As we conclude 2023 and look toward the new year, MediaRadar reviewed advertising from hotels, airlines, tourism bureaus among others in the travel industry. Here are some recent trends and key advertisers within this space.

Whether these sectors are quickly advancing or slowly rebounding, gain insights to create strategic outreach and make informed media planning decisions for your clients.

Read on for our exclusive analysis of the categories poised to take flight in 2024 based on the latest national advertising insights.

For more updates like this, stay tuned. Subscribe to our blog for more.

Will Travel Advertising Take Off in 2024?

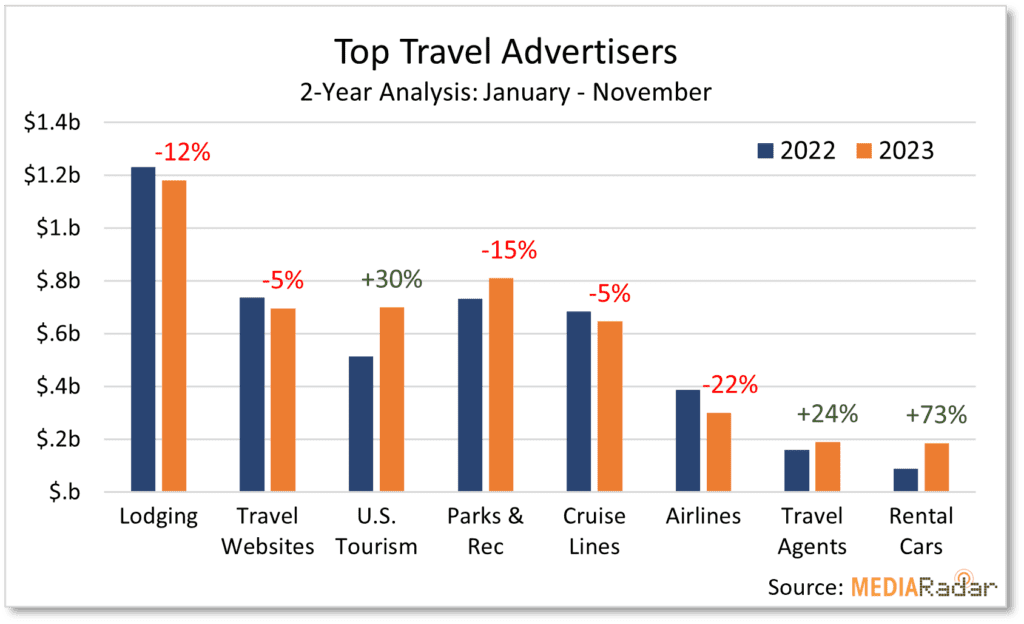

MediaRadar’s analysis of national advertising across TV, print, and digital channels shows travel ad spending reaching $5.25 billion through November 2023. While this represents a modest 5% year-over-year increase from 2022, it masks significant fluctuations across quarters and travel subcategories.

The 18% YoY increase to nearly $1.57 billion in Q1 2023 points to travel providers eager to capture early bookings. However, ad investment pulled back 14% and 17% YoY in Q2 and Q3 respectively as brands likely reassessed economic conditions. The 35% YoY ad spend spike (to $605 million) observed in October and the 66% YoY jump in November to $735mm seems to indicate travel marketers are optimistic about 2024 and securing future bookings.

12 Travel Advertisers to Watch in 2024

Here are twelve highlighted travel brands ranging from Avis Rent A Car System to Visit St. Pete/Clearwater. Combined spend from these 12 brands exceeded $954 million. A collective 126% YoY increase resulted versus the $423mm spent during the same period in 2022. All invested more than $12 million.

