As we conclude 2023 and look toward the new year, MediaRadar reviewed advertising for baby & kids’ brands.

Whether this sector is quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of this category poised to fizzle up in 2024 based on the latest national advertising insights. For more updates like this, stay tuned. Subscribe to our blog for more.

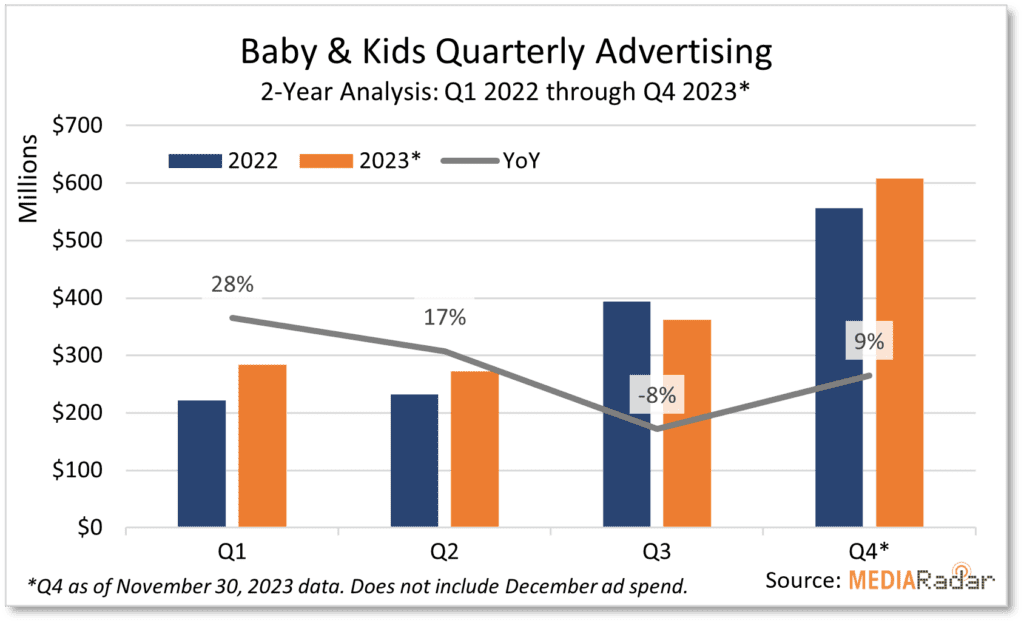

MediaRadar’s data sample estimated over $1.5 billion was spent by baby & kids advertisers through November 2023. That’s a jump of 20% YoY compared to the $1.3b invested during the same time in 2022. The number of companies spending also increased by over 33% to three thousand.

The only quarter that saw a decrease was Q3, which was down by 8% YoY to $362mm. With only two months into Q4, the quarter already saw a 9% YoY uptick compared to 2022.

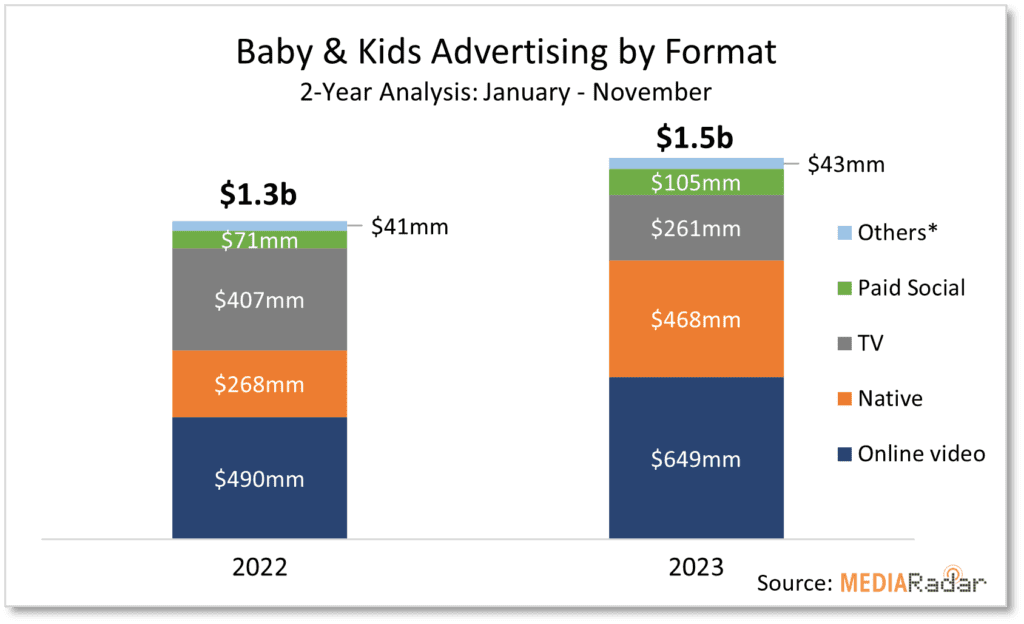

Digital media exceeded $1.25b (82%) of the total spend. Online video captured 43% with a 33% YoY bounce up to over $649mm. Next up, native spend with retail media services such as Amazon, Target, and Walmart, grew by 75% YoY. TV spend decreased by over 33% to $261mm and print media was slashed by 23% YoY to $11.8mm.

Toy and game advertisers drove this arena contributing 61% of the investment totaling over $928 million. Diaper companies spent $216mm, which was 14% of the category spend. Growing the most YoY by 131% YoY was baby & kids’ accessories advertising, which reached over $125mm.

12 Baby & Kids Advertisers to Watch in 2024

Out of 3.5 thousand baby & kids brands that advertised this year, 12 are highlighted below. All spent more than $9.8 million, some of which started their ad spend this quarter. The combined spend was $335 million through November 2023. These brands saw a collective year-over-year growth of 88% compared to the same period last year.

