If one thing is clear in the brand and publisher space for 2018, it’s that the media mix is shifting.

As new platforms continue to enter the advertising space, there’s more and more for brands, publishers, and ad sales teams to consider in knowing where advertisers want to be.

For brands, the shifting media mix leaves them with new and interesting ways to reach their audiences.

For publishers, the shifting mix means a few things. It means that brand spend could fluctuate between mediums. It also means that they may be faced with new and growing competition amongst sellers.

In the grand scheme of things, it means that there is more for publishers to take advantage of, more for them to use, yet more for them to compete against.

This creates a necessity for publishers to always stay on top of the latest ad buying trends and fluctuations. In 2018, to maximize their own returns, publishers need to know where advertisers are investing.

Mobile Disruption

Mobile has made quite a name for itself in recent years, and with it, has come new platforms, and new ways of engaging audiences.

Mobile devices now serve as one of the most effective ways for publishers and brands to serve advertisements to content consumers.

As a company capitalizing on that growing mobile market, Snapchat serves as one of the best examples of the current shifting media mix.

Snapchat, the mobile messaging and social media app, started serving ads in 2014, and has continuously grown ever since. Upon going public in March of 2017, however, Snapchat’s growth hit a bit of a slowdown, and concerns started to rise.

While it’s no secret that other social media companies such as Facebook also stuggled a bit with growth when initially going public, Snapchat’s somewhat niche market started to create worries surrounding their place in the market.

Their most recent update says otherwise.

Snapchat just released their Q4 report, and many of those rising concerns have been shelved.

Snapchat revived their growth, having their largest new-user count since becoming a publicly traded company, and with new ad sales rising by 72% to $285.7 million.

What does that mean?

Even though Snapchat has a more niche market than the likes of Google and Facebook, these numbers tell us that brands do, in fact, desire Snapchat as a place to advertise.

For publishers, that makes it essential to learn and understand how brands are leveraging Snapchat to reach their presumably youthful audience.

Snapchat is the perfect example of why publishers always need to immerse themselves in the trends of the market, but also presents an opportunity for publishers to leverage their knowledge of Snapchat to better optimize their own strategies.

That being said, let’s take a look at a few reasons why brands are liking Snapchat so much:

While Snapchat does have a more niche market than other major social media companies, in recent months, they’ve taken aim at their niche qualities and pressed them even harder. In focusing more on what makes them unique, they were able to re-stimulate growth.

All Vertical, All the Time

Snapchat has always been a leader in vertical video, it just took a long time to begin catching on elsewhere. They are constantly innovating within their vertical space, allowing users to engage with content in ways not available anywhere else.

This is simple. Brands that love mobile, love Snapchat. Having an entirely mobile interface allows Snapchat to put the utmost effort into maximizing mobile experiences for users. Because of that, brands can capitalize on an always vertical-optimized environment.

In seeing the brands investing in Snapchat, publishers can see who is buying into the trend of vertical video ads.

User-Engagement

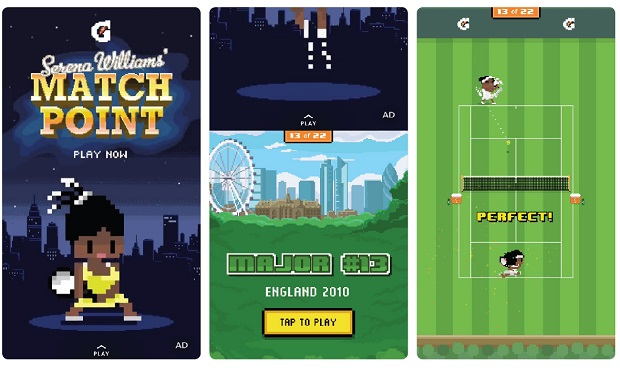

With branded filters and video ads, Snapchat has found a way to get users to quite literally engage with advertisements. A great example being Gatorade’s ad featuring an arcade game for user’s to play upon swiping up.

This is obviously of great use for advertisers. Snapchat allows users to have fun experiences with brands directly, and then pass that fun experience along to their friends. Higher engagement means more awareness and reach for brands.

Publishers can use this to see the advertisers seeking brand awareness amongst a youthful demographic.

Portions

One of Snapchat’s more recent innovations, was separating publisher content from the user-messaging portion of the app. This was one of the features that Snapchat pressed harder to optimize, and is one of the features that makes them most unique to publishers and advertisers.

This separation of content distinguished Snapchat as a unique format for publishers and brands to showcase content and video ads to users in a brand new way.

Programmatic Ads

Lastly, is Snapchat’s shift towards programmatic. In Q4, 90% of ads on Snapchat were purchased programmatically, signifying an easier process for advertisers.

This is particularly a big deal for publishers. Here, publishers can see whether or not brands are getting the proper return on their programmatic ad buying investment.

For publishers with young audiences, it’s important to know how Snapchat advertisers are using the app to reach that demographic. They can leverage all of this information in trying to win the business of those brands.

Overall, Snapchat’s latest news shines a clear light onto the shifting media mix, and signifies that it’s more important than ever for publishers to know where advertisers are investing.