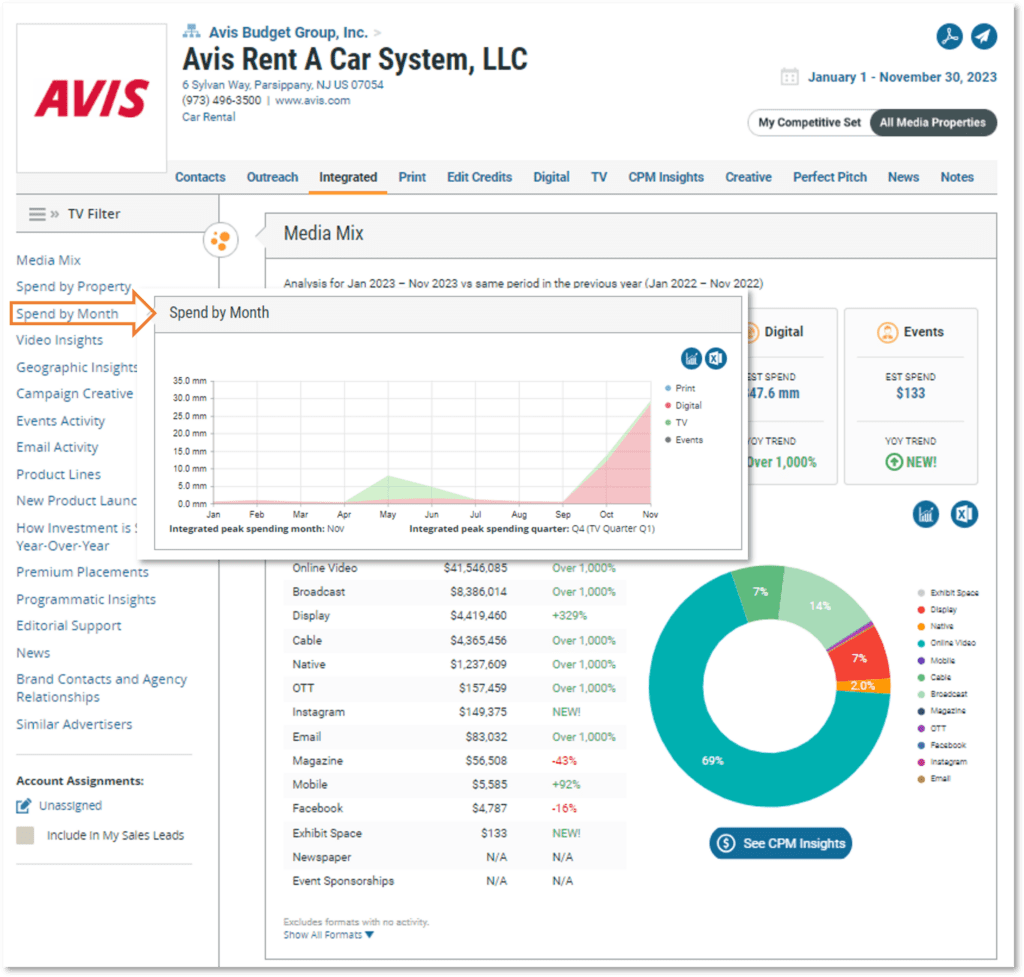

Avis Rent A Car System spent over $60 million to advertise its rental car service through November of this year, after a 1000% increase YoY. Avis’ online video (OLV) investment surpassed cable and broadcast TV (21%), capturing 69% of the investment. Both digital and TV increased over 1000% YoY. Summer months May ($6.7mm) and June ($3.3) saw Avis leaning into TV’s peak spending. The brand kicked off Q4 by spiking digital spend to over $11mm in October and $28mm in November.

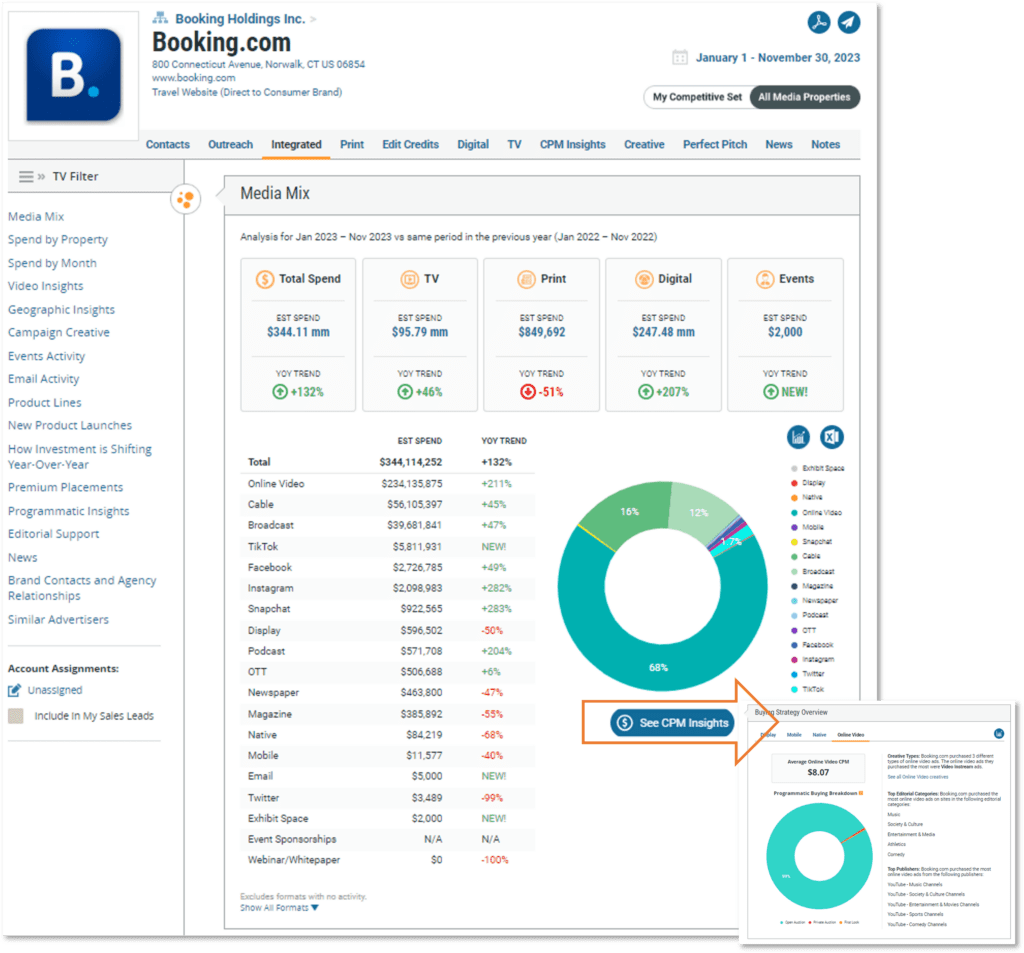

Booking.com increased advertising by over 132% YoY to $344 million invested through November. While the national spend was diversified across digital and TV media, 68% was dedicated to online video (OLV) after a 211% YoY jump. MediaRadar’s data revealed Booking.com’s average CPM was $8.07, with video instream being the most purchased through open auction.

