It’s hard to believe media powerhouses like YouTube have “off” quarters too.

According to Alphabet, YouTube’s parent company, the video giant’s ad revenue dropped by about 2% in Q3 2022.

YouTube wasn’t the only giant facing an unusual dip—Facebook’s ad revenue dropped, too, as advertisers reigned in their budgets amid the economic uncertainty.

But don’t feel too bad for YouTube—the platform still attracted almost $30b in ad revenue last year, and according to our data, that number will continue going up.

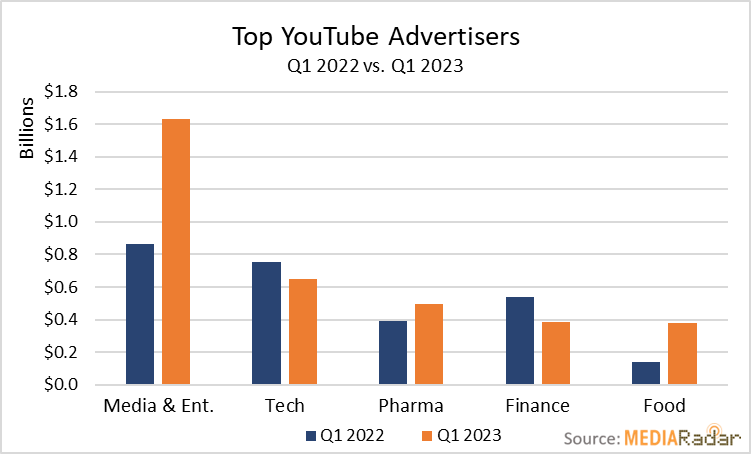

In Q1 2023, nearly 9.8k advertisers in industries such as Media & Entertainment, Technology, Medical & Pharmaceutical, Finance, and Food, spent $5.7b on YouTube, representing a 28% YoY increase from Q1 2022. Advertisers in those categories accounted for $3.5b or 62% of the ad investment in YouTube in Q1.

Let’s take a closer look at how some of those advertisers helped bring YouTube’s ad business back to life.

A Media & Entertainment Playground

More than 60% of global consumers watch videos on YouTube, and almost all do so for entertainment.

Case in point: In 2020, people consumed more than 6b hours of content on YouTube Gaming, up from 3.15b in 2019. (It’s worth noting the pandemic likely contributed to the 90.5% increase and subsequent change in people’s watching habits.)

this was fueled by the COVID-19 pandemic

Unsurprisingly, this makes YouTube a playground for Media & Entertainment advertisers.

According to our data, advertisers promoting movies, drama TV shows, subscription TV services, and game titles all increased their investment in YouTube by more than 60% YoY. Overall, Media & Entertainment advertisers increased YouTube spending by 88% YoY in the first quarter.

A level deeper, advertisers promoting movies, who accounted for 20% of the spending from this category’s advertisers, invested more than $328mm in YouTube.

For The Walt Disney Company’s advertisers, some of those dollars went to ads leading up to the release of Ant-Man and the Wasp: Quantumania in theaters in February, and the ongoing promotion for its forthcoming release on Disney+ (May 17, 2023).

Meanwhile, advertisers promoting drama TV shows, including HBO’s The Last of Us, spent almost $236mm.

Emily Giannusa, HBO’s VP of program marketing, said, “This was a massive-scale campaign [to promote The Last of Us]. Even though I can’t talk about budget here, we ignited all over the world.”

Giannusa and Co. used “breadcrumb” content to appeal to the series’ fans, including YouTube ads, a teaser that generated more than 57mm organic views in 72 hours, and ads on HBO Max.

Streaming service advertisers fight for supremacy

Advertisers for big names such as Apple, Paramount, and The Walt Disney Company, collectively increased their investment in YouTube by 168% YoY to $178mm. (Apple, Paramount, and The Walt Disney Company accounted for 70% of the investment in Q1.)

For these advertisers, the triple-digital increase comes amid the ongoing battle for streaming supremacy as new entrants gain footing and Netflix loses market share.

Advertisers for HBO Max, Apple, Paramount, and The Walt Disney Company will likely see this as an opportunity to woo consumers, especially as some services raise their prices and push even the loyalist consumers away.

That said, spending from streaming advertisers could change course quickly if the recession puts too much pressure on people’s budgets. According to data from early 2023, just over 15% of Americans say they don’t use any TV subscription services, up by almost 3% compared to October 2022.

Pharma Advertