It’s important for each B2B Media Company to differentiate itself from the competition. And proper preparation before a sales call can help one showcase its greatest assets and nab more of a brand’s ad dollars.

A recent decline in B2B print ad spend could be attributed to the fact that there are many other, promising places for brands to invest their advertising dollars – event sponsorships, native advertising, and online video, just to name a few.

This poses a challenge – there is more competition than ever and fewer barriers between you and your competition.

These are the questions that B2B media companies should be asking themselves about their prospects before a sales call.

1. How Can I Best Fit Into My Prospect’s Advertising Strategy?

What media formats do they value? How does their message change by channel? Can you capitalize on this market?

First, you want to make sure that you see the whole market. While you have a targeted and niche market, you need to see everywhere your prospect is advertising to understand what type of media formats it values most. Knowing this will help you capitalize on the market.

What types of ads do they use to promote certain brand messages? Which formats do they use and can you offer all of them to your prospects? Build a proposal that will ensure exposure through all their favorite channels.

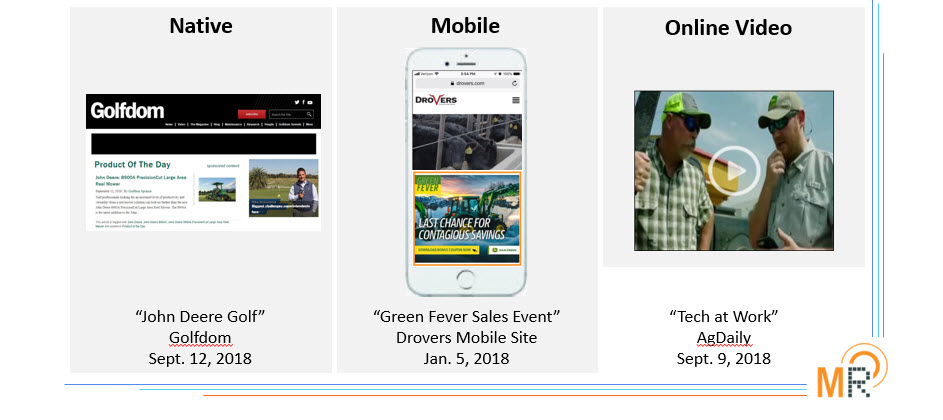

As you can see below, John Deere is an example of a brand that has invested in multiple media formats, buying mobile ads, online video ads, print ads, and TV ads.

On January 5th, 2018, the brand bought space for a mobile ad entitled “Green Fever Sales Event” on Drovers Mobile Site. John Deere also showcased its “Tech at Work” in an online video on AgDaily on September 9th, 2018. See the ads here:

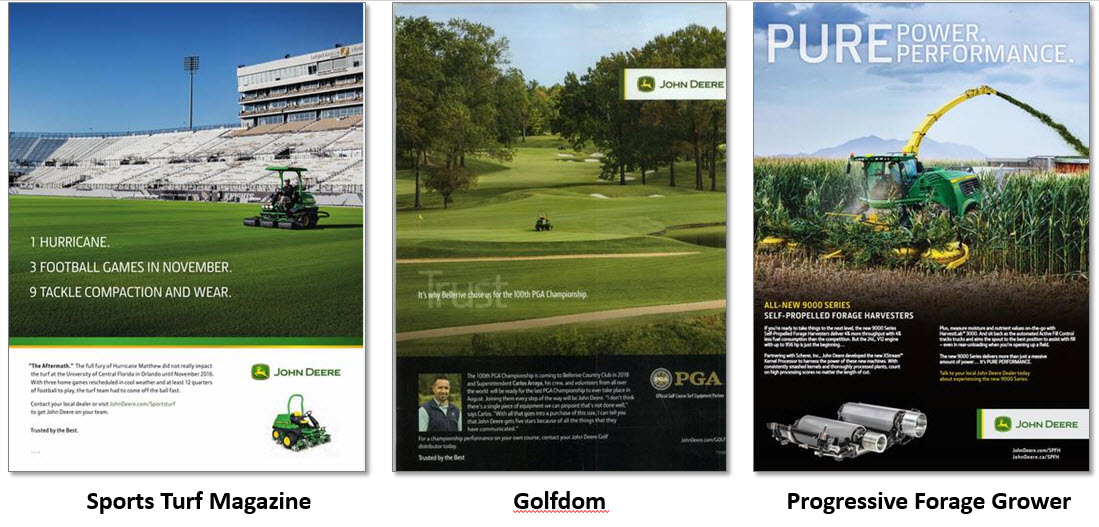

To promote some of its other products, John Deere also bought print ads in publications concerning the agricultural industries of farming and grounds keeping, including the Sports Turf Magazine, Golfdom, and Progressive Forage Grower. The ads are below.