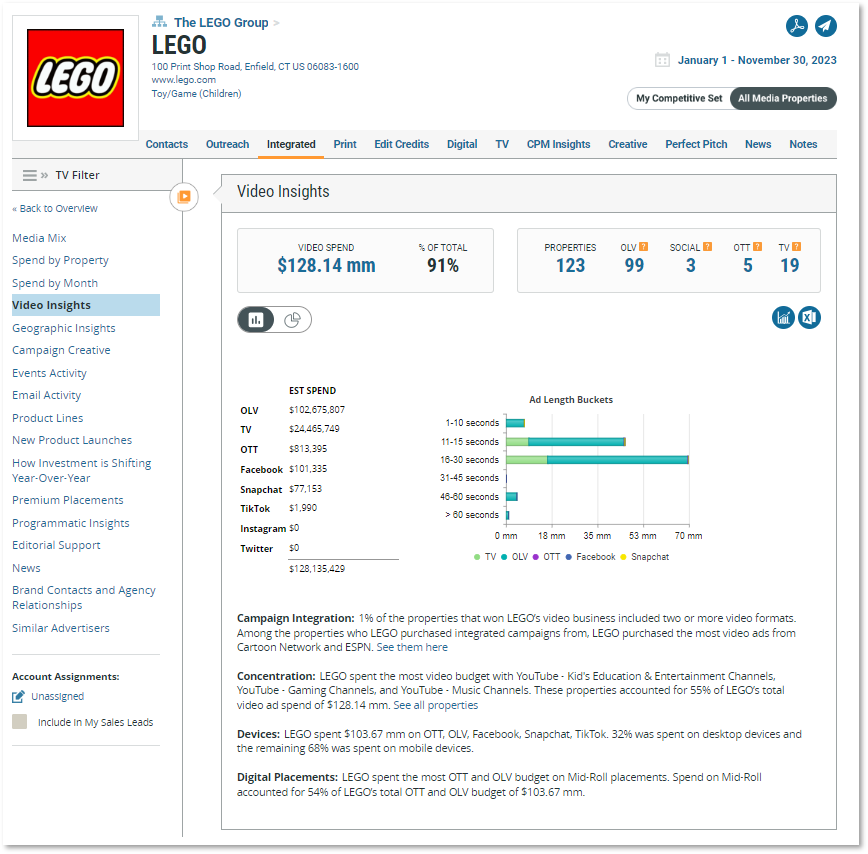

LEGO spent $141 million advertising its product lines ranging from LEGO Technic to LEGO Star Wars with 91% of that dedicated to video ads. The OLV, paid social, and TV ads were predominantly 30 seconds or less. YouTube’s Kid’s Education & Entertainment, Gaming, and Music channels captured 55% of the $128mm video spending. TV spending was at $24.4mm and went toward programs like Nick at Nite among others. Over half (54%) of LEGO’s OTT and OLV investment of $104mm was on mid-roll placements. Digital media advertising built up by 46% compared to the same period in 2022.

