We recently looked at how much consumer packaged goods (CPG) advertisers are spending on TV to kick off 2023, including Super Bowl costs for a 30-second commercial ($7mm).

In Q1, CPG advertisers from names like Pepsi, Procter & Gamble (P&G), and Mondelēz International spent more than $1.5b on TV, up by 12% YoY.

The message is clear: TV ads are still a big part of CPG advertising strategies. Unsurprisingly, CPG advertisers’ love for motion pictures extends to YouTube.

During Q1, advertisers for more than 470 CPG companies spent over $650mm on YouTube, up by nearly 2x from Q1 2022. Where did those ad dollars go in YouTube’s orbit, and will they continue to flow from CPG advertisers?

We looked at our data to find out.

Diverse Audiences Attract a Variety of CPG Advertisers

It’s easy to see why CPG advertisers flock to YouTube—they can reach 40% of global Internet users with ads proven to drive purchases. According to Think with Google, 63% of people say they bought something they saw on YouTube.

Much of that effectiveness stems from advertisers’ ability to target niche audiences consuming content on unique programming categories, which no CPG advertiser can take for granted as third-party cookies fade.

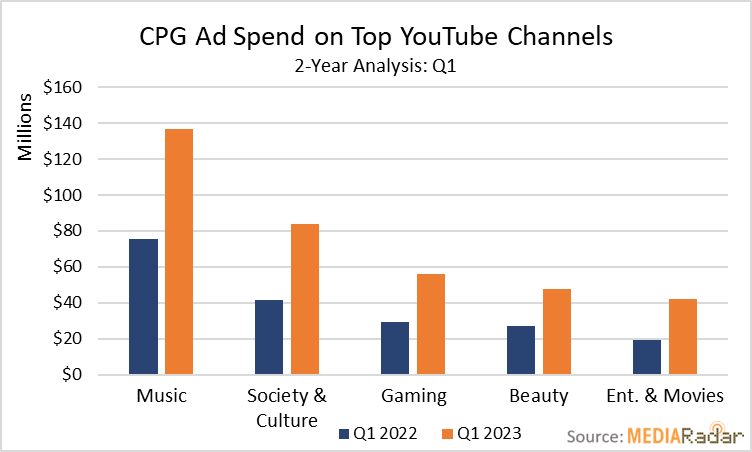

In Q1, more than half of the YouTube investment from CPG advertisers ($366mm or 56%) went to ads on channels in five categories: Music, Society & Culture, Gaming, Beauty, and Entertainment & Movies.

Much of that investment (almost $140mm) went to Music channels, increasing by 81% YoY. At the same time, spending on Society & Culture channels jumped by 100% YoY to more than $83mm thanks to big investments from Lindt Lindor, Old Spice, and Cascade Platinum, whose combined investment surpassed $13mm.

The link between YouTube, music, society, and culture is well established, making these channels a no-brainer for CPG advertisers. But as YouTube spreads its wings to appeal to a more diverse audience and compete with the likes of Facebook and TikTok for consumer attention, it’s also opening its doors to a new community: Gaming.

YouTube’s presence among gamers skyrocketed during the pandemic. In fact, people watched more than 100b hours of video on YouTube’s active gaming channels in 2020 alone—and CPG advertisers are taking notice.

In Q1, advertisers, including those from Lindt Lindor, Oreo, and Ritz, spent $56mm to promote their products on Gaming channels, representing a 90% YoY increase. (Advertisers at Lindt Lindor, Oreo, and Ritz accounted for 16% or $9.2mm of the investment in Gaming channels from CPG advertisers).

As YouTube continues to roll out the red carpet for the gaming community, expect CPG ad dollars to follow.

Although YouTube has seen engagement among the gaming community drop post-lockdown, the video giant isn’t turning its attention away from a market worth billions. Actually, it’s likely just getting started under the leadership of Leo Olebe, who formerly held the title of Managing Director of Google Play’s Games Partnerships team.

Advertisers capitalize on YouTube’s evolution

CPG advertisers also made their presence known on channels related to Beauty and Entertainment & Movies.

In Q1, spending from CPG advertisers on Beauty channels surpassed $48mm, up by 78% YoY as advertisers from e.l.f. Cosmetics O Face Satin Lipstick, M.A.C. Cosmetics Powder Kiss Lipstick, and Sol de Janeiro Body Care Collection combined to spend $9mm (19% of ad spend on these channels).