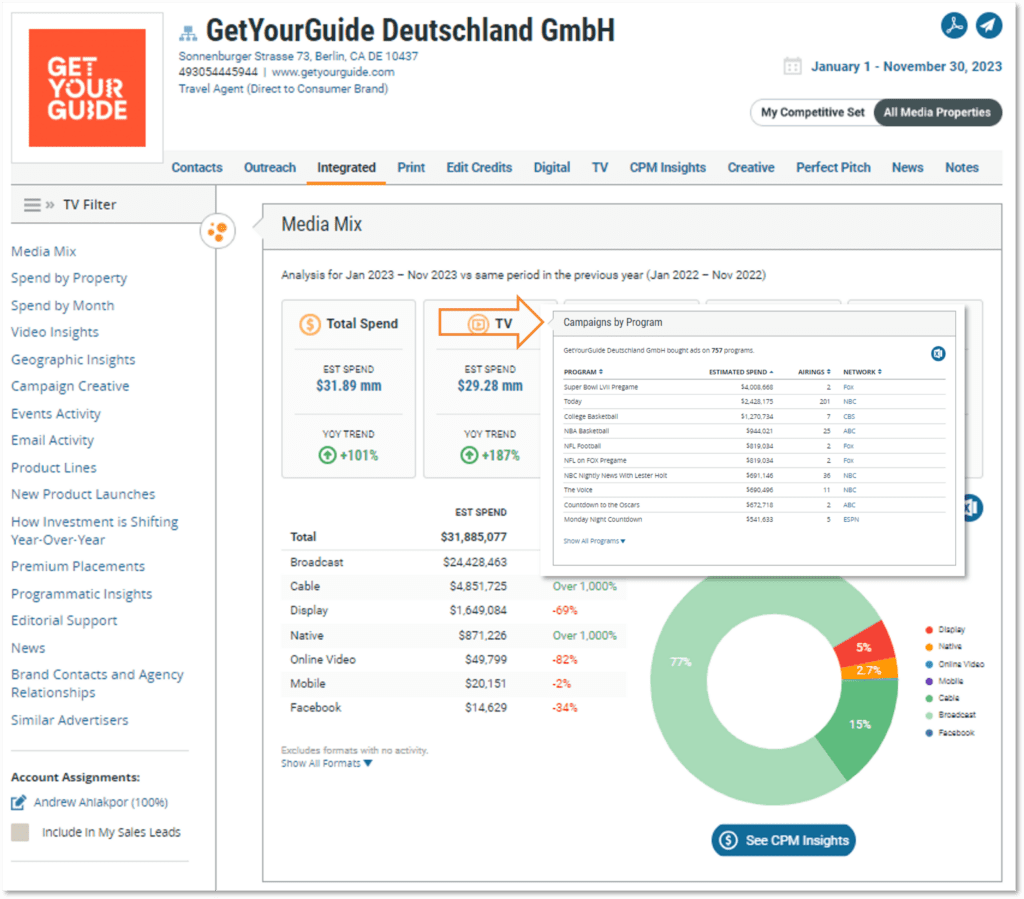

GetYourGuide raised its national ad investment digital, print, and TV ad investment by over 100% to more than $31mm in 2023 so far. The travel agency, offering an online marketplace to book tour guides and excursions, leaned into TV media at over 90%. Over 44% of the brand’s ad spend occurred during Q1 thanks to two airings during the Super Bowl LVII Pregame this year. It’ll be interesting to see if GetYourGuide’s ad strategy continues with TV in 2024 or if the brand will lean more into digital media.