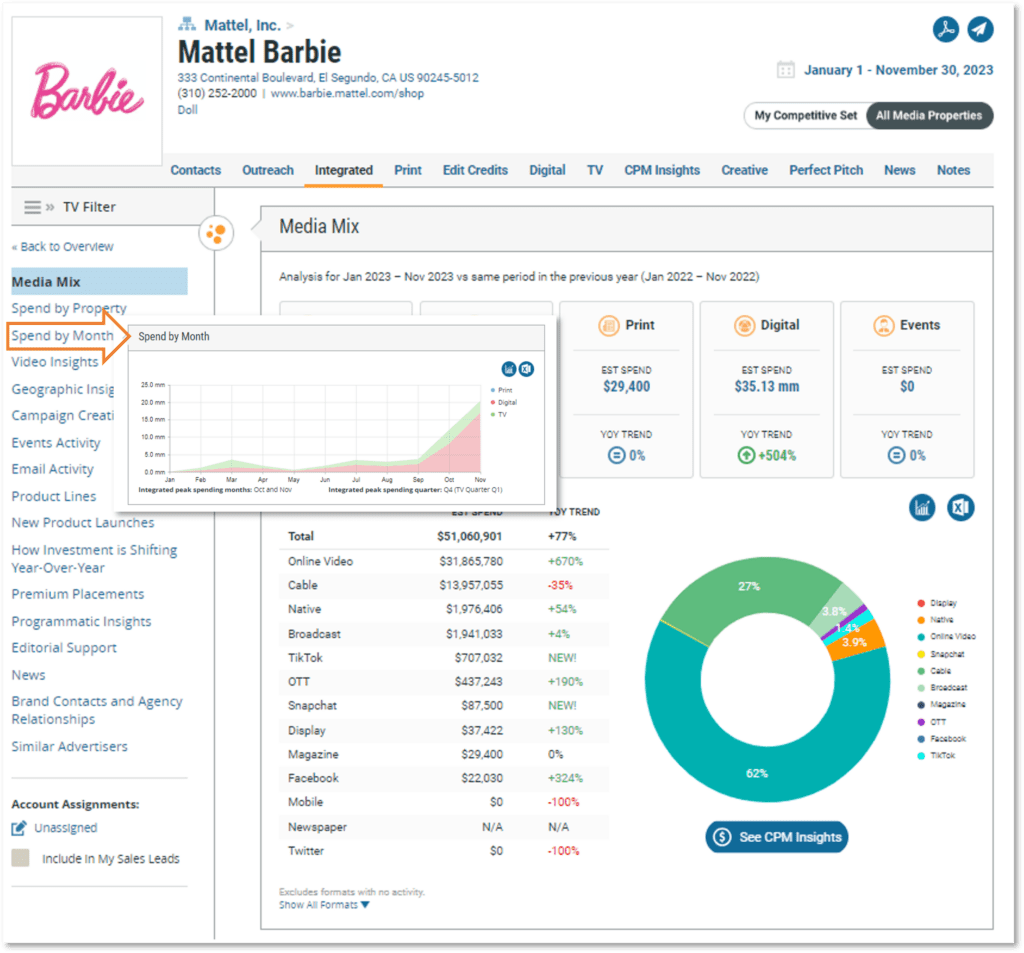

Mattel Barbie’s advertising expanded by 77% YoY to more than $51 million through November 2023. The doll’s digital spend was up by a whopping 500% YoY to $35mm with a concentration in online video ads. As the holiday approached, peak integrated spending happened in Q4. Video investment through OLV, TV, paid social, and OTT reached $49mm. YouTube – Kid’s Education & Entertainment and Society & Culture channels along with Nickelodeon saw 67% of that. Pre-Roll accounted for 65% of Mattel Barbie’s $33mm OTT and OLV spending.

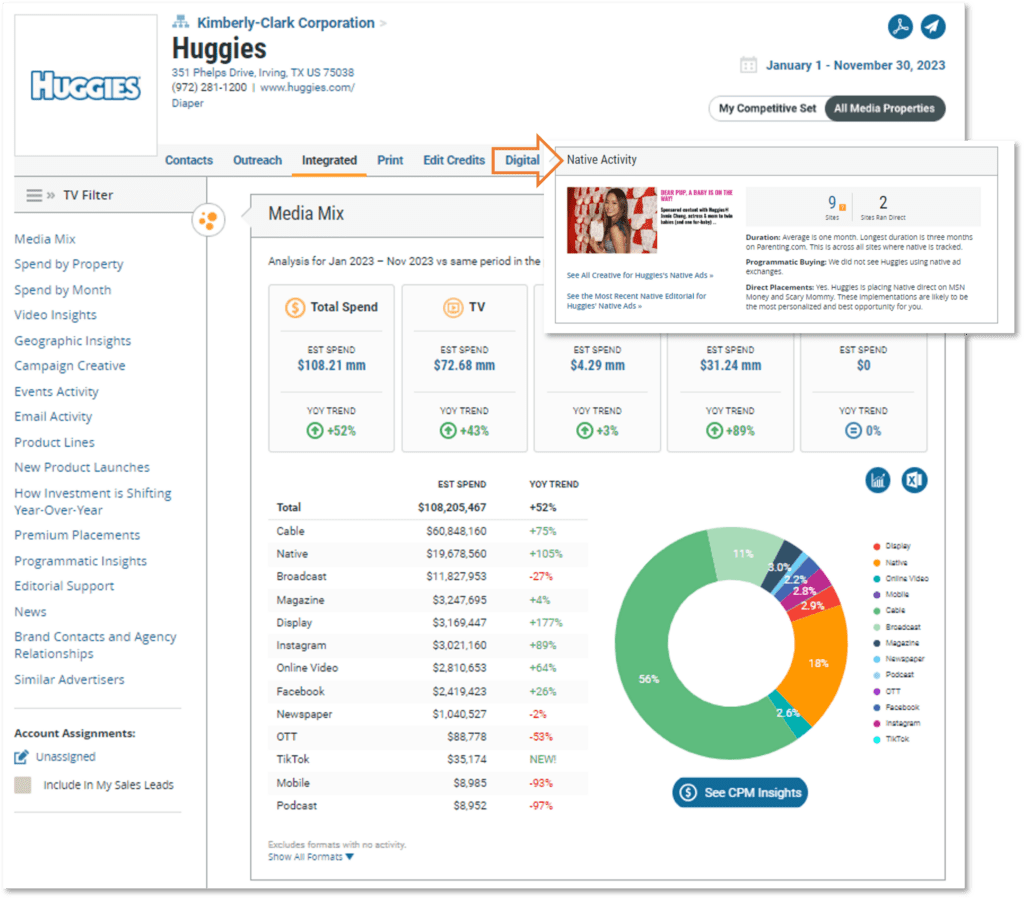

Huggies wrapped up the first 11 months of 2023 with over $108 in digital, print, and national TV advertising. The brand’s increase by 52% YoY occurred in all media with TV ads over 67% of the spend, $73mm with cable up by 75% YoY, while broadcast dipped by 27% YoY. Huggies spent the most video dollars with MTV, E! Entertainment Television, and ABC. These three outlets accounted for 26% of its $79mm towards the format. Native advertising spiked by 105% YoY to nearly $20mm with an average ad duration of one month. MediaRadar tracked three months as its longest duration on Parenting.com. The diaper brand bought native directly with MSN Money and Scary Mommy.

