As we conclude 2023 and look toward the new year, MediaRadar reviewed gambling and casinos advertising.

Whether this sector is quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of this category poised to fizzle up in 2024 based on the latest national advertising insights. For more updates like this, stay tuned. Subscribe to our blog for more.

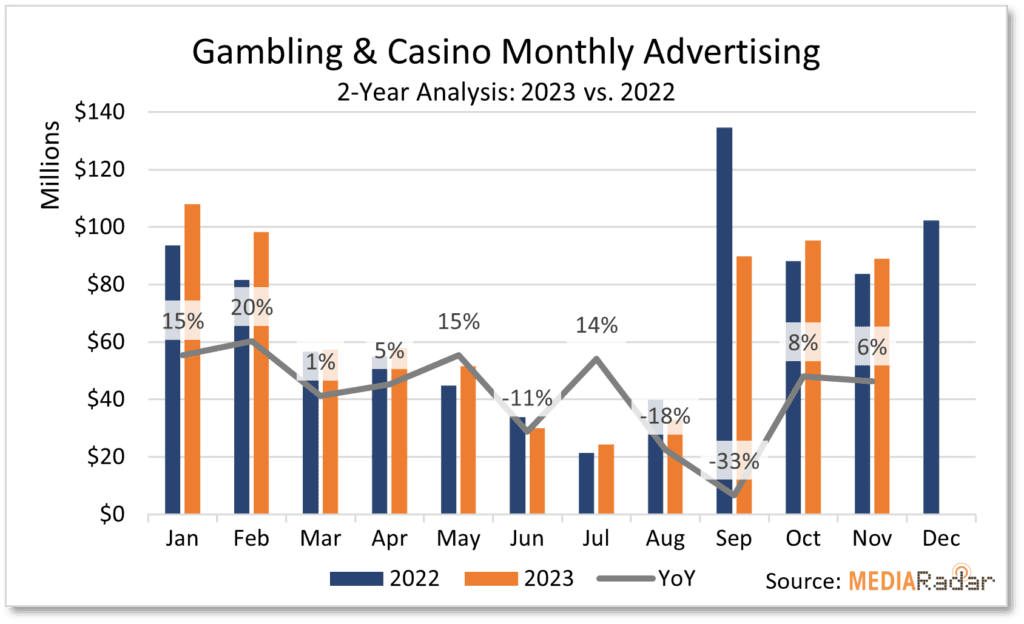

MediaRadar’s data sample estimated that $734.8mm was spent by casinos, fantasy sports leagues, and gambling websites among others to advertise through November 2023. Ad spend remained relatively flat from the $733.5mm spent in 2022 during the same period.

While Q1 and Q2 both increased by 14% YoY and 4% YoY respectively, Q3 dropped by 25% YoY. It’s too soon to see if December will result in any expansion for Q4, but October saw an 8% YoY uptick and November was up by 6% YoY.

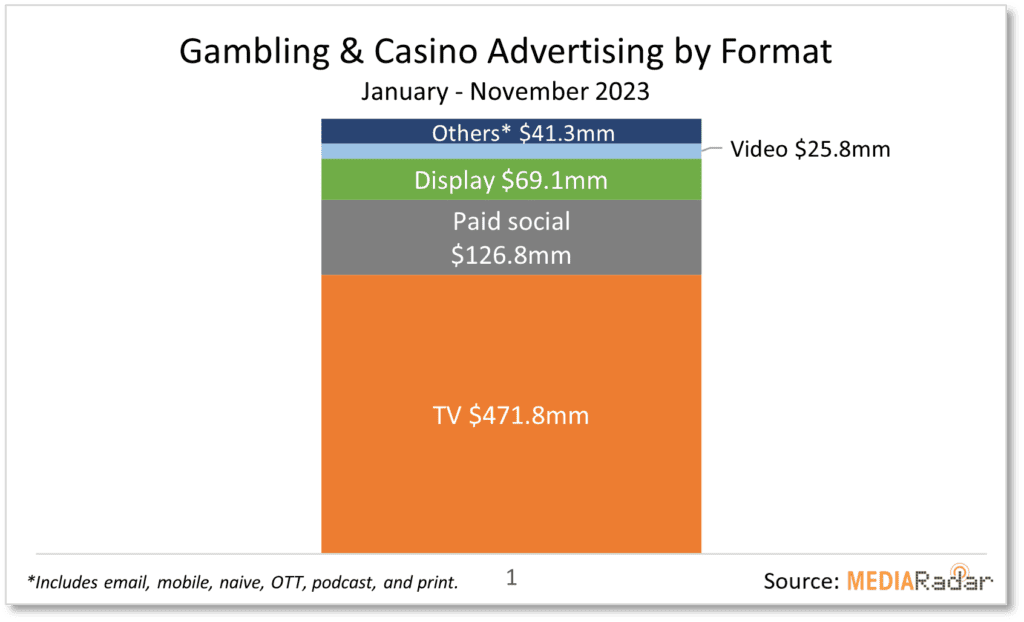

Sports leagues placed their bets this year to the tune of $441 million, which is 60% of the ad spend in this space, after increasing by 4% YoY. TV was at 85% of the spend for these advertisers.

TV was the preferred method to capture audiences at 64% ($472mm). Paid social ads were at 17%, followed by digital display ads being 9%, or $69mm.

Gambling websites spent more than $183mm, accounting for a quarter of the $735mm investment through November. TV and paid social were each 36% of the spend hovering around $66mm, followed by digital display at 18%, $34mm.