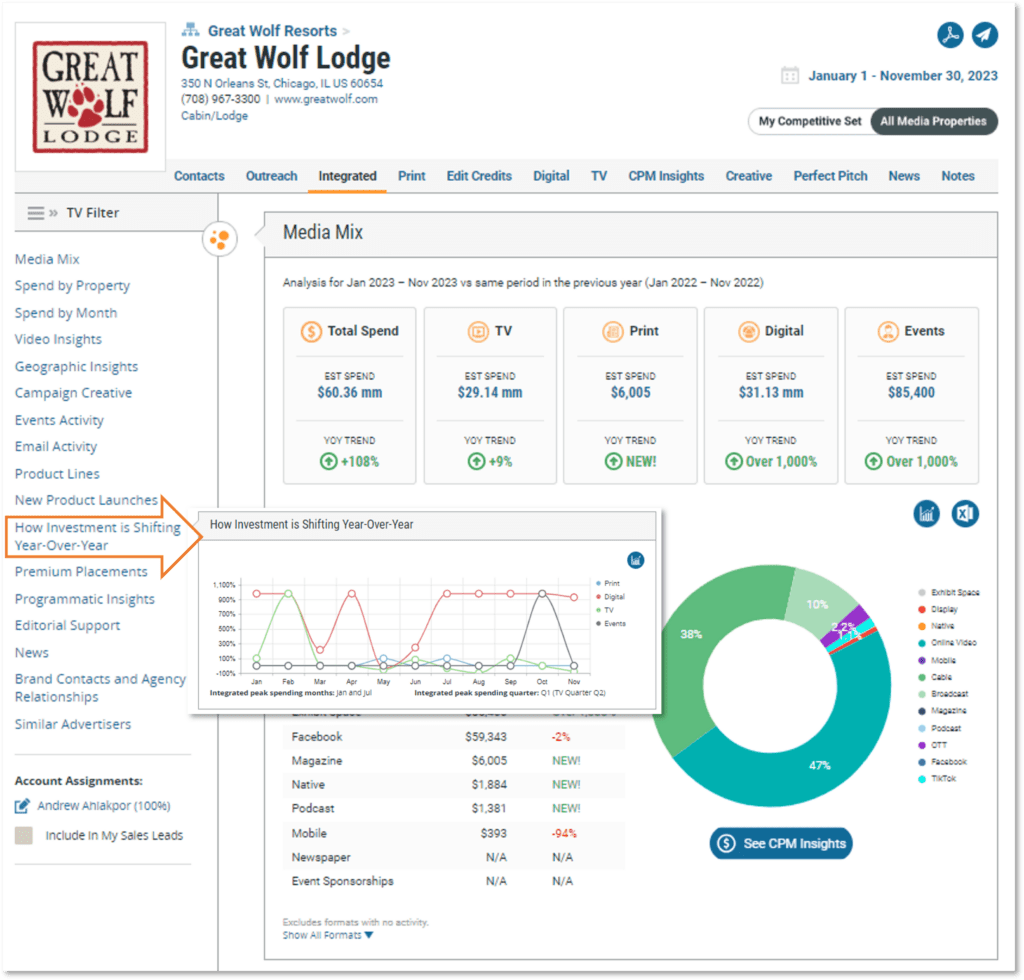

Great Wolf Lodge increased national spending by 108% YoY to over $60 million. Most notably, OLV increased by over 1000% YoY to 47% of the investment. Several months saw over 1000% YoY in digital media spikes. Of Great Wolf Lodge’s advertising, 99% was attributed to video through online video, paid social, and TV. Three top properties that captured spend include YouTube – Kid’s Education & Entertainment, BET, and ABC Network, which account for 39% of the video spend.

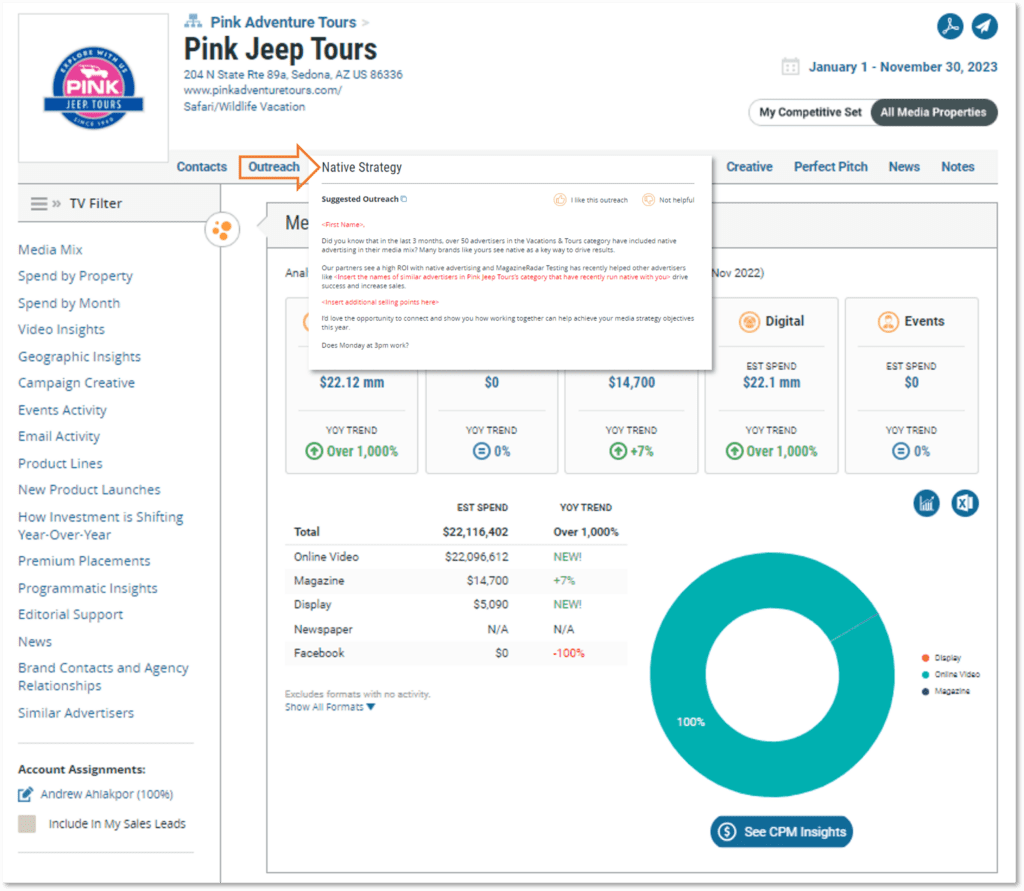

Pink Jeep Tours spent over $22 million in advertising so far this year. They kicked off in October (September was less than $300k) to reach potential passengers for its on and off-road excursions. Over 99% went toward online video with all ads being 45 to 60 seconds. Three top properties were 94% of the OLV: YouTube’s Kid’s Education & Entertainment, Music, and Society & Culture programming channels. Be prepared with MediaRadar’s Outreach Writer as this brand may explore other advertising media in 2024.

