A sharp decline in demand for all things hospitality during the pandemic led to an equally sharp decline in revenue—in the first 10 months of 2020, the tourism industry lost $935b.

The reduced demand greatly impacted how much hospitality advertisers, including those promoting restaurants, resorts, and hospitality management training and software, spent on B2B print and digital ads.

Although the World Health Organization (WHO) has yet to rip the pesky “pandemic” tag from the coronavirus, the tourism industry is back in full swing, and hospitality advertisers are spending like it’s the good old days.

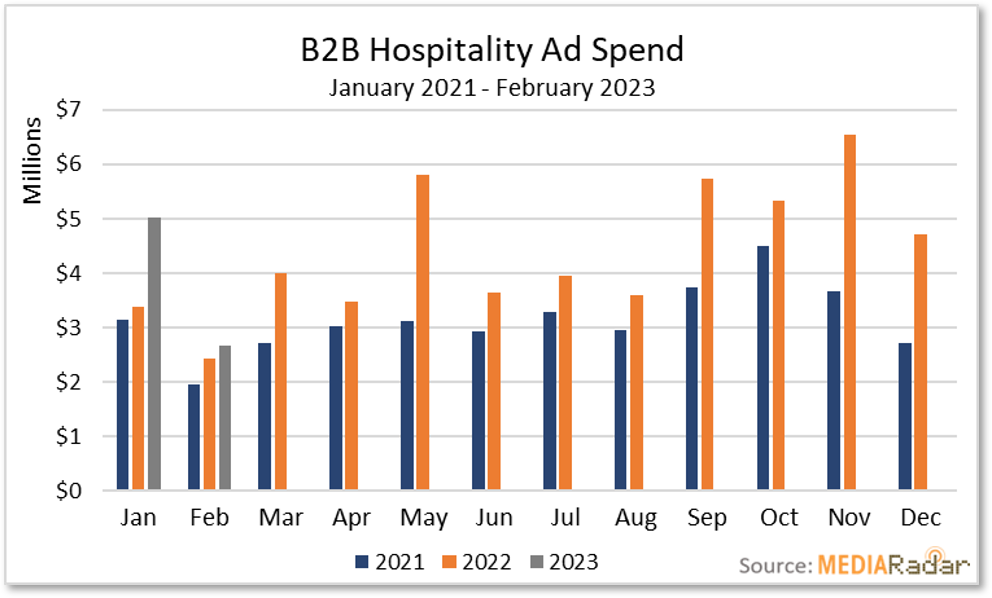

In fact, based on MediaRadar’s analysis of nearly 1,900 B2B print and digital publications, hospitality advertisers increased spending by 39% YoY in 2022 to $52.6mm on B2B ads, with major leaps in November (78%) and December (73%).

True to form, they’ve kept their wallets open in 2023.

B2B Hospitality Advertising Soars into 2023

Through February 2023, almost 550 hospitality advertisers spent more than $7.7mm on B2B traditional print and digital ads, representing a 33% YoY increase from the same time last year.

