Last week, nearly every major digital advertising player seemed to be on stage at some point during Advertising Week in New York. That is, except for the tech giant you’ve definitely heard of but may not even realize is in the ad business: Amazon.

Amazon may not be touting its efforts in public, but behind the scenes it has been trying to expand its footprint in the ad business, digital media executives say.

To date, Amazon’s ad business has mostly focused on driving online sales with targeted ads on sites across the web, leveraging its rich supply of shopping data culled from years of operating a massive e-commerce business. It can, for example, help an advertiser target people who have recently searched for men’s apparel products.

Lately the company has been catering to a wider range of brands — the kind that advertise on TV and focus on “top of the purchase funnel” metrics, such as getting people to feel favorably about their brand. Amazon believes its data is just as useful for those marketers.

Elsewhere, Amazon has dabbled in other areas of the ad business: it sells search ads onAmazon.com and it has a “header bidding” product meant to help publishers make more money off programmatic ads.

Still, little is known about Amazon’s longer term ambitions. It’s easy to imagine the company attacking huge, potentially lucrative swaths of the advertising industry.

“They’ve been putting all of the pieces together,” said Ian Schafer, founder and chairman of the digital ad agency Deep Focus. Mr. Schafer said that to date, Amazon has mostly focused on targeting e-commerce shoppers with digital ads. “But they just have so much [consumer] intent data, and now video data, that you’ve got to think they’re up to something.”

For example, the company could make a bigger play for mobile search dollars–an arena that is less dominated by Google than search on the desktop Web. Amazon is also one of the few companies in position to track people across multiple devices, a big advantage in the mobile ad game. The company could mount a bigger challenge to Facebook’s Audience Network, which essentially aspires to run ads on every site on the web. Or Amazon could charge into the nascent world of advertising on connected TVs.

Despite all this potential, plenty of ad industry executives wonder whether Amazon is totally committed to building its ad business. After all, the company derives the vast majority of its revenue selling everything under the sun online, and is busy with a variety of other projects from original TV programming to package-delivering drones.

“They’ve been operating for a few years functionally in stealth mode. You have to ask the right people, or pull the right chains to get an understanding of what they’re doing,” said Evan Hanlon, director of strategy & platforms at the ad buying giant GroupM.

Amazon doesn’t break out ad revenue in its earnings reports. The company generated over $107 billion in sales in 2015.

According to eMarketer, Amazon should pull in just over $1 billion in online ad revenue in 2017 in the U.S., an increase of 9.4% compared to this year. Contrast that with Snapchat, which is expected to generate $800 million next year in the U.S., a year-over-year surge of over 130%, says eMarketer. Google’s U.S. ad revenue in 2017 is expected to approach $34 billion, while Facebook’s U.S. revenue should be north of $15 billion.

You’ll find plenty of digital ad insiders betting that Amazon, despite being far behind Google and Facebook in advertising, could legitimately challenge the behemoths.

Currently, Amazon operates its own “demand-side platform,” through which it buys targeted ads for its many retail partners using its robust set of consumer data. The company lets big marketers use this technology, Amazon Advertising Platform, and its data, to buy ads on sites across the web through ad exchanges managed by firms like AppNexus and Google.

Amazon sets tight limits on how its data is used; advertisers can’t use it outside of its platform.

“They play it really close to the chest,” said Britney Greenhouse, director of video and digital Investment at the ad buying firm Horizon Media.

Four years ago Amazon was one of the first companies to introduce “header bidding,” which enables publishers to have multiple ad tech companies bid on ad space simultaneously.

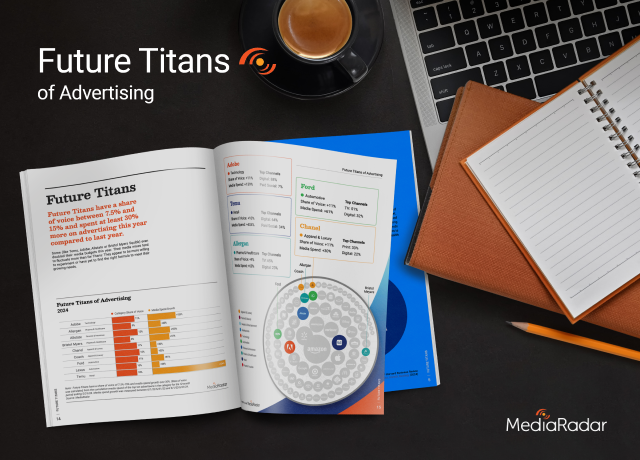

MediaRadar, a company that provides ad sales intelligence to over 1,400 media clients, says Amazon’s header bidding software is plugged into around 100 websites, including sites managed by Time Inc., Hearst and The Weather Company. Indeed, publishers like USA Today say they’ve only just started pulling in demand from Amazon in recent months asheader bidding becomes more popular.

Mr. Hanlon of GroupM sees real potential in Amazon’s efforts to service companies trying to build brand awareness rather than spur an immediate purchase. For example, a travel advertiser might target people who have in the past purchased luxury luggage and accessories with vacation ideas, said Mr. Hanlon.

“They are not ubiquitous and not mandatory for many clients yet, but I could easily see that changing,” he said.