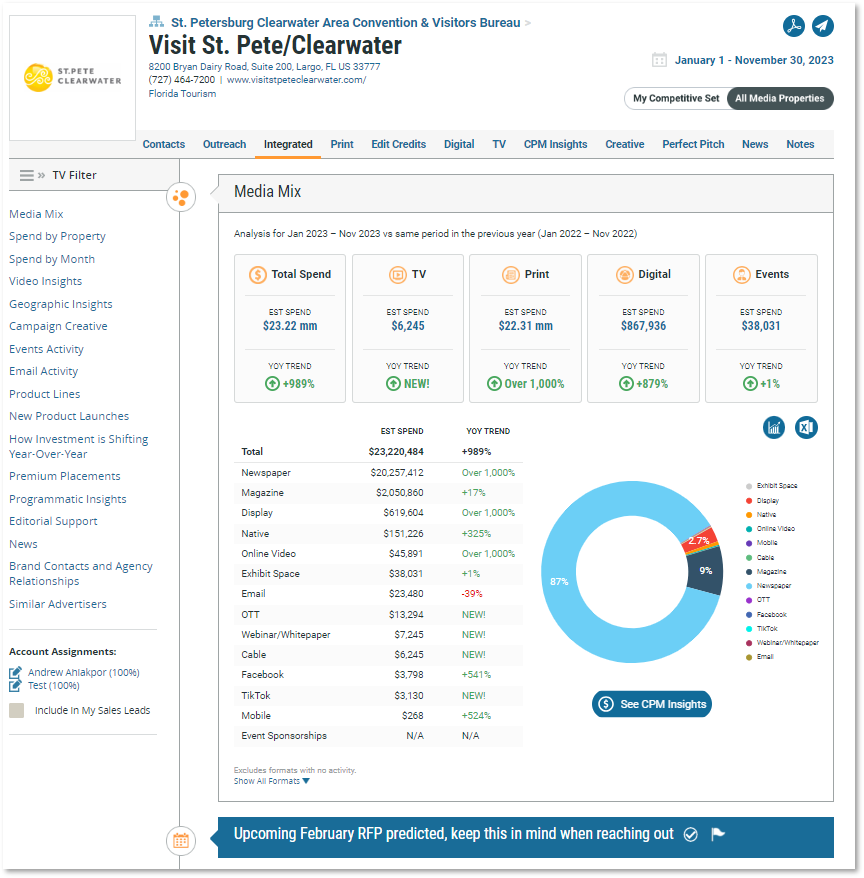

Visit St. Pete/Clearwater increased by 989% YoY to more than $23 million spent attracting tourists to Pinellas County, Florida so far this year. The tourism bureaus selected a 96% print strategy for this year. Newspaper advertising increased by over 1000% YoY with The New York Times as a top outlet. The bulk of spending (99%) occurred in July, most likely to entice the “snowbirds” to the south for the winter season. There’s an upcoming RFP in February.

