With the pandemic behind us and some consumers powering through financial woos, advertisers are spending like it’s 2018.

Retail media networks, for example, are expected to attract $45b in the first half of the year, while Meta’s ad revenue is expected to hit almost $122b this year, up by 8.18% YoY after an unheard-of dip the year before.

Despite the push from advertisers, not all advertising ecosystems are reaping the benefits of the return to (somewhat) normalcy.

For instance, ad spending on B2B print and digital media publications dropped by 11% YoY to $1.13b in Q1 2023.

Still, a select group of advertisers is investing in these publications, including those in the hospitality and energy industries. This article looks at the latter.

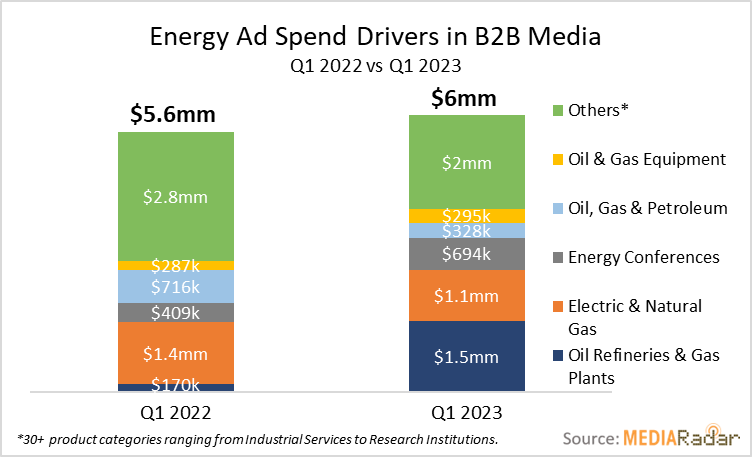

Here’s what you need to know about how energy advertisers, including those promoting oil refineries & gas processing plants, electric & natural gas, energy conferences, oil gas & petroleum, and oil & equipment, spent on B2B media publications in Q1 2023.

Advertisers for Oil Refineries & Gas Processing Plants Restart Their Engines

“I Am Legend,” the blockbuster film starring pre-slap Will Smill, predicted that the cost of gas during the apocalypse would hover around $6.63.

At the time of the film’s release—December 14, 2007—that price likely seemed outlandish. After all, a gallon of gas went for around $3.

More than a decade later, a gas station in Los Angeles one-upped that prediction, setting the price for a gallon of regular unleaded gas at $6.99.

It’s safe to say that the oil and gas industry was squarely in the spotlight for much of 2022 as the war in Ukraine, ongoing sanctions, a travel boom, and economic uncertainty drove significant demand for crude oil.

The natural demand for oil and gas, however, lessened the need for ads—and companies did just fine without them.

Case and point: Aramco Services Company, Saudi Arabia’s national oil company, reported an annual profit of $161b in 2022, the largest ever by an energy firm.

With the oil and gas industry correcting course, advertisers are adjusting and their budgets are increasing.

