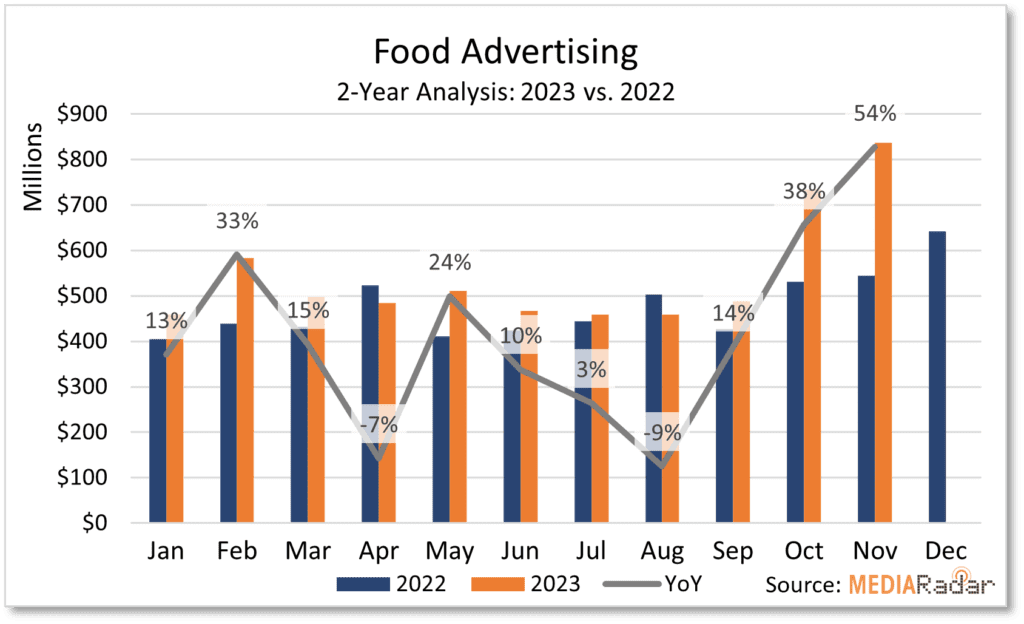

As we conclude 2023 and look toward the new year, MediaRadar reviewed advertising for food brands.

Whether this sector is quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of this category poised to fizzle up in 2024 based on the latest national advertising insights. For more updates like this, stay tuned. Subscribe to our blog for more.

MediaRadar’s data sample estimated nearly $6 billion was invested by 4.5 thousand food companies from January through November 2023 via digital, print, and national TV outlets. That’s an 18% YoY increase in spend and a 5% YoY decrease in the company’s advertising.

TV, online video, and native were the top three formats bought by food advertisers. The three accounted for 82% of the spend with over $4.8 billion. OLV and native both increased by 98% and 16% YoY respectively. While TV declined 10% YoY to $2.3b, the media still captured 39% of the ad spend this year.

Unwrapping the food categories, over $2.7b was dedicated to advertising snacks and desserts. That’s 46% of the food vertical digital, print, and TV spending through November. Top advertisers in snacks & desserts increasing YoY included chocolate (up by 23% YoY), candy (up by 24% YoY), cookies (up by 179% YoY), and crackers (up 17%). These four snacks & desserts sub-verticals spent over $1.6 billion combined.

Others increasing year-over-year spend include breakfast food advertisers, up 20% to $434 million, dairy which increased by 21% to $324mm, and frozen foods which were up a staggering 91% YoY to over $210 million.

12 Food Advertisers to Watch in 2024

Of the 8,000 food brands that advertised so far in 2023, twelve brands from different food sub-verticals increased year-over-year. Each invested more than $7.5mm and combined spent nearly $567 million after a collective over 250% YoY spike. Interestingly, all embraced different ad mixes.