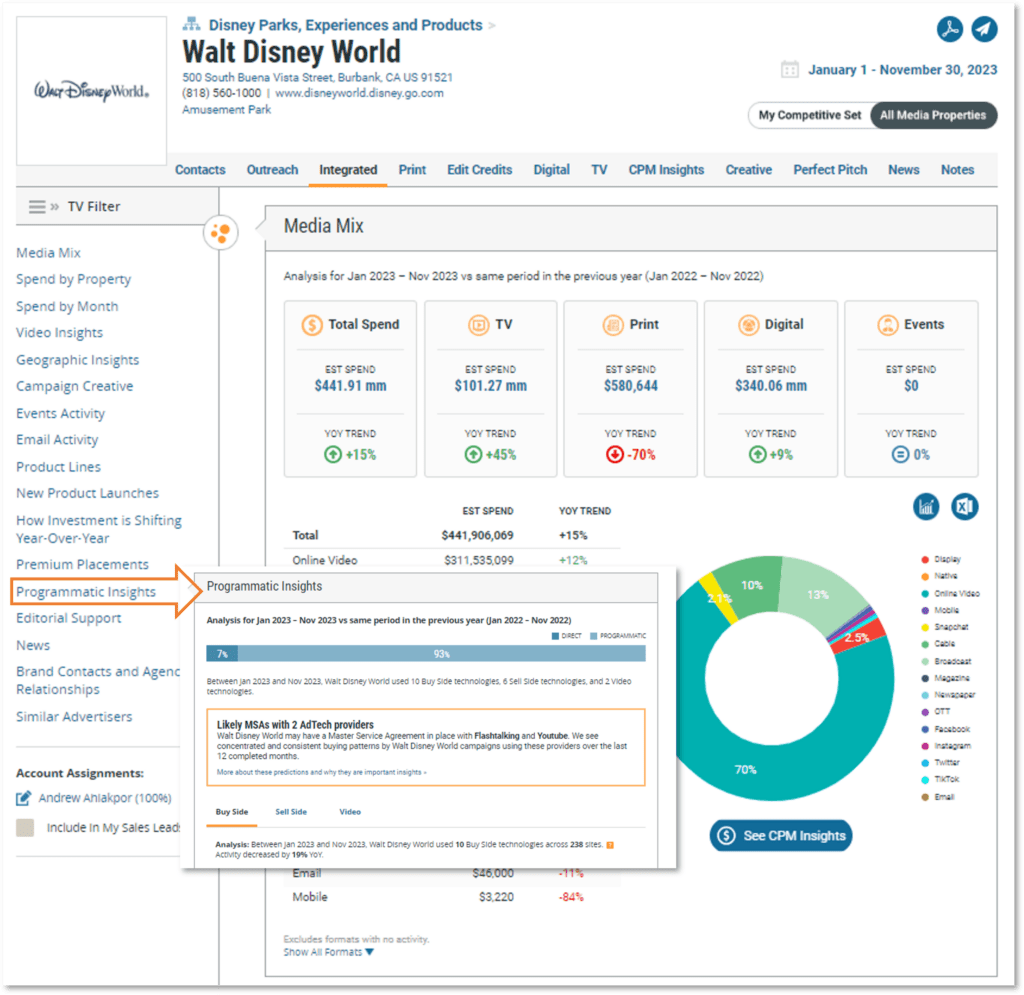

Walt Disney World increased by 15% YoY to nearly $442mm invested to advertise its amusement park. Digital topped $340mm after a 9% YoY increase through November and TV was up 45% YoY. Print ad spend decreased 70% YoY to less than $600k. Of the digital spending, 93% was bought programmatically so far this year.

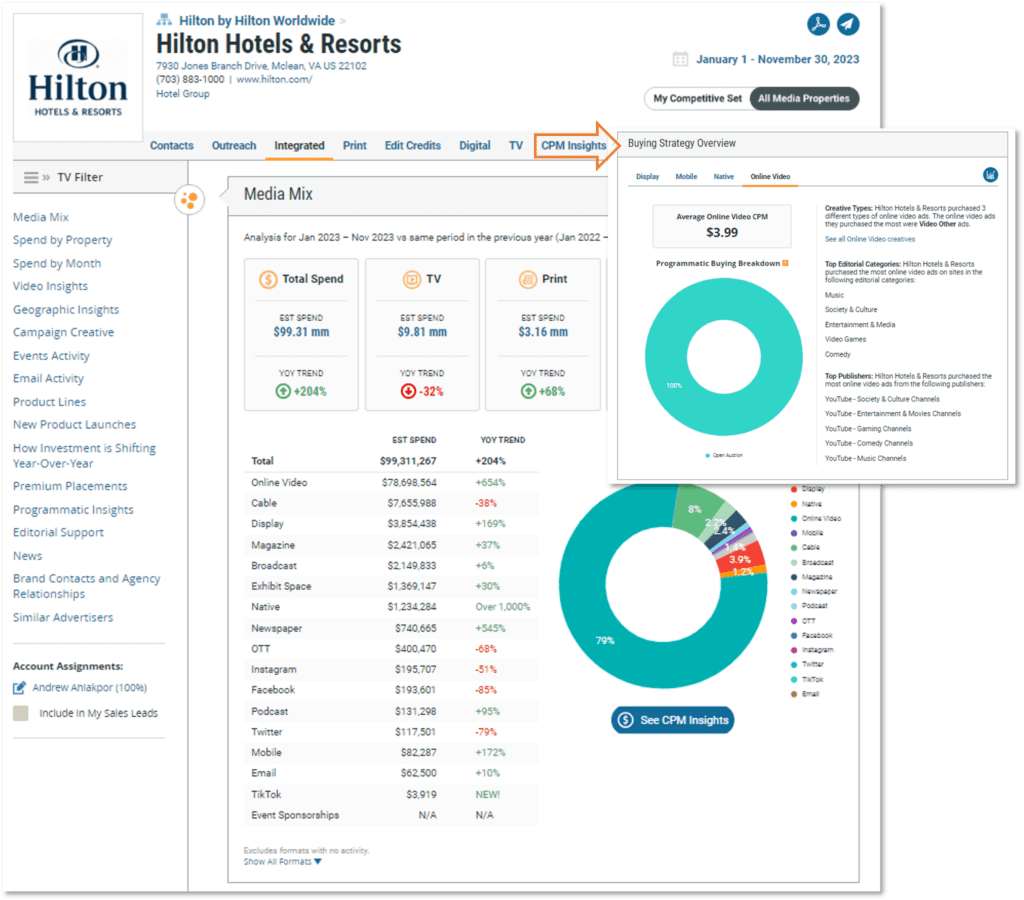

Hilton Hotels & Resorts invested over $99 million after a 204% YoY increase driven by digital media, increasing by nearly 450% YoY. The hotel group dedicated 79% to online video ads, topping $78 million after increasing 654% YoY. The average online video CPM was $3.99 with 100% bought through open auction with top placement on YouTube’s Society & Culture channels.

