As we conclude 2023 and look toward the new year, MediaRadar reviewed advertising for non-alcoholic beverage brands.

Whether this sector is quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of this category poised to fizzle up in 2024 based on the latest national advertising insights.

For more updates like this, stay tuned. Subscribe to our blog for more.

Non-alcoholic (NA) beverages encompass an incredibly diverse range of products – from traditional sodas and juices to newer offerings like kombuchas, nitro teas, and more. These highly competitive beverages boast strong brand loyalty as we continue turning to them to quench our thirsts, provide hydration, deliver nutrition, or simply enjoy their flavors and sensations.

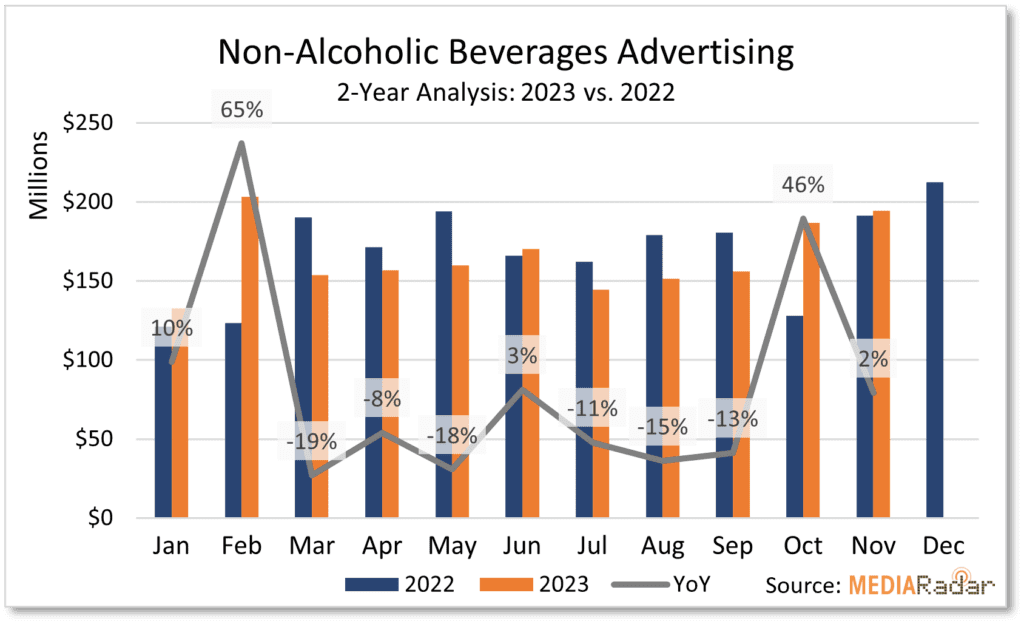

Recently, MediaRadar reviewed advertising spend for this dynamic segment. MediaRadar’s data sample revealed that over $1.8 billion was spent. National digital, print, and TV outlets from January to November 2023 remained flat compared to the same period last year. Ad spend increased by 13% year-over-year (YoY) to $489 million in Q1 2023. However, Q2 and Q3 declined by 8% and 13% respectively compared to 2022. October has shown some signs of recovery, kicking off Q4 ad spend 46% higher while November increased 2% YoY.

TV advertising garnered a 51% share of ad spend at nearly $930 million. Digital media captured 45% at $807 million year-to-date. An additional $73.5 million in ad spend has gone toward print. The number of brands actively advertising has decreased by 14% YoY to 1.2 thousand companies through October 2023 – economic volatility that forced certain brands to pull back.

Soft drinks represent 20% of the 2023 NA beverage ad spend to date with $363mm spent on advertising so far after a 5% YoY increase. Coffee was 17% with $309mm despite a 2% YoY decrease. Sports drinks follow at $235mm (13% of bev spend) owing to a 17% YoY increase.

12 Non-Alcoholic Brands to Watch in 2024

Below are twelve brands to watch in the Non-Alcoholic Beverages space ranging from 5-Hour Energy Extra Strength to RYZE Superfoods. These brands had a combined spend of over $441 million after a collective 85% YoY increase through November 2023. Each brand or product line invested $12mm or more.

