The slew of mergers and acquisitions in the entertainment world continues to make headlines.

After taking a controlling stake a few years ago, Disney is expected to buy the rest of Hulu.

In 2022, WarnerMedia (which owns HBO Max) merged with Discovery (which owns Discovery+), creating Warner Bros. Discovery. Then, there were talks about HBO Max and Discovery+ joining forces as a single platform.

The list goes on.

Most mergers and acquisitions focus on how the content lineup will change, what these freshly ramped-up media companies can offer consumers, and which player will likely take the biggest piece of the pie.

But the real driving force behind the streaming wars is the ability of media and tech companies to reach audiences. It’s proving to be a winning combination.

Tech companies entered the media world (here’s to you, Amazon), and media companies are entering the tech — or, at least, streaming — world (we see you, NBCU).

With advertising as the driving force, the streaming wars have had another welcome effect for both ad sales and creatives: Changing how advertisers can reach their audience.

For Hulu, that initially meant offering ways to appeal to viewers finally catching up on a recent episode. In the case of NBCU, it’s a mashup of Out-of-Home (OOH) and digital advertising strategies.

As mergers and acquisitions shake up the industry and competition intensifies, every player in the space will have to innovate to woo advertisers in their favor; their ad revenue depends on it.

Hulu Embraces the Binge

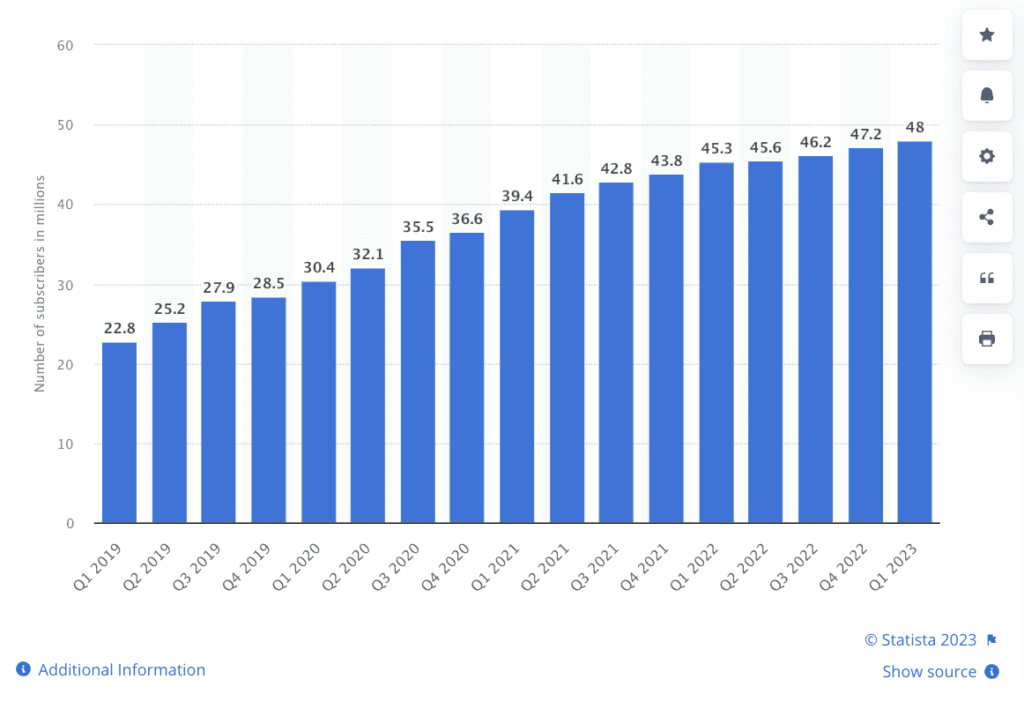

As a streaming native, Hulu has much less disruptive advertising than its traditional broadcasting counterparts. But as the Disney-controlled streaming giant tops 48 million US subscribers, it intends to cut down its advertising load even further.

According to a report from AdAge, Hulu planned for 50 percent of its ad revenue to come from non-intrusive formats by 2021.

Hulu announced a brand new binge-watch ad format to kick off those efforts.

“We’re trying to recognize that the viewer experience in on-demand viewing is different from traditional TV, and we should and must evolve the ad experience,” Peter Naylor, Hulu’s SVP of Ad Sales Peter, told AdWeek in an interview.