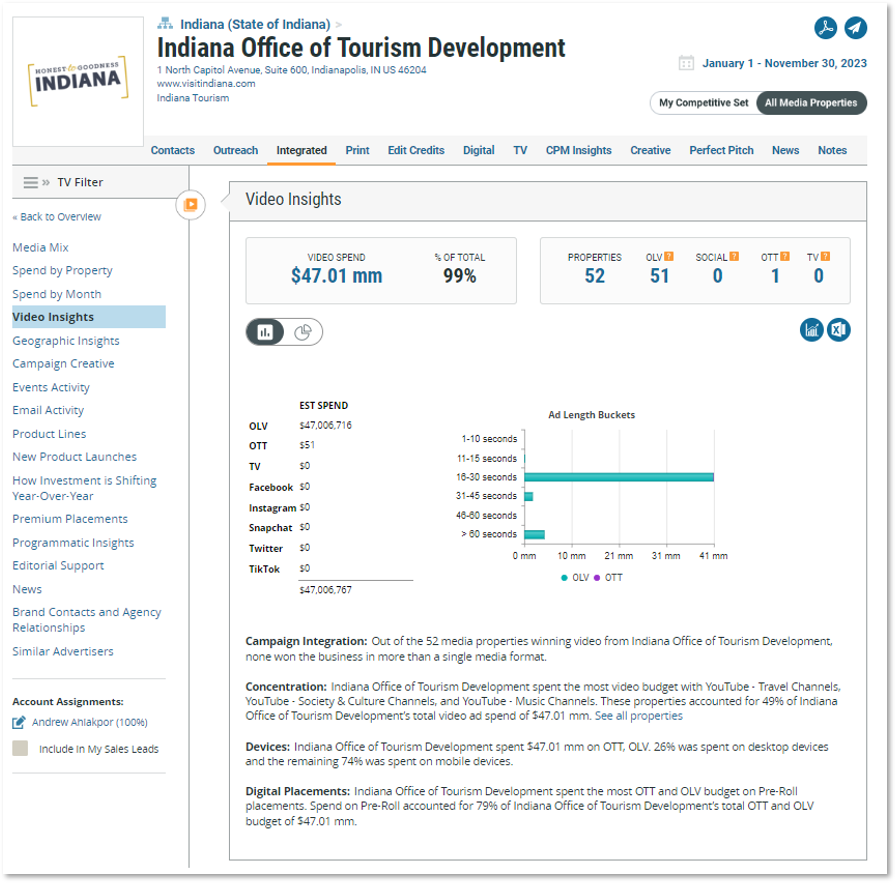

Indiana Office of Tourism Development spent over $47 million to entice visitors to its area. That’s a result of online video spend increasing by over 1000% YoY with 99% of the ads dedicated to OLV. The majority were 16 to 30 seconds in length ($41mm) with the most concentration on YouTube’s Travel, Society & Culture, and Music channels which saw 49% of the video spend.

Atlas Ocean Voyages increased by 436% YoY to more than $17.6 million spent. The cruise line leaned into newspaper advertising at 84% of the spend and magazines were at 15%. As a result, print investment was over $17.4mm thanks to a 467% YoY increase in the media. Ads spanned across 12 print trade outlets with The New York Times capturing the largest share at nearly 85%.