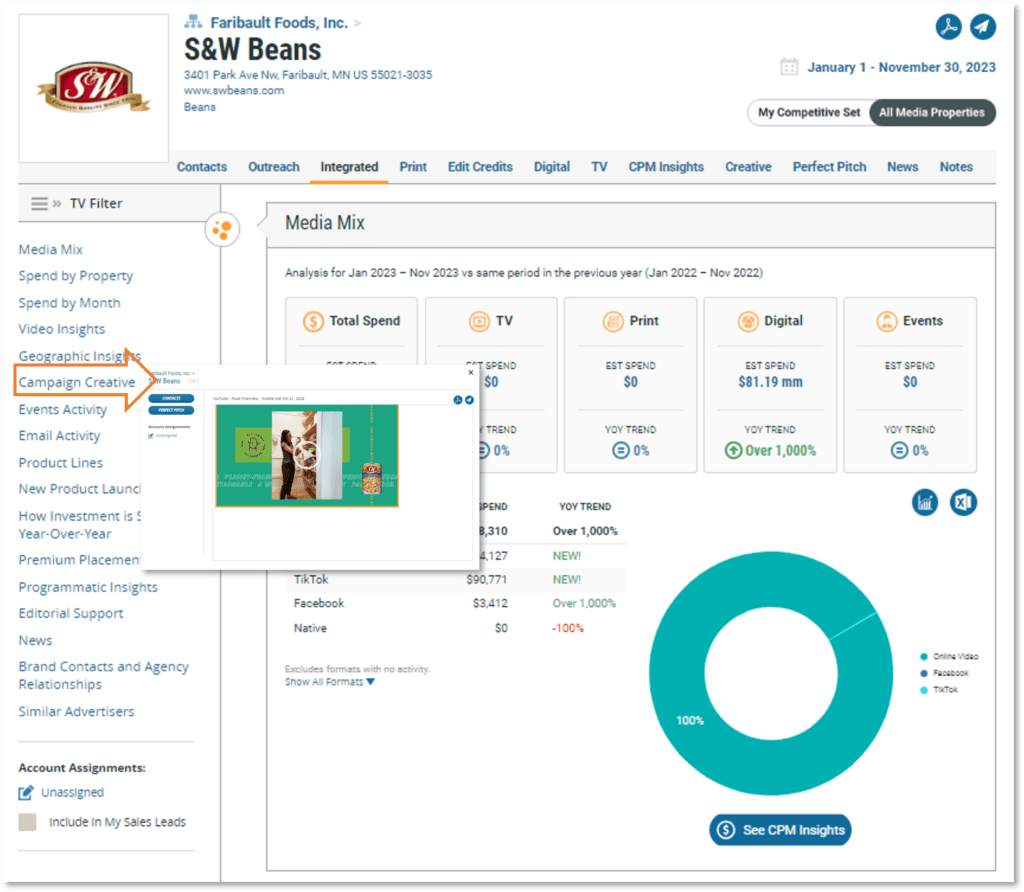

S&W Beans kicked off its 2023 campaign in October with over $81mm bought 99% programmatically. Ads were placed predominantly through YouTube’s Food and its Health & Fitness channels, with each capturing over $30mm. There was some paid social spend with Facebook and Tiktok. MediaRadar shows an agency relationship with space150, and one video ad in the campaign. It’ll be interesting to see how the 2024 ad strategy develops for this bean brand.

Fage Total Plain ad spend is up by over 1000% YoY to more than $12 million invested. The Greek yogurt brand leaned into national TV at 99% of its spend through November. Ads were bought on 21 cable and two broadcast networks including A&E Network, TBS, Fox News, and Hallmark, among others. The largest primetime spend is on reality programming. There was less than 1% dedicated to digital display and native. Peak spending occurred in January, May, and September.

