference between those numbers.

For a publisher looking at this data, it’s easy to see the others in their demographic are undervaluing their ad inventory, with average CPMs much lower than the internet-wide CPMs for the same ad units.

Let’s get a little more specific.

For a 300 x 600 ad unit, the internet-wide average CPM is $1.95. For Local News, however, the average CPM sits at $1.36. That’s a difference of $0.59.

In this case, local news networks are leaving extra returns on the table because they’re undervaluing the audience they can offer advertisers.

In studying this, however, publishers now know to raise their price floor to meet the value of their regional, niche audience, which can increase CPMs and weed out unsavory advertisers.

Size Does Not Equal Value

For publishers, it’s important to never think of their site as “small.”

A small audience does not mean inventory loses value; think of a small audience as simply being more specific.

Brands greatly value regional and niche audiences, like local news websites, because for many of them, more specific audiences are better, safer places to advertise. The latter is particularly top of mind, given ongoing concerns related to privacy and brand safety.

Ultimately, setting the price floor is always a guessing game—and even though there may be a certain number in mind, optimizing the price floor to create the most returns over time is always the most important.

Price floors can always be adjusted, so it’s not the end of the world if publishers miscalculate their price at some point.

For more insights, sign up for MediaRadar’s blog here.