As we conclude 2023 and look toward the new year, MediaRadar reviewed advertising for beauty brands.

Whether this sector is quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of this category poised to fizzle up in 2024 based on the latest national advertising insights. For more updates like this, stay tuned. Subscribe to our blog for more.

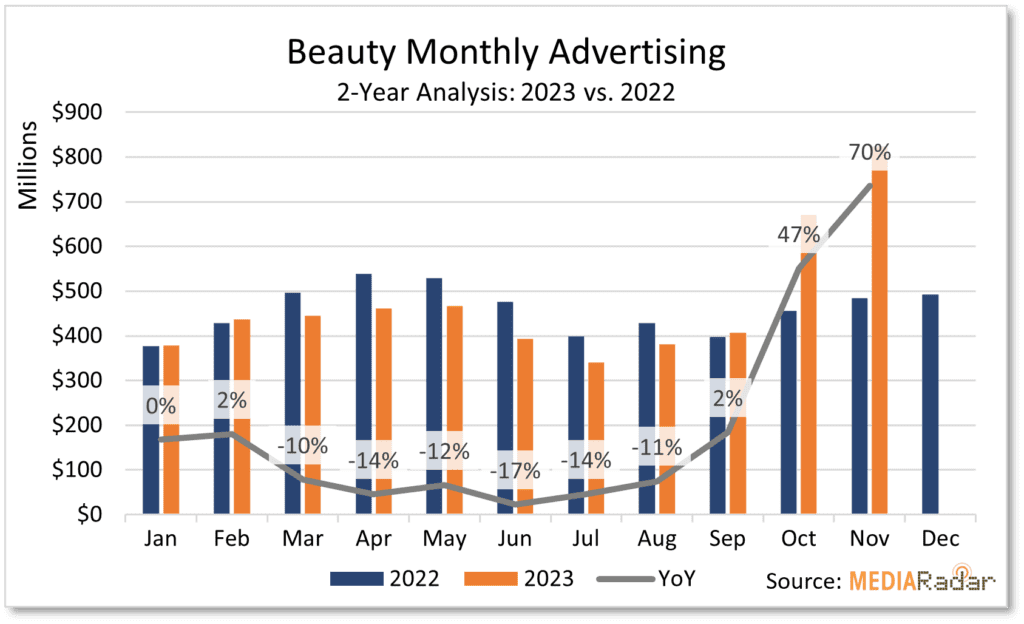

MediaRadar’s data sample of beauty ad investment revealed over $5.2 billion spent by 5.2 thousand companies advertising 11.6 thousand brands or product lines through November 2023. Ad spend dipped by 3% YoY, while the number of companies increased by 17% and brands/product lines were up by 11% YoY.

Advertisers scaled back investment this year compared to 2022’s post COVID spike when more people were traveling and returning into the office. The nearly 50% YoY increase in October was driven by P&G spiking spending by 147% that month for its brands like Old Spice among others. November’s $834mm was a 70% increase from the $485mm spent last year. All in time for holiday celebrations and gift giving.

TV continues to grab the majority of spend at 34% seeing nearly $1.8 billion even with a 10% YoY decrease. Beauty advertisers invested over $1.5b towards online video after a 35% YoY increase. Resulting in a 30% of beauty’s spend dedicated to OLV so far this year. Additionally, native rose 41% YoY to nearly $582mm. These three formats accounted for $3.9 billion of beauty’s ad spend.

Skincare and hair care ads saw a 6% YoY uptick while cosmetics ad spend was up by 3% compared to the same period in 2022. Deodorant spending increased 72% to $454 million through November 2023.

Some advertisers reducing ad spend included oral hygiene products reduced spend by 8%YoY to around $398mm. Additionally, bath & shower advertisers cooled off with a 20% YoY decrease to $227mm.

12 Beauty Advertisers to Watch in 2024

Below are 12 beauty brands highlighted ranging from deodorant to skincare, all of which increased advertising year-over-year through November 2023. Each spent more than $12 million. Combined ad investment from these 12 brands exceeded $475mm after a collective increase over 430% YoY.

