Economic experts are ringing the alarm bells—again—and warning of an imminent recession. Billionaire investor Stan Druckenmiller even said, “It’s just naive not to be open-minded to something really, really bad happening [to the economy].”

Based on our data from April 2023, that gloomy outlook isn’t putting too much fear into the minds of consumer advertisers.

This article takes a look at those fearless advertisers, the ones tightening their belts, and what it all means as the long-awaited recession finally arrives (we think?).

Advertisers Are Cautiously Optimistic…for Now

The economic and global uncertainty is putting pressure on consumers and businesses alike. According to a recent study, 55% of consumers have reduced their non-essential spending in 2023. Meanwhile, many marketers are treading water with fewer resources than ever.

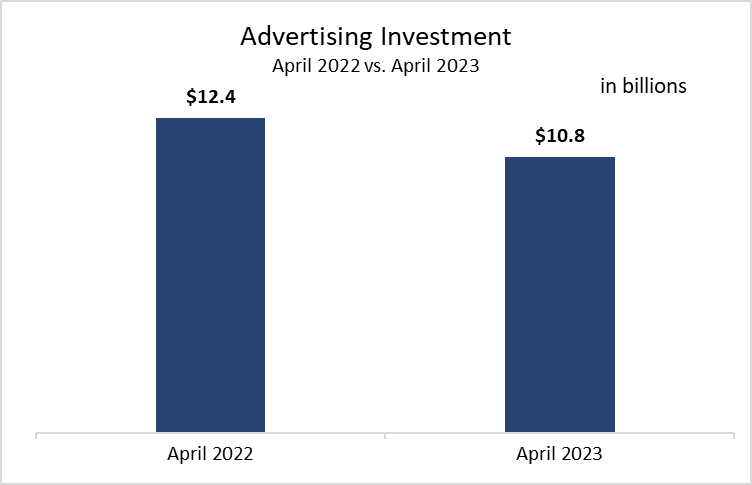

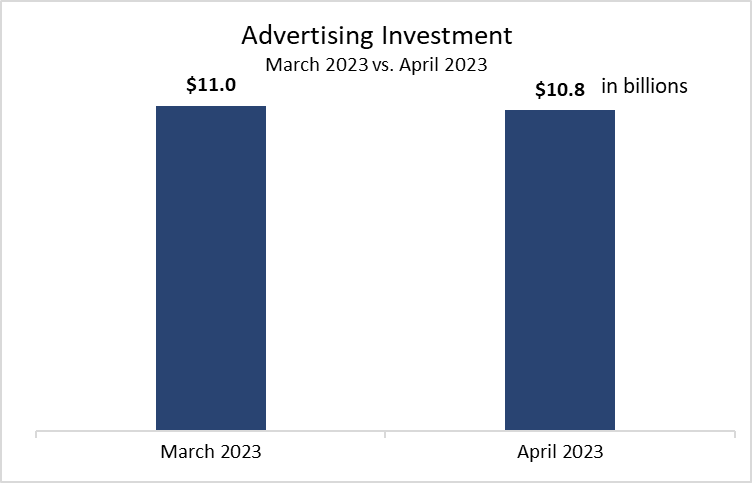

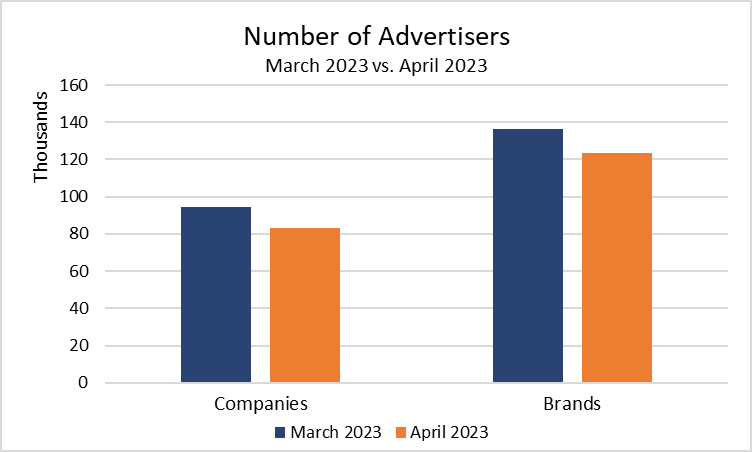

Still, there are still plenty of advertisers spending. In April, advertisers for over 83k companies spent almost $11b to promote nearly 124k brands. While that dollar amount represents a decline of 13% from April 2022, it’s a modest 1% dip from March of this year, and comes despite the number of companies buying ads falling by 12% MoM. The number of product lines or individual brands promoted fell by 9% MoM as well.

Note: The number of companies and brands advertising increased by 6% and 4% YoY, respectively.

It’s clear that advertisers are cautiously optimistic but not quite ready to pump the brakes completely. The ones with a greater appetite for risk aren’t just willing to spend, though. Many are embracing new ad types.