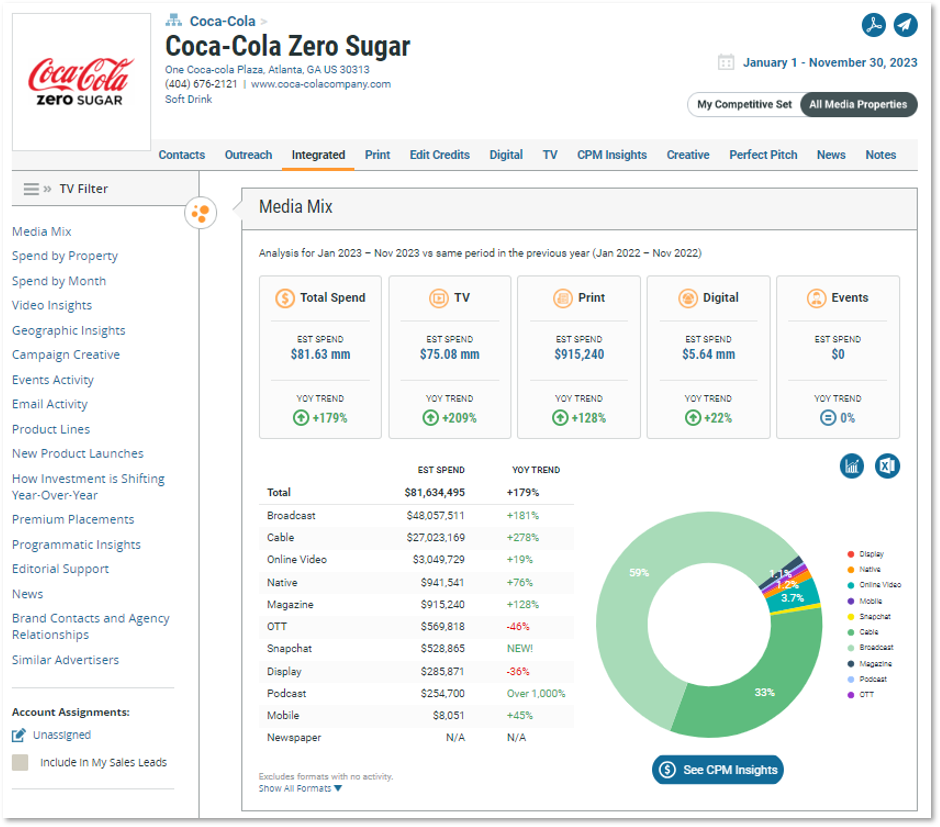

Coca-Cola Zero Sugar increased by 179% YoY to nearly $82 million invested so far in 2023. Over 90% of the brand’s spend was dedicated to TV ads after a 209% YoY increase compared to the same period last year. Peak spending occurred in February and again in October. Both broadcast and cable increased by 181% YoY and 278% YoY respectively. Over $5.6 million was also dedicated to digital media after a 22% YoY increase with online video capturing nearly 4% of the overall ad investment.

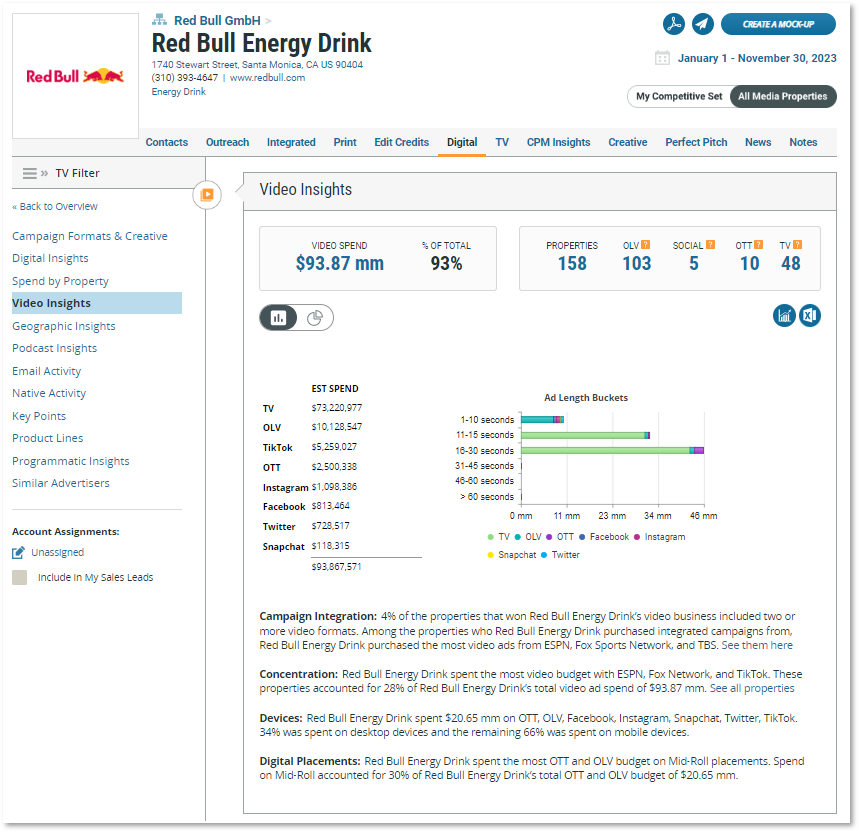

Red Bull Energy Drink scaled back spending by 24% YoY but still invested over $100 million to advertise. TV decreased by 26% YoY to $73 million. Cable decreased by 32% YoY and made up 56% of Red Bull’s overall advertising. Online video reduced by 60% YoY to hover around $10 million. Overall, video spend through TV, paid social, and OLV reached close to $94mm with ads less than 30 seconds in length.