Gambling & Casinos Advertisers to Watch in 2024

Below are 12 out of the 700 brands advertising in the gambling space. Each show increases in advertising spend compared to the same period in 2022. Collectively, these 12 saw a 126% surge in spending bringing combined spend to $430 million so far this year.

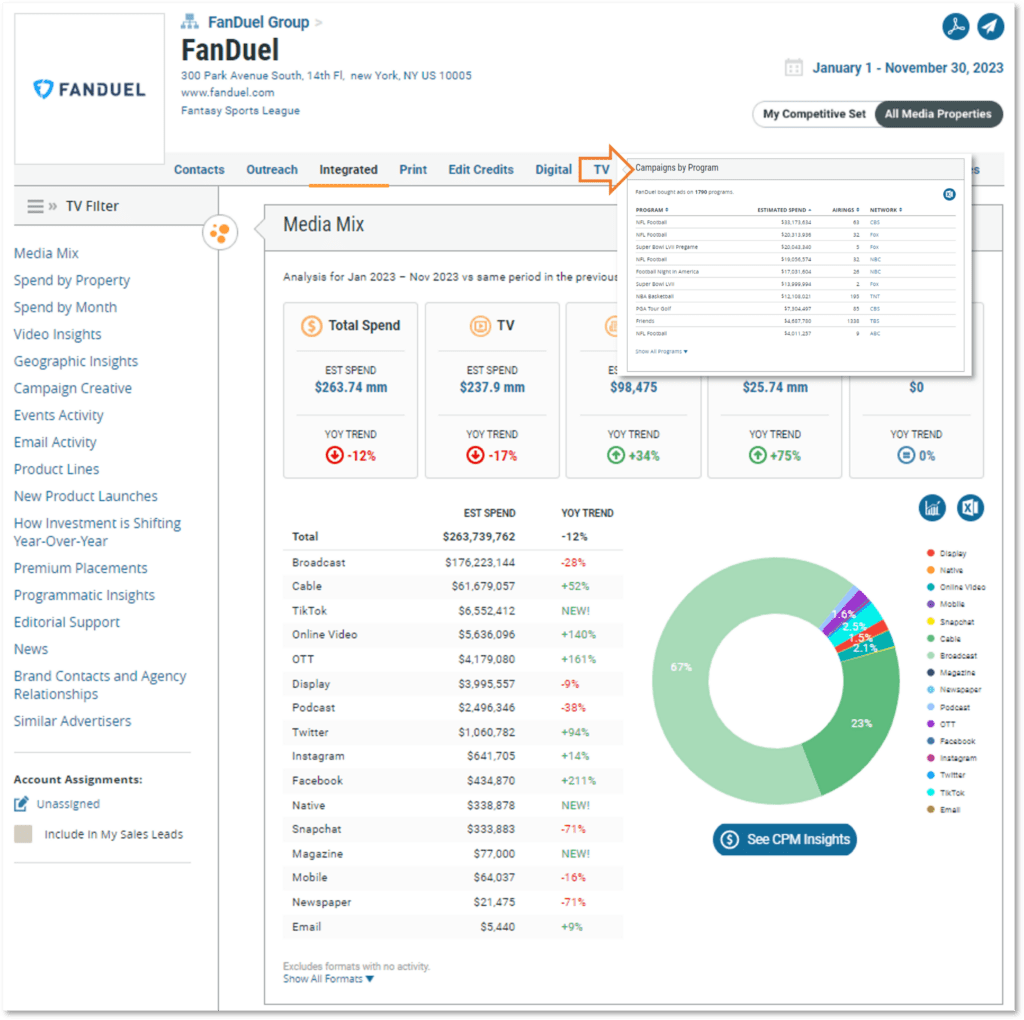

FanDuel decreased its overall spending by 12% YoY, yet it still became a top advertiser in the gambling realm with over $264 million invested. FanDuel’s ad mix saw decreases in broadcast, print, and a few digital formats. TV overall downshifted by 17% YoY to $238mm (90% of spending), but digital’s increase by 75% YoY to $26mm helped to offset that. Peak spending follows the football season (Q1 and ramp up end of Q3). NFL Football, Super Bowl 57, and its pregame captured the majority of TV dollars. Fanduel dedicated $138mm Pro Football TV programming.