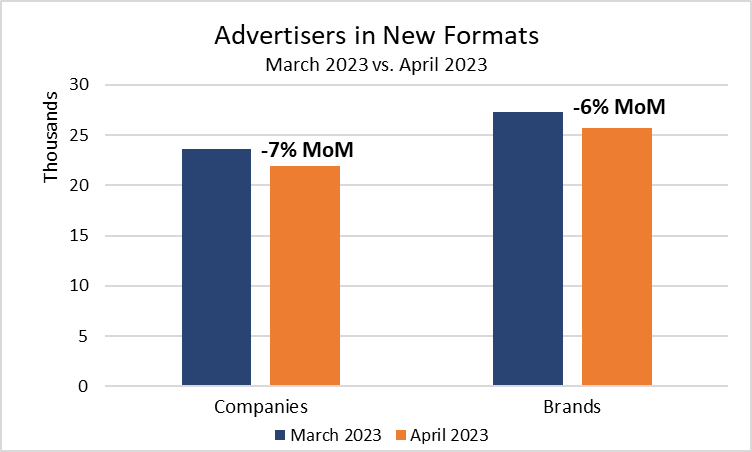

In April, advertisers for almost 22k companies and 25.7k brands invested in new ad formats across social media, OTT, and YouTube, among other channels. Much of the investment in new formats came from advertisers in the Professional Services (16% of companies, 4k), Technology (11%, 2.8k), and B2B Industrial (10%, 2.4k) industries.

The adventures into unknown—and sometimes unproven—ad types speak to advertisers’ willingness to get outside of their comfort zone, but also the pressing need to meet consumers across the digital world, especially as different channels evolve in tandem.

For example, Hulu’s GatewayGo ad unit “allows brands to get significantly closer to their conversion goals in streaming TV by shifting conversion actions from the TV screen to mobile.” Meanwhile, Meta’s continued investment in the creator community gives advertisers more effective ways to tap into the authenticity of influencer marketing.

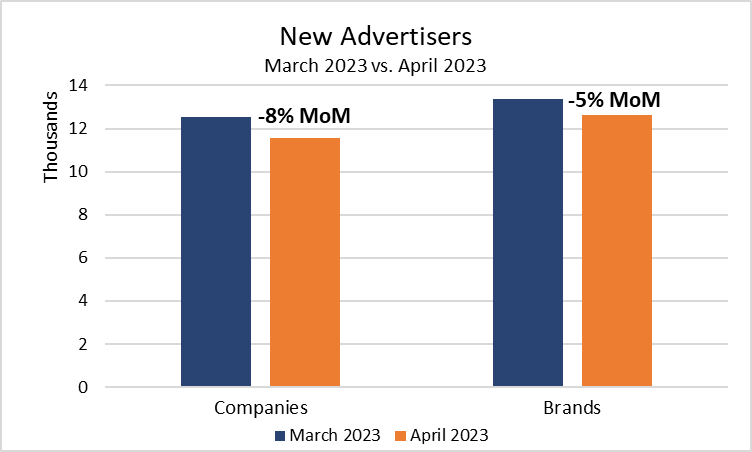

New brands and companies are investing, too. According to our data, over 11.5k companies and 12.6k new brands advertised for the first time in April, with much of that spending (39% or 4.7k advertisers) coming from advertisers promoting Professional Services, Technology, and Media & Entertainment.

Alcohol and Animal Pharma Advertisers Prep for the Summer

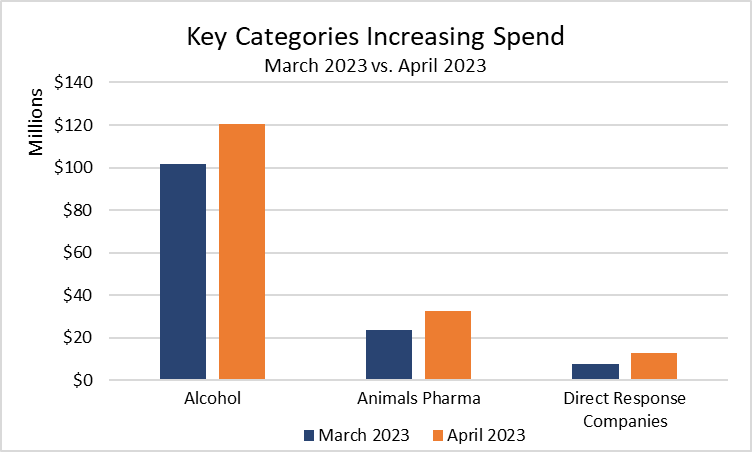

Advertisers in several key pockets of the consumer world increased spending MoM in April, including those promoting Alcohol and Animal Pharmaceuticals.