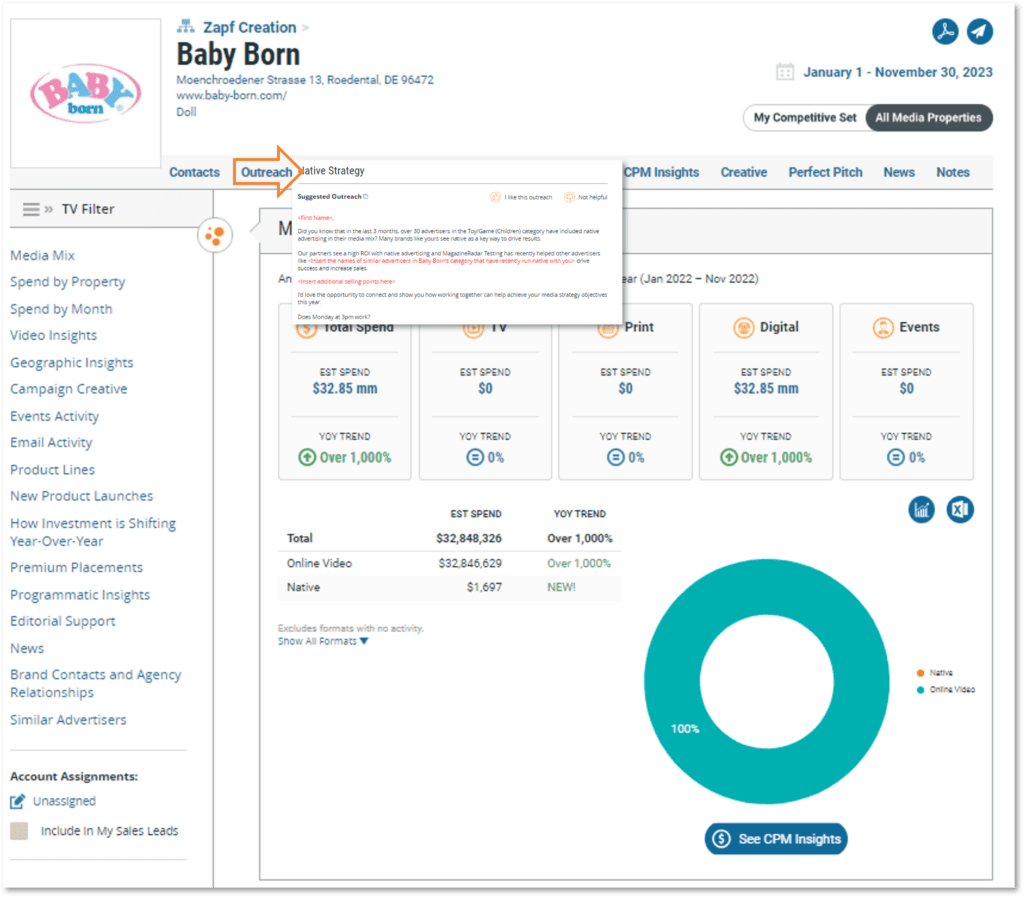

Baby Born went 100% with online video (less than $2k towards native ads) spending nearly $33 million advertising its doll through November 2032. That’s $7.7mm in October and $25mm in November in time to get into children’s hands for the holidays. Ads placed were longer than 45 seconds with YouTube’s Education & Entertainment, Society & Culture, and Music channels getting 96% of the OLV ads. As the brand strategizes for 2024, consider MediaRadar’s Outreach Writer’s to help customize a pitch.

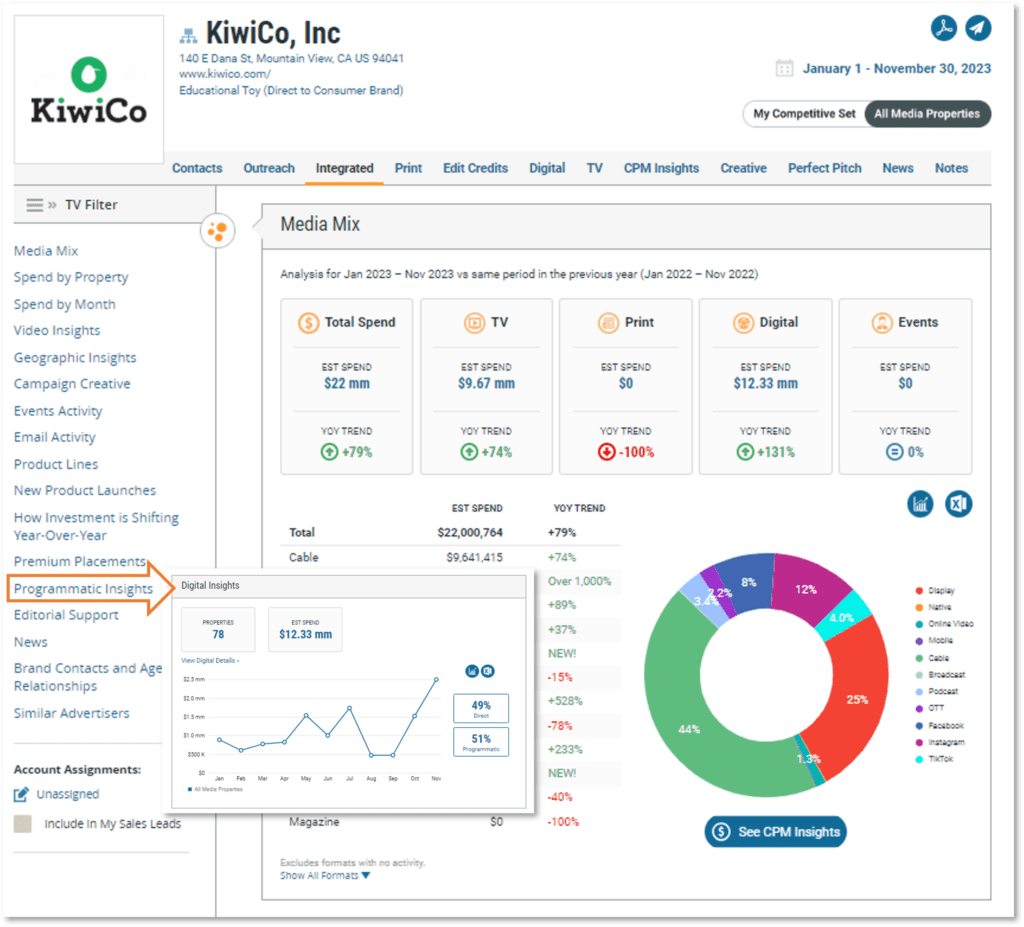

KiwiCo, Inc’s advertising dollars excelled past $22 million with shift of TV increasing by 74% YoY to $9.7mm and digital media saw a $12.3mm investment after leaping by 131% YoY. The educational toy’s digital media was focused on display (+1000% YoY) and paid social – both saw more than $5mm spent. Direct placements were 49% of the ads across 75 plus outlets with peak spending in Q4.

