Amazon has dominated eCommerce and fulfillment for years. No one can ever deny that. In Q1 2021, Amazon made $837,330.25 every minute.

Now, it’s a major contender in the streaming wars.

How will the tech-turned-everything company approach programmatic advertising?

In 2013, Digiday called Amazon the ‘sleeping giant’ of media. Now, it seems, the giant has awakened.

In this post, we’re talking about Amazon, the media company, not necessarily Amazon, the eCommerce platform.

Amazon has slowly transformed into a media company, replete with the Fire Stick, Kindle Fire, Amazon Prime, and owned and operated sites like IMDb.com.

What has Amazon done with this owned content, and where is it going?

Amazon, the Third Largest Ad Platform in the US

Now firmly established as a media company, Amazon has quickly increased its advertising game.

“For more than a year now there’s been a steady murmur about Amazon’s encroachment on the territory of the Facebook-Google duopoly,” writes Nicole Perrin in a report for eMarketer.

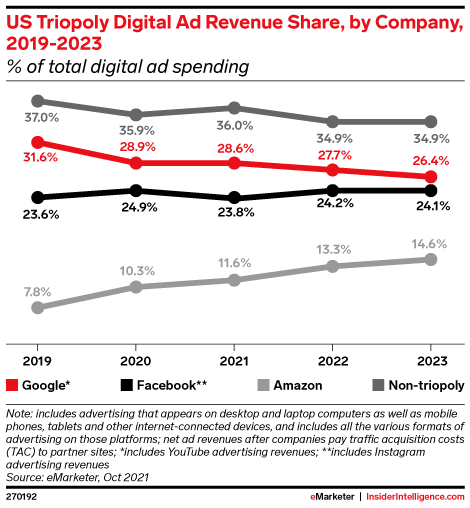

But Amazon is slowly taking a piece of that total digital ad spend, percentage point by percentage point.

In 2018, Amazon accounted for 4.1 percent of all digital ad spending in the U.S.

In 2021, Amazon was expected to account for 8 percent of the digital advertising revenue; by 2026, that number will reach 13 percent.

It doesn’t sound like much, but it makes Amazon the third-largest programmatic ad platform in the U.S., behind Google and Facebook. In 2021, Google, Amazon, and Facebook accounted for 64% of all US ad spending.

Amazon isn’t exactly new to the programmatic advertising environment. Kindles have been around for a decade, and Amazon has offered sponsored spots at the top of its results pages for at least as long.

But the company has made critical changes to how it approaches programmatic advertising—changes that may contribute to making it a bigger player.

Amazon’s advertising business grew by 19% in Q4 2022, while Google and Meta saw ad revenue slow. That said, Facebook still beat estimates in Q4.

The growth is particularly impressive given the recession and financial anxiety many people are experiencing. But it does highlight the premium advertisers are putting on retail media networks and where they’ll fit into media mixes for years to come.

Where Is Amazon Going With Programmatic Advertising?

The ‘first steps’ in doubling down on programmatic advertising came in September 2018, when Amazon consolidated its advertising offerings.

Before, advertisers had to navigate Amazon Marketing Services (the full suit of CPC ad formats), Amazon Media Group (the unit that sold display ads on Amazon devices and properties) and the programmatic advertising platform itself. Now, these are all operated under one roof as Amazon Advertising.

“We’ve unified our product offerings under the name ‘Amazon Advertising,’” said Paul Kotas, SVP of Amazon Advertising. “This is another step towards our goal of providing advertising solutions that are simple and intuitive for the hundreds of thousands of advertisers who use our products to help grow their business.”

With simplification and accessibility as the goal, Amazon offers five features in one console:

- Sponsored Products specifically for the eCommerce platform

- Display ads for both Amazon and third-party sites

- Video ads for Amazon devices and properties like IMDb

- Amazon Stores to create branded stores

- Amazon DSP for CPC bids and monitoring

What does this mean for Amazon’s expansion into the programmatic advertising market?

Garett Sloane at AdAge writes that while there won’t be a major difference in the status of Google and Facebook as a duopoly, there will be a differential in what Amazon offers. “No other major platform is so plugged into what consumers buy,” Sloane writes. “Amazon doesn’t need to close the loop from ad to sale by reading uncertain data about when a person saw an online ad and when that led to an actual purchase. Amazon is the loop.”

That difference means Amazon will continue strengthening its impact on the programmatic advertising market. And it will certainly change what, why and how advertisers buy on a programmatic platform.

Retail Media Is the Future

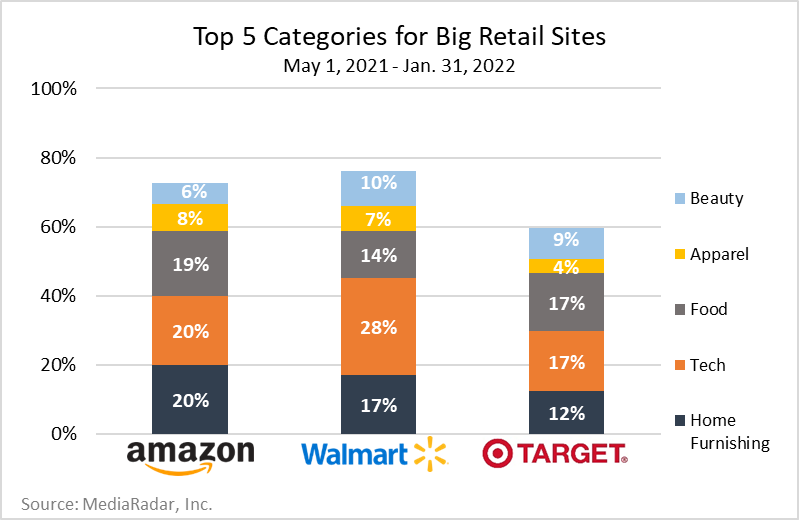

Amazon isn’t just walking on Google and Facebook’s hallowed ground. It’s also ushering in a new era of advertising: retail media.

According to WPP’s GroupM, retail media represents 10.7% of global ad spending and is expected to grow 60% by 2027. The growth is staggering, but it makes sense.

Retail media networks give advertisers instant access to shopper-level data they can use to hyper-target consumers. For example, advertisers for Colgate could target Amazon shoppers who’ve bought a competitor’s product in the past 30 days.

That level of precision would catch the attention of advertisers under normal circumstances. Still, given the impending demise of third-party cookies and Apple’s App Tracking Transparency, the value increases exponentially.

As retail media continues to go mainstream, Amazon will evolve.

At the same time, other retailers looking to get a piece of the pie will invest. Walmart and Target are prime examples.

For more insights, sign up for MediaRadar’s blog here.