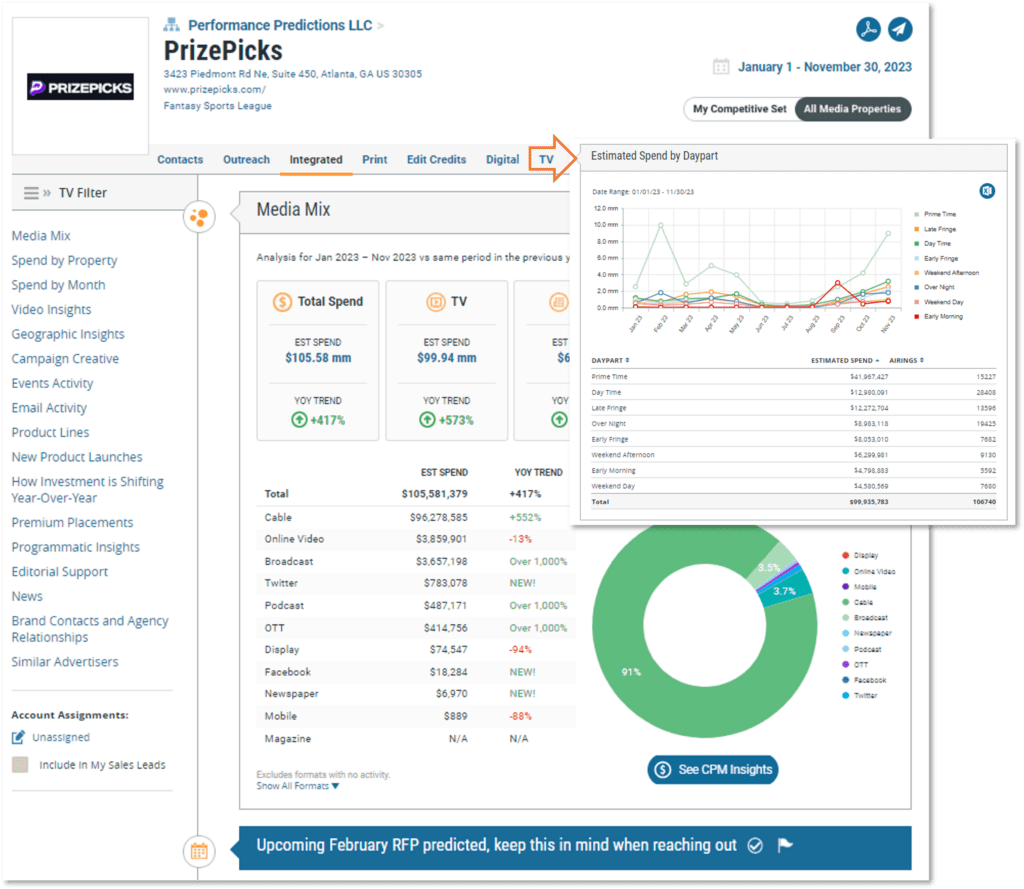

PrizePicks invested nearly $106 million thanks to an increase of over 400% YoY. TV, mostly cable (91% of total spend) was chosen this year with $100mm dedicated to the format. Peak spending was in November with over $21mm in ad dollars. The brand had the highest primetime spend in February with $10mm and again in November at $9mm. Overall primetime captured $42mm of its TV ads this year. There’s an upcoming RFP predicted in February.

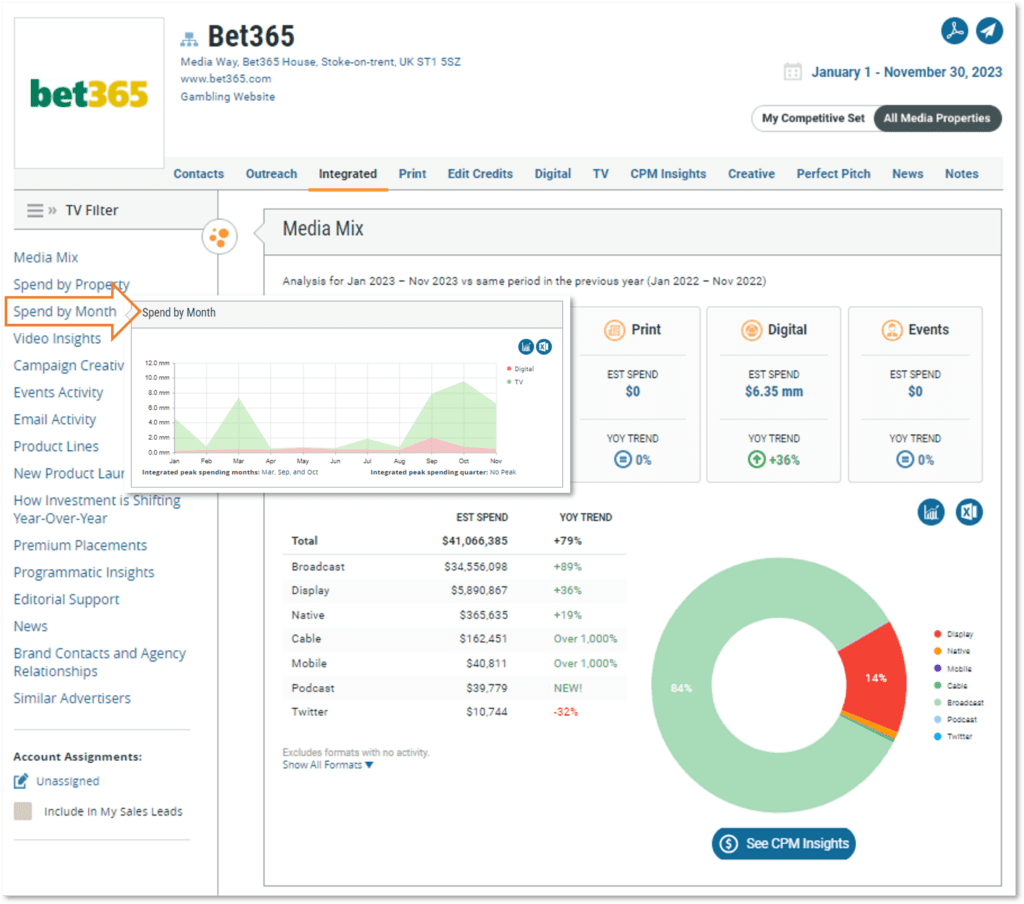

Bet365, the sports betting website, leaned into broadcast TV at 84% ($35mm) of the $41 million spent through November. Overall advertising saw a 79% YoY spike. The remaining spend was placed on digital display ($5.9mm, 14%) and a mix of native, cable, mobile, and podcast. Football Night in America and MLB Baseball were two top shows garnering more than $10mm combined. Peak spending happened in March and then ramped up again starting in September.