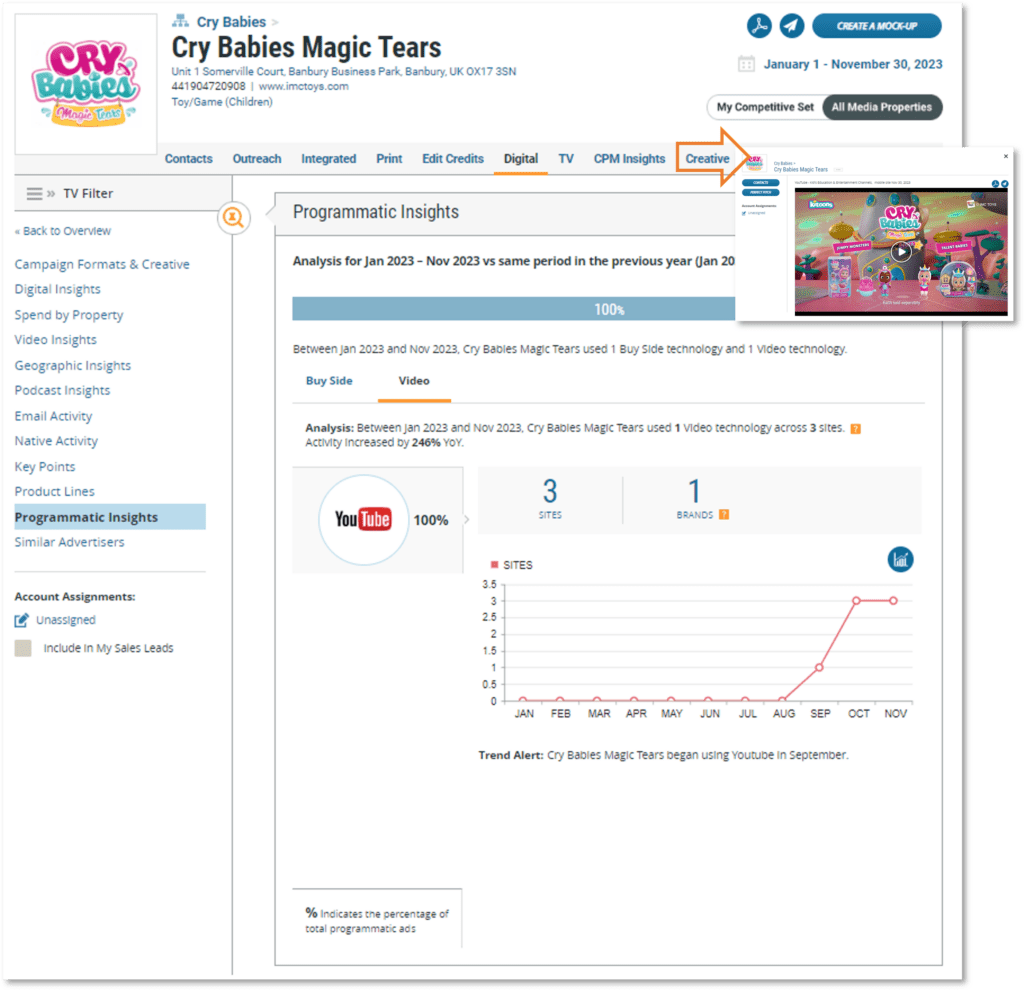

Cry Babies Magic Tears shimmered to over $21 million in 100% online video. The toy brand reduced TV ads to less than $65k while enhancing digital by 1000% YoY. OLV was 100% placed through ad tech with peak spending starting October. Around $20.6mm was devoted to ads 16 to 30 seconds long, the remaining dollars were spent on 31 to 60 second ads.