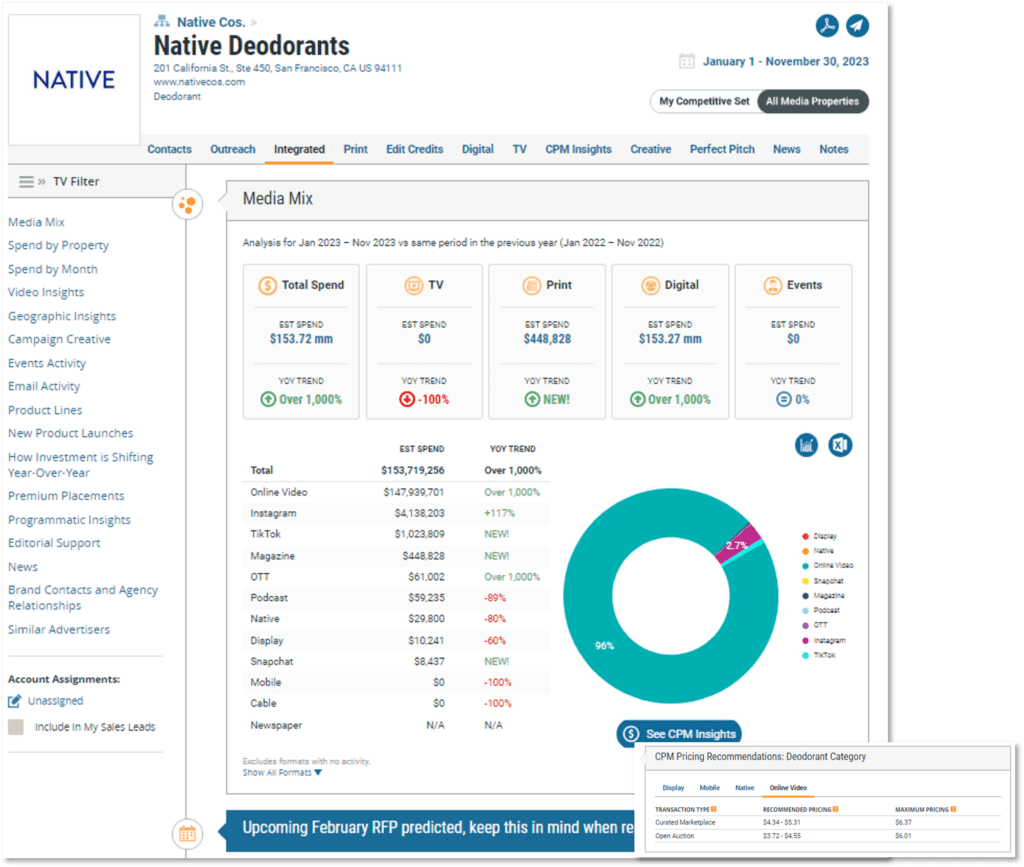

Native Deodorants’ advertising through digital and print media skyrocketed in September. The overall spend jumped by over 1000% YoY to hover around $154 million through November 2023. The ad mix adjusted with a 100% decline in TV ads, while online video drove the year-over-year increase and new magazine ads ran. MediaRadar recommends maximum OLV pricing not to exceed $6.01 for deodorant advertisers as the recommended pricing range is $3.72 to $4.55.

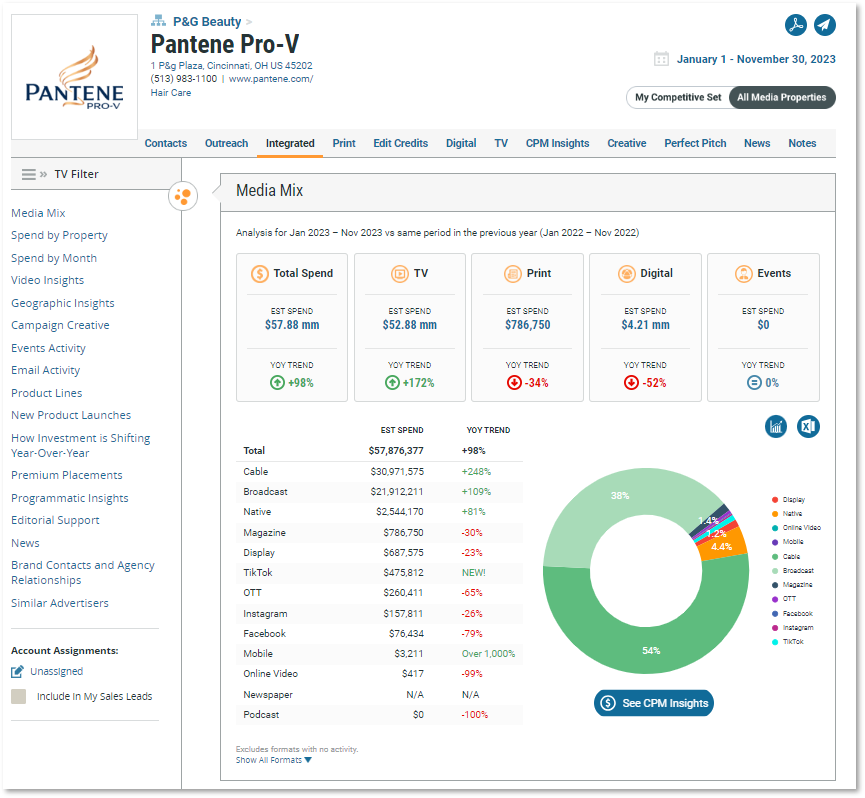

Pantene Pro-V spent nearly $58 million through November advertising its hair care name after a 98% YoY increase. 2023’s strategy leaned into TV ads, which increased substantially by 172% YoY. As a result, over 92% of its ad spend was dedicated to cable (54%) and broadcast (38%) TV. Digital media dropped by 52% YoY to $4.2mm spent. Nearly 4.5% of that was native advertising, which reached $2.5mm thanks to increasing by 81% YoY.