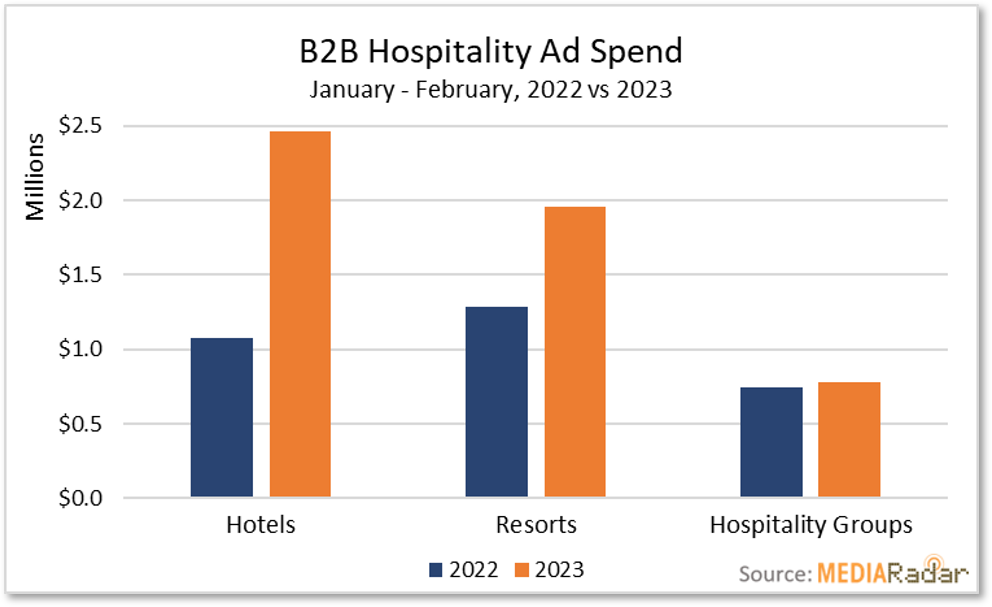

Advertisers in three categories—hotels, resorts, and hospitality groups—accounted for $5.2mm or 67% of the investment.

To offset the lost revenue from fewer bookings, advertisers for major hotel chains, such as Hilton Worldwide Holdings, Hyatt Hotels Corporation, and Marriott International, ramped spending considerably for their hotel names. Through February, they increased their budgets by 129% to nearly $2.5mm.

“To no surprise, the hurt continued and intensified for hotels around the country,” said Jan Freitag, STR’s senior VP of lodging insights. “The performance declines were especially pronounced in hotels that cater to meetings and group business, which is a reflection of the latest batch of event cancellations and government guidance to restrict the size of gatherings.”

Overall, the occupancy rate of the hotel industry in the U.S. dropped by 33% in 2020, and according to STR, revenue-per-available-room hit an all-time low.

At the lowest point of the pandemic, Annette Nichols, general manager of Hyatt Place Rogers/Bentonville, closed her hotel’s top three floors and let go 90% of the staff.

She said, “We dropped from 100% occupancy Monday through Wednesday nights and 80% on Thursdays, down to maybe 15% to 20% per night.”

As if the pandemic-induced challenges weren’t enough to send hospitality advertisers into a tizzy, most are still going toe-to-toe with online marketplaces (Airbnb, Vrbo, etc.) that are also licking their wounds but also fighting to woo the public back in their favor.

Although these online marketplaces have steadily gained market share—Airbnb accounted for 18% of the total U.S. lodging revenue in 2020—they’ve encountered a handful of challenges related to regulatory changes, safety concerns, and rising prices.

These factors are pushing some people back to hotels, which will likely put advertisers for these online marketplaces into a higher gear. Certain hotel advertisers must respond in kind, which may mean more dollars toward key B2B print and digital ecosystems.

And this doesn’t even consider that many people will forgo vacations amid the unstable economy and fluctuating inflation.

Resort advertisers are in a similar boat

Resorts were hit hard by the pandemic—MGM Resorts’ revenue, for example, dropped by more than 50% in 2020.

But the environmental forces pressing many hotels and online marketplaces (and their advertisers) right now won’t necessarily have the same impact on resorts.

People dishing out extra cash for all-inclusive packages and resort fees are less likely to have Airbnb and other home-sharing platforms on their radar. After all, price is one of the biggest draws of home-sharing platforms.

Much of resorts’ target demographic is also less likely to put their vacation on hold while the economy rights itself.

Because of resorts’ unique position in the lodging market, they’re not as central in the battle for market share, but that’s not to say their B2B ad dollars are drying up.

In 2022, resort advertisers increased spending on B2B media by 52% YoY, thanks to triple-digital budgets from those at Hilton WW (The Diplomat Beach Resort, etc.), Unique Travel Corp (Beaches Turks & Caicos, Sandals, etc.), Marriott International (Atlantis Paradise Island, The Westin La Paloma Resort, etc.), TRT Holdings (The Omni Homestead Resort and Omni PGA Frisco Resort), and Palace Holding (Le Blanc Spa Resort Cancun).

The lessened pressure does mean, however, that advertisers may be open to “less proven” channels across all formats, like OTT and CTV advertising.

