In December 2022, Insider Intelligence published advertising trends to watch in 2023, highlighting the impact of the uncertain economy and the continued rise of retail media.

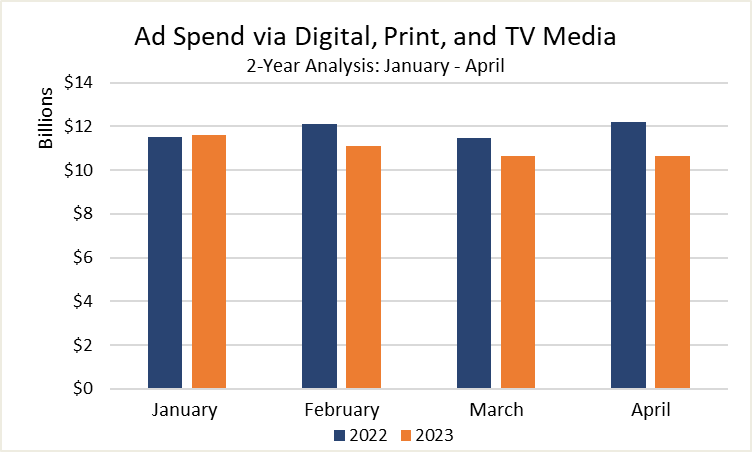

Many of those predictions were spot on. According to our spending data through April, nearly 145k advertisers spent $44b across digital, print and TV media, representing a 7% YoY decrease from the same time in 2022. At the same time, retail media is expected to reach a market value of $45b this year and grow by another $10b in 2024.

As we wait to see the ultimate accuracy of the rest of their claims, we want to make a few advertising predictions own. Here are three for the second half of 2023.

Advertisers Deal with Uncertainty Differently

Advertisers dealt with a swarm of uncertainty in 2022.

That uncertainty, however, didn’t impact advertisers and their budgets equally.

Airline advertisers, for example, spent more than $422mm, up by 138% YoY despite rumblings of a recession. Meanwhile, pet advertisers pulled back even though millions acquired new furry friends during the pandemic.

There’s only one economy, but it impacted advertisers differently in 2022. We expect that variability to remain in effect in H2.

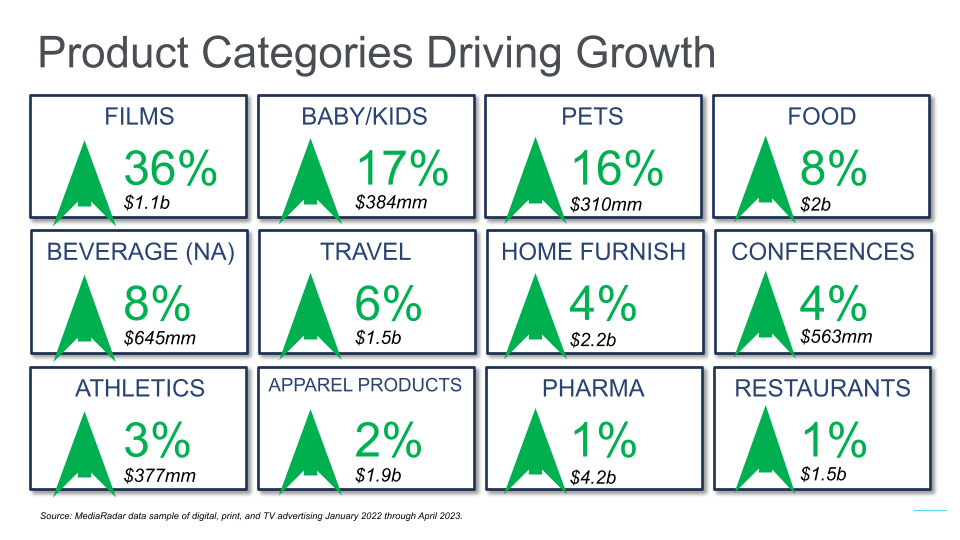

Through April 2023, advertisers in 12 product categories increased spending, including those promoting films (up by 36% YoY) such as Ant-Man and the Wasp: Quantumania, Guardians of the Galaxy Vol. 3, and Knock at the Cabin increased their budgets through April in the lead-up to their premieres (Ant-Man and the Wasp in February, Guardians of the Galaxy in May, and Knock at the Cabin in February).

