As we conclude 2023 and look toward the new year, MediaRadar reviewed advertising within the automotive industry.

Whether this sector is quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of this category poised to fizzle up in 2024 based on the latest national advertising insights. For more updates like this, stay tuned. Subscribe to our blog for more.

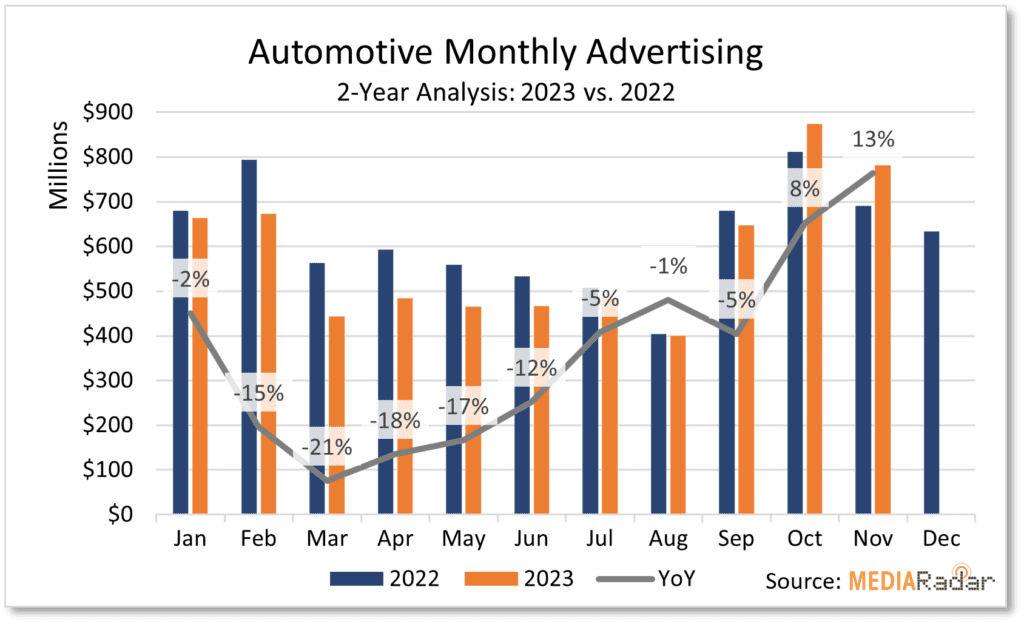

MediaRadar’s data sample revealed over $6.38 billion spent by automotive makers, dealerships, auto websites, and parts & accessories advertisers through November 2023. There were over 9.3 thousand companies investing in ads for 13.4 thousand brands, models, or product lines.

Digital, print, and national TV ad spend decreased by 6% compared to the same period in 2022. The number of companies advertising dropped by 28% from the 12.9k spending through November last year. Although there’s fewer players in the space, dollars haven’t contracted as much.

Automotive models drove the vertical with more than $4.4 billion spent. That’s 70% of the spend. And they scaled back by 7% YoY. SUVs, the largest driver of models dipped by 11% YoY to $1.4b. Additionally, electric vehicles and trucks decreased by 7% YoY and 10% YoY respectively as import models increased by 10% YoY to $1.27 billion.

Auto parts & accessories advertisers stayed fairly flat at $564mm spent this year to advertise. Auto dealerships, new and used, reduced by 26% YoY to invest around $427mm.

Considering there are bug automakers such as Hydudai, GM, Toyota, it’s not surprising that TV ad spend came close to $3.4 billion despite a pull back of 14% YoY from 2022’s nearly $4b. Inversely, online video investment increased by 20% to more than $1.25 billion from automotive advertisers.

12 Auto Advertisers to Watch in 2024

Below are our highlighted 12 for ‘24 automotive brands, out of the 13.4 thousand, that show spending increases this year. Combined spend idled around $870 million after a collective 97% YoY spike.