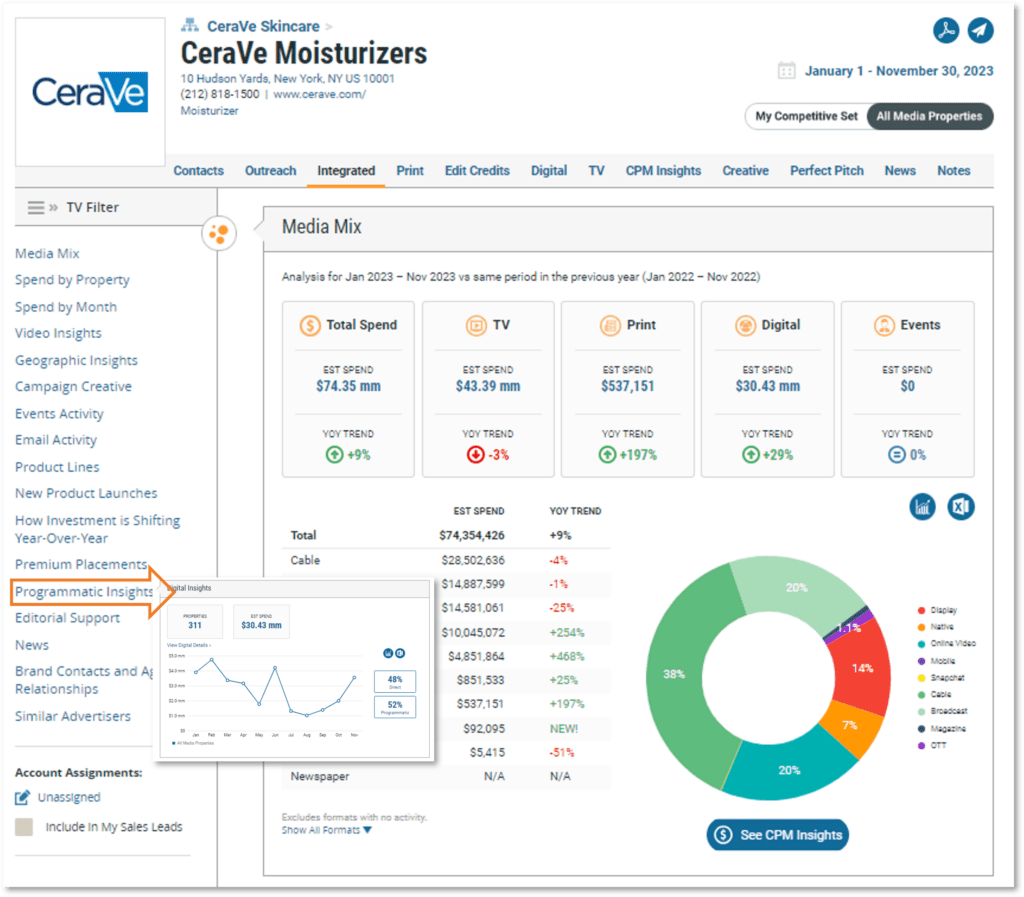

CeraVe Moisturizers’ ad investment through November this year exceeded $74 million with a 9% increase from the same period in 2022. The ad mix adjusted with TV dipping by 3% YoY to $43mm, digital media overall increasing by 29% YoY to $30mm, and print was nearly 200% YoY to $537k. Of the digital buys, 52% were programmatic and 48% direct across 311 outlets.