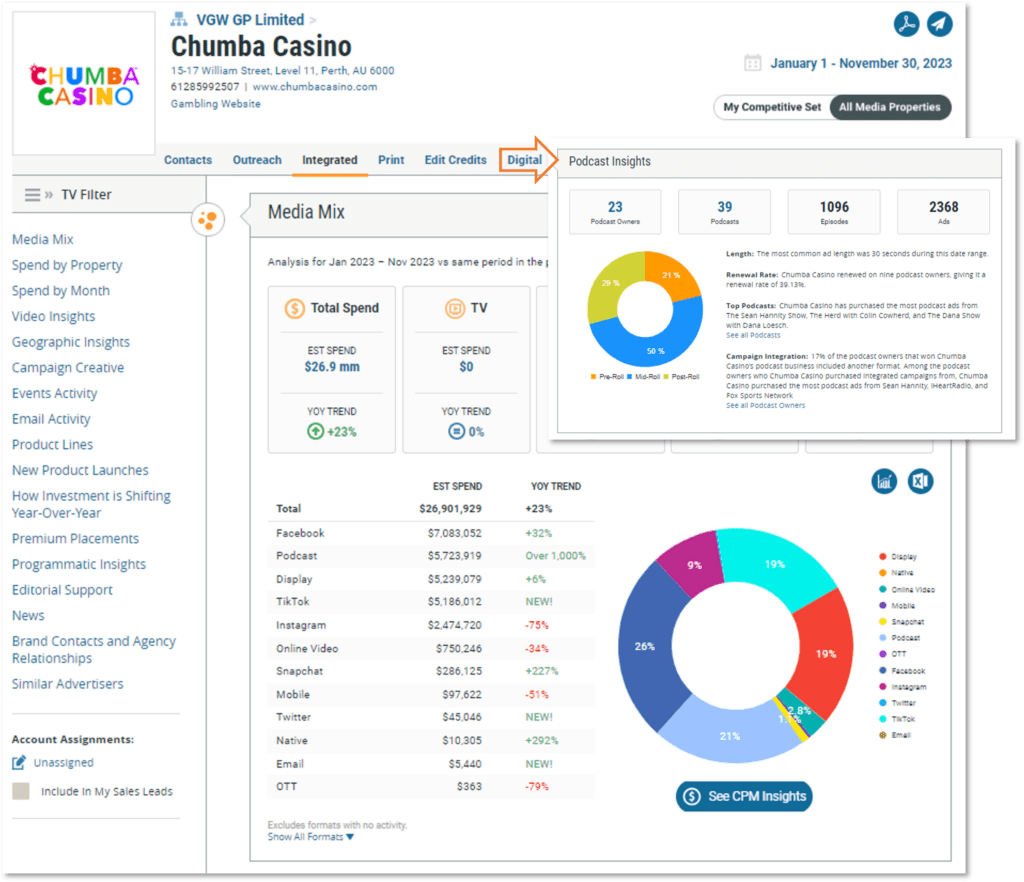

Chumba Casino placed a $27 million bet on 100% digital ad spend this year with an increase of 23% YoY. Paid social advertising was a concentration, with Facebook alone snagging 26% of the total. Podcasting was Chumba’s next focus with more than $5.7mm dedicated to the format. The Sean Hannity Show, The Herd with Colin Cowherd, and The Dana Show with Dana Loesch were some top podcasts running ads for the gambling website. The majority were 30 seconds long with 50% placed mid-roll.