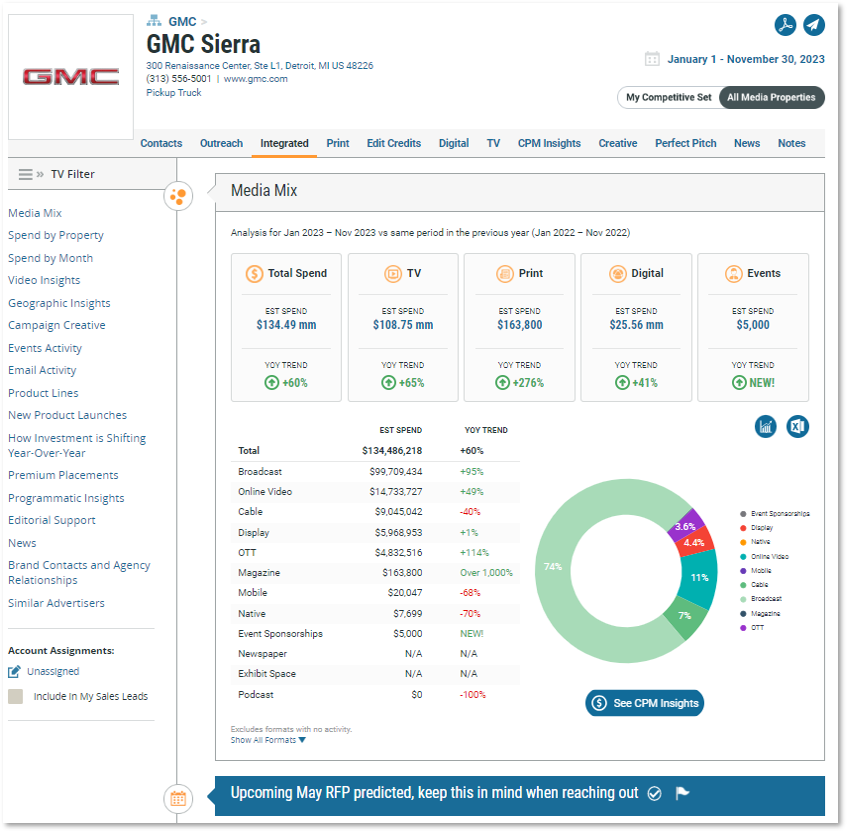

GMC Sierra ramped up its ad investment by 60% YoY through November, reaching over $134 million. TV spending was up by 65% to nearly $109mm, which comprised 81% of the spend. There was also a 41% YoY expansion in digital media, in which 58% of the $25.6mm 58% was bought programmatically. Sierra’s OLV spending was close to $15mm concentrating on ads 16 to 30 seconds long. In terms of overall video placement with OLV and OTT, mid-roll accounted for 48% of the $19mm spent in these two digital formats. There’s also an upcoming RFP predicted in May for GMC’s pickup truck model.

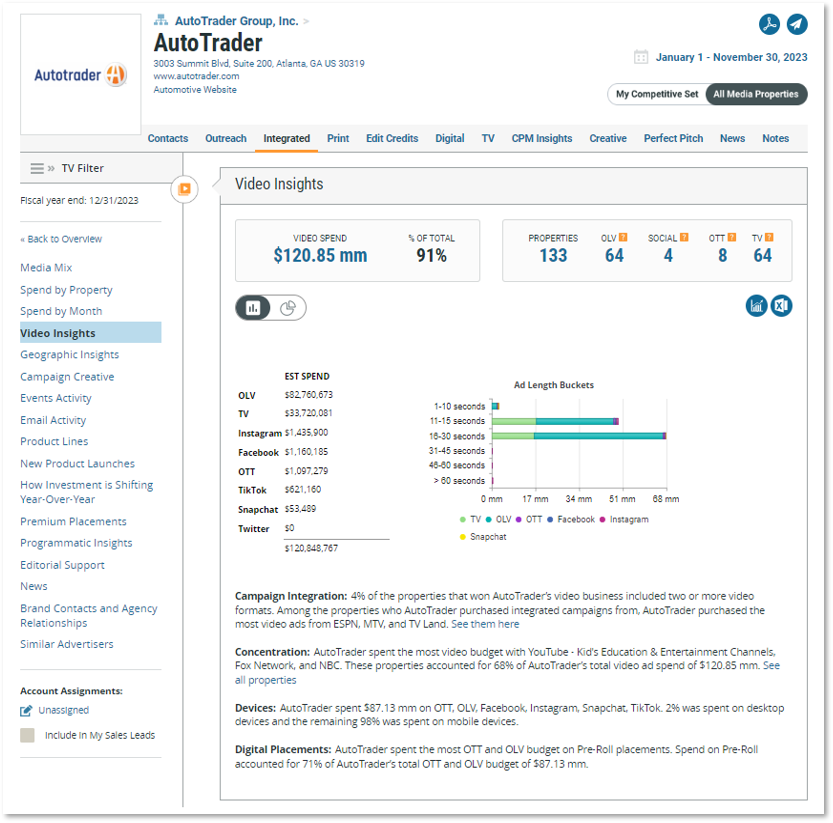

AutoTrader increased its ad spend by 191% from last year to more than $132 million. Its concentration of dollars landed with online video with around $83mm spent after increasing by more than 700% YoY. There were paid social increases with Facebook, Instagram, Snapchat, and TikTok. The $34 million spent towards TV ads was a mix of both broadcast ($17.4mm) and cable ($16.3mm). Video advertising was 91% of spend through OLV, OTT, padi social, and TV with concentration buys placed with YouTube’s Kids & Education channels, Fox, and NBC. These three outlets captured 68% of the $121mm spent.

