Over-the-top technology (OTT) is still fairly new.

Sure, Netflix rose to fame in 1997, and Hulu said hello for the first time ten years later. Still, one could argue that OTT didn’t achieve mainstream status until the pandemic, when global streaming subscriptions topped 1b.

OTT ad spending hasn’t been a “no-brainer” for advertisers, either. In fact, OTT ad spending currently represents roughly 3% of total digital spending per month.

Either way, the rise of OTT is impossible to ignore from both a consumer and advertising standpoint.

The number of OTT users is expected to reach 4.2b by 2027 (a user penetration rate of 53%, up from a projected 45.7% in 2023).

OTT ad spending will certainly follow; OTT ad spending was predicted to end last year about 20% higher than last year.

This is boosted by entrants to the market like Disney+, HBO MAX, and Peacock.

Over-the-top (OTT) platforms are marketing themselves with little restraint because they believe it’s where TV viewership is going. Over the next five to ten years, we will likely see the evolution and collapse of many of these platforms as they fight to make their business model profitable—we’ve already seen that with Quibi.

Every OTT platform will need to run ads to make their business sustainable. Even Netflix is realizing that.

Kareem Daniel, the chairman of Disney Media and Entertainment Distribution, said in a statement, “Expanding access to Disney+ to a broader audience at a lower price point is a win for everyone – consumers, advertisers, and our storytellers.” He continued, “More consumers will be able to access our amazing content. Advertisers will be able to reach a wider audience, and our storytellers will be able to share their incredible work with more fans and families.”

This sentiment won’t change—and neither will OTT’s role in big and small brands’ media mixes.

State of OTT: Peacock Officially Kicks Off the Streaming Wars

When Peacock launched in 2020, it not only brought NBCUniversal’s take on OTT to the table but also officially kicked off the OTT streaming wars.

As of that day in July, all major streaming services were live, and the end of the era of “waiting for the next big launch” was over.

“The largely free, somewhat confusing service feels most significant for the era its presence effectively ends,” wrote Alison Herman at The Ringer. “But while the opacity of streaming companies makes some speculation inevitable, our days of reading the tea leaves by way of press releases and trade reports are effectively over. Peacock was the final chess piece to show up on the board. Now, the game can begin.”

The race to the top of OTT’s proverbial mountain is underway, but where do all the platforms stand?

Where each OTT platform stands in 2023

With the crowded playing field, consumers have to choose which streaming platforms they want to pay for. While most people are fine dishing out a few extra bucks for multiple platforms—75% of Americans have 2 or more OTT subscriptions—favoritism remains.

In reality, their “favorite child” often comes down to what content they enjoy, the price, and what they already subscribe to.

- Netflix: The clear market leader of streaming platforms was the first to bring streaming of its type to consumers. At the end of 2022, Netflix reported 231mm subscribers, up from 183mm in 2020. That said, the OTT OG announced its largest quarterly loss in subscribers ever in mid-2022.

- Disney+: As of Q4 2022, Disney+ had more than 164mm subscribers, representing a more than 166% increase from April 2022, thanks mainly to stay-at-home orders.

- HBO and HBO Max: HBO and HBO Max have a combined 46mm subscribers in the U.S. as of Q1 2022.

- Peacock: The newest platform has 15mm paid subscribers and 30mm monthly active users (MAUs). According to NBCUniversal’s chief executive, Jeff Shell, Peacock has grown paid subscribers by 70% since the start of 2022.

While millions of households subscribe to streaming services, consumers experience streaming fatigue and are unwilling to shell out more money for endless subscriptions. In fact, 59% of Americans are unwilling to pay more than $20 a month for streaming. The down-and-out economy certainly won’t help.

This is a challenge for new platforms because the business model hasn’t been proven. To overcome this financial challenge, new contenders are experimenting with advertising options to offer consumers the most competitive price possible.

OTT Platforms Experiment with Ad-supported Options

As the last to enter the streaming wars, Peacock had no option but to offer ad-supported video on demand (AVOD). It looks like other streaming services will follow suit.