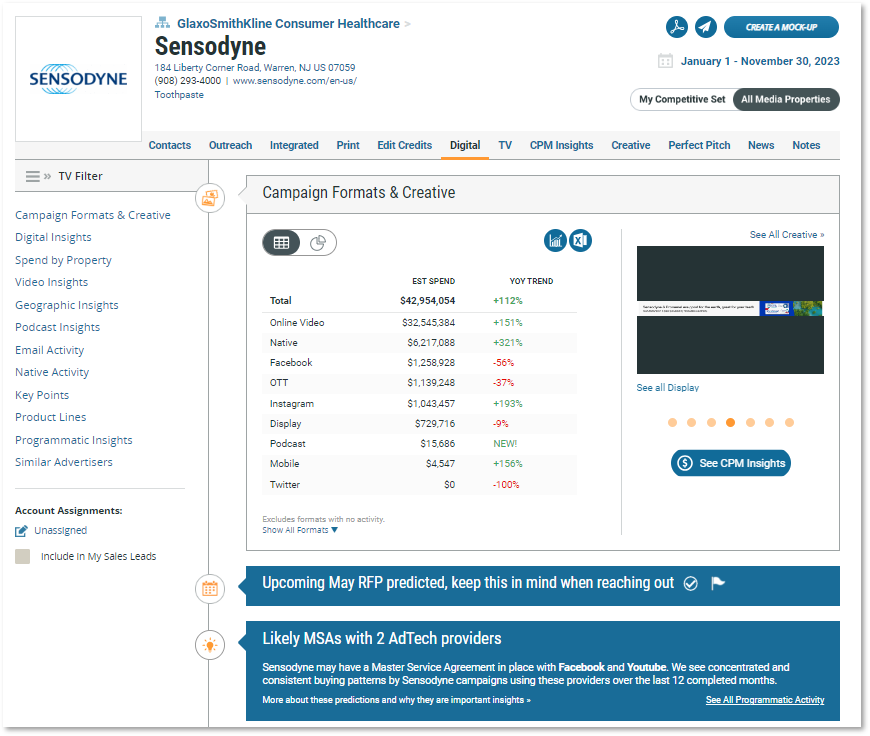

Sensodyne invested nearly $93 million after increasing by 22% YoY. The toothpaste brand went with TV ad spent at $49.5mm (54%) and digital media was nearly $43mm with a mix of OLV, native, paid social among others. There were some print media ads placed as well in 2023. There’s an upcoming RFP predicted in May, so keep this in mind the online video increase by over 150% YoY and native spend exceeding $6mm – there’s digital expansion occurring.

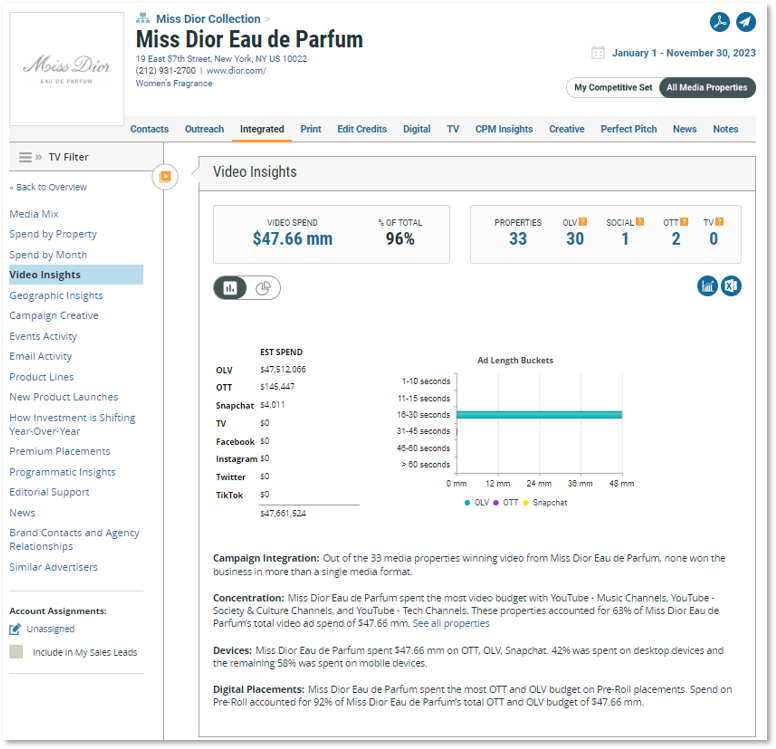

Miss Dior Eau de Parfum spent over $49 million to advertise after increasing by 424% YoY compared to through November of 2022. Its dollars went into digital media to the tune of over 99%, with the majority dedicated to online video. OLV leaped by 881% YoY to $47.5mm. All video ads were 16 to 30 seconds long with the exception of OTT ads 31 to 45 seconds (less than $150k). There were concentrated buys with YouTube’s Music, Society & Culture, and Tech channels, which accounted for 63% of the $47.6mm video spend.