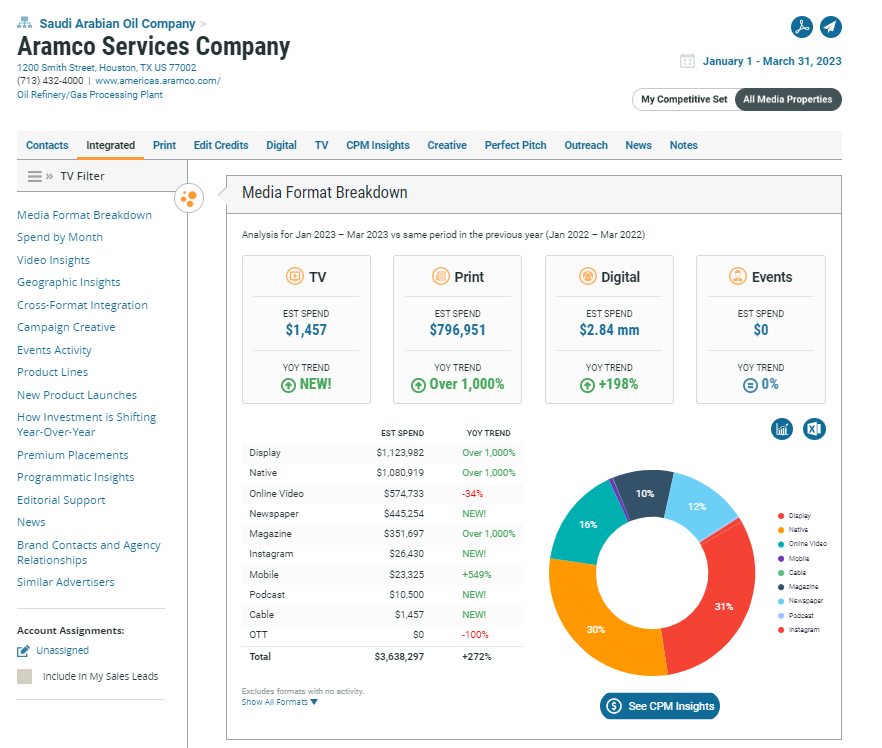

In Q1 2023, advertisers for oil refineries & gas processing plants increased spending by a collective 800% YoY to more than $1.5mm. Much of that increase came from advertisers at Aramco Services Company, who increased their investment in digital B2B publications by almost 200%. `

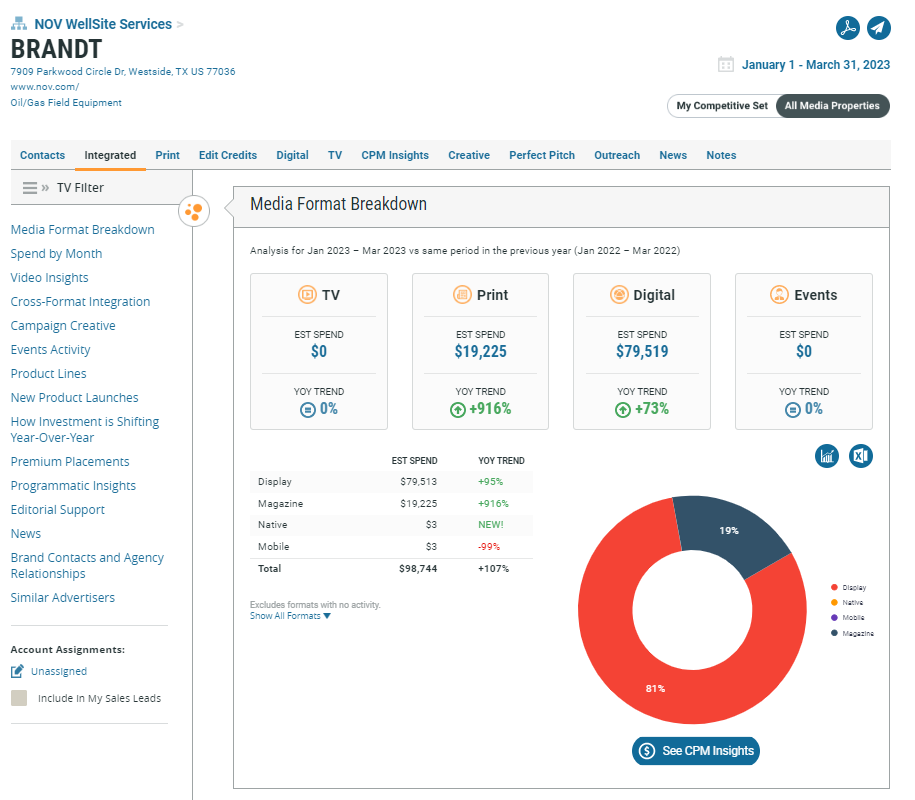

Meanwhile, advertisers promoting oil & gas field equipment, including Brandt, Flogistix, and Weatherford International, spent 57% ($295k) on B2B media in Q1 2023 than they did during the first quarter last year. (Brandt, Flogistix, and Weatherford International accounted for more than 63% of that investment.)

When fewer ads are a good thing

We often associate a reduction in ad spend with trouble on the horizon, but if history repeats itself, which it usually does, less spending from oil refineries & gas processing plant advertisers could be a good thing—at least for them.

In 2022, when demand rose, ad spending dropped.

Demand for oil is expected to balloon in 2023, thanks in large part to rebounding air traffic.

In fact, following an 80 kb/d (thousand barrels a day) contraction in Q4 2022, world oil demand growth is expected to grow from 710 kb/d in Q1 2023 to 2.6 mb/d in Q4.

If advertisers flip back to the same page in their playbook, ad spending will drop as demand goes up.

Energy Conference Advertisers Make Their Grande Re-entrance

The value of the B2B trade show market declined from $15.5b in 2019 to just $3.8b in 2022, representing a staggering ~75% dip in just a year. Unsurprisingly, advertisers for energy conferences weren’t spending on B2B media.

With conferences back in full swing, advertisers are re-entering the picture.

According to Emerald Holding, Inc, a company that organizes B2B trade shows, revenues jumped by 124% YoY to $325.9mm. The company also estimates that revenue will reach $400mm this year.