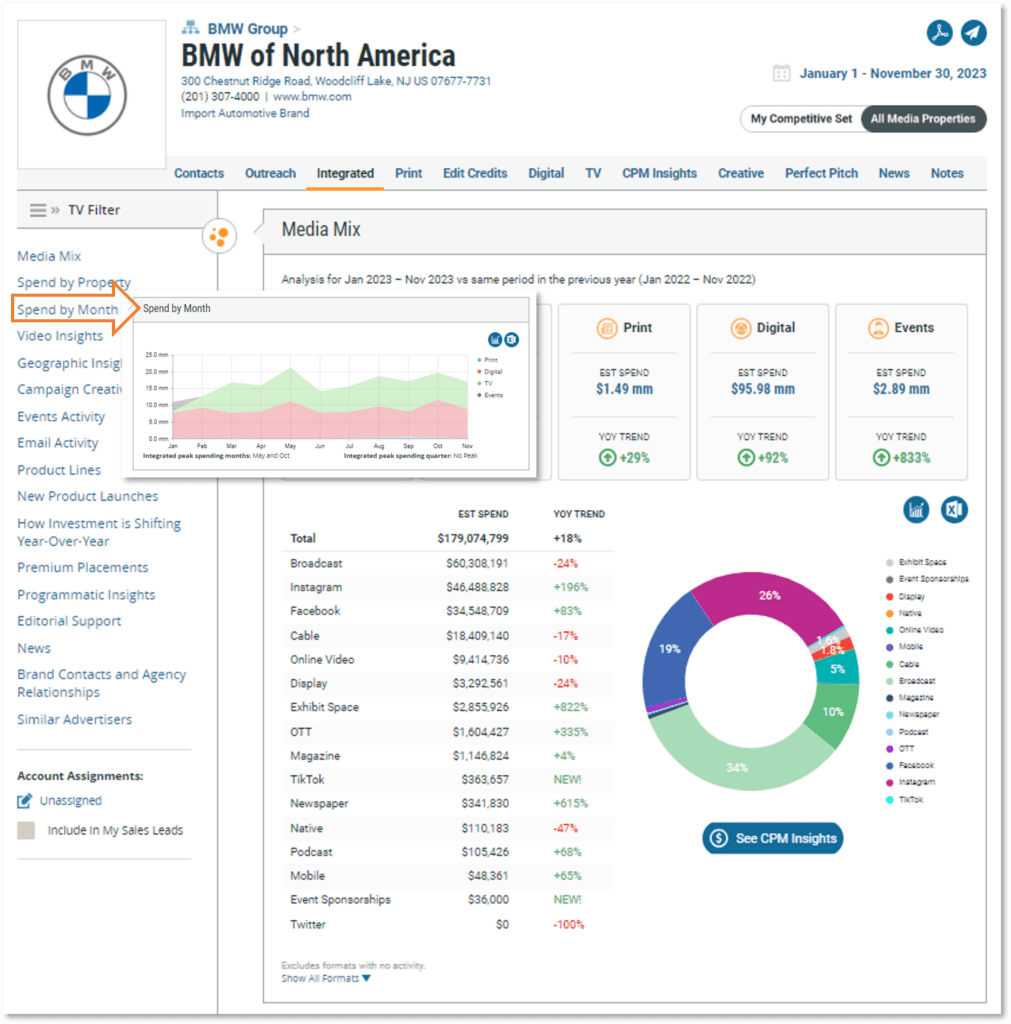

BMW of North America nearly reached $180 million in ad investment through November. Digital media increased by 92% YoY, print was up by 29% YoY and TV saw a 23% YoY decline. Overall, ad spend settled with 18% YoY growth from the same time last year. Digital media was driven by paid social ads, which increased with Meta platforms and TikTok. There was increased exhibit space and new sponsorship spending as well. Peak integrated spending happened in May and October.