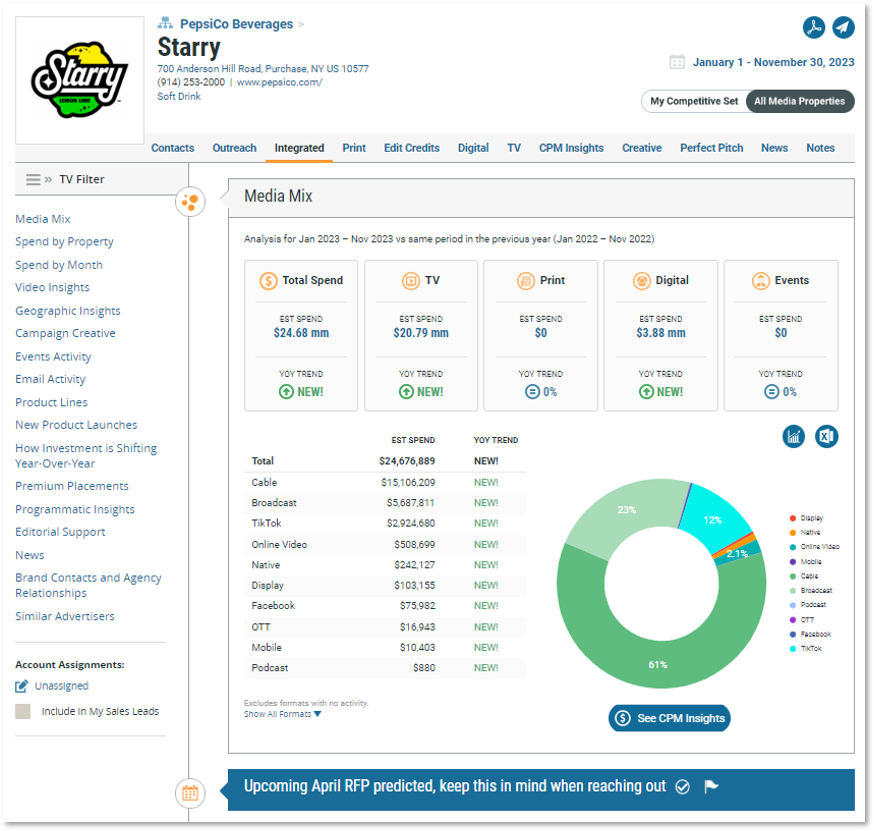

Starry, a Pepsi brand soft drink, invested nearly $25 million to reach customers in 2023 which was all new spending for the product. The majority of dollars were dedicated to reaching TV audiences to the tune of $21 million (84% of ad investment). There was just under $4mm dedicated to digital advertising, most of which landed with Tiktok, which captured 12%. The remaining 4% of spending was a mix of online video, native, display, Facebook, OTT, and mobile. There’s a predicted RFP in April 2024 for Starry, so be prepared to pitch.

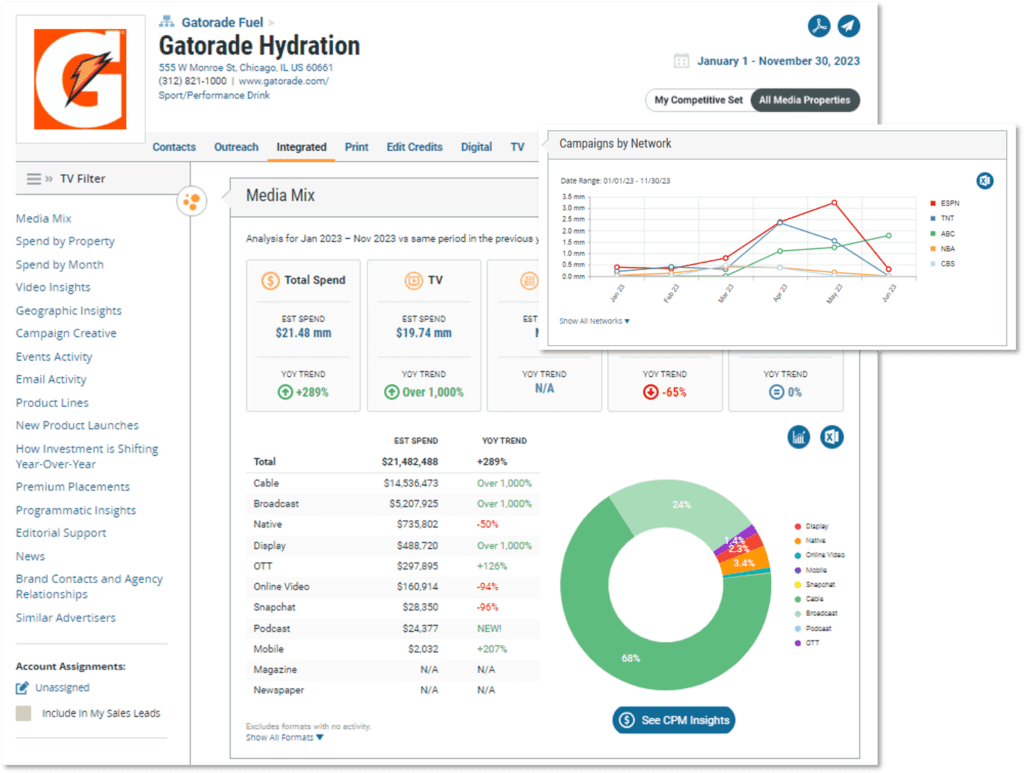

Gatorade Hydration spiked its ad investment by 289% YoY to more than $21.4 million through November this year. TV increased by over 1000% to $20 million. Ads were bought on 16 cable and four broadcast networks including ABC, CBS, ESPN, and eight other major networks. Interestingly, top spending occurred with TNT during April, while ESPN captured the most dollars during May. The brand’s largest primetime spend is against pro basketball programming.

