Cough and cold season is here, but advertising spend by over-the-counter (OTC) medicine brands combating related symptoms is down compared to last year according to a new analysis from MediaRadar. Major marketers like Bayer, Procter & Gamble, and Reckitt Benckiser have scaled back ad budgets for top cold relief products, resulting in a 13% year-over-year decline in spend through September 2023 according to the data sample.

Last fall’s “tripledemic” which included COVID-19, RSV, and the flu was well documented as one of the worst cold and flu seasons in recent history. This caused a spike in advertising for OTC medications. So far this season, the same necessity products or the investment in advertising aren’t seen.

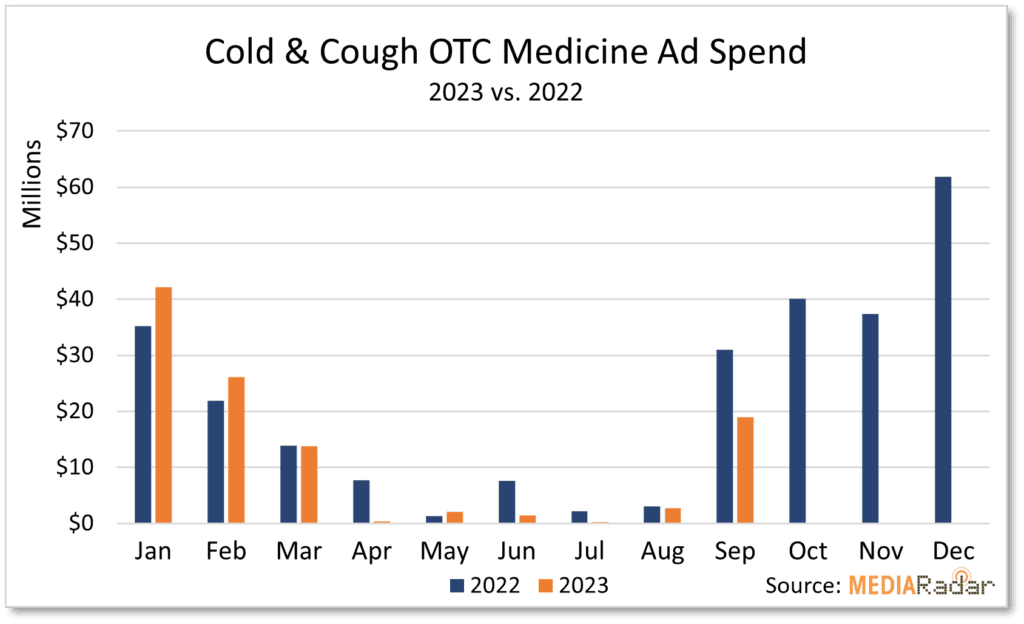

OTC Ad Spending Peaked Early 2023

MediaRadar analyzed ad spend data for top over-the-counter cold and cough medicine brands advertising on TV, online video, print, and other media. Spending on OTC cold and cough remedies hit $107.7 million from January through September 2023. This was down from $124 million during the same period last year.

OTC cold and cough medicine ad spending increased 16% year-over-year in Q1 2023, reaching $82 million. January and February spend both rose 19% compared to 2022. Spending for cold and cough OTC meds typically ramps up again in late Q3 after an expected summer lull. This year the season kicked off with September down 39% year-over-year.

Historically, over half of OTC cold medicine ad dollars are spent in Q4 heading into the winter illness season. But with recent pullbacks, it remains to be seen if brands will ramp up ad budgets as cough and cold cases rise this fall and winter.

Top OTC Advertisers Pull Back Spending

Driving the overall decline in OTC ad spend are major cutbacks from leading cold medicine brands. Bayer AG, the maker of Alka-Seltzer cold remedies, decreased OTC cold and cough spend 86% year-over-year in September 2023. The brand has faced multiple class action lawsuits since last year over how its cold medicines are advertised. This legal scrutiny seems to have put a chill on Alka-Seltzer’s ad budget.

Another OTC cold and cough heavyweight, Procter & Gamble, reduced spending for top cold medicine lines like Vicks DayQuil Severe Cold & Flu (-64% YoY) and Vicks NyQuil (-33% YoY) in September. However, P&G did boost spend for its Vicks Vapo brand, indicating a shifting strategy.

Overall, the advertising landscape for over-the-counter cold and cough medicine brands remains fluid heading into the pivotal winter illness season. Major marketers have cut back ad budgets so far compared to last year’s spike during the “tripledemic.” However, with cold and flu cases expected to rise in coming months, key advertisers may ramp up spending to combat symptoms and capture sales.

By leveraging advertising intelligence tools like MediaRadar to track omnichannel ad trends, OTC marketers can optimize their strategies and budget allocations to stand out. Sellers can leverage MediaRadar’s useful pitch points, CPM calculator, and recently verified contact information to create compelling sales communication and a connection with key media buyers in this space. Those that adapt fastest to the changing advertising climate will be best positioned to increase their bottom lines this cough, cold and flu season. Request your free demo today.