For many years, we would hear “This is the year of mobile.”

From the first half (1H) of 2017 to the first half of 2018, mobile advertising did increase 42%, noted an IAB Internet Ad Revenue report conducted by PWC. By 2021, mobile video is expected to reach approximately $16.2 billion. Snapchat, the messaging and social media app, recognized the potential of this medium and capitalized on the expanding market.

But, that doesn’t seem to be what advertisers are focused on today. According to them, this is “the year of audio.”

Out of the roughly 3.6 hours U.S. users devote to their mobile devices each day, 52 minutes (the biggest portion of mobile usage) are spent listening to audio, notes a Goodway Group article. The topic of podcasts also came up in two-thirds of the 2019 discussions at Digital Content Next, a conference that brings together high-quality digital content companies that manage trusted, direct relationships with consumers and marketers. Both ESPN and the Harvard Business Review brought up the theme unprompted. The trade association even showcased rapper and businessman, Sean Combs, also referred to as “Puff Daddy” and “P. Diddy,” because of his involvement in the audio and music industry.

Ad Spending on Podcasts

Digital Spend on Ads for Podcasts

The number of digital ad dollars spent on podcasts tripled year over year (YoY) in 2018 and more than 144 different podcasts advertised.

Print Ad Spend from Podcasts

The amount of print advertising spent on podcasts also tripled YoY in 2018. The biggest spender was “Fatal Voyage: The Mysterious Death of Natalie Wood.” See the ad below.

Podcast Listeners

Between 2013 and 2018, the number of people listening to multiple podcasts in one month grew from an audience of 3.3 million to an audience of 48 million, as stated by Edison Research.

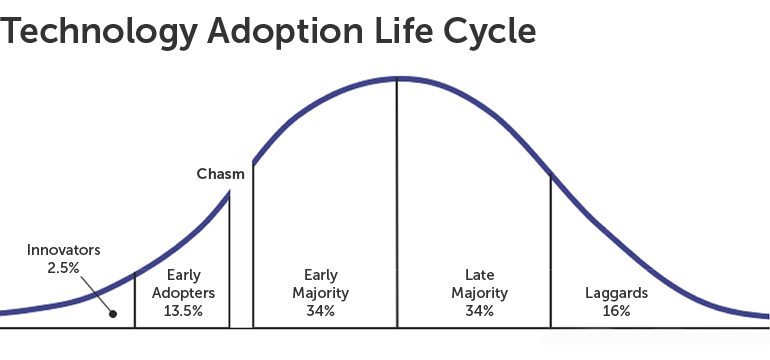

Technology Adoption Life Cycle

According to the Spring 2018 study by Edison Research and NPR, an estimated 18% of Americans now own a Smart Home device. This number is significant because it represents the fact that technology has finally progressed passed the dreaded “Chasm” in the technology adoption cycle (see image below). Evidence shows that new technology, such as Smart Glasses and 3D TVs, did not pass this gap in previous years.

As these Smart Home devices entered the “Early Majority” phase, two major players in the market recognized a golden opportunity. Amazon and Google invested a lot of money in advertising their Amazon Alexa, Amazon Echo, and Google Home products in 2018. Together, the companies spent a total of over $250 million.

Both advertised their devices across multiple mediums, such as TV, online, mobile, Snapchat, and other platforms. More specifically, Amazon advertised its Echo and Amazon Alexa on TV and online during every single month of 2018, so that more than 20% of the company’s total ad spend for the year was spent solely promoting these two products. Google also dedicated over 20% of its advertising budget to its Smart Home device. The popular technology company advertised its product online every month, but only ran TV ads during their first quarter (Q1) and fourth quarter (Q4).

Spotify versus Pandora verus Castbox

These two digital music services and the podcast platform, Castbox, are all vying to be the best podcast discovery engine, wrote Ad Age. Even though it’s difficult to associate itself less with music, Spotify‘s goal is for users to discover and loyally listen to the 170,000 podcasts on the platform through its recommendation tool. Just last month, Pandora also launched its Podcast Genome Project, which recommends shows based on about 1,500 different signals. Finally, Castbox recently transcribed every word from its podcasts to format a searchable database that would let users look for a certain topic and find shows that talked about that topic.

Conclusion

Between 2016 and 2017, podcast ad revenue increased 86%, reports Ad Age. The Interactive Advertising Bureau (IAB) predicts that revenues will grow to $659 million by 2020.

The same article says that ad inventory is scaled since 67% of listeners prefer host-read ads at the beginning and ending of a show. Even though this proves challenging, advertisers still see a lot of potential.

There are celebrity-curated playlists, daily news briefs from digital assistants, in addition to branded podcasts, notes the Goodway Group. The variety of audio formats and niche audiences give advertisers multiple paths and opportunities to tap into in 2019.