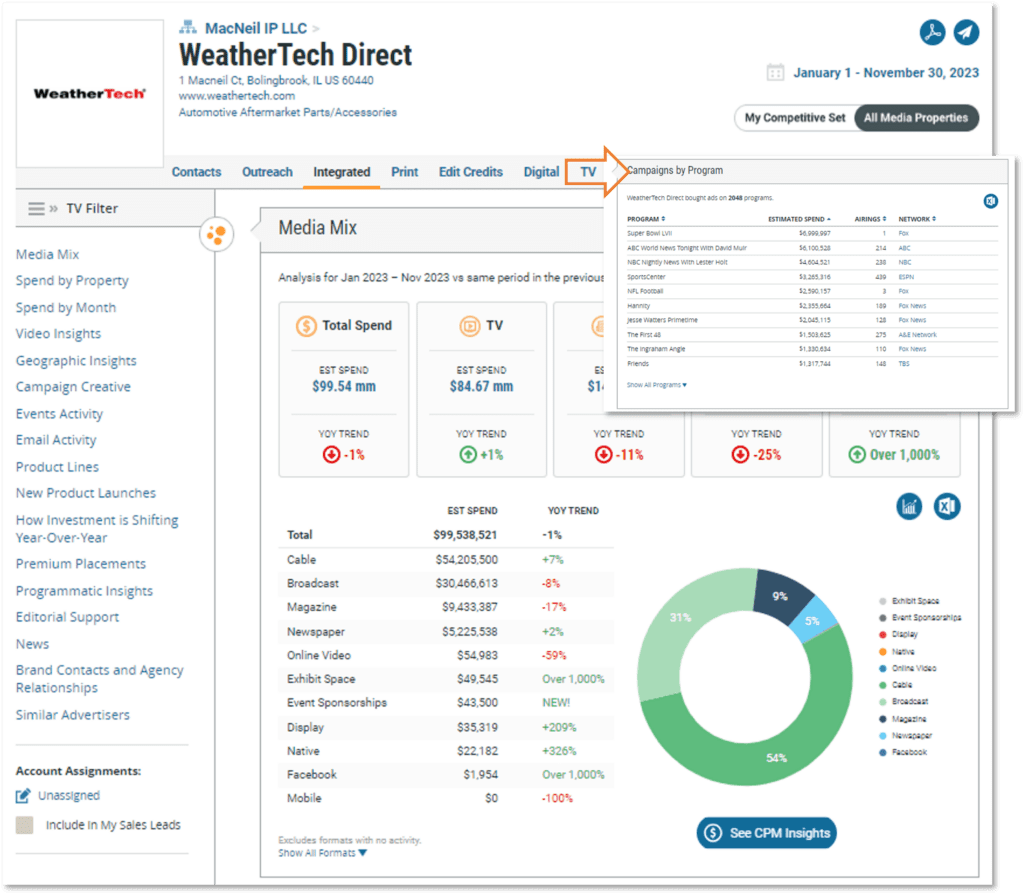

WeatherTech Direct dipped slightly by 1% YoY still investing nearly $100 million to advertise its auto aftermarket products this year. There was peak spending in February, thanks to appearing during the Super Bowl game. And peak spending again in November with a creative campaign featuring red bows in time for the gift giving season. TV ads were 16 to 30 seconds with ABC World News Tonight, NBC Nightly News in addition to the Super Bowl LVII were top programs capturing ad placements.

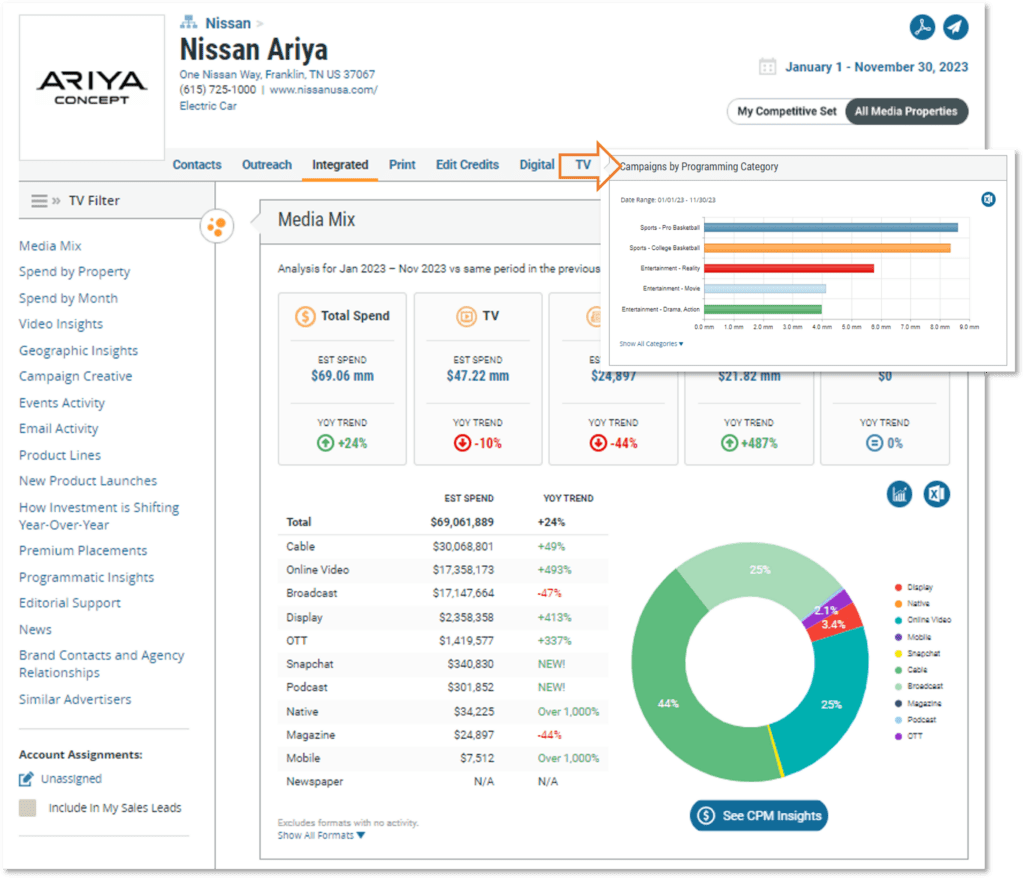

Nissan Ariya spent over $69 million so far this year, which is a 24% YoY bump from the advertising dollars last year. TV spend dipped to $42mm and digital spending surged by 487% YoY with peak integrated spending occurring Q1. Online video was 25% of the ad spend topping $17mm. There were some print ads placed totalling less than $25k. Ariya’s TV programming centered around basketball with ESPN and CBS as top networks.