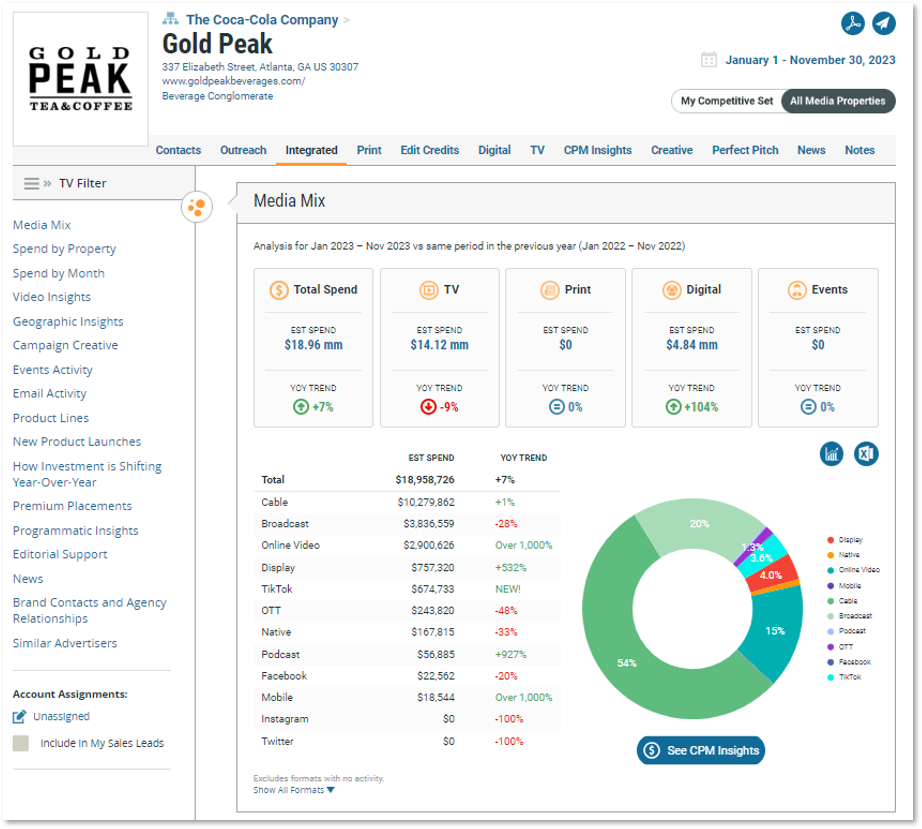

Gold Peak (owned by The Coca-Cola Company) increased by 7% YoY to around $19 million (mm) spent on digital and TV ads with national spend starting in May. Over $14mm (84%) was cable and broadcast spend, and the remaining $4.8mm was digital with OLV concentration. Video was 94% – $18mm with TV ads 11 to 15 seconds in length. The OLV, TikTok, and OTT ads ranged from 11 to 30 seconds. Peak spending for the beverage brand occurred in June and November.