Emerald’s Chief Financial Officer, David Doft, said, “Emerald’s full-year 2022 earnings results reflect the events industry’s continued and strong post-pandemic recovery, further validating the immense value of in-person experiences.”

It’s not surprising, then, that advertisers for energy conferences, including Power-Gen International Knowledge Hub, Hart Energy Conferences, and the Connected Plant Conference (Access Intelligence), started strong in Q1 2023, increasing their budgets in B2B media by 70% YoY to $694mm.

Further increases are certainly on their way.

Doft continued, “More importantly, Emerald’s strong exhibitor pre-booking trends, coupled with the significant increase in buyer attendance we have seen since the New Year, are highly encouraging and indicate significant growth potential in 2023.”

He attributes much of that growth to easing supply chain constraints, the return of travel, and the ease of any COVID concerns keeping attendees at bay.

Down But Not Out

Energy advertisers didn’t universally up their investments in B2B media in Q1 2023.

Advertisers for energy power & natural gas, for example, decreased spending by 18% YoY to $1.1mm, while those promoting oil, gas, & petroleum did so by 54% YoY to $328k.

For advertisers who were down and out on B2B media to kick off 2023, their reluctance doesn’t mean they aren’t advertising.

Advertisers for Williams Companies (electric power & natural gas), for example, decreased spending on B2B media by over 99% YoY in Q1 but still invested in consumer print and digital display.

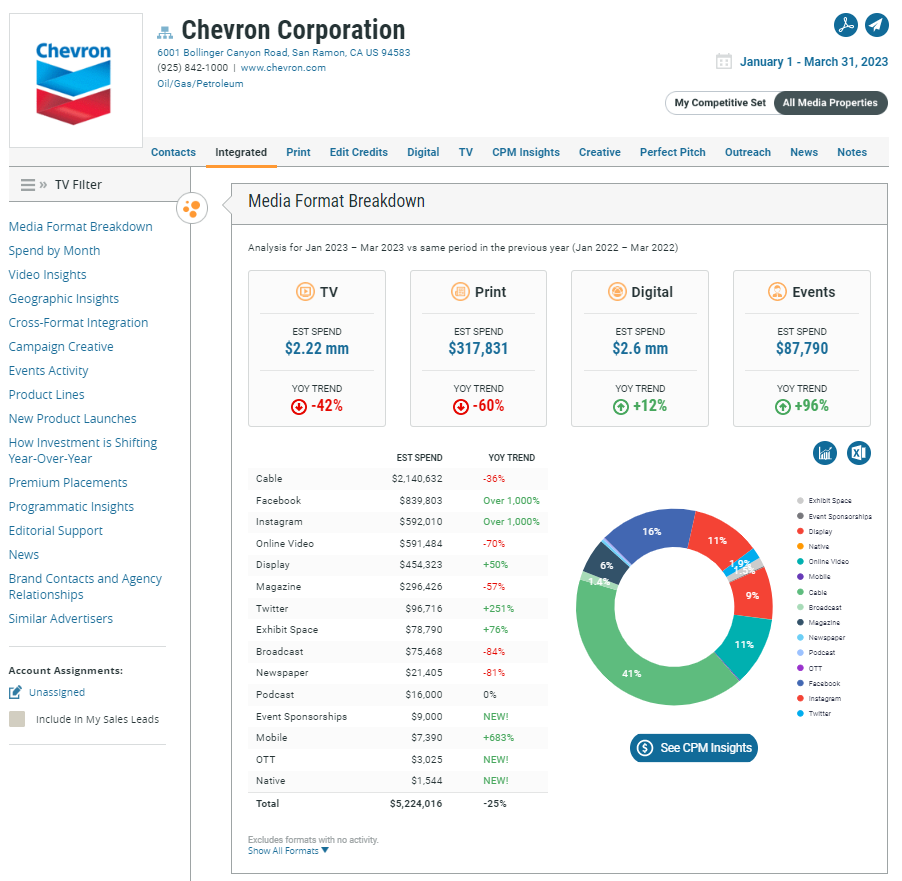

At the same time, advertisers for Chevron Corporation decreased spending on B2B print by 89% YoY, while upping their investing in digital media by 12%.

Regardless of their strategies in Q1, all advertisers driving B2B media spend—oil refineries & gas processing plants, electric & natural gas, energy conferences, oil gas & petroleum, and oil & equipment—may find a new level of appeal in the format as the year goes on.

Not only could B2B media offers a more affordable alternative, especially to mainstream digital channels, but it’ll give advertisers an effective way to reach B2B buyers with precisions without third-party cookies.

For more insights, sign up for MediaRadar’s blog here.