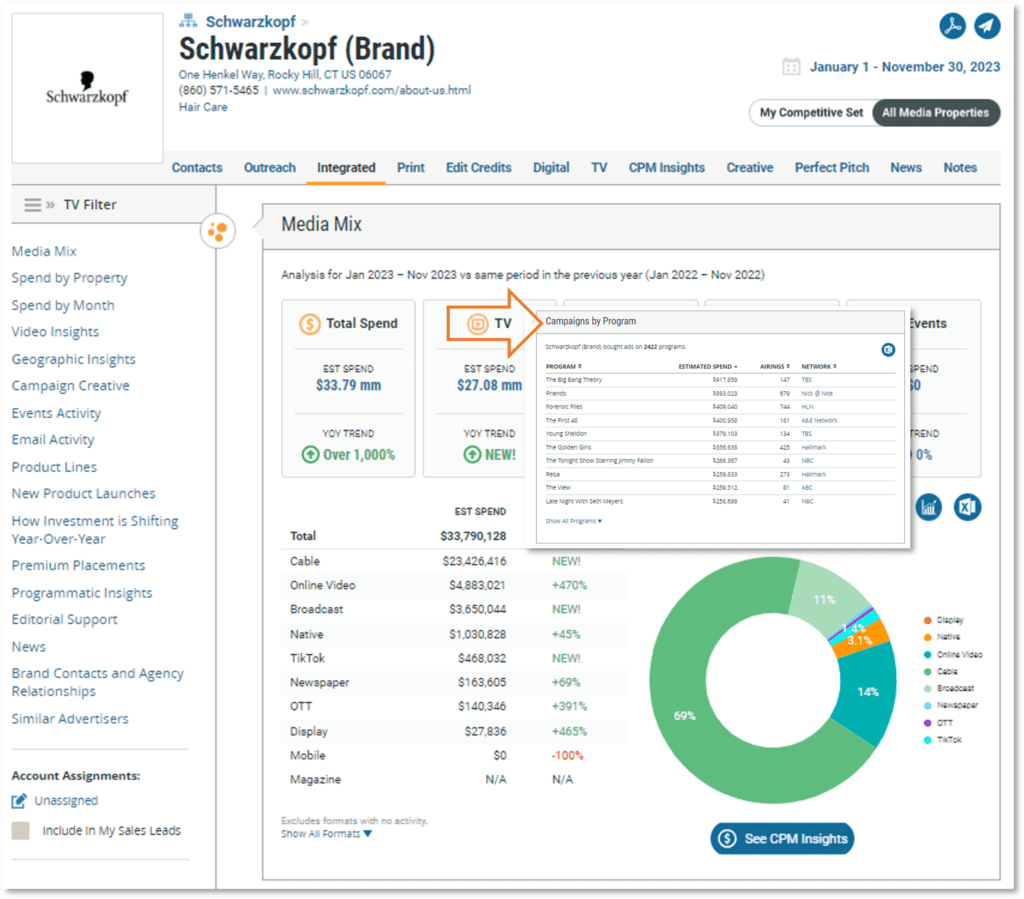

Schwarzkopf (Brand) blew out 2023 by increasing by over 1000% YoY to nearly $34 million to reach audiences. TV spending over $27mm which accounts for 80% of the total investment is new this year. The hair care brand’s peak spending occurred in March and August. The brand bought ads on 46 cable and six broadcast networks including A&E, ABC, Animal Planet and more with sitcoms as top placements. Its ads were tracked on over 2.4k TV shows ranging from The Big Bang Theory to Late Night With Seth Myers.

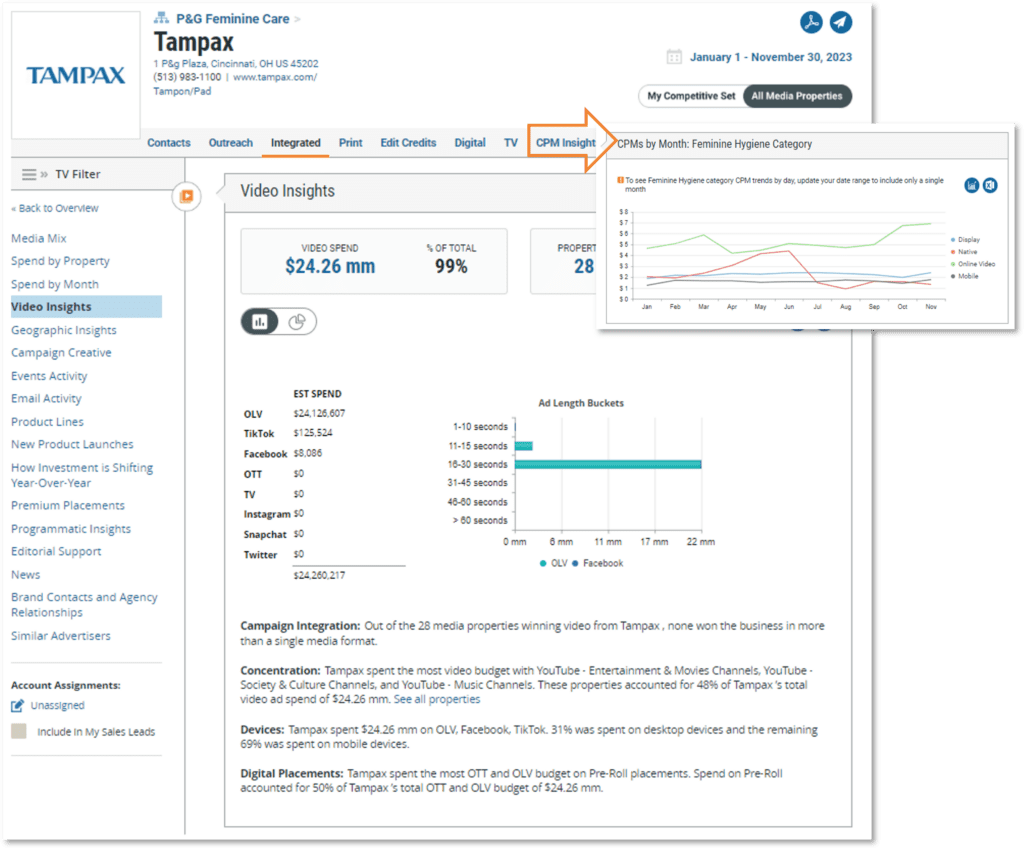

Tampax, one of P&G’s feminine hygiene brands, invested more than $24 million advertising digitally with a 512% YoY increase. Its strategy was video ads at 99% that were predominantly 16 to 30 seconds. Three of YouTube’s channels, Entertainment & Movies, Society & Culture, and Music, captured 48% of the brands video spend. Average online video CPM increases to around $7 for brands in Tampax’s space. Be prepared with other ad insights entering 2024.

