Move aside, ChatGPT: 70% of specialty crop growers are now combating labor shortages and rising prices with farm robots and artificial intelligence.

The way agriculture advertisers are promoting crops is also evolving.

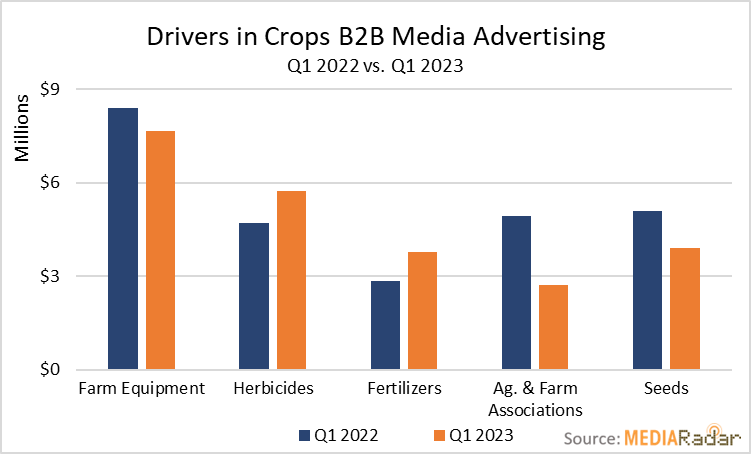

In Q1 2023, advertisers for crops spent more than $34mm on B2B media publications, down by 11% YoY. Most of that investment ($23.8mm, or 70%) came from advertisers promoting farm equipment, herbicides, fertilizers, agriculture & farm associations, and seeds.

Here’s a closer look at how a few of those advertisers—agricultural & farming associations, farm equipment, and seeds—spent on B2B media publications and what it means for agriculture advertising in the post-pandemic world.

Agricultural & farming associations

The biggest YoY decrease in B2B media spending came from advertisers promoting agriculture & farming associations who collectively reduced their budgets in B2B media by 44% YoY.

The National Corn Growers Association, in particular, decreased spending by 57% YoY, but they could be gearing up for a spending spree as historically top grain producers, including Ukraine and Russia, struggle with output. In fact, experts predict Ukraine’s harvest could fall by more than 50% compared to before the war.

These losses, according to Aakash Doshi, Head of Commodities, North America at Citi Research, could come stateside. He said, “The Ukraine losses will need to be made up elsewhere over time, including from Russia itself but with a stronger focus on U.S.Canada, Brazil, and Argentina exportable surplus.”

Advertisers for other associations dealing with similar environmental forces may also find themselves in a position to spend on B2B media publications.

Advertisers for the Southern Cotton Ginners Association, for example, increased their investment in these publications by 64% YoY despite coming off a historically difficult year for the cotton industry.

According to the USDA, America’s cotton production was expected to drop to about 14mm bales, down by 21% from last year.

The challenges have continued into 2023, with ongoing supply-chain issues disrupting the industry’s growth. According to the latest data from the National Cotton Council, U.S. cotton acreage is projected to be down by 170% from last year.

Farm equipment

Advertisers for farm equipment reduced their investment in B2B media by 9% YoY to $7.7mm, thanks largely to reductions from advertisers at Deere & Company, Kubota, and Unverferth Manufacturing, who pulled back on B2B media publications by 57%, 11%, and 54% YoY, respectively.

For John Deere, however, the decrease comes at a time of rapid growth. According to the company, net sales grew by 40% in Q4 2022 on the heels of a particularly resilient farming industry.

John C. May, Chairman and CEO of Deere & Company, said, “Deere is looking forward to another strong year in 2023 based on positive farm fundamentals and fleet dynamics as well as an increased investment in infrastructure.” He continued, “These factors are expected to support healthy demand for our equipment. At the same time, we have confidence in the smart industrial operating model and our ability to deliver solutions that help our customers be more profitable, productive, and sustainable.”

The rosy outlook for John Deere—2023’s forecast predicts higher sales—should propel ad spending, but based on Q1, that may not include B2B media.