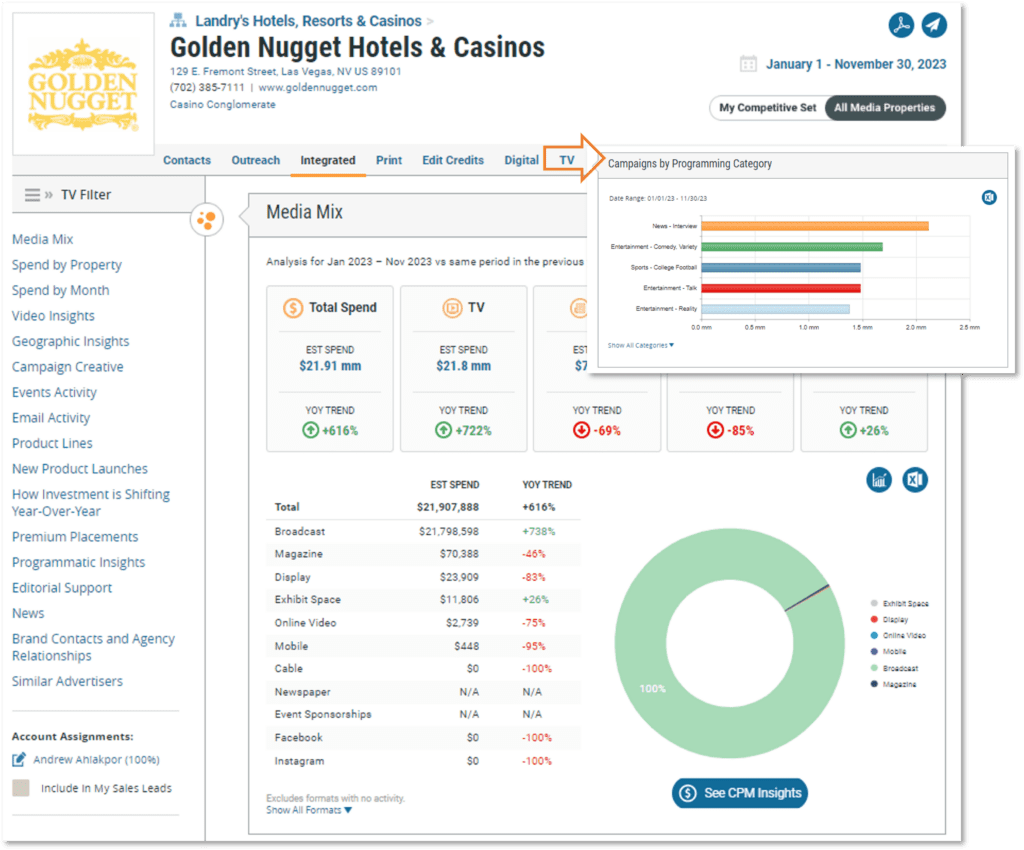

Golden Nugget Hotels & Casinos invested $22 million to reach potential casino guests through November 2023. That’s a leap of 616% YoY, with a heavy TV focus. There was less than $100k spent with digital and print media. Ads were placed across five broadcast networks including CBS, and CW, among others. Golden Nugget’s largest primetime spend is against news-interview programming with top three shows: The Point, Inside Edition, and College Football.

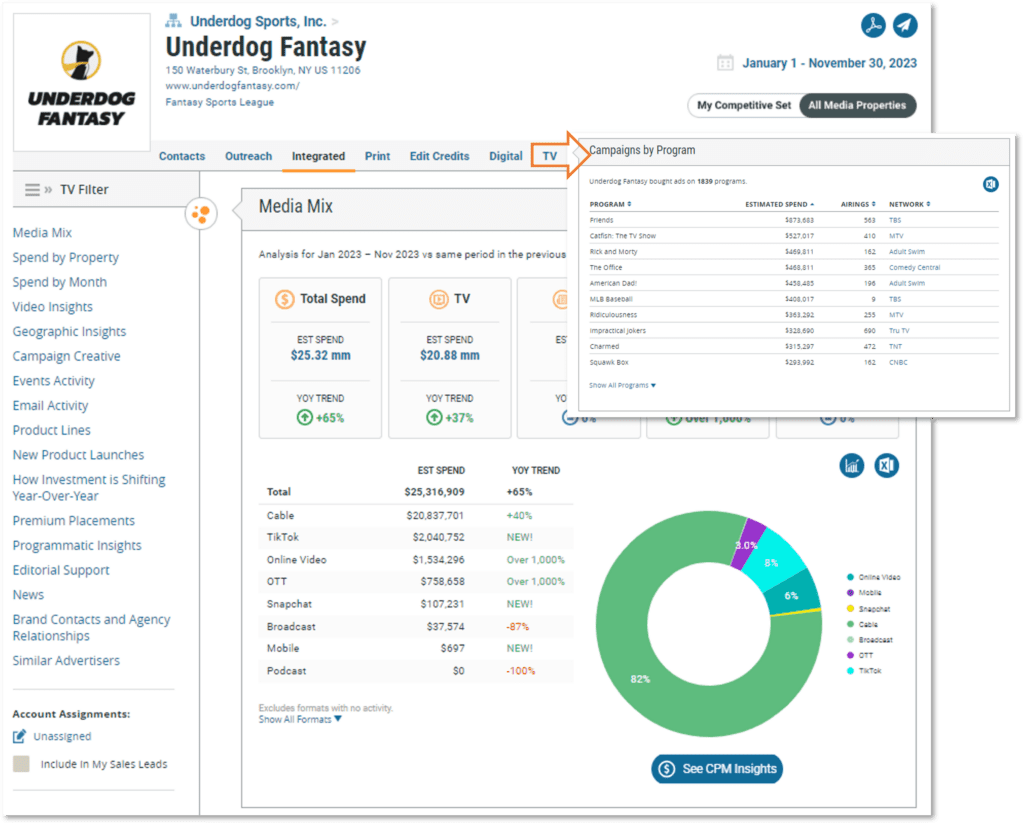

Underdog Fantasy’s ad spend topped $25 million this year after increasing by over 60%. Cable ad dollars were at $20.8mm (82%) thanks to a 40% YoY increase. Ads were running throughout the year, but the first spend spike was tracked starting in September. Top programming was reality TV, movies, and sitcoms, which all saw more than $3.5mm each. Some shows included Friends, Catfish, and Rick and Morty.