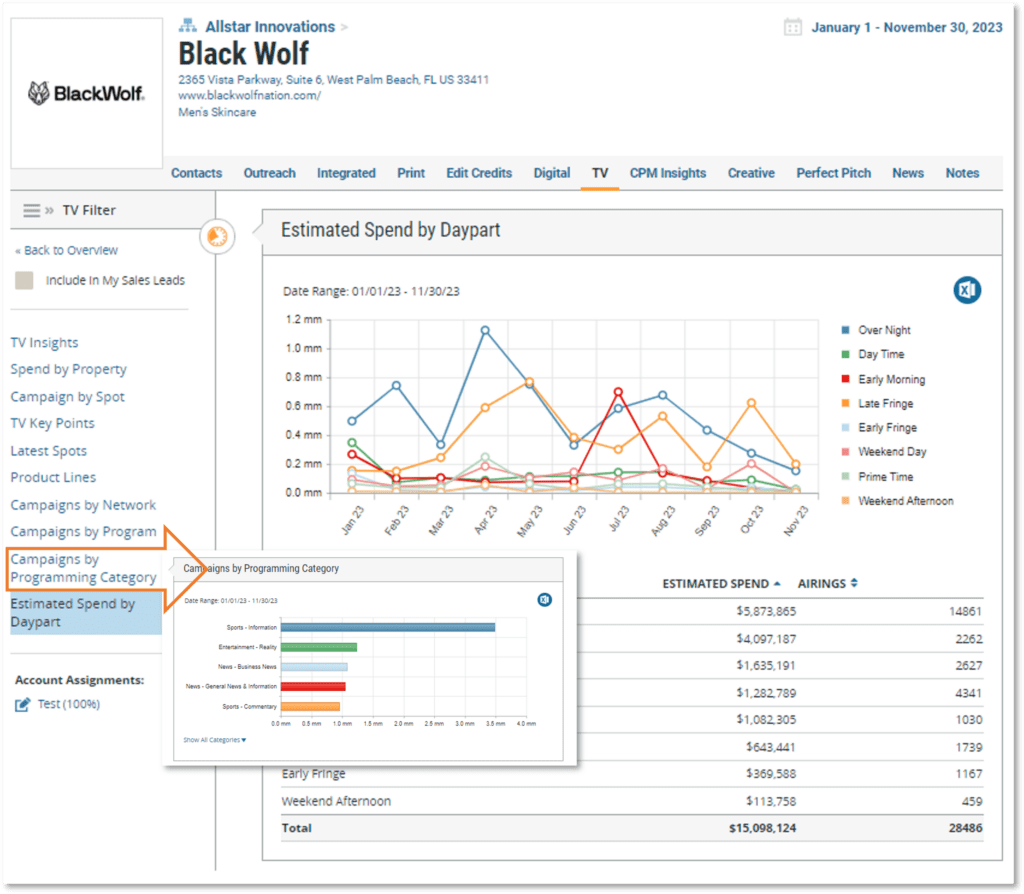

Black Wolf increasing ad investment by nearly 500% YoY through November resulted in over $15 million with TV ads nearly 98% of that. The men’s hair care, skincare, and body wash product lines were seen on 40 cable and one broadcast networks including ESPN, CNBC, Fox among others. Overnight ads saw peak spending in February and March, while weekend afternoon ads saw the most spend during May and October.