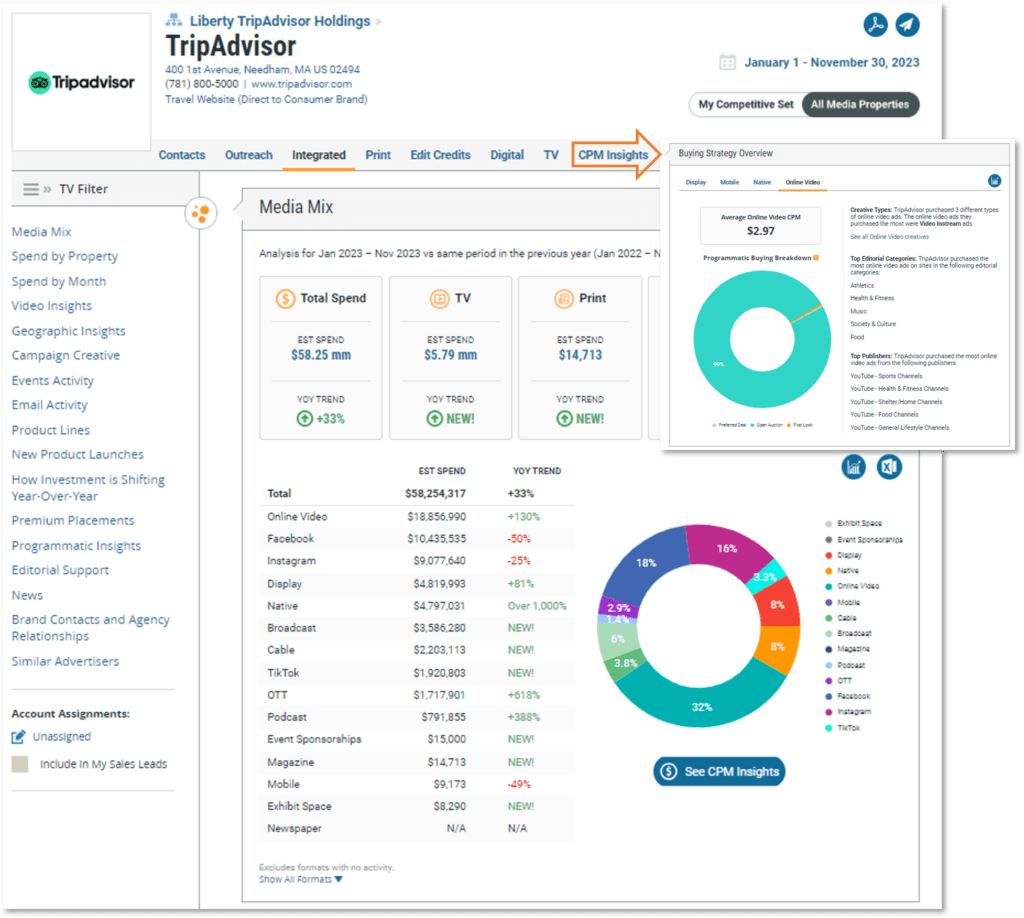

TripAdvisor increased by 33% YoY to over $58 million spent through November 2023. Digital media increased 20% YoY and spending started with TV and print outlets this year. The travel website adopted a diverse mix with paid social ads in over 37% of its spend at over $30mm, followed by online video at 32% with nearly $19 million. The average online video CPM was $2.97, recommending not exceeding $6.34 in open auctions.

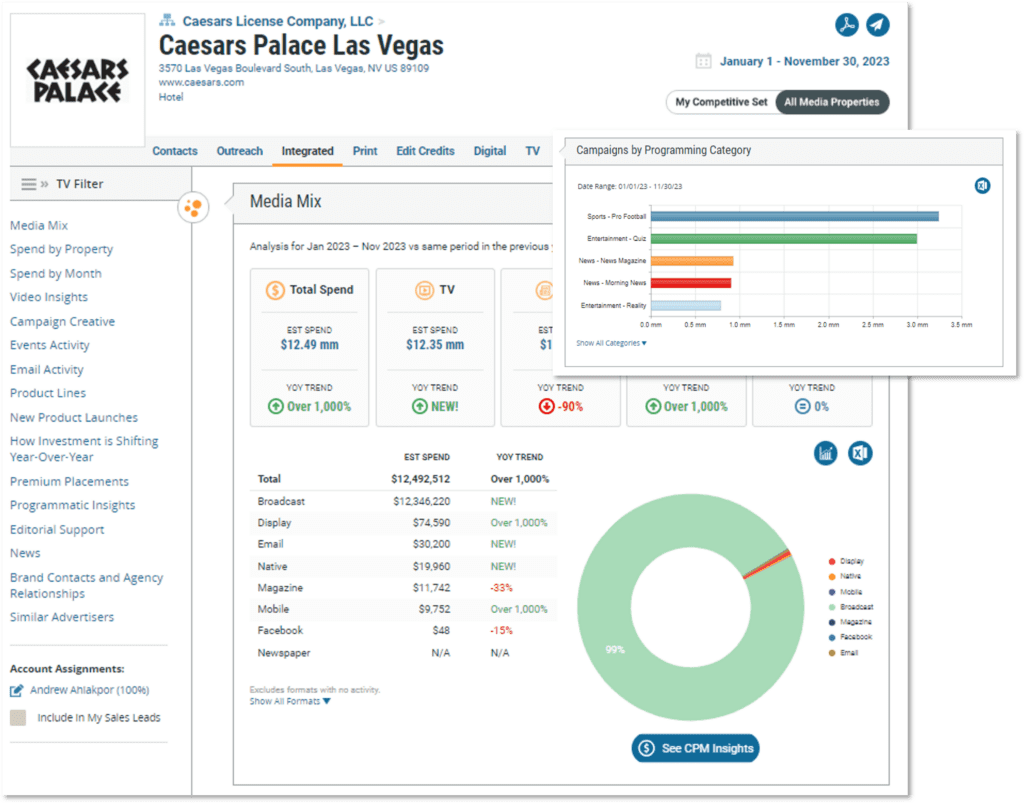

Caesars Palace Las Vegas spent nearly $12.5 million so far this year with 99% of the spend dedicated to national broadcast TV ads. Spending kicked off in July, but September was a period of peak spend with over $9.4mm invested that month. The top networks were ABC and CBS with Pro Football as the top TV programming category with $3.3mm invested.

MediaRadar Shows Travel Advertisers Spending

MediaRadar’s advertising data reveals that some sectors of the travel industry are ready for growth in 2024, after weathering economic uncertainty. Rental cars (+110% YoY) and online travel agencies (+19% YoY) are already increasing ad spend.

Subscribe to our blog for more exclusive advertising insights and data-backed recommendations across industries. See how MediaRadar’s competitive intelligence platform can support your sales strategy and be your revenue partner in 2024.