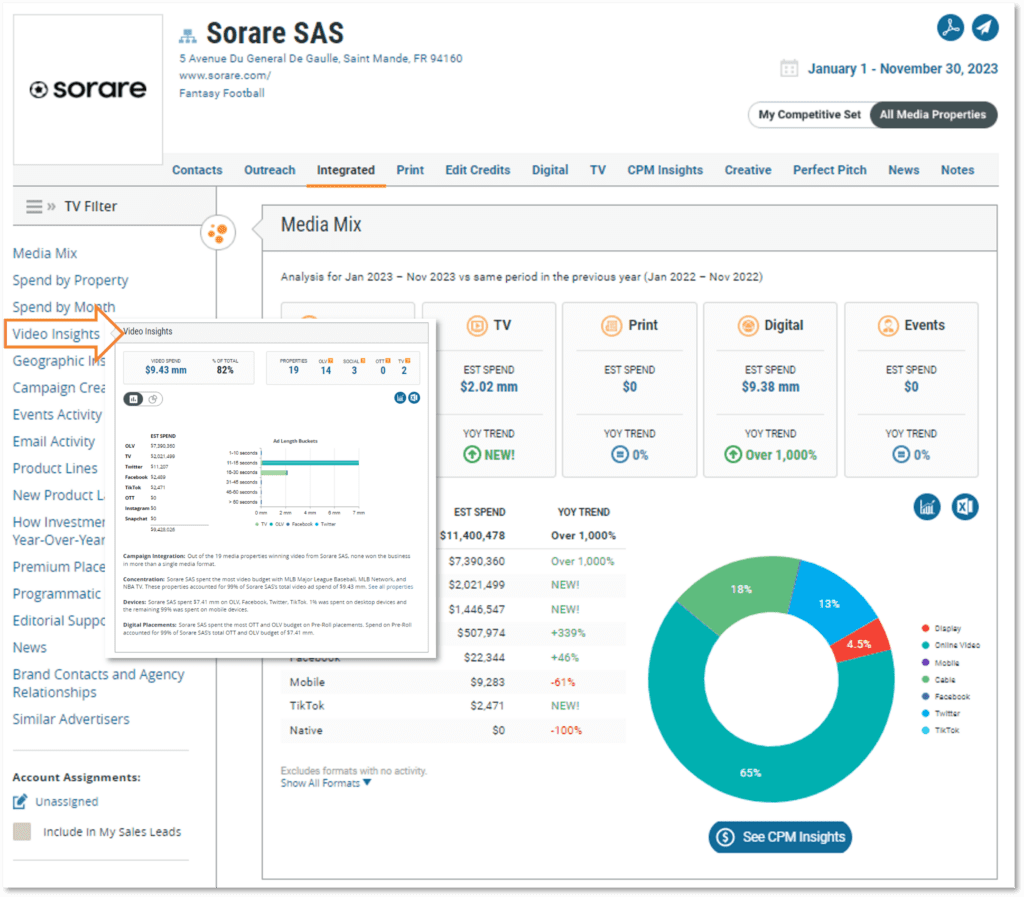

Sorare’s advertising slammed more than $11.4 million towards reaching audiences so far this year. That’s an increase of over 1000% compared to the same period last year. Online video was at 65% with $7.4mm spent, followed by cable ad dollars surpassing $2mm. Overall video spending for the brand was at 82% of spend, stretching over $9.4mm with the majority being 11 to 15 seconds. Sorare spent the most video with MLB Major League Baseball, MLB Network, and NBA TV with these three bagging 99% of video dollars. Pre-Roll accounted for 99% of its OLV budget of $7.4mm.