As a B2B publication, ask yourself how you can capitalize on John Deere’s sophisticated and varied advertising strategy.

FedEx is another brand example. Unlike John Deere, FedEx values TV over any other media format at the moment. But, pay attention. From one TV ad to the next, the brand’s messaging and tone changes and so does the specific audience it’s targeting. Who is the new target audience? What kind of person is being featured in the brand’s second set of ads?

Between September 9, 2018 and October 30, 2018, FedEx ran a 30-second ad around 820 times on 22 networks (last seen on the NFL Network) for almost $5,500,000. The content of this “Possibilities” commercial emphasized receiving a package and about those people who would be excited to get one.

Between September 30, 2018 and October 6, 2018, FedEx also launched a 30-second commercial entitled “Opportunity,” which was last seen on the NFL Network (see below). It aired nearly 150 times on 16 different networks and cost over $750,000. The content of the commercial emphasized how FedEx helped a small, e-commerce bakery, as it shipped more and more orders. FedEx’s ad slogan fittingly read, “Opportunity: what we deliver by delivery.”

From FedEx’s “Possibilities” commercial to this “Opportunities” commercial, the messaging shifted. The ad became more about shipping, rather than receiving, a package. The target audience also changed.

Ask yourself – do your media properties cater to a professional audience? Do you work with small businesses or e-commerce companies? Can you penetrate FedEx’s market better than your competitors? If so, incorporate those points into your pitch.

2. Is My Prospect Focusing on Events?

Is event sponsorship part of your opportunity’s marketing strategy? Are brands investing in your competition’s events instead of yours? Are you missing out on certain prospects? Has your competition stolen them? Is there a chance that you can still get a piece of the pie?

Annually, trade event sponsorships bring in over $62 Billion B2B revenue, and spending on event sponsorships is still rising. Understanding a prospect’s place in this massive industry is necessary to understand how best to position yourself as a beneficial addition to their marketing and advertising portfolio.

For more insight into the massive impact events have on the B2B media landscape, check out this quick video we made to announce our newest product: MediaRadar Events

3. How Does My Prospect Prefer to Allocate Ad Dollars?

Do your prospects use high-CPM units like native and online video?

As a B2B company, pay attention to where a brand is advertising – there may be additional opportunities for you to grab more of that brand’s ad spend.

John Deere is a good example of a brand that values high-CPM units. It’s buying primetime ads on TV, inside cover ads in print, and multiple other high-CPM digital formats like online video and native advertising.

Recently, John Deere started promoting its small tractor product line. The brand felt like it had already dominated the large tractor division, steadily taking over the market and selling more large tractors than any other brand. To highlight its small tractors, John Deere ran a TV spot on nearly 25 different networks. Watch the ad here:

As a B2B publication, you have a targeted audience of likely buyers. In this example, you have to ask yourself – could John Deere capitalize further in the B2B market?

It is your responsibility to show the brand the value of your audience. In this case: small tractors to farmers and ranchers. Leverage their affordable pricing and luxuries like AC and heat.

The TV ad may have been brushing the surface of the brand’s desired audience, but with, for example, an online video on the right targeted B2B site, John Deere can reach an audience that is likely to buy and one that fits perfectly within its target audience.

4. Does My Prospect Value e-newsletters?

Most B2B media companies already have an e-newsletter with a loyal following and high open rate. But, there are always opportunities to garner more subscribers and increase engagement.

Readership is key. You need to make sure that you’re reaching your audience and putting content that is relatable, helpful, and interesting in front of them.

Native display ads can help. They boast a click-through-rate (CTR) that is 8.8 times higher than traditional display advertising. Implementing native advertising and running dedicated e-blasts can turn your e-newsletter into strong revenue producers.

Conclusion

Don’t forget to think about these four things when developing your pre-call research strategy. Being prepared for your call will help you build trust with your prospect and not leave potential revenue on the table.