Supply-side platforms (SSPs) are one of publishers’ most powerful ad tech tools, but, at the end of the day, advertising is typically driven by demand, not supply.

If brands don’t want ads, the supply—even if it’s the best—means nothing. (Ads are almost always in high demand, but the down economy, ongoing privacy concerns, and downfall of third-party cookies are scaring some brands away.)

It’s why print publishers are moving digital, online publishers had to get creative after display ad prices dropped (enter branded content studios), and now SSPs are courting advertisers.

“Brands are the belles of the ball,” writes Seb Joseph at Digiday. “Ever since header bidding made a single impression available through multiple exchanges, SSPs are no longer exclusively in the business of trying to wring the most money from every impression for publishers. Now, they’re trying to run a two-sided marketplace where the most successful SSPs are the ones buyers trust enough to spend more of their money with them over their rivals.”

In other words, SSPs are no longer ‘just another’ programmatic player: They offer bid transparency that brands are typically unable to glean through DSPs alone.

What Are Supply Side Platforms (SSPs)?

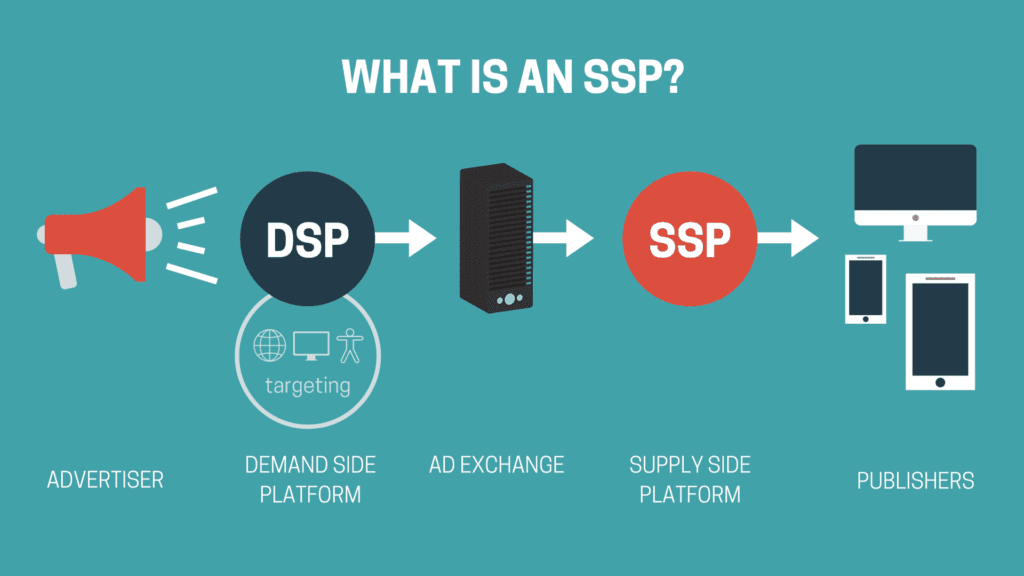

Supply-side platforms (SSPs) connect publishers to demand sources (DSPs), allowing publishers to aggregate, consolidate, and manage the demand for their ad inventory.

Supply-side platforms (SSPs) vs. demand-side platforms (DSPs)

SSPs are for publishers—they allow them to sell their ad inventory. On the other hand, demand-side platforms or DSPs allow advertisers to buy this inventory. The most well-known DSPs include MediaMath, Amazon DSP, and Google Marketing Platform.

Why Are SSPs Prioritizing Demand?

This brings us to an op-ed from Chip Schenck, SVP of data and programmatic solutions at Meredith Corp (the publisher that sold the IP to Sports Illustrated and acquired Time).

“In the ad tech supply chain, supply-side platforms (SSPs) have traditionally served as a proxy for the publisher, helping manage ad network yield and real-time bidding (RTB) as a true partner to publishers,” writes Schenck. “However, amid recent market changes such as consolidation, commoditization and pressure to grow, SSPs have started looking more like something else entirely: Exchanges that are driven by buy-side requirements. They have been leaning into demand-side needs at the risk of abandoning their core publisher clients in the process.”

Not convinced? Yahoo shut down its SSP in February 2023 to focus on its DSP.

Yahoo CEO Jim Lanzone said, “It’s really about narrowing our focus on the piece of ad tech we do best, which is our DSP [and] not spreading our resources too thinly across every part of the stack.” He went on to say that Yahoo will refine the scope of its DSP to “focus on the premium side of the market, Fortune 500 companies and top agencies instead of the long tail of advertisers.”

Even more telling: EMX filed for bankruptcy in February 2023, while Magnite let go of 6% of its workforce.

SSPs Aren’t Going Away

There’s no denying that many SSPs are shifting their focus on demand due to the commoditization of the technology and intense economic headwinds, but they aren’t going away.

While times are tough—PubMatic saw its revenue drop by 1.7% in Q4 2022—industry players are bullish.

A recent Digiday’s Seb Joseph, said, “They [PubMatic] saw enough in those final three months of the year to believe that their business remains insulated from the worst of the pressures weighing down on the ad tech industry.” He continued, “Over the fourth quarter, the business saw its automotive and food and drink advertising verticals grow at 25%. It helped soften the loss of dollars in shopping, tech and personal finance, all of which in aggregate declined 13% in the same period a year ago.”

According to Joseph, PubMatic believes the tides will turn in H2 2023. “This is when it expects its finances to take a turn for the better on the back of more ad spending, better profitability thanks to cost cuts and optimization to its tech.”

The shuttering of Yahoo and EMX also eliminates a route to publishers that advertisers would have used. As a result, those ad dollars will go to other SSPs.

So, are SSPs going away? No.

“Some industry pundits have concluded that this might be the beginning of the end for the SSP industry,” Magnite CEO Michael Barrett said on the company’s recent earnings call. “We couldn’t disagree more. What we’re seeing now isn’t the beginning of the end of the SSP, but the death of the undifferentiated SSP.”

Let’s Wait and See

SSPs typically focus on giving publishers the tools they need to manage their inventory and demand with price flooring, buyer roles and inventory packaging.

Now, according to Schenck from Meredith, many SSPs have created new tools focused on buyers, allowing DSPs to buy inventory on SSPs more easily in the name of more efficient real-time bidding pipelines.

But that change had an unintended consequence: “As the demand side provided feedback, the buyer tools, such as enhanced bid reports, have become progressively more like the very tools that publishers had, reducing the publisher’s advantage.”

In effect, SSPs often provide more value to buyers and less value to publishers. Now, DSPs can integrate with publishers themselves, and publishers could reorient their inventory outside the context of an SSP.

Still, some SSPs aren’t hurting. While some are shutting down, others are weathering the storm and, over time, may benefit from the shift as the industry narrows its focus.

Either way, the shifts are a big change to the ad tech ecosystem.

For more insights, sign up for MediaRadar’s blog here.