A Healthy Appetite for B2B Print and Digital Ads

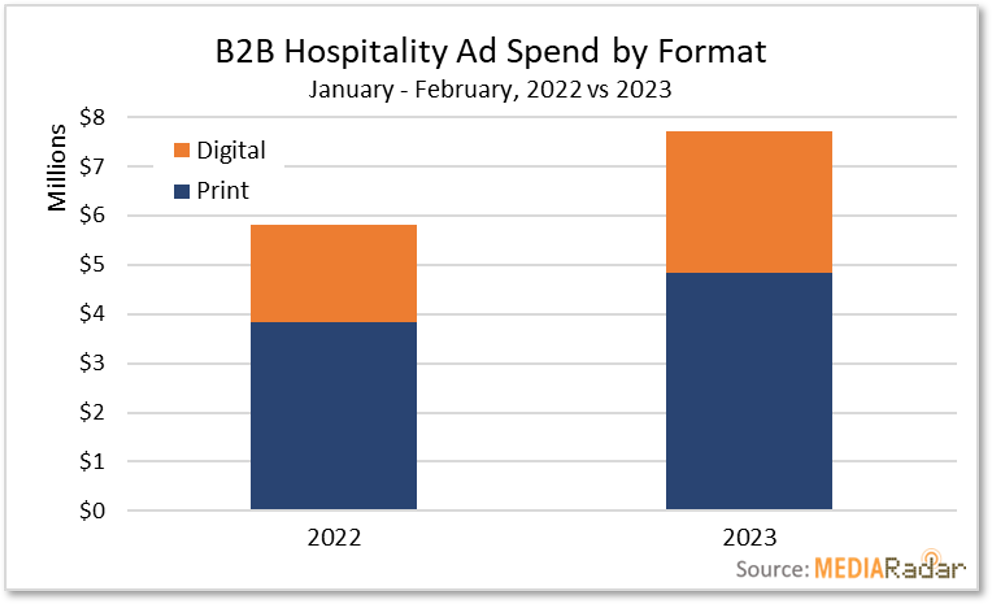

Digital ad spending is expected to grow by 10.5% in 2023, and some of that growth will come due to the comeback of hospitality advertisers.

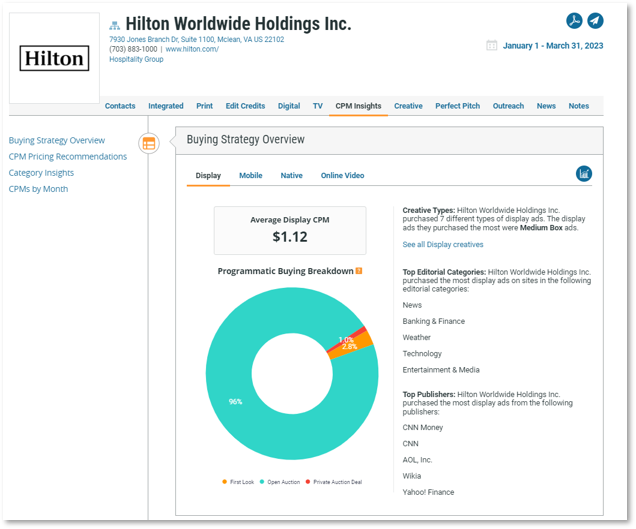

Through February, advertisers from big names, such as Resorts Casino Hotel (Mohegan Tribe of Indians Connecticut), Hilton Worldwide Holdings, and Hyatt Hotels Corporation, increased their digital display budgets by 39%. (The three brands above collectively spent over $790mm+ on digital advertising through February 2023.)

For advertisers across the hospitality industry, B2B digital ads allow them to run seasonal- and destination-specific campaigns, bring their stories to life in visually stunning ways, and target with precision.

But despite the digital dominance, hospitality advertisers are still spending on traditional formats.

Through February, hospitality advertisers increased their investment in B2B print publications like Smart Meetings, Travel Weekly, and Prevue by 27% YoY.

Advertisers could be following their contemporaries in other industries who are returning to their traditional roots in light of increasing competition, diminishing trust in digital ads, and the downfall of third-party cookies.

They could also be keeping their roots alive and banking on the idea that B2B media will remain a source of inspiration and influence for travelers, especially among affluent and older travelers who still fancy print and TV.

That’s sound thinking for older generations, but not so much for younger ones privy to just about everything to do with technology—and nothing to do with the opposite.

With young people expected to hit the road, sea, and sky more than anyone else this year, hospitality advertisers would be wise to bring more of their ad dollars where the next generation is spending their time—and that’s online.

Regardless of where hospitality advertisers spend their budgets for the remainder of 2023, there’s no doubt that travel is back, consumers are ready to spend, and brands are ready and raring to go, ad dollars in hand.

For more insights, sign up for MediaRadar’s blog here.