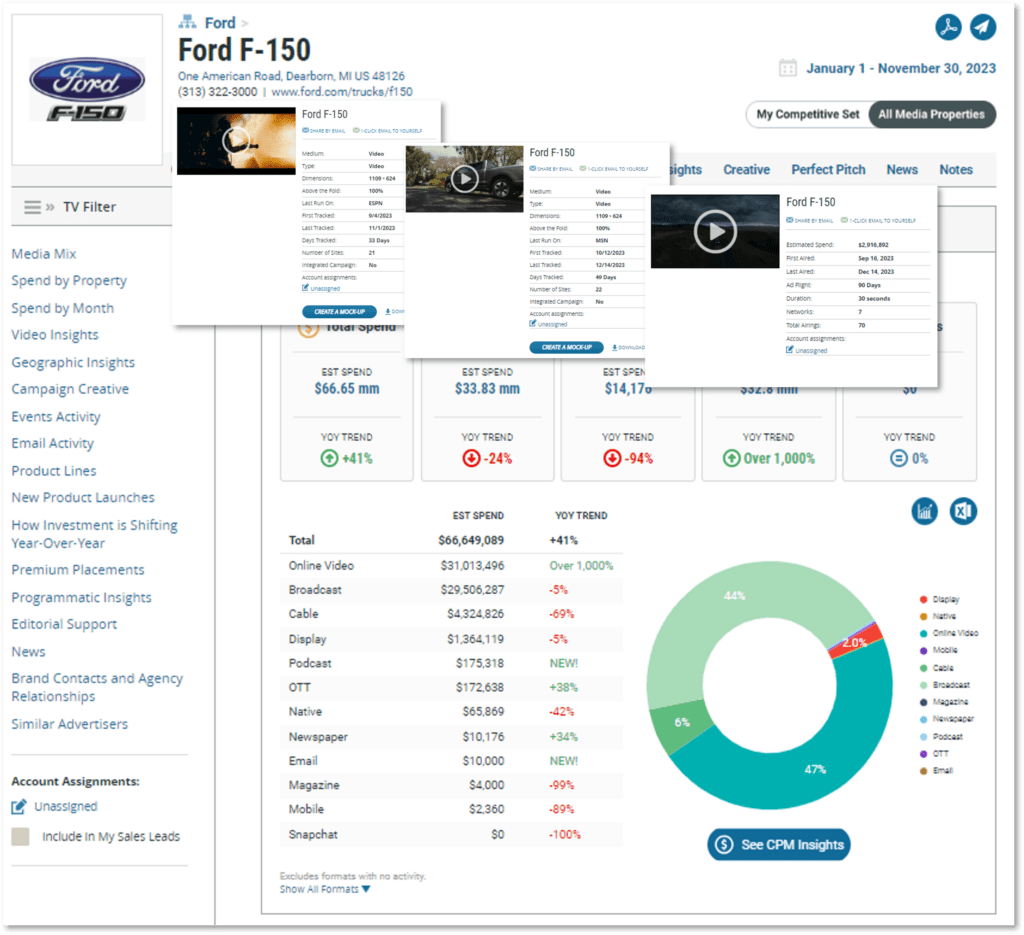

Ford F-150 invested nearly $67 million to advertise through November 2023 and leaned heavily into video spending. Over $65mm (97% of ad spend) was dedicated to OLV, OTT, and TV ads between 11 and 30 seconds long. Three outlets captured 71% of that spend – YouTube’s Automotive channels, Fox, and CBS. Drilling into campaigns, various were used spending on the video outlet and TV network.