We expect that investment to increase in the coming quarters as Beauty advertisers tap influencers to strengthen their connection with consumers and YouTube enhances its commerce capabilities.

For example, in 2022, the video platform announced a partnership with Shopify to launch integrated livestream shopping, allowing eligible YouTube creators to connect their Shopify stores to their profiles “so that viewers can complete their purchases without leaving YouTube.”

The move from YouTube follows successful pushes into livestream shopping from TikTok’s sister app, Douyin, Instagram, and Amazon.

The investment in commerce and embrace of the creator community, which we know consumers trust, will undoubtedly keep Beauty channels at the heart of CPG advertising strategies moving forward.

Meanwhile, the investment in Entertainment & Movie channels increased by more than 115% YoY to $19mm as advertisers for Cascade Platinum, Lindt Lindor, and Old Spice, among others, rode the wave of YouTube’s continued investment in primetime.

In November 2022, YouTube launched Primetime Channels to “bring shows and movies from more than 30 services directly into the YouTube interface,” including Paramount+, Epix, and more niche offerings like The Great Courses and Magnolia Selects.

The launch made all the sense in the world to YouTube. According to Erin Teague, the leader of the Primetime Channels project, “You’ll [users] watch trailers on YouTube and leave YouTube to go start from scratch on the streaming service. So we were like, ‘What would happen if we just collapsed that experience and made it convenient to watch all this content in one place?”

YouTube is fundamentally changing the entertainment model but also creating a stickier experience for consumers, which will continue to catch CPG advertisers’ attention in the entertainment world.

Hopping on the Bandwagon: New Advertisers and Brands Flock to YouTube

The lion’s share of YouTube ad spending from CPG advertisers comes from those firmly entrenched in the ecosystem.

According to our data, of the 470 companies that bought YouTube ads in Q1, 81% did so in 2022, and more than 380 were responsible for 99% of the investment.

But that doesn’t mean there aren’t rookies.

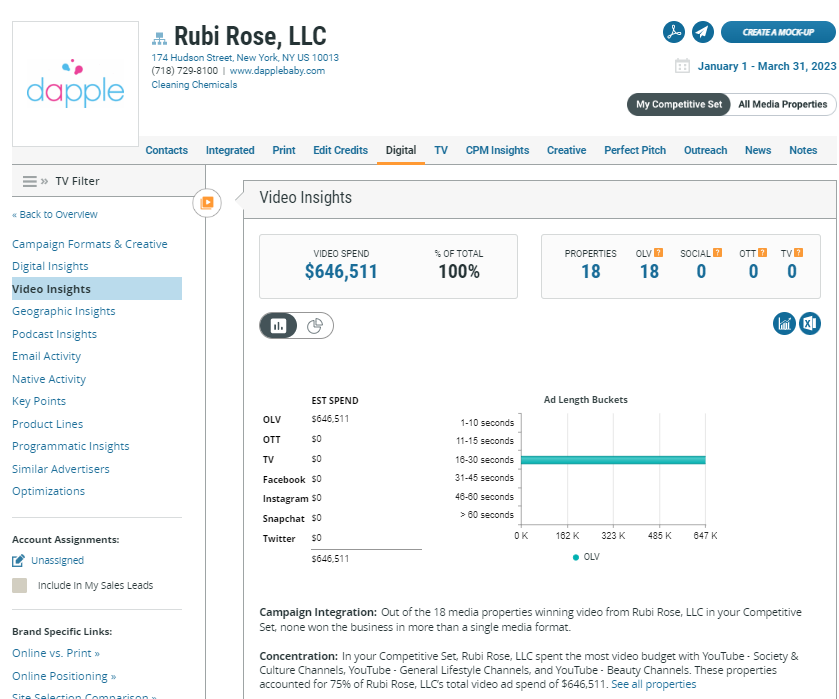

In Q1, 11 “newcomers,” including Rubi Rose (Dapple Baby), Age Sciences (PMB beauty product lines), and Vitapod, invested more than $100k in YouTube. Overall, these newcomers spent $3.6mm.

While these are relatively low spenders on the YouTube-ad-spending spectrum, established advertisers promoting new brands are also leveling up their YouTube strategy. Overall, advertisers spent almost $60mm to promote 275 new logos in Q1.

By now, another message should be abundantly clear: YouTube is a central cog in CPG advertising strategies that’ll remain in place as the platform makes itself a one-stop shop for consumers and advertisers to embrace its targeting prowess in a world without third-party cookies.

For more insights, sign up for MediaRadar’s blog here.