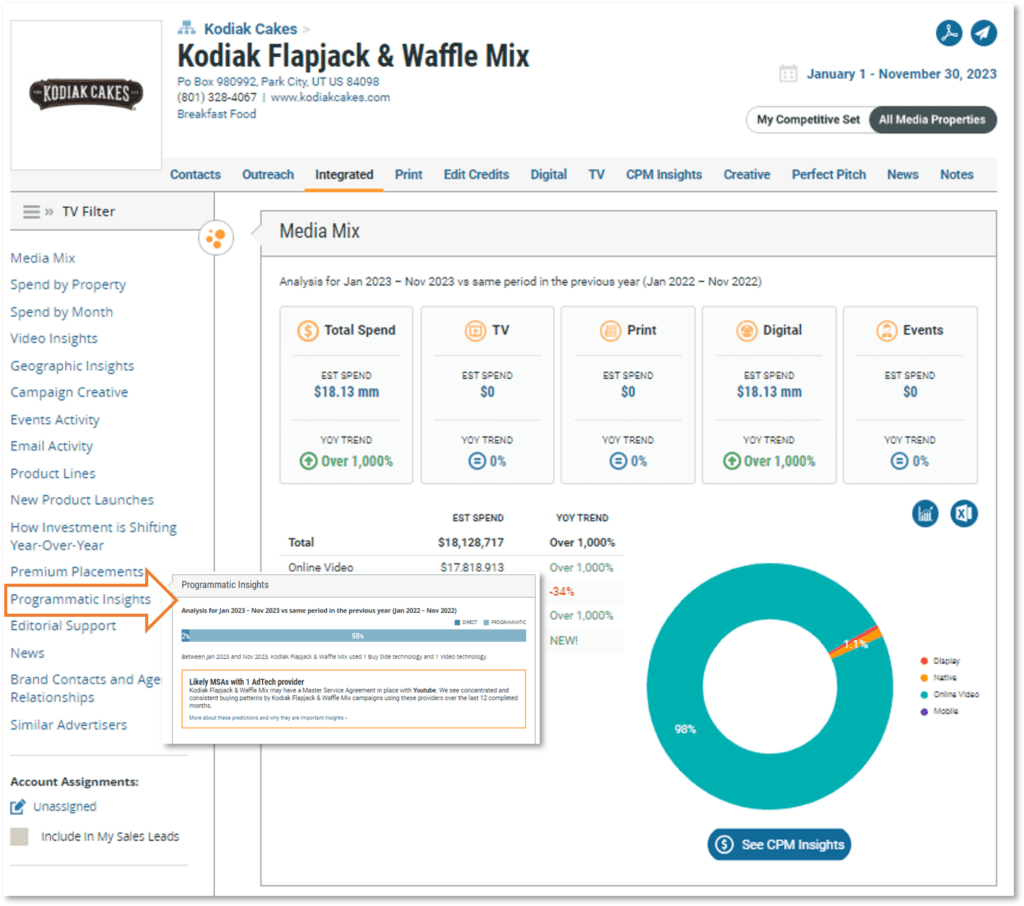

Kodiak Flapjack & Waffle Mix was another advertiser that increased over 1000% YoY through November. The $18mm invested by the breakfast food was 98% online video with the remaining native, display, and mobile. Monthly digital spend was less than $240k until September when it spiked to $9.5mm. Kodiak spent most of its video budget on YouTube – Sports, Society & Culture, and Beauty Channels. These properties accounted for 62% of the $17.8mm video ad spend. Digital buys were 98% programmatic, with some direct placements with Target, The Walt Disney Company, and Walmart.

McCormick Spices increased brand spending by over 1000% YoY to $17.8 million. Native ads were 93% of that spend and YouTube’s Homepage and Playlist captured $16mm of McCormick’s investment to advertise its spices. There was an investment in paid social with Facebook and TikTok, estimated at less than $1mm. Not surprisingly for a CPG brand, there was retail media spend with Amazon.com, Target, and Walmart. Peak spending began at the end of Q3 in time for holiday meals. MediaRadar’s ad tool provides verified contacts and agency relationships.

GT’s Living Foods invested over $8 million in advertising through November with increases in online video and paid social. Video was 97% of the investment with 41% spent with YouTube’s Music, Society & Culture, and Gaming channels. This health food brand also purchased print ads with Convenience Store News (B2B) and The Philadelphia Inquirer (B2C). The exhibit space spend remained flat from 2022 by attending the Americas Food and Beverage Show & Conference. Peak spending is upcoming in H1 2024 for GT’s, so be prepared to offer an integrated ad mix with MediaRadar’s ad insights.

Lindt Lindor invested more $133 million through November 2023 after increasing by 93% YoY to advertise its chocolate product lines. Digital media was up by 137% to over $108mm, print increased by nearly 200% YoY reaching $633k, and TV spend was up by 5% YoY to $24mm. All OLV, OTT, and TV video ads were less than 30 seconds long. Peak integrated spending occurred in February and November.