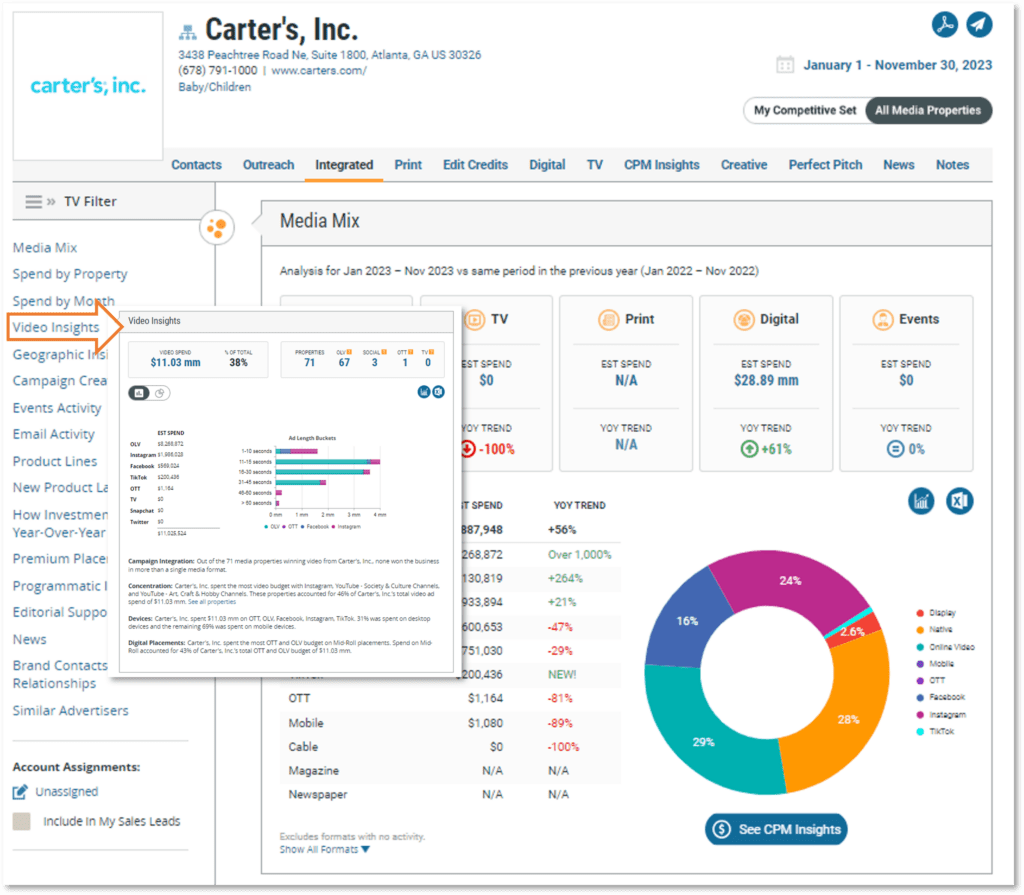

Carter’s, Inc. ad spend saw a 56% YoY uptick to nearly $29 million through November 2023 nestled in various digital formats. Online video (+1000% YoY) and native (+264% YoY) both saw investments of $8mm. Its digital ads span over 230 outlets and were 75% placed programmatically. Peak spending was Q1 in February to around $6mm but ads have been averaging $2mm or more each month.

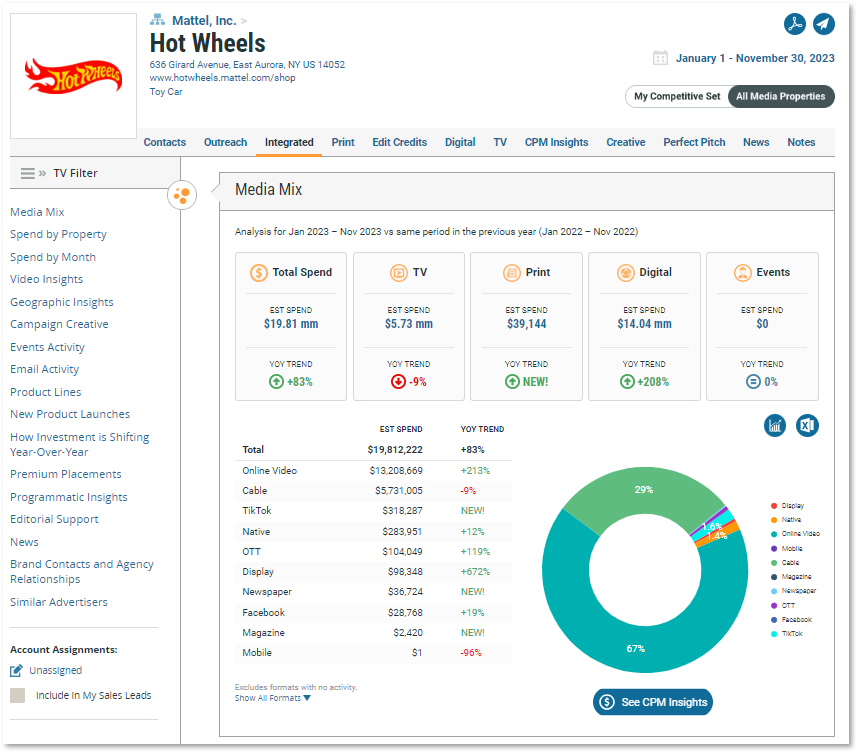

Hot Wheels is speeding close to $20 million in advertising with an ad mix focused on digital media, which surpassed $14mm. TV was the only decrease of 9% YoY, but that didn’t put a pothole in its overall increase of 83% YoY. Video advertising had a big seat with over 97% of the spend going to OLV, TV, paid social, and OTT ads. Its preferred length was 11 to 15 second, which had all $5.7mm of TV and $8mm of OLV dollars. For OLV YouTube’s Kid’s Education & Entertainment channels was a top outlet and TV Nickelodeon snagged the most spend.

