Yesterday, the executives of Google, Facebook, Amazon, and Apple had a long day defending company practices to lawmakers.

According to Tim Derdenger, an associate professor of marketing and strategy at Carnegie Mellon University’s Tepper School of Business, U.S. representative Val Demings hammered Google for its immense role in programmatic ad technology.

But it’s not just Google that has a position in programmatic—all four of these powerhouses have some cut of the pie. According to Google, programmatic is a crowded market (despite consolidation trends).

With these hearings, it’s only fitting we do a check-in on programmatic advertising. In April, programmatic ad spend experienced a slump, but was on the rise by May. How did programmatic fare in June?

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

State of Programmatic

It’s true that Google isn’t the only player in the programmatic ad market—and even though Google was under the spotlight yesterday, other ad companies have been reporting good news since May.

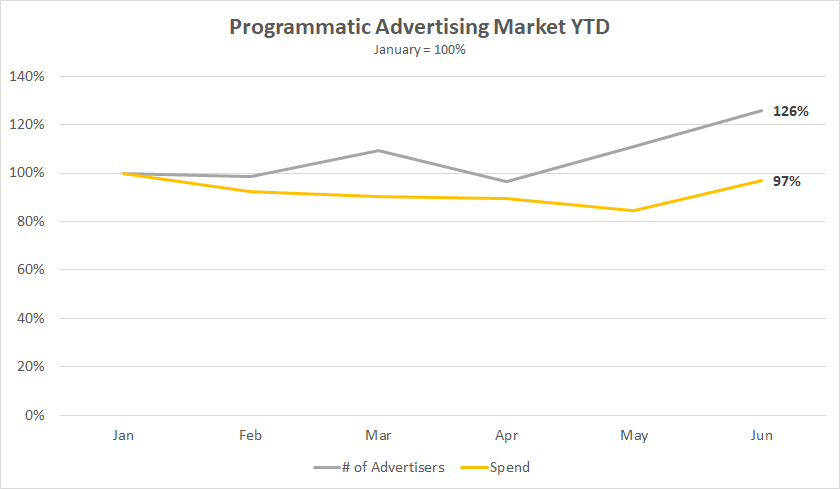

MediaRadar research found that the number of advertisers running programmatic ads is up 26% since January. In June, spend levels hit their highest point since January. In fact, spend levels in June were down just 3% when compared to January.

Advertising company Criteo also reported that market conditions in May improved and revenue trends were better than expected. In early June, stocks for Criteo rose 16% after it released its second quarter results.

Part of this may be its emphasis on direct response advertising.

“We believe our core strength in direct response marketing will help our customers best rebound from these unusual times,” explained Criteo CEO Megan Clarken to AdWeek in April. Direct response ads have been a linchpin for advertisers during COVID-19, as they are designed for immediate conversions, such as eCommerce shopping or gaming, which have increased during the pandemic.

What does this translate to? Large advertisers may be pulling back dollars, but small advertisers are piling into programmatic as they hope for data-driven targeting strategies.

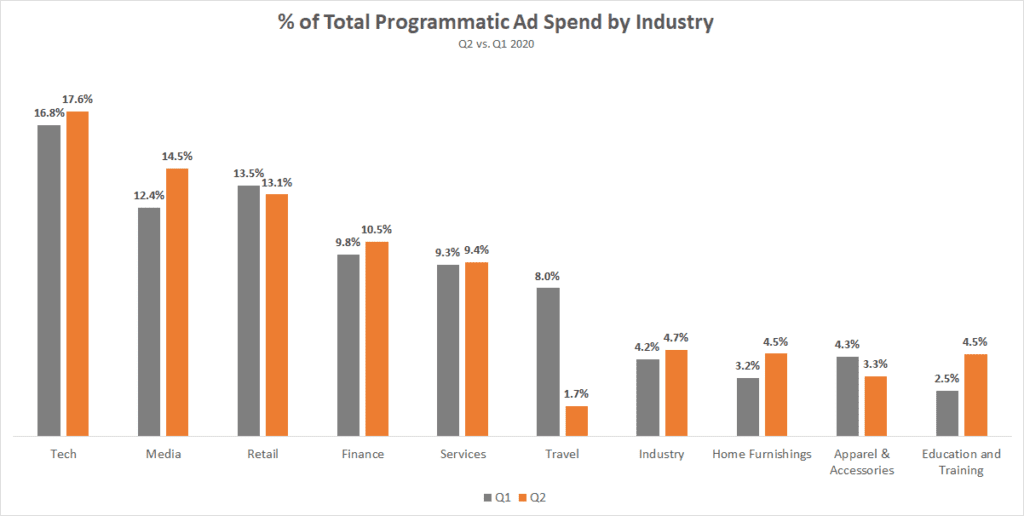

The types of companies buying programmatic ads shifted in Q2 compared to Q1. Most noticeably, travel brands drastically cut spending. Categories spending more include Media, Home Furnishings, and Education/Training.

The Trade Desk, another major player in programmatic advertising, saw its stock shoot up 30.5% in June. The Trade Desk is doing particularly well amid the pandemic due to its investments in connected TV technology. Since March, the company has been up 200%.

One thing we will be watching later this year is the release of Apple’s new privacy features bundled in with iOS 14. Apple said there will be new features that allow users to block location tracking more extensively and the system will include transparency tools to prevent apps from recording users without their knowledge.

This is likely to have a large impact on the advertising industry, curbing advertisers’ ability to hyper-personalize with targeted ads.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.