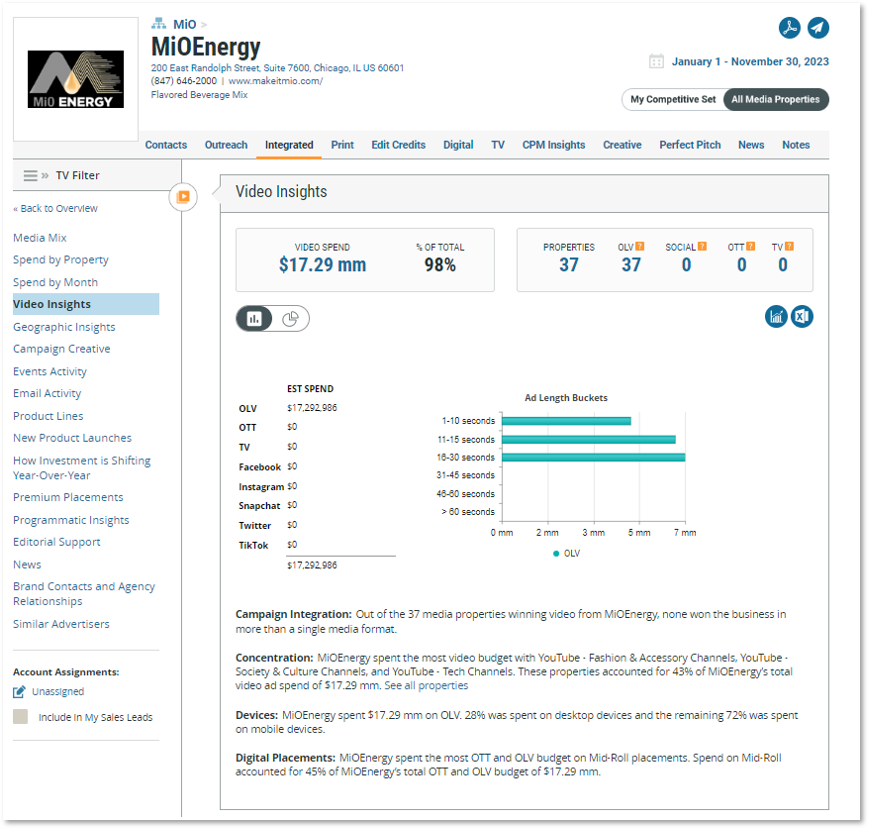

MiOEnergy increased by over 1000% to advertise its flavored water and caffeine product line with a spending spike in October. The result was nearly $17.5 million invested and 99% of that was dedicated to online video. All ads were less than 30 seconds, but the brand mixed in varying lengths. YouTube’s Fashion & Accessory, Society & Culture, and Tech Channels accounted for 43% of MiOEnergy’s total video ad spend of $17.29 mm.

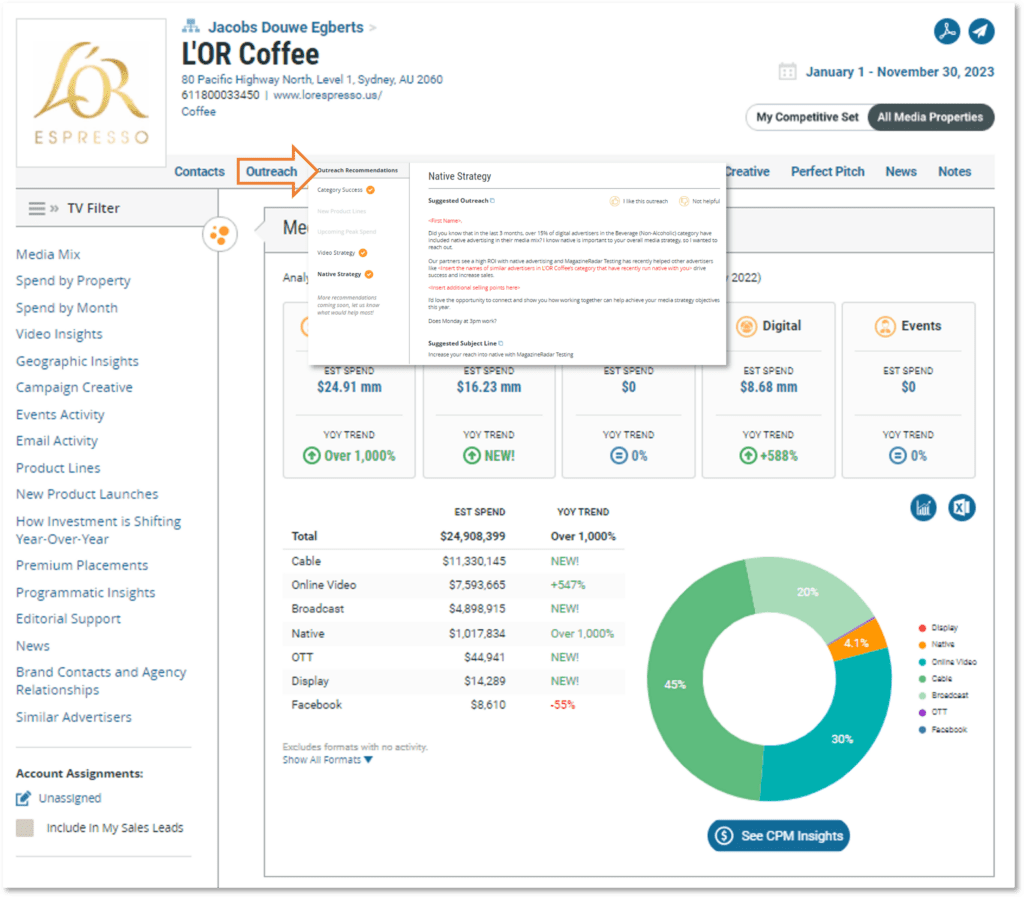

L’OR Coffee’s advertising amped up by over 1000% to nearly $25 million spent through November. Not only did the brand increase digital investment by 588% YoY, but it also started investing in TV ads, with cable and broadcast accounting for 65% of the investment. Online video dollars exceeded $7.5 million after a 547% YoY surge. Native ad spend increased by over 1000% YoY, topping $1mm, and new OTT and display spend was also tracked, showing format dollar expanding.