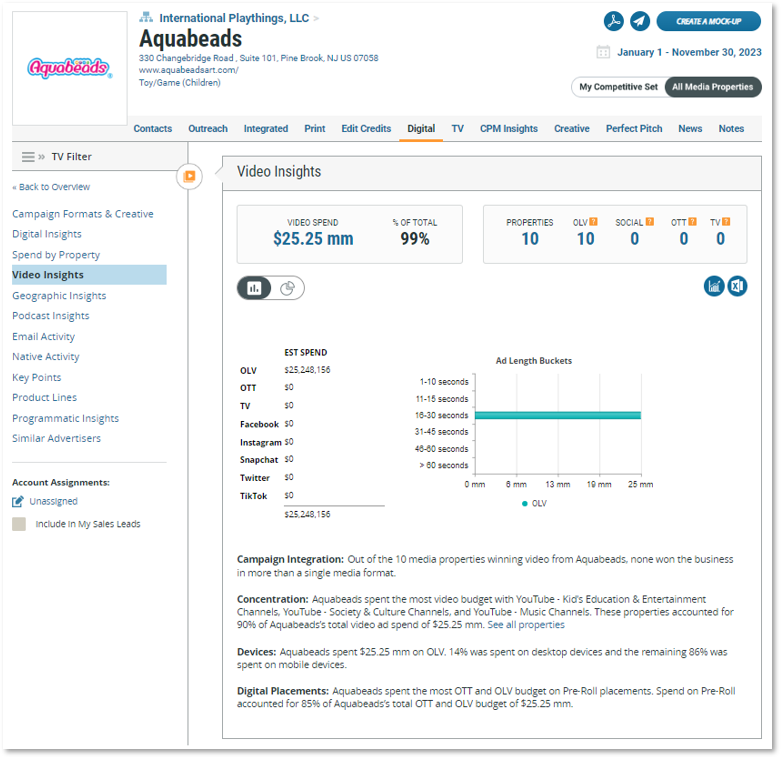

Aquabeads was heavily submerged in online video with more than $25mm spent after increasing by 548% YoY. There was less than $41k of native ads after a 85% YoY plunge of investment in the format. Its brand kept all ads between 16 to 30 seconds with 90% dedicated to three YouTube channels: Kid’s Education & Entertainment, Society & Culture, and Music. Pre-roll placements accounted for 85% of the spend.

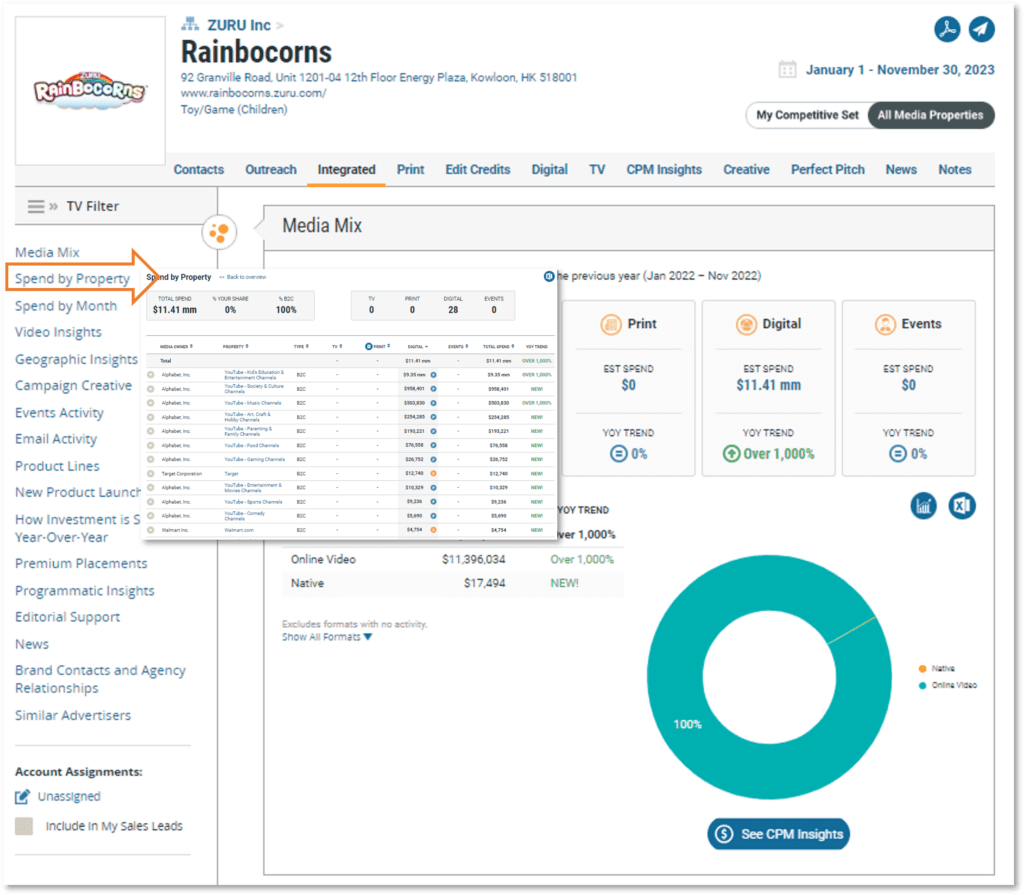

Rainbocorns’ advertising kicked off in Q4 2023 and it has already invested over $11.4 million with 100% digitally focused. Online video was the format the toy brand settled into this year, although there were some native direct ads placed with Target and Walmart among others. MediaRadar shows an agency relationship with Blue Plate Media and recently verified contact details.