Advertisers can take two approaches with this offering.

They can offer a longer ad to watch the third or fourth episode in a completely ad-free binge. Or they can hit a binging viewer with a relevant creative — like offering food delivery.

The streaming service dubbed this new ad format ‘television’s first binge advertising experience.’

Binge ads undoubtedly excited advertisers — as did the rest of its presentation at NewsFront. That said, Hulu made it known that it wasn’t trying to recreate that magic.

Not because Hulu was going away but because Hulu would no longer get its own slot at NewsFront.

Instead, Disney said it’d “include discussions around Hulu advertising in talks around the rest of its media properties.”

Hulu has also introduced a new ad format called GatewayGo. The ad format marries traditional TV ads with prompts designed to increase the connection between viewers and brands — think QR codes and push notifications.

At the same time, Hulu integrated with Nielsen Media Impact to bolster its measurement capabilities.

“Streaming is leading one of the most profound consumer behavior shifts in history. For advertisers, streaming TV is no longer a ‘nice-to-have’ or ‘a place to test and learn.’ It’s a must-have, and it will redefine advertising in the same way that search did twenty years ago,” said Hulu president Kelly Campbell.

NBCU Bridges Traditional TV With Digital Advertising

As it keeps focusing on digital streaming and advertising, NBCU has announced its intention to cut its ad load by 20 percent by the end of 2019. Part of the plan was to include prime pod ads (60-second spots in the first or last break of each program) and more targeted ads in its offerings.

According to MediaRadar data, viewers see 4.6 ads per show and 8.7 ads per hour.

NBCU also introduced a Shoppable TV ad unit. The ad format “shows a QR code that viewers can scan with their mobile cameras,” writes Andrew Blustein at The Drum. “Viewers can then interact with and potentially buy from a given advertiser on their phones.”

The QR codes remain on screen for 30 seconds, meaning the shoppable ads will most likely be combined with NBCU’s previously announced prime pod ad formats.

NBCU’s head of marketing, Josh Feldman, made the broadcaster’s intention clear in a press statement: “By pairing brands with our premium content, storming the purchase funnel, and removing the barriers consumers traditionally encounter between seeing a product and making a purchase, we’re giving marketers a direct sales channel to millions of viewers across the country.”

For those dubious of the clunky foray into digital, Feldman had an answer: The first test of the shoppable format resulted in 50,000 QR scans in five minutes.

Netflix Enters the OTT Advertising Wars

After years of shunning ads, Netflix introduced an ad-supported tier in late 2022. The move from the OTT OG comes after a declining user base and intense competition from legacy (Hulu) and up-and-coming platforms (Disney+, Paramount+, etc.).

For Netflix, the move was a long time coming, and early indications show it was smart. The streaming giant ended 2022 with around 231mm paid subscribers, up 4% YoY.

It’ll take some work to get there, though.

According to an independent report, less than 10 percent of new signups in the month following launch were for the ad-support tier.

Still, Netflix has high expectations for its ad business. The company believes ads will eventually drive at least 10% of revenue.

Its first-party data could help it get there.

“[If] you think about the growing relevance of first-party data and how we do that, those are real big advantages that we can bring relative certainly to the traditional TV world,” said etflix’s new Co-CEO Greg Peters.

Growing pains aside, everyone else in the OTT world is feeling the pressure, which is good for advertisers. Over time, that pressure will drive advertising innovation.

The Upshot: TV Advertising is Evolving, Not Dying

Hulu’s NewFronts announcement is a streaming native expanding its offerings for media buyers, while the NBCU ad format is a traditional broadcaster getting up to speed with digital.

Both show how TV advertising is evolving in the midst of the streaming wars.

The NBCU experiment shows that ad tech is not a matter of digital advertising replacing TV ads — it’s a matter of TV advertising starting to incorporate digital formats and data. “Innovations are making TV advertising more compelling,” the CMO article concludes.

At the same time, the new binge-worthy ad format from Hulu shows that online advertising — even in over-the-top television — will only continue to get more targeted for customers and customizable for media buyers.

Now it’s just a matter of bringing the two together. Incorporating digital into TV advertising, like NBCU has done with its QR code, is a start. But TV advertisers will increasingly want ways to target more effectively while taking advantage of the emotional connection TV advertising offers. And media companies will have to be ready.

For more insights, sign up for MediaRadar’s blog here.