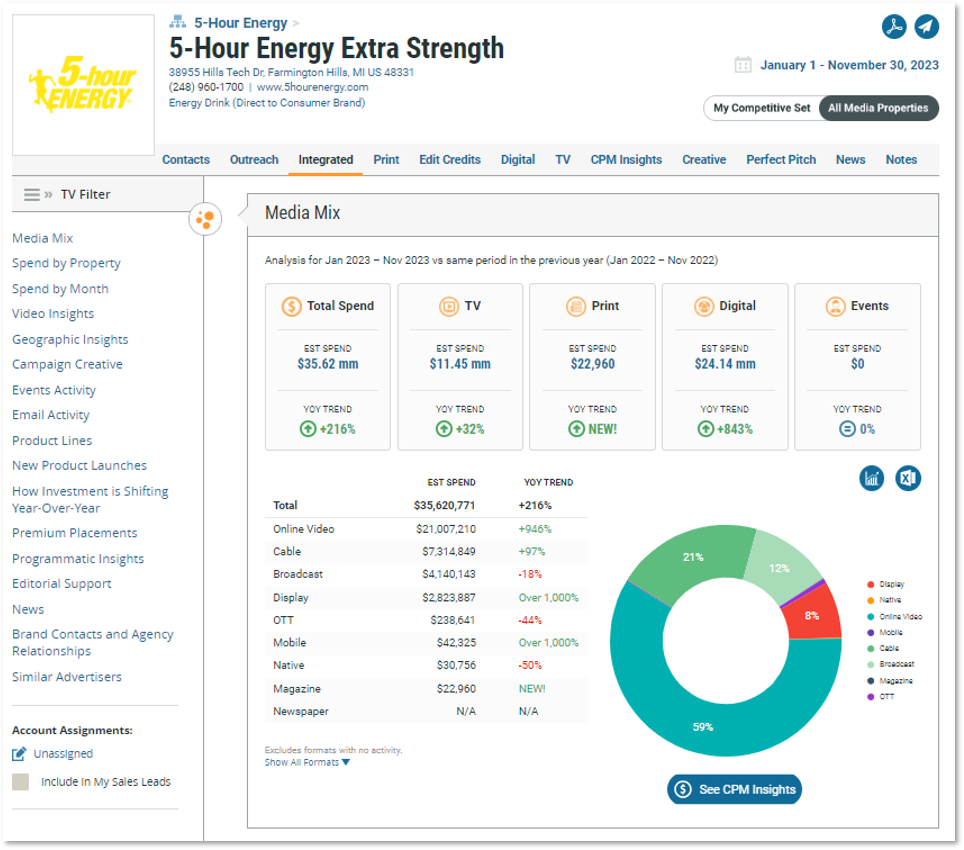

5-Hour Energy Extra Strength increased ad spend by 216% YoY to over $35mm, advertising its extra strength line of 5-hour Energy. Video spend through online outlets, OTT, and TV was 91% of the advertising through November 2023. All ads were less than 30 seconds long. OLV ad spend increased by over 940% YoY, cable was up nearly 100% YoY, and broadcast ads decreased by 18% from the same time last year. The product line increased digital display ads by over 1000% YoY to 8% of the ad spend.

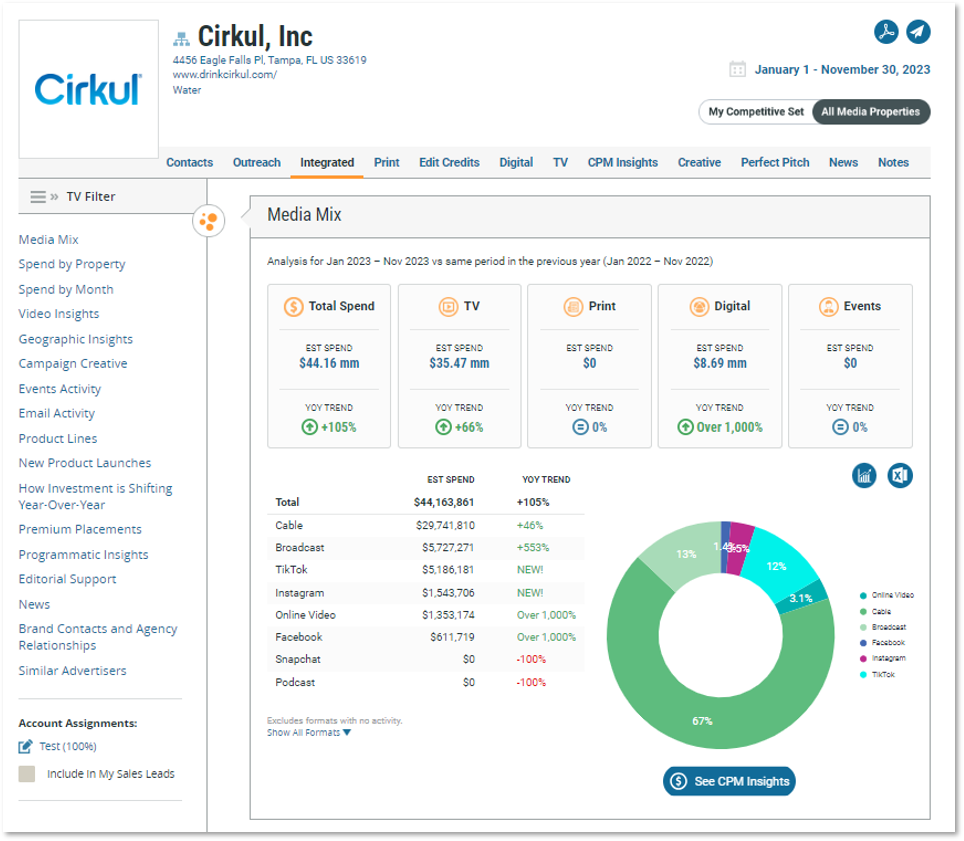

Cirkul, the brand with the mission of “making drinking water convenient, delicious, and fun” increased 2023 spend by 105% YoY through November 2023. Over $35mm was spent on TV ads, which captured 80% of the ad investment. Cable ad spend was 67% of total spend after a 46% YoY so far. Facebook and online video advertising were both up by over 1000% from the same time in 2022. Cirkul also started Instagram advertising this year. Paid social spend remains at less than 16% of its total ad investment.