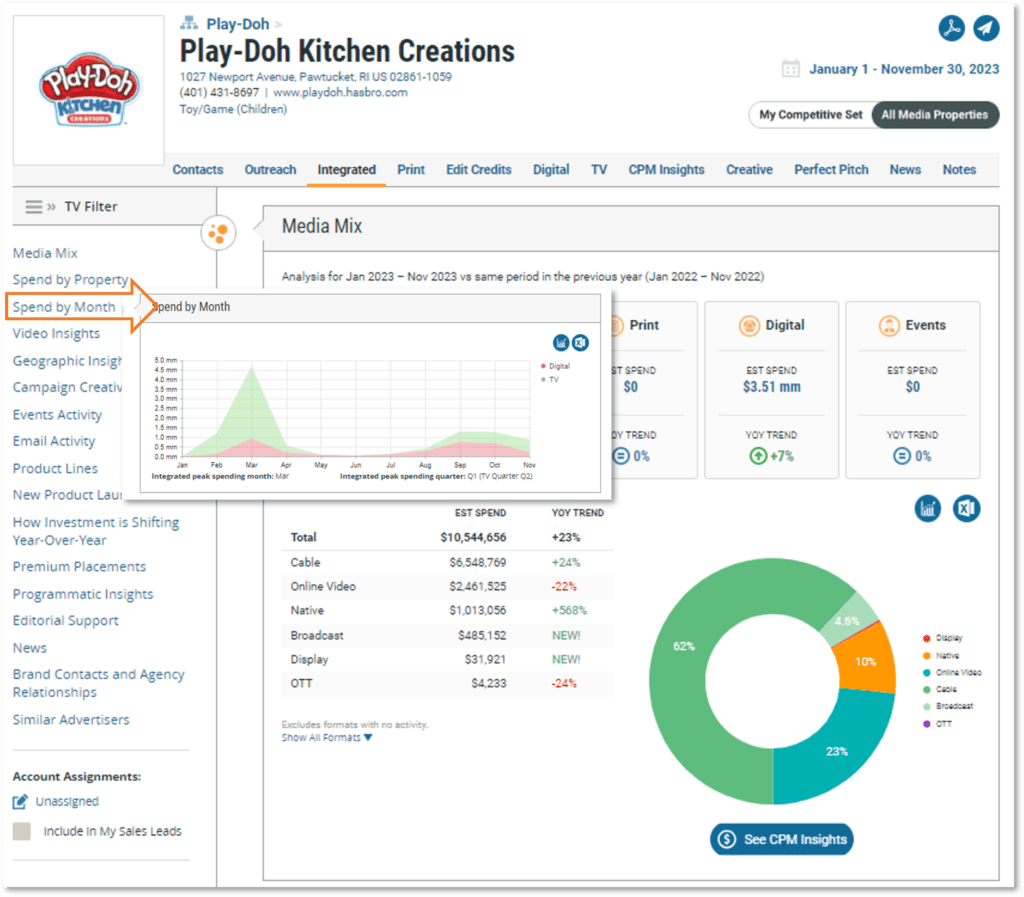

Play-Doh Kitchen Creations baked in a 23% YoY increase of advertising to $10.5 million through November 2023. National cable TV spend reached $7mm after rising by 24% from last year during the same period. Digital spending saw a 7% YoY bump to $3.5mm with 31% of that being direct buys. OLV ads dipped by 22% YoY while native ads jumped by over 560% YoY. Peak spending occurred in March.

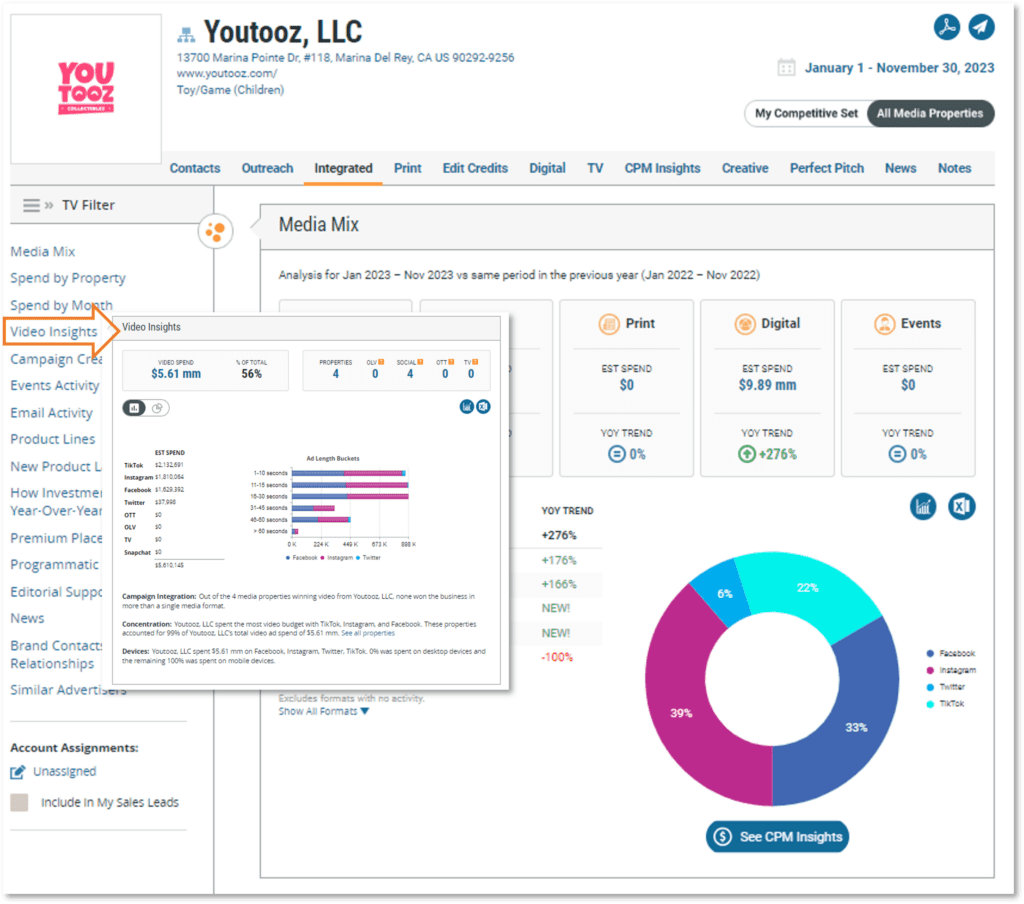

Youtooz, LLC took the paid social route with its $9.9 million in ad spend so far this year. Facebook, Instagram, and TikTok all saw increases by over 100% YoY. Social video was 56% at $5.6mm with ad lengths varying, most concentration seen with those less than 30 seconds long. MediaRadar’s CPM Insights places recommended pricing for open auction OLV buys between $4.63 and $5.65 based on brand buying behaviors in the toy & game space.

Use MediaRadar to better understand how advertising investment is shifting in your market. MediaRadar will help you uncover new prospects, prepare your pitch, and connect with the right decision-makers at the right time. Request a completely customized demo of MediaRadar today.