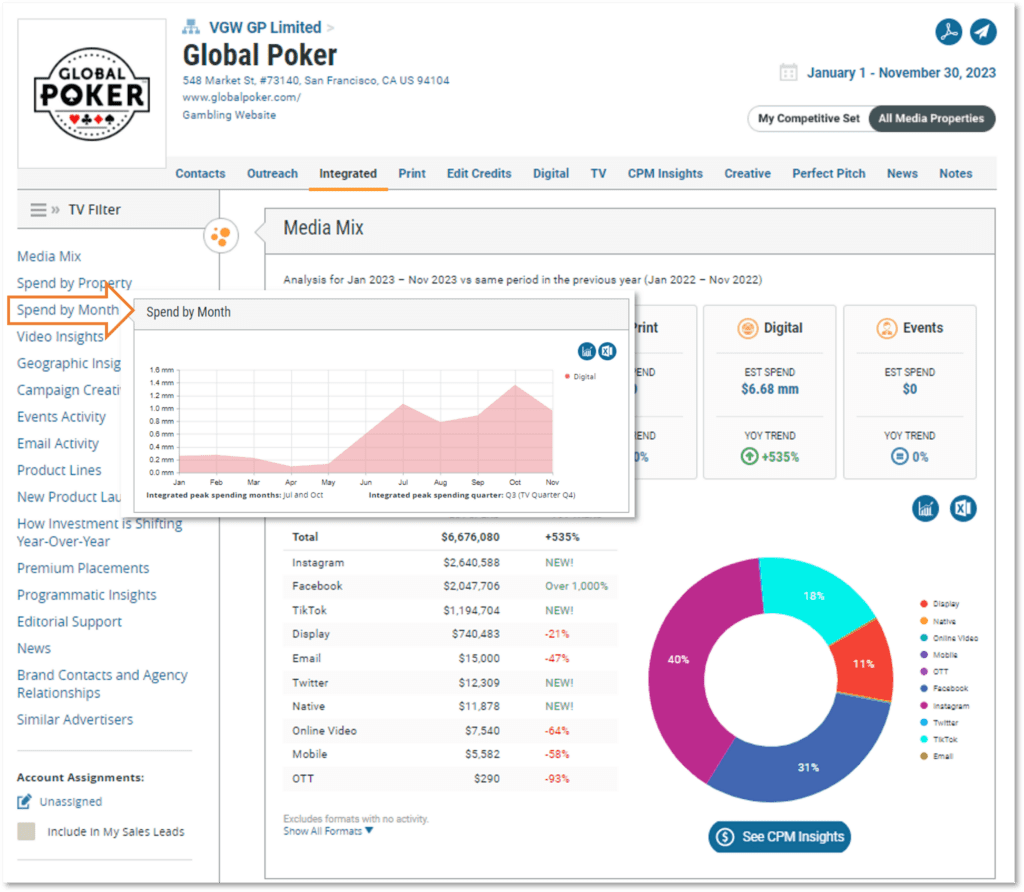

Global Poker upped its advertising spend by 535% YoY to more than $6.6 million. TikTok, Instagram, and Facebook were 99% of that, with 95% programmatically placed. Consistent buying patterns have been using Sizmek over the last 12 months. Peak spending occurred in July and October. Ads were tracked in 12 states, which is a more narrow geographic audience compared to similar advertisers running OTT or OLV ads in an average of 15 states.

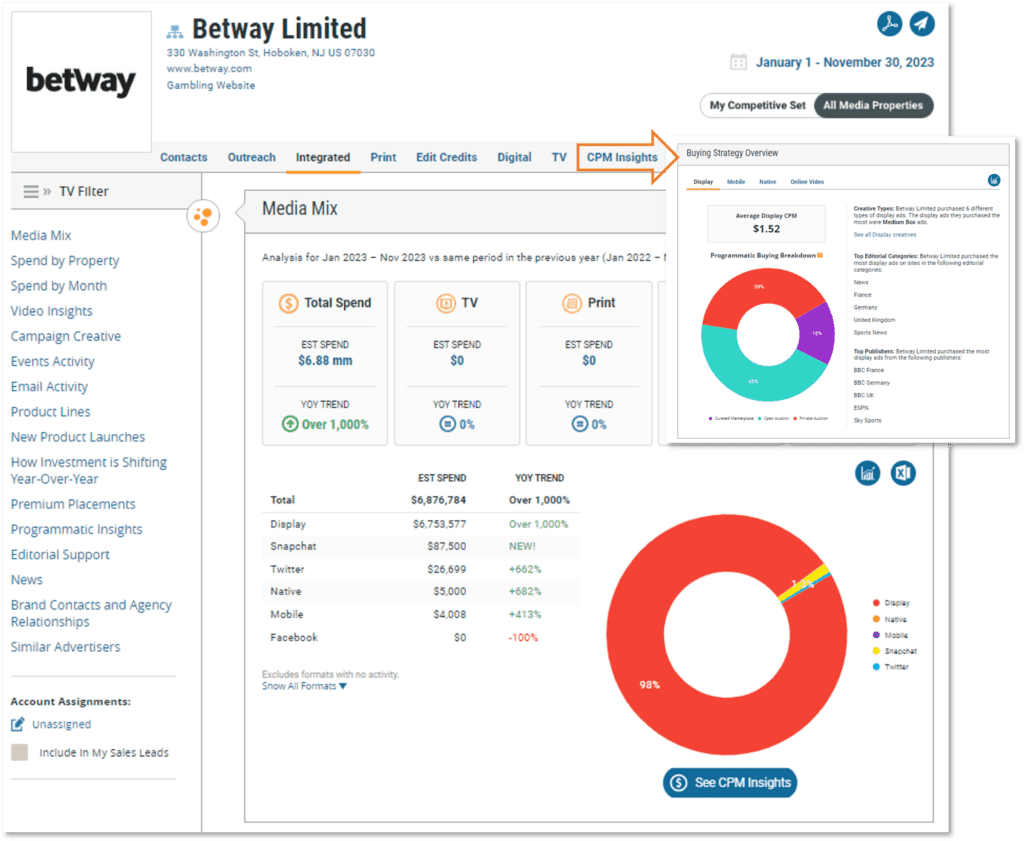

Betway Limited invested $6.8 million in advertising 100% digitally, with 55% of that bought programmatically. Most of which were display ad dollars, which exceeded $6.7mm. Betway’s most purchased were medium box ads and the average display CPM was $1.52 through 45% open auction, 39% private auction, and the remaining curated marketplace. November is when advertising started with $5.8mm spent.