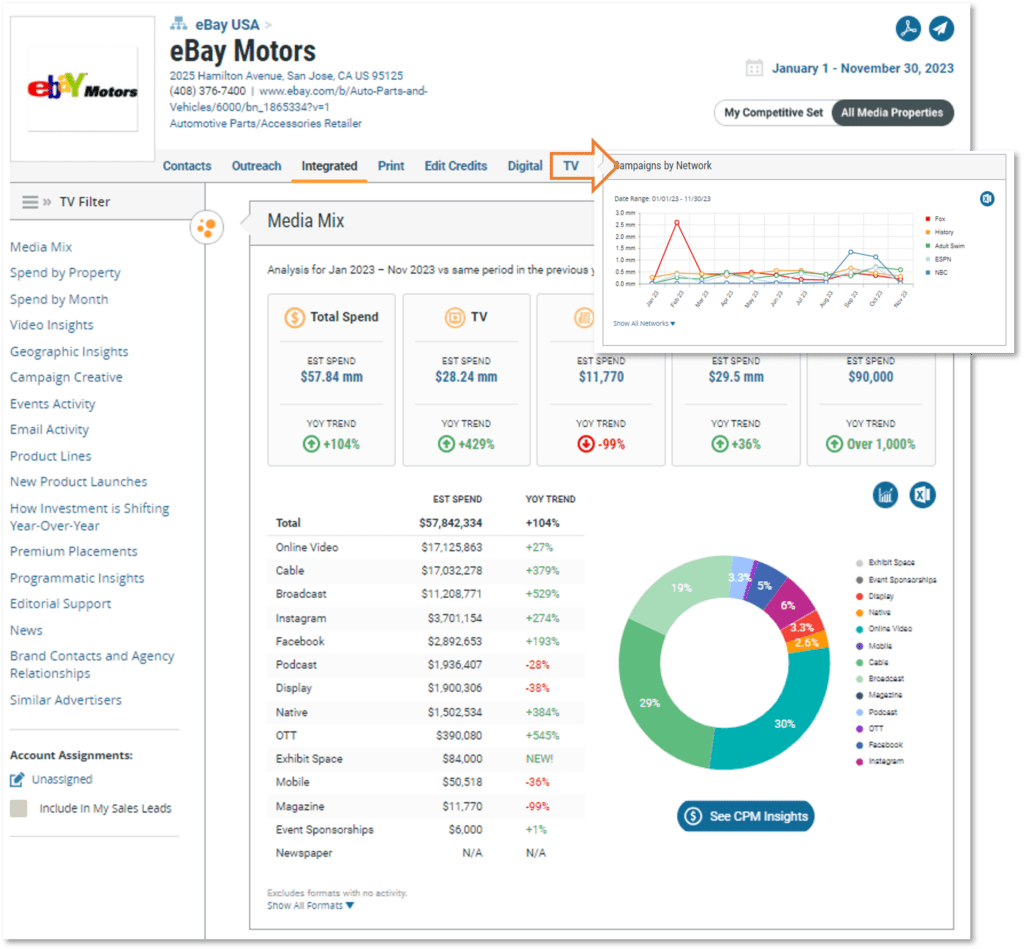

eBay Motors revved up its advertising to over $57 million after increasing by 104% YoY this year. The auto online marketplace almost implemented a 50/50 TV and digital mix by increasing cable and broadcast advertising 429% compared to the same time last year. While it didn’t show during the big game, there was peak spending in February thanks to ad investment during the LVII’s Program show. Football Night in America was a top program as well. Three top TV networks included Fox, History, and Adult Swim.

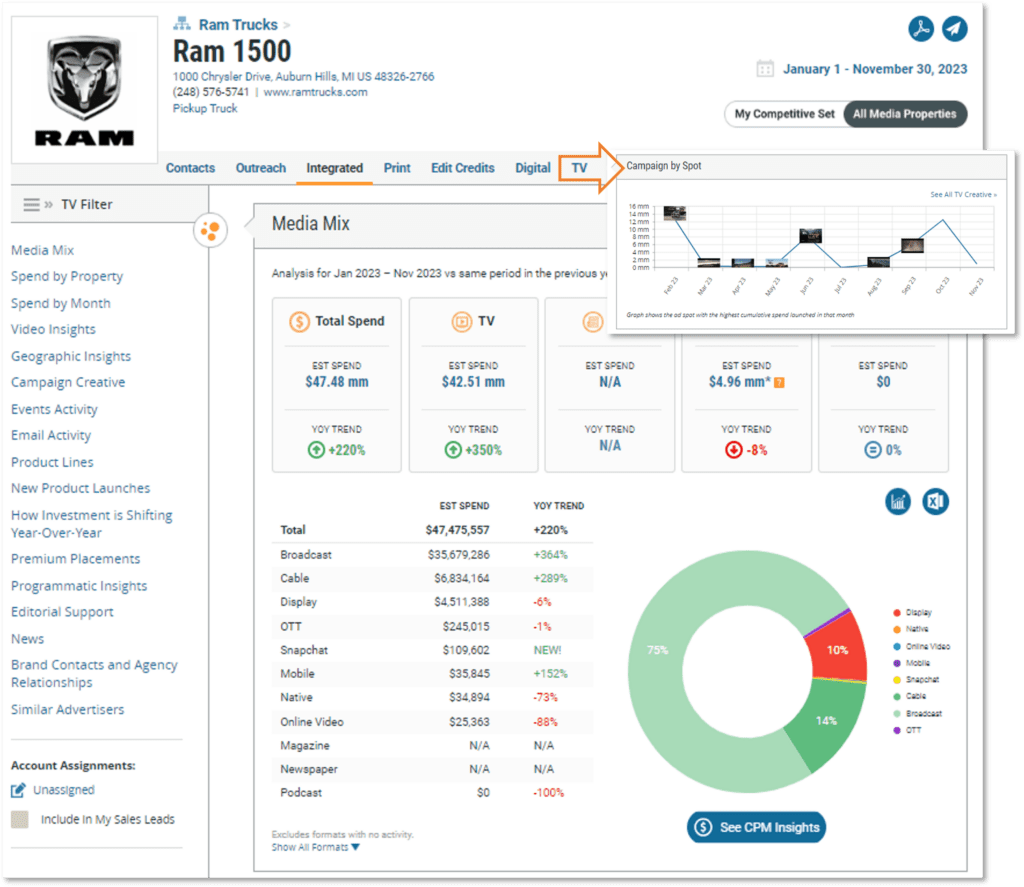

RAM 1500 adjusted its advertising mix this year with an overall 220% YoY spike to more than $47 million. The truck was mostly seen on TV, which was $42.5mm between cable and broadcast. Both were up by over 280% YoY. Seven ad spots were tracked with high spend that were launched through the year. Inversely, its digital ads were down by 8% YoY overall with digital display ads driving the format.