For advertisers at The Walt Disney Company, spending to promote the latest installment in the Ant-Man series was inevitable given the film’s $200mm production cost. The big investment by Disney illustrates the pressure on studios to turn a profit and precisely why this corner of the entertainment world will likely continue to invest significant ad dollars in 2023.

Unsurprisingly, Travel advertisers are also back (up by 6% YoY), including those in Lodging (+13%), Cruise Lines (+20%), and U.S. Tourism Bureaus (+38%). Although inflation and the looming recession are putting a dent into entertainment budgets, many Americans have made it clear that travel line items aren’t getting cut.

Other advertisers haven’t been so lucky and may be in for more cuts in 2023.

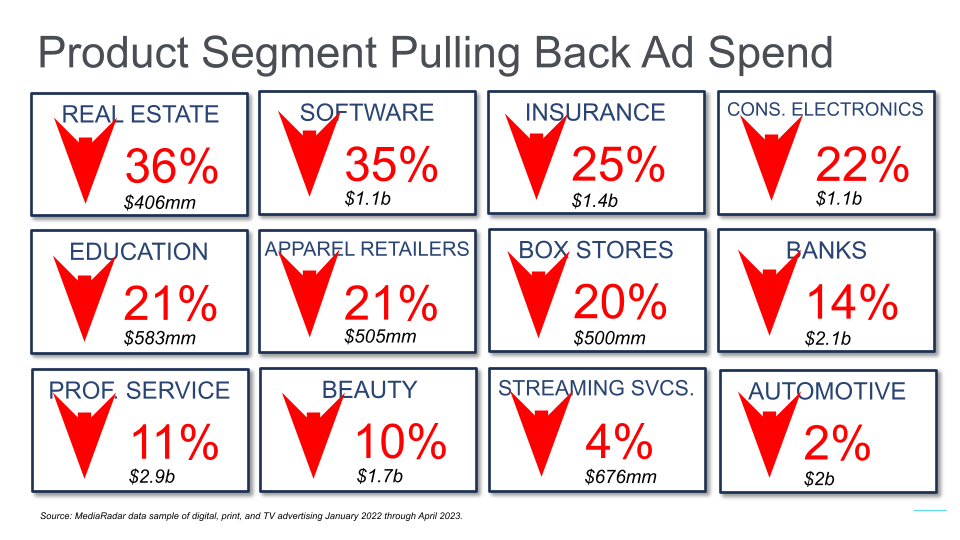

Through April, advertisers in another 12 product categories reduced spending, including those promoting Software, Colleges and Universities, Big Box Stores, Professional Services, and Beauty products.

For instance, advertisers promoting Finance and Business Software decreased spending by 22% and 10% YoY, respectively, while those promoting Colleges and Universities did so by 13% to $397mm.

The decline in education advertising could be seasonal—we saw advertisers increase spending during key enrollment periods in 2022—but it could also be tied to the rising cost of tuition and, subsequently, lower enrollment rates.

Between 2019 and 2022, undergraduate college enrollment dropped by 8%. With employers putting less emphasis on higher education, enrollment may continue to fall, which could also bring spending from Colleges and Universities down.

There’s a Streaming Shake Up On the Horizon

It’s no secret that streaming giants like Netflix, Hulu, and Amazon Prime Video grew during the pandemic’s stay-at-home orders; Netflix even broke some records. It’s also no secret that many of the same platforms are experiencing growing pains.

Not only did Netflix report a decline in subscribers for the first time in a decade, but just over 15% of Americans now say they don’t use any TV subscription services, up by 2.8 percentage points from October 2022.