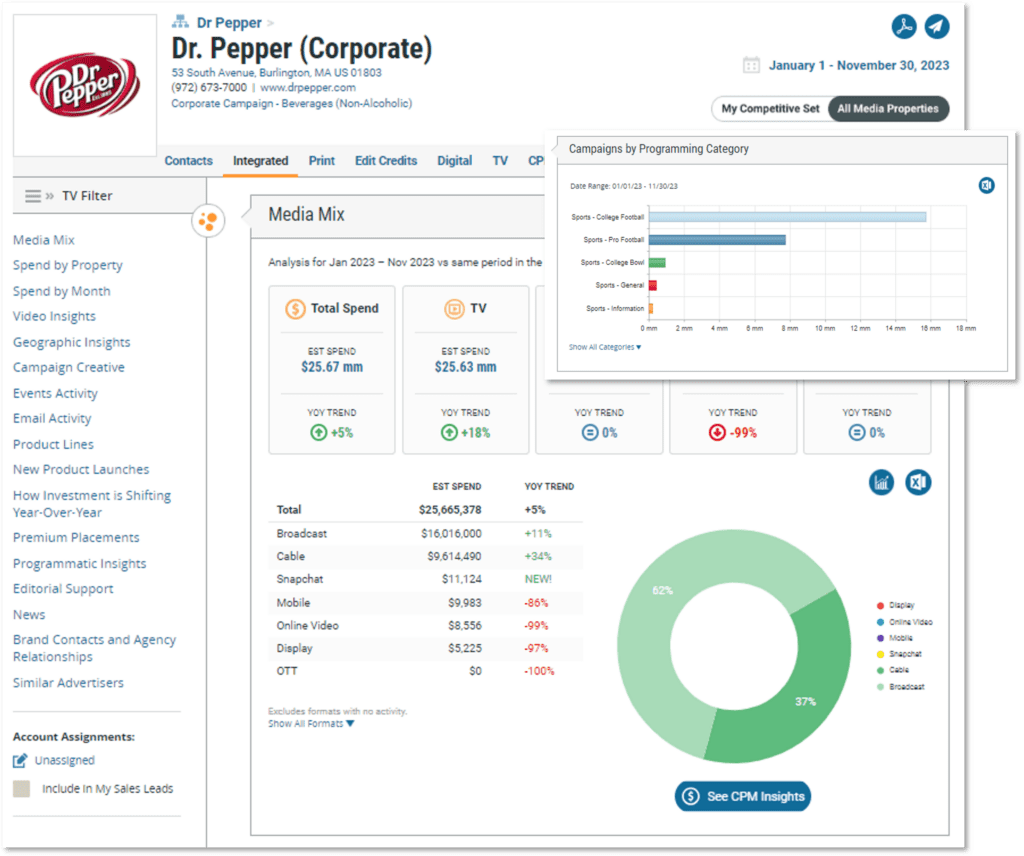

Dr. Pepper’s corporate advertising, which pertains to multiple product lines owned by the company, increased by 5% YoY with over 99% dedicated to TV ads. They kicked off 2023 with a $9.1mm January ad spend. Campaigns included its “Dr. Pepper Fansville” video series ad campaign, which also picked up again in September – just in time for the start of the NFL season. TV ads targeted 100% of sports programming. In 2023, MediaRadar observed less than 1% (less than $25k) of spend on mobile, Snapchat, display, and OLV.