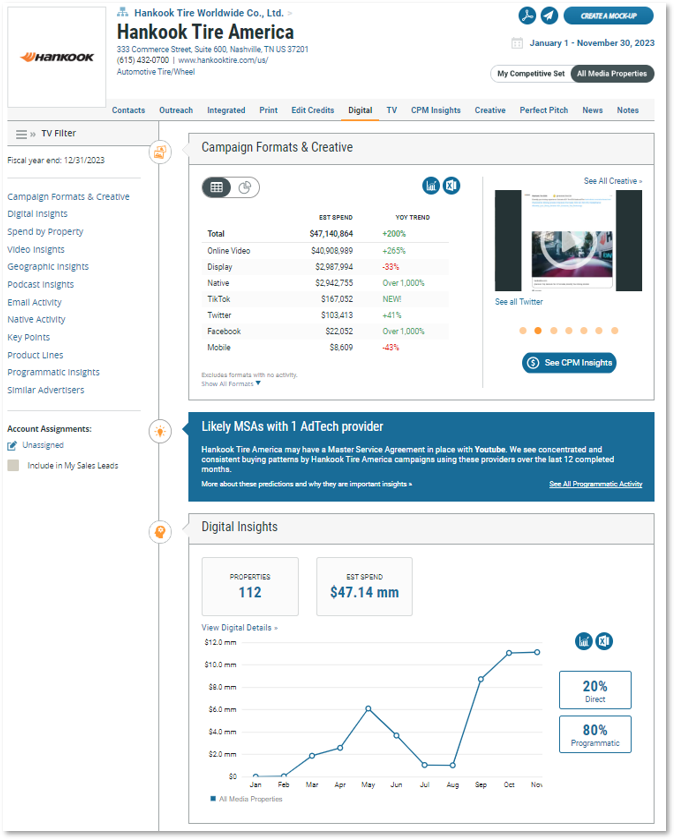

Hankook Tire America’s nearly $48 million spent advertising was 85% dedicated to online video. Its overall increase by 112% YoY was driven by OLV amping to nearly $41mm, which is a 265% increase from the same period in 2022. Digital buys were a 80% programmatic and 20% direct mix with over 110 outlets. TV spend dropped to less than $650k and there were less than $65k in print ads placed. 2023’s

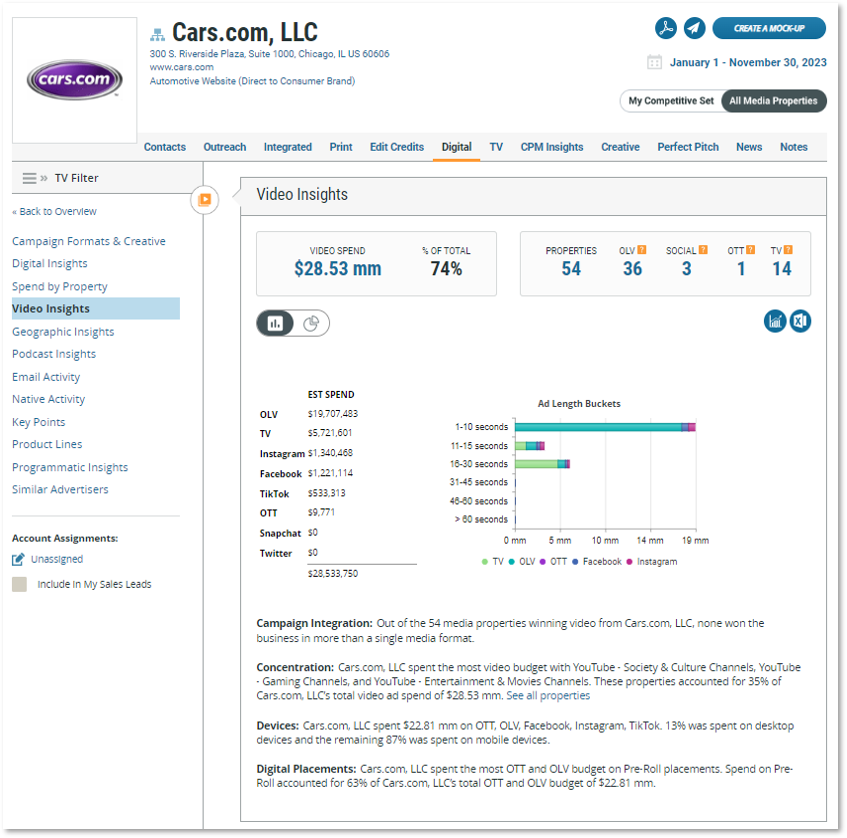

Cars.com, up by 124% YoY, spent over $38 million to advertise. Its concentration was digital media which surged by 142% from last year. Over half of the dollars was dedicated to OLV, which skyrocketed by over 1000% YoY. TV spend exceeded $5.7mm. Overall video was 74% of the ad investment with TV ads 11 to 30 seconds in length and OLV mostly saw ads 10 seconds or less. YouTube’s three channel categories: Society & Culture, Gaming, and Entertainment & Movies captured 35% of this spend. Of the $22mm spend with OLV, OTT, and paid social, 87% was mobile devices.