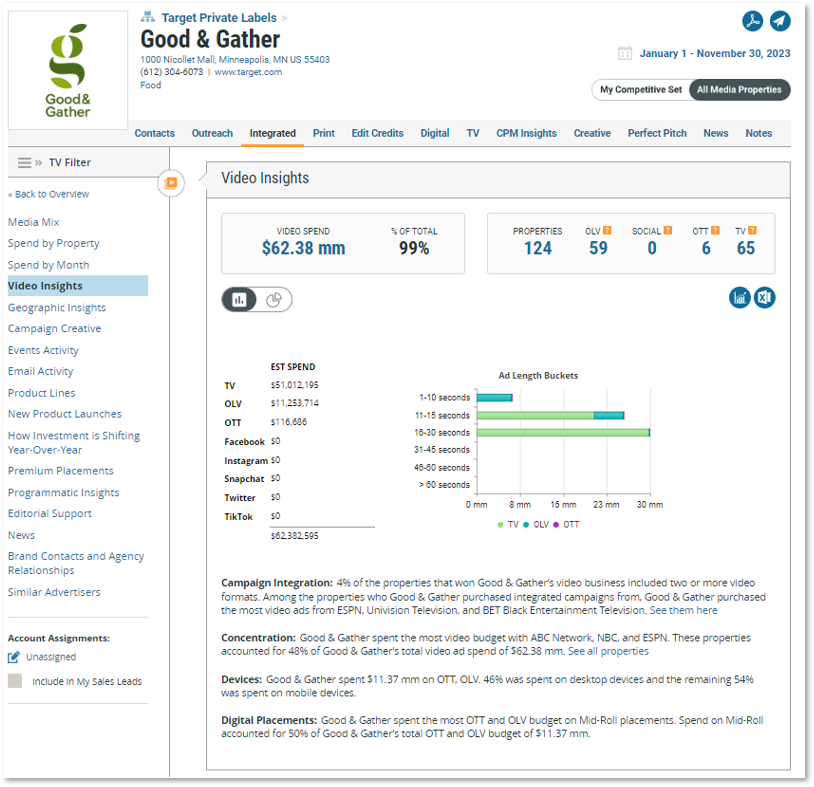

Good & Gather, Target’s food label, invested more than $62mm through November after spiking by over 1000% YoY compared to 2022. TV media was 82% of the investment so far with $51mm in ads. Following is online video, which had over $11mm dedicated to the media. Overall video spending for the brand was 99% through TV, OLV, and OTT with all commercials being less than 30 seconds. Video spend with ABC Network, NBC, and ESPN accounted for 48% of the $62.3mm.

Pepperidge Farm Cookies’ 2023 advertising saw over a 1000% YoY increase to more than $33 million spent through November. Peak spending occurred in July and online video was 96% of the ad investment. The brand’s spend on pre-roll ads accounted for 60% of its total OTT and OLV budget of $32.72 mm. The ads were 16 to 30 seconds long.

Jimmy Dean spent over $58.6 million advertising through November with an overall increase of 25%YoY. Cable and broadcast TV increased by 22% YoY to over $33mm (57% of ad spend). Ads were placed on 43 cable and six broadcast networks including A&E and ABC among others. Digital spending was shy of $21 million after a 28% YoY increase. Online video was 18% of the spend and remained fairly flat at around $11mm. MediaRadar shows an agency relationship with Mindshare Chicago.

DiGiorno increased by a modest 5% YoY to invest over $30.5 million to advertise its frozen pizza. Digital media’s 56% YoY increase to $15mm offset the 22% YoY dip in TV advertising. Cable and broadcast ads were 49% of the spend, reaching over $15mm as well. Video spending was at 87% through TV, OLV, and OTT, with most ads being less than 15 seconds long. Native spend increased over 100% YoY to exceed $9mm.

Nature Valley Bars spiked by over 230% YoY to more than $83 million spent in national digital, print, and TV advertising with all formats up. Online video was the majority of spend after skyrocketing by over 1000% from 2022 with nearly $49mm invested. 59% was dedicated to OLV. TV spending through cable (28%) and broadcast (7%) totaled over $29mm. The granola bar’s peak integrated spend happened in Q4 – both October and November were over $16mm in ad dollars.

Trident’s advertising exceeded $38 million after increasing by 97% YoY, an increase driven by digital media. Nearly $31mm was dedicated to online video ads (80% of spend) after a 143% surge from 2022. TV spend was less than 15% with $5.6mm spent after a 9% YoY decrease. Peak digital spending was in November. It’s reaching a wider geographic audience across 42 states compared to similar advertisers in the Gum category, which were seen running OTT or OLV ads in an average of 18 states.

Use MediaRadar to better understand how advertising investment is shifting in your market. MediaRadar will help you uncover new prospects, prepare your pitch, and connect with the right decision-makers at the right time. Request a completely customized demo of MediaRadar today.