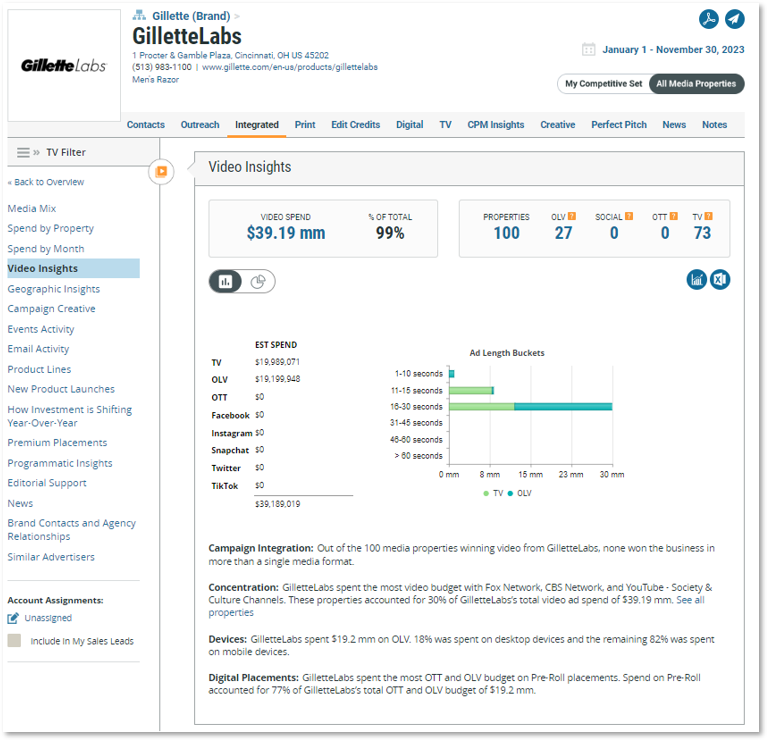

GilletteLabs, P&G’s men’s grooming line, launched campaign spending this year with over $39 million spent through TV (51%)and online video (49%) with peak spending occurring in Q4. Both video media saw around $19mm spent with all ads less than 30 seconds. Fox , CBS, and YouTube’s Society & Culture channels saw 30% of the $39.2mm of video investment. Its preference was pre-roll placements, which accounted for 77% of the spend on over 100 digital and TV outlets.

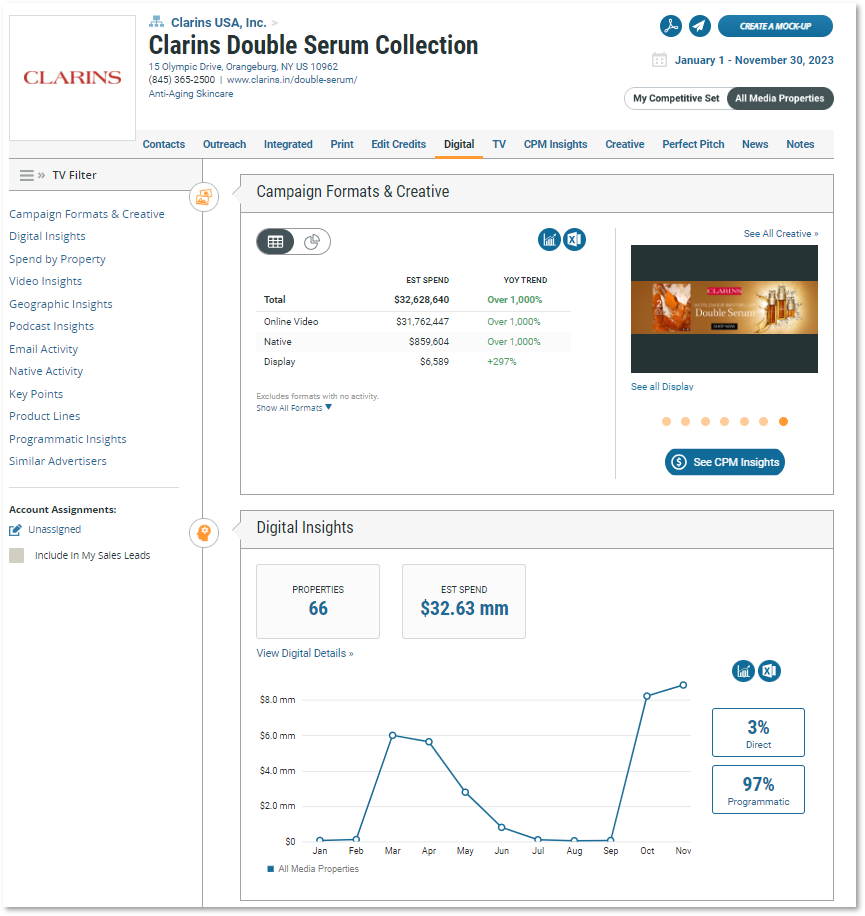

Clarins Double Serum Collection nearly $39 million in advertising through November was 99% digitally placed with peak spending in time for the holidays. YouTube’s Beauty, Society & culture, and General Lifestyle channels snagged around $20mm alone of the video spend. The brand leaned into programmatic spending 97% and digital ads were tracked on over 65 outlets so far this year.