Alcohol advertisers, for example, increased spending by 18% MoM to over $120mm following a year (2022) chock-full of budget reductions. Driving this increase were advertisers at Casa Modelo Mexican Beer and Corona Extra Light, who combined to spend $69mm or more than half of the month’s investment from Alcohol advertisers.

The sizable increase to promote Case Modelo Mexican Beer comes as Modelo, the No. 2 beer brand in the U.S., expands its Mexican beer portfolio to bring more Chelada offerings and test three new beverages.

Greg Gallagher, Vice President of Brand Marketing at Modelo, said, “In addition to being the No. 2 beer brand in the country, Modelo Especial is the best-selling beer in nine key markets throughout the U.S. While we will continue to drive our flagship offering, we hope these innovations will continue our momentum and bring new opportunities for drinkers to enjoy Modelo products.”

Spending from advertisers at Modelo will certainly follow as they expand and build new offerings in an already well-established industry.

At the same time, advertisers promoting Animal Pharmaceuticals increased spending by 14% MoM. Key drivers in this category included companies promoting flea and tick, heartworm, and deworming medications—think Bravecto and Heartgard Plus—which increased spending by 30%+ MoM. General Animal Pharma brands increased spending by 60% to nearly $8.7mm as well.

The heavy promotion to promote flea and tick medications comes in the lead-up to one of the most active times (summer) for these bothersome pests, but also following the mass adoption of pets during the pandemic. According to the American Society for the Prevention of Cruelty to Animals (ASPCA), 23mm American households acquired a pet during the pandemic.

Flea and tick season aside, an uptick—pun intended—from Animal Pharma advertisers was as inevitable as losing a sock every time you do laundry.

Some advertisers are losing steam

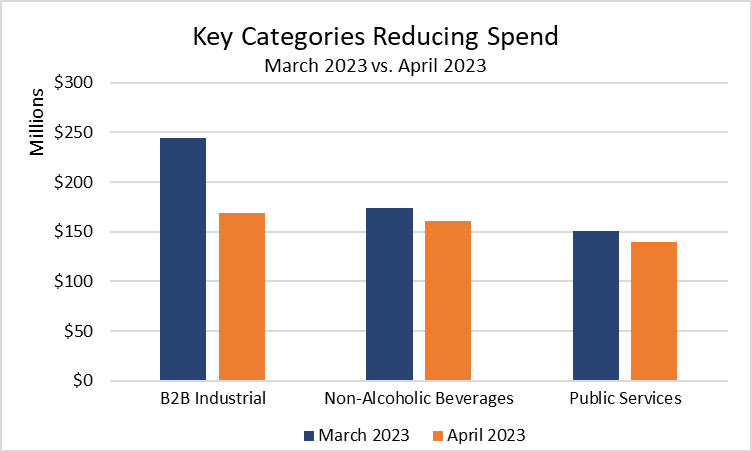

While many advertisers increased spending in April, others pulled back amid the uncertainty. The biggest MoM reductions came from advertisers in the B2B Industrial (-21% MoM), Non-Alcoholic Beverage (-6% MoM), and Public Service (-23% MoM) industries.

Advertisers in B2B Industrial decreased spending by more than 21% MoM. A layer deeper, advertisers for industrial companies spent $169mm, down by more than 33% YoY. Advertising for Industrial Machinery, which represented 15% of the category’s spend, dropped by 48% MoM to $243.5mm.

The reduction by B2B Industrial brands highlights the fickle beast that is advertising in a down economy. In 2022, nearly 25k B2B industrial companies—agriculture, energy, and industrial machinery—spent $1.9b on ads, representing a 4% increase in spending and the number of advertisers.

It seemed likely that B2B Industrial advertisers would remain resilient in 2023, but the economic instability may be a greater challenge than anticipated.

Meanwhile, advertisers promoting non-alcoholic beverages decreased spending to $161mm. Soft drink brands, in particular, pulled back, collectively reducing their investment by 30% MoM as more people ditch sugary beverages. Interestingly, coffee and water brands also reduced spending in April, doing so by 12% and 24% MoM, respectively.

Finally, spending from Public Service advertisers in April fell by $139mm, thanks largely to sizable reductions from those promoting national security advertising for military branches and religious public services.

What’s Next for Consumer Advertising in 2023?

The MoM decline in ad spending in April means one of two things:

- Advertising budgets are stabilizing post-pandemic.

- Advertisers are truly starting to tread carefully as a recession seems more likely.

In reality, it’s likely a combination of the two. Nevertheless, there are opportunities to be had, as many advertisers make it clear that they’ll push through the uncertainty—and some are ready to spend big.

In April, advertisers in nearly 90 categories invested more than $1mm, ranging from acne prescriptions to house cleaning services, the latter of which are in high demand as people return to the office.

MediaRadar is here to help you uncover these opportunities, expand your total addressable market (TAM), focus your prospecting efforts, and create customized outreach strategies for your prospects. Contact us today.