We know HBO Max did with its own free, ad-supported plan. At the time, WarnerMedia (the company that owns HBO Max) said that an ad-supported version of HBO Max could potentially carry between two to four minutes of advertising per viewing hour.

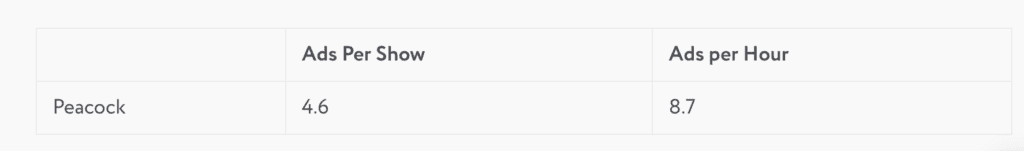

In contrast, viewers see 4-9 ads per hour on Peacock and almost always 10 or more on Hulu (as of 2021).

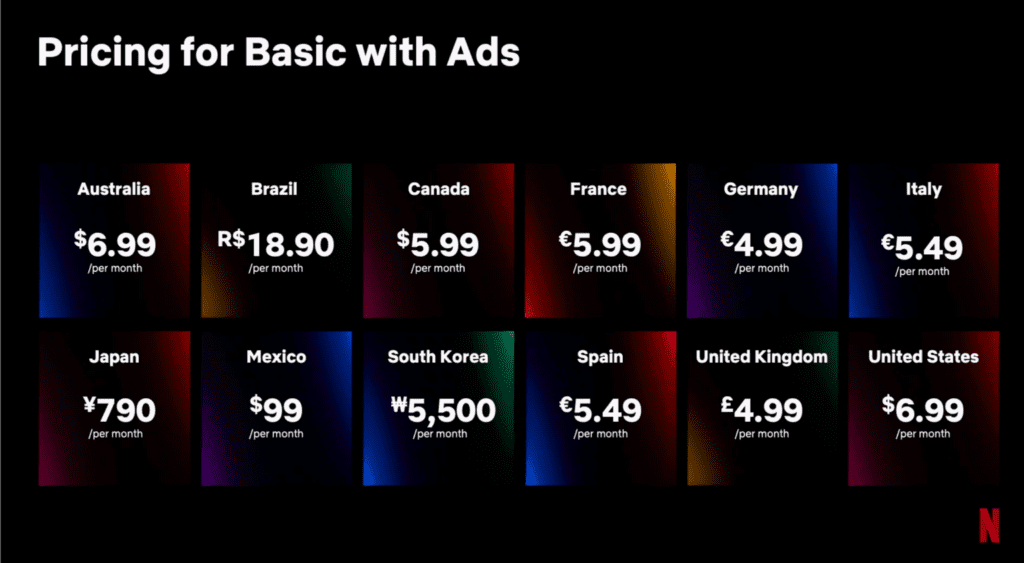

The biggest shakeup in ad-supported OTT came in late 2022 when Netflix entered the fray. While the ad-supported tier is priced 30% less than its previous least-expensive tier, adoption has been slow.

According to independent research, about 9% of Netflix’s sign-ups were for the $6.99/month ad-supported package the month following the launch, making it the least popular among its plans.

In contrast, when HBO Max launched its ad-supported option in 2021, 15% of the platform’s sign-ups that month were for HBO Max With Ads.

Additionally, Netflix initially fell short of viewership guarantees made to advertisers and subsequently allowed advertisers to take their money back for ads that hadn’t run.

Still, Netflix execs are celebrating the push into advertising, with the platform gaining more than 7mm subscribers in the month following its foray into OTT advertising.

Overall, the embrace of ad-supported OTT is good news across the board for advertisers. As competition inside OTT’s walls continues to heat up, big and small platforms will be forced to evolve their ad offerings to appeal to advertisers and keep consumers happy.

For now, consumers seem to be ok with trading ads for free content; 76% of viewers said they’re willing to watch ads for free video streaming.

That sentiment can change fast, especially if platforms increase ad loads to counteract a potential drop in revenue during the recession.

For more insights, sign up for MediaRadar’s blog here.