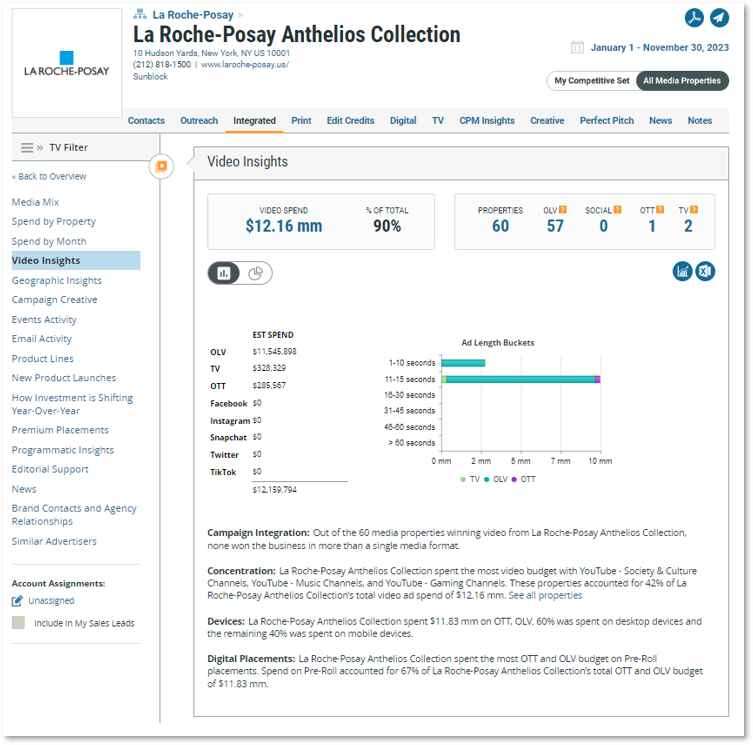

La Roche-Posay Anthelios Collection invested more than $13 million to advertise as expected a large ad spending occurred in May and June during peak sun exposure. It leaned into video ads at 91% with OLV, TV, and OTT and they were less than 15 seconds in length. YouTube’s Society & Culture, Music, and Gaming channels saw 42% of the collections’ total video ad spend of $12.16 mm. Pre-Roll accounted for 67% of that.

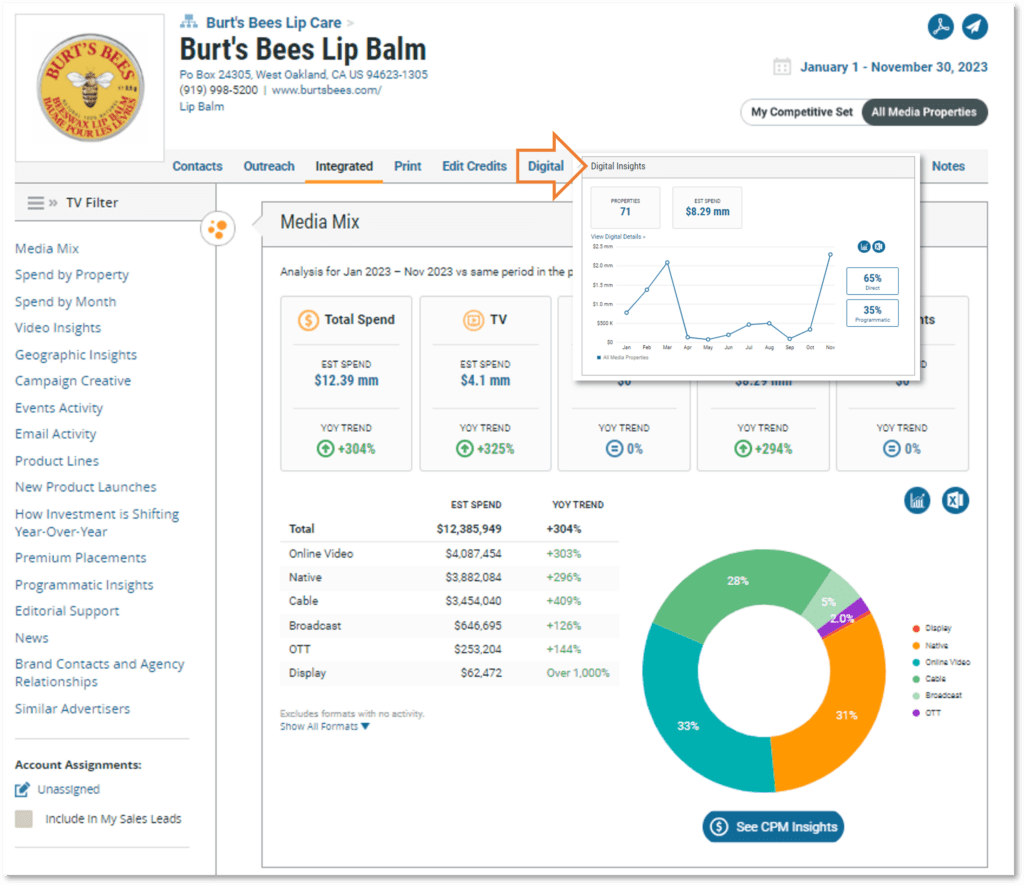

Burt’s Bees Lip Balm ads totalled over $12 million as the brands increased TV and digital formats overall by 304% YoY. Of the $8.2mm digital spend over 70 outlets, 65% was tracked as direct buys. OLV ad spend amped up by 303% YoY to $4.1mm and was a ⅓ of the total ad investment. Native ads weren’t too far behind at 31% after increasing by 296% to $3.9mm. Peak integrated spending occurred in Q1 with digital media peak spending month in November entering the winter season.

Use MediaRadar to better understand how advertising investment is shifting in your market. MediaRadar will help you uncover new prospects, prepare your pitch, and connect with the right decision-makers at the right time. Request a completely customized demo of MediaRadar today.