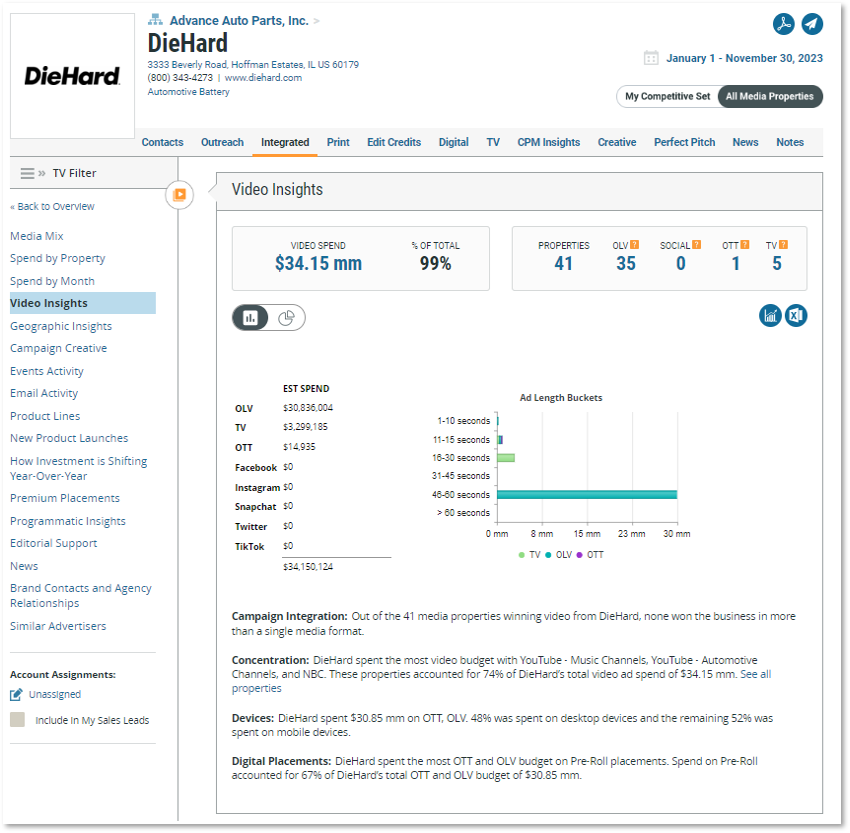

DieHard charged up its spending by 334% so far this year to $34 million. Online video was the format of choice at 90% of investment for the Advance Auto Parts battery brand. TV spending was down by 57% YoY. Even so, TV ads were $3.3mm. Video investment was 99% with TV focused on ads less than 30 seconds. OLV ads were 46 to 60 seconds long, $30mm spent.

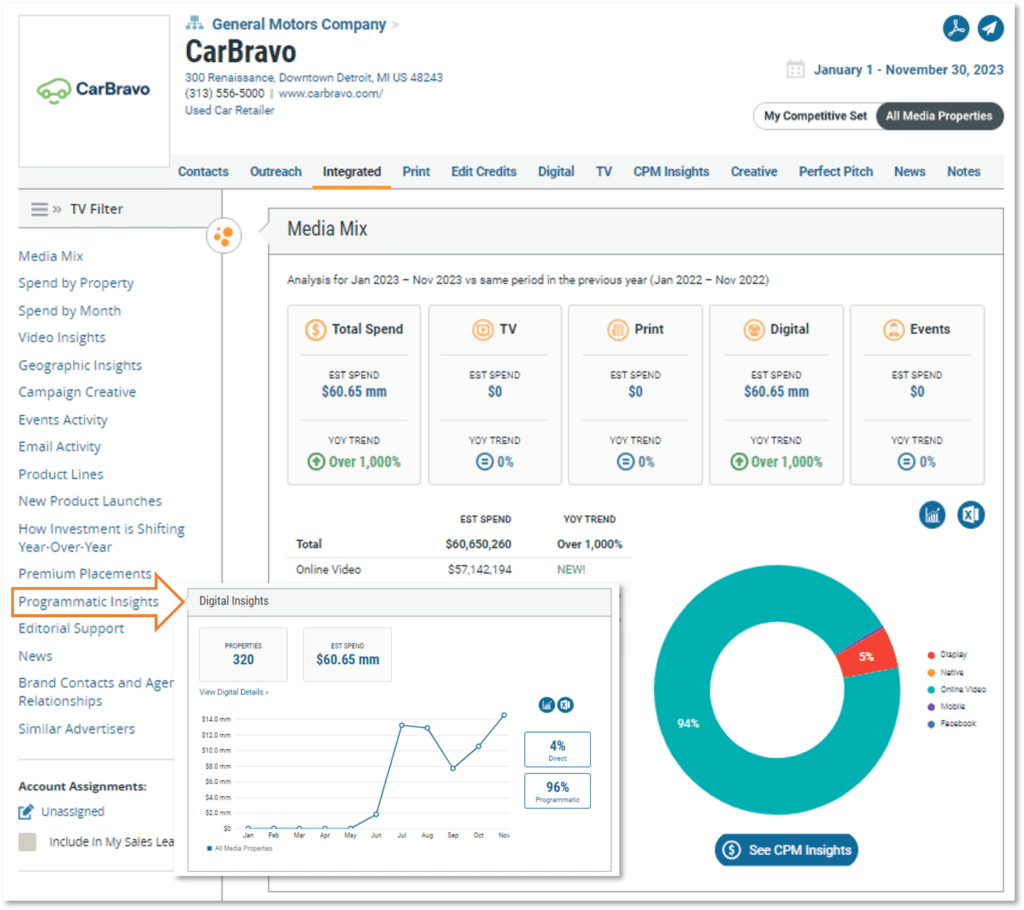

CarBravo, which falls under General Motors’, spent more than $60 million from June when spending kicked off to November. And all of it was digital with 96% programmatically placed so far this year over 320 outlets. Direct buys were placed with The Weather Company and Kelley Blue Book among others. July, August, and November were peak spending months for the brand.

Use MediaRadar to better understand how advertising investment is shifting in your market. MediaRadar will help you uncover new prospects, prepare your pitch, and connect with the right decision-makers at the right time. Request a completely customized demo of MediaRadar today.