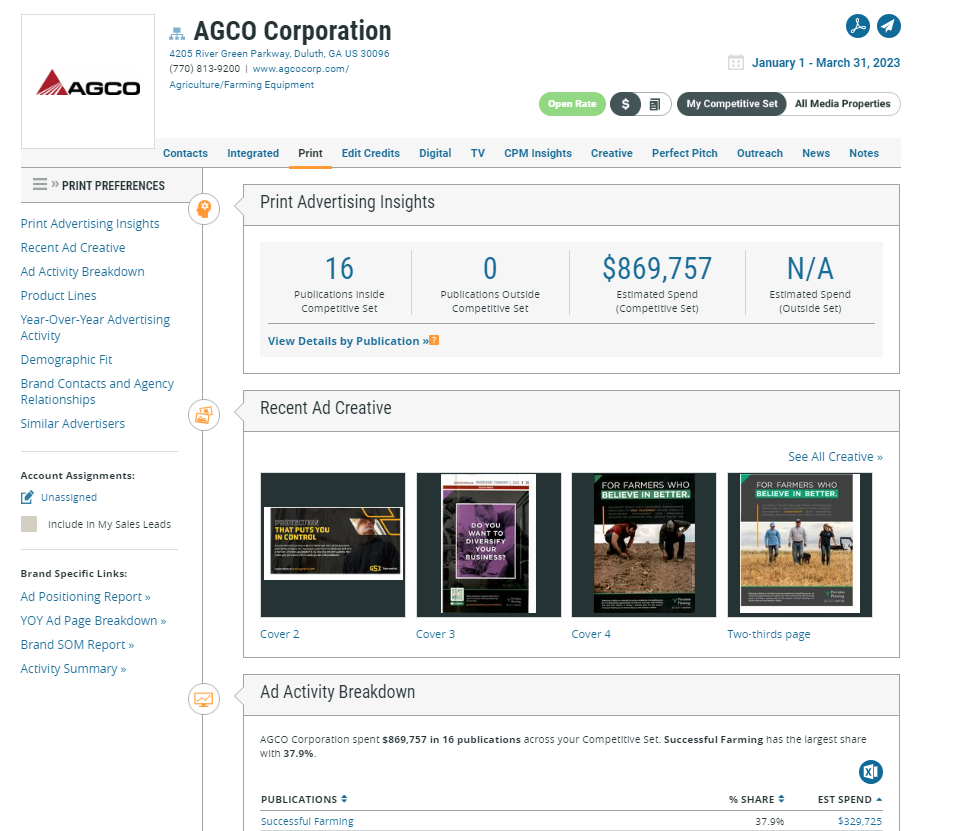

For other farm equipment advertisers, however, B2B media will likely be in the mix. In Q1, advertisers for AGCO Corporation increased their investment in B2B media publications by 100% YoY. A level deeper, the advertisers invested nearly $870k across 16 B2B publications, with the largest share (39.7%) going to Successful Farming.

Hybrid seeds

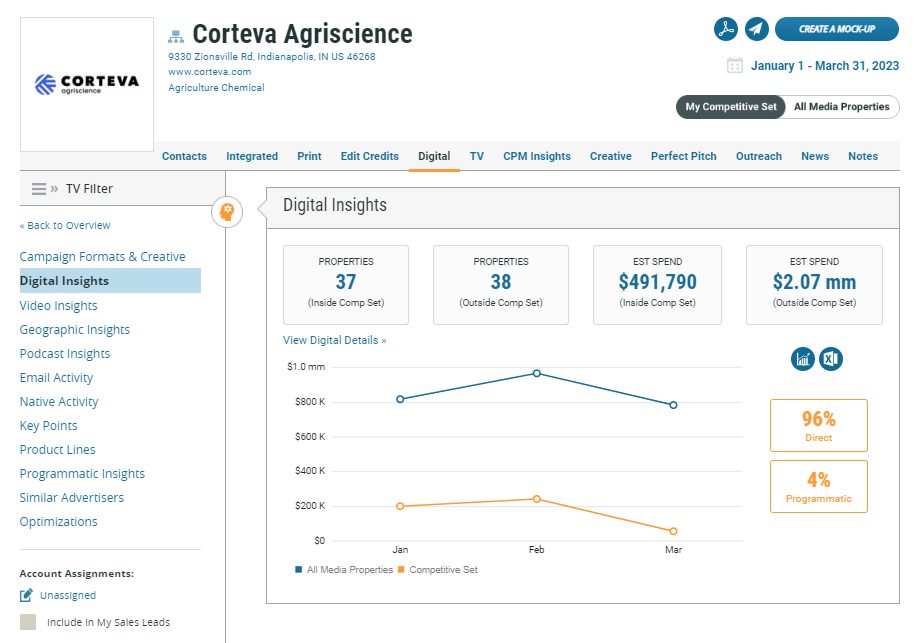

Seed advertisers, including those for hybrid seeds, decreased spending on B2B media by 24% YoY to $3.9mm as advertisers for companies like Beck’s Hybrids (down by 49%) and Corteva Agriscience (spending on hybrid seeds was down by 54%) decreased their investments.

(Note: Corteva’s advertisers increased overall seed advertising by 145% YoY in Q1.)

While spending on B2B media from hybrid seed advertisers is down, there may be fruit on the horizon as the demand for hybrid seeds grows due to their higher yield and resistance to disease.

As the market grows, advertisers for competing companies such as Biostadt India Limited and Crystal Crop Protection, may follow the game plan of Beck’s Hybrid’s and Corteva Agriscience given their penchant for advertising. In fact, advertisers for these two companies spent more than $10mm on ads through November 2022, representing 35% of the total investment from seed advertisers.

It’s Not You, It’s Me

There’s no ignoring the environmental forces putting pressure on agriculture advertisers of all shapes and sizes. But there’s also no denying that they’ll spend throughout it all.

Through November 2022, agriculture advertisers invested more than $153mm, up by 7% YoY compared to the same time in 2021.

Despite the perseverance, spending on B2B media was down for many advertisers in Q1 2023, which could indicate that these publications are falling out of favor with advertisers as they shift their budgets to channels embraced by younger generations entering the workforce—think social media and OTT.

While the shift will likely continue to push ad dollars away from B2B media, some advertisers will still find a reason to spend. For example, in Q1, advertisers promoting herbicides and fertilizers increased their investment in these publications by 22% and 32% YoY, respectively.

For more updates like this, stay tuned. Subscribe to our blog for more updates.