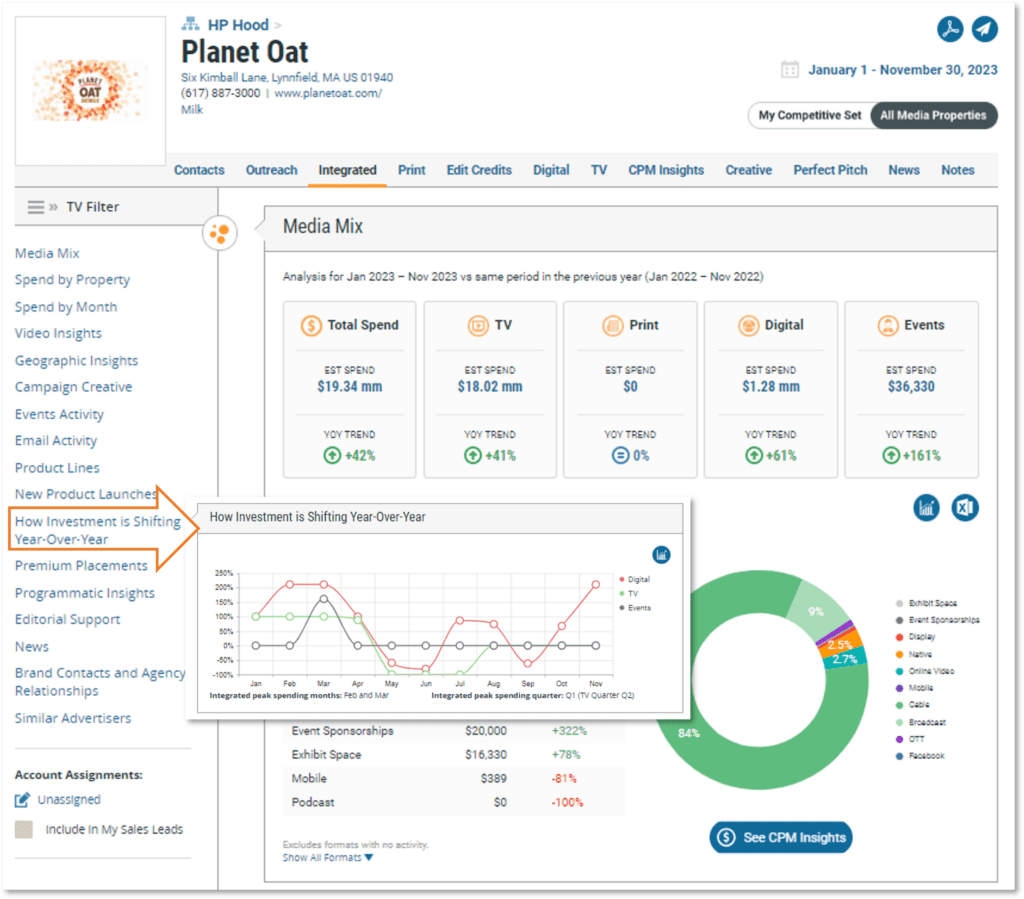

Planet Oat advertised its dairy, gluten, soy, peanut peanut-free oat milk with peak spending in February and March. MediaRadar’s data revealed a 42% YoY increase to over $19mm. Of that, 93% was dedicated to broadcast (9%) and cable (84%) ads. The remaining ad spend was a mix of digital formats and event spend. Planet Oat increased its event space and sponsorship spend by over 161% at the Natural Products Expo West event this year. While the brand’s media type remained consistent from 2022, the YoY changes varied showing peak spend occuring Q1.

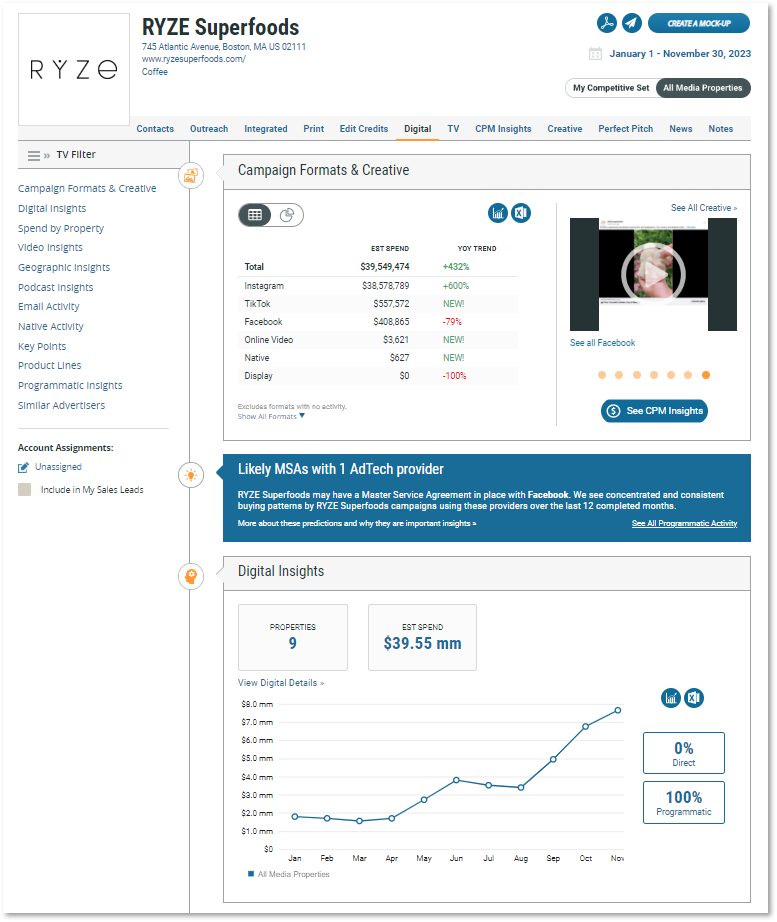

RYZE Superfoods dedicated 98% of its nearly $40 million ad spend to Instagram advertising. The coffee brand increased by over 432% YoY through November 2023 with 100% bought programmatically. MediaRadar’s ad insights also revealed consistent month-over-month growth this year. There was less than $4k of new spend tracked with native and OLV as well.

Use MediaRadar to better understand how advertising investment is shifting in your market. MediaRadar will help you uncover new prospects, prepare your pitch, and connect with the right decision-makers at the right time. Request a completely customized demo of MediaRadar today.