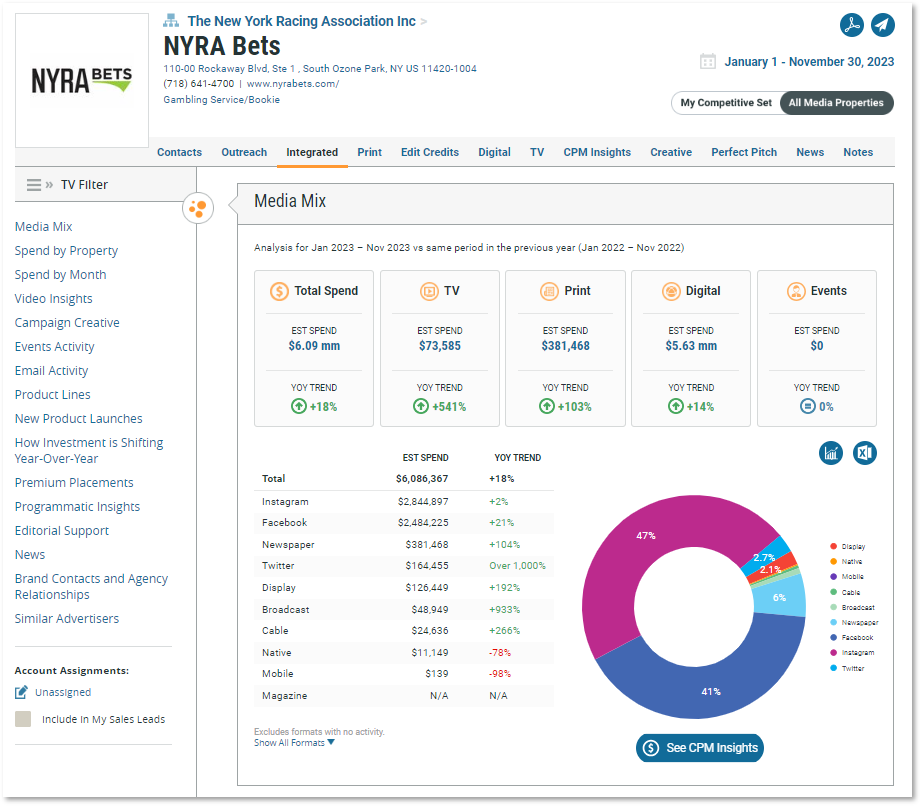

NYRA Bets’ advertising ante was upped by 18% YoY to more than $6 million placed 99% programmatically. The NY Racing Association went the social route with over 90% of ad dollars going toward Instagram, Facebook, and X (formerly Twitter). Nearly $5mm (81%) were video ads, mostly 11 to 15 seconds long. Peak spending occurred in April and May with investment tampering down coming into Q4, with less than $70k spent in November.

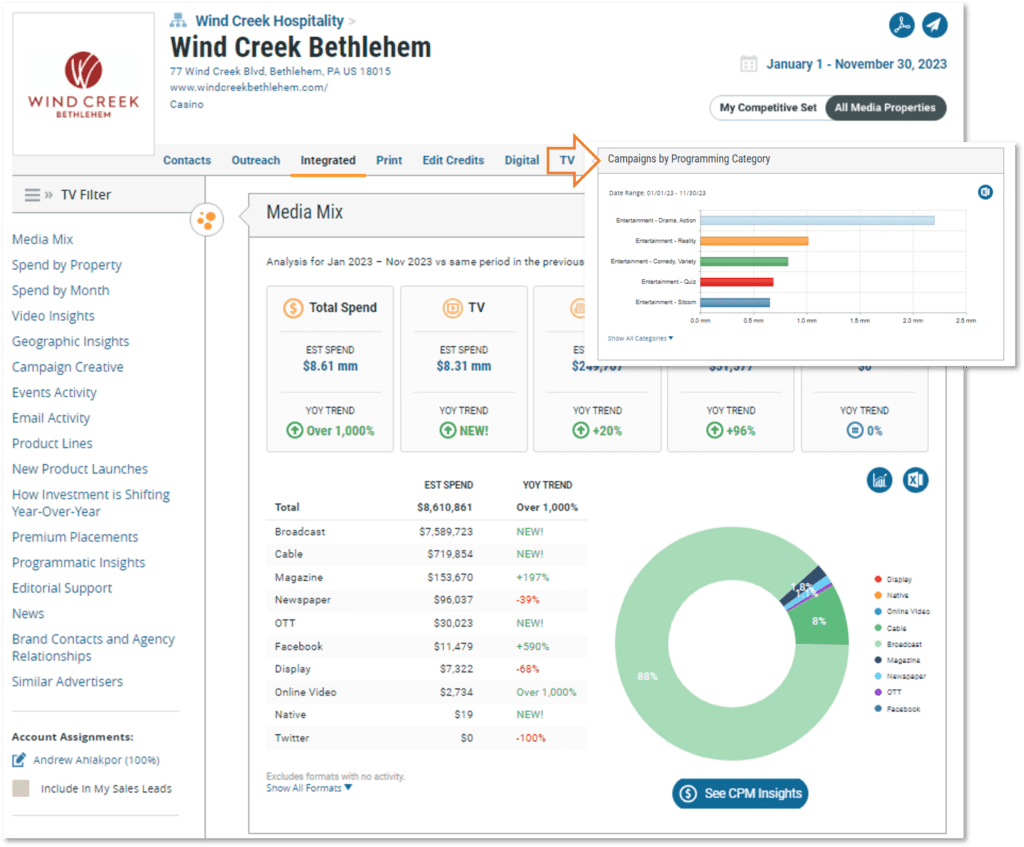

Wind Creek Bethlehem’s $8.6 million advertising spend through November was a result of increasing by over 1000% YoY. The casino’s focus was TV viewers with 96% of its spending dedicated to broadcast and cable TV. The top TV programming category was drama via three cable and five broadcast networks including CBS, ABC, and Fox among others. Digital media such as OTT and paid social saw an overall increase of 96% YOY to over $50k. Print media saw a 20% YoY uptick to nearly $250k. March and April are when peak spending occurs.

BetRivers placed nearly $2 million toward advertising this year after an uptick of over 1000% YoY. The bulk of dollars went towards digital display at almost $1mm, followed by online video. The casino and sportsbook placed 65% of that programmatically. There were concentrated and consistent buying patterns with Adelphic, as an ad tech provider, over the last 12 months. Video spend was around $900k with MSN, The Washington Post, and FOX News, capturing 44% of that.

Use MediaRadar to better understand how advertising investment is shifting in your market. MediaRadar will help you uncover new prospects, prepare your pitch, and connect with the right decision-makers at the right time. Request a completely customized demo of MediaRadar today.