Although cost-cutting measures are in place for consumers and streaming companies, that’s not stopping the latter from shaking things up.

Discovery recently combined HBO Max and Discovery+ into one service, Max. According to Warner Bros. Discovery Global CEO Jean-Briac Perrette, the merger comes at a “time of transition for the streaming industry” and the company’s desire to curate content catering to “every member of the household.”

Meanwhile, it seems more likely that Comcast will sell its 33% stake in Hulu to Disney between now and 2024. NBC Sports Philadelphia is even heading to Peacock later this year.

All of this shuffling will impact consumers’ sentiment and how advertisers spend on OTT inventory.

AI Will Disrupt the Advertising Duopoly

Meta and Google have ruled the digital advertising roost for some time, with the only outside pressure coming from Amazon and the economy. In Q4, Meta and Alphabet (Google’s parent company) saw ad revenue decline slightly as advertisers reigned in their budgets amid the economic uncertainty.

For all intents and purposes, Meta and Google had ad budgets on lock, with no true natural predators in sight.

That said, the rise of AI, namely, ChatGPT, is putting unprecedented pressure on the duo. Google, in particular, is between a rock and a hard place.

As people default to AI for initial queries, follow-up suggestions, and more, Google could slowly lose its grip on search—and ad dollars. If consumers drop Google from the tools they use to make purchase decisions, advertisers will divert their budgets accordingly.

Unsurprisingly, Google is already testing generative AI in search and “heralding big changes to the platform’s user experience, e-commerce features and advertising.” According to Google, ads will appear in dedicated slots in AI-generated responses, similar to how they surface in conventional searches today.

From a shopping standpoint, Google’s AI-powered search uses Google Shopping Graph to present recent reviews, ratings, prices and product images that inform purchasing decisions.

Still, it’s impossible to ignore that Google’s stranglehold is loosening, and advertisers will likely look to other ecosystems—at least until Google figures things out.

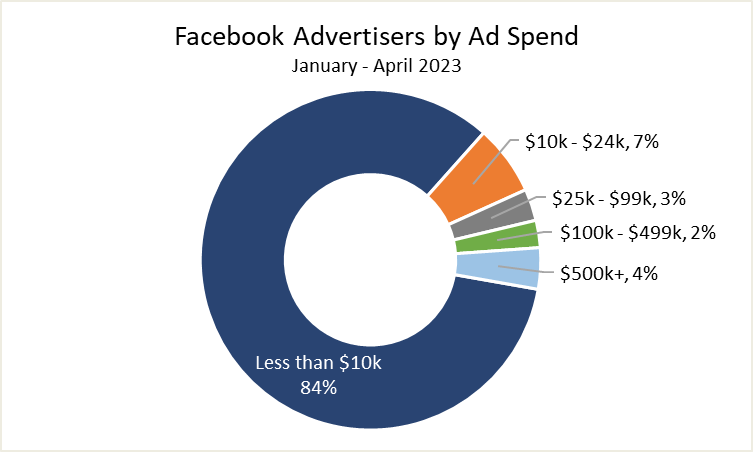

Amazon and other retail media networks will likely benefit. As will Facebook, especially among advertisers for small-to-medium (SMB) businesses who continue to flock to the social media OG. Through April, nearly 26k companies invested in Facebook, with 91% (23k) spending less than $25,000.

Few Things Are Certain in 2023

An excerpt from Insider Intelligence’s report reads: “Advertisers are scrutinizing their budgets. With inflation driving up operating costs and a looming recession, marketing is getting deprioritized.

Our data support that prediction, with spending in April falling by just 1% MoM.

But despite the decline, shake-ups are on the horizon, and opportunities are out there.

- Advertisers in certain industries will continue to spend, including those in Travel.

- Strategic maneuvers in the streaming war will force advertisers to reallocate their OTT ad dollars.

- Google and Facebook will evolve quickly in the face of AI’s rapid advancement.

For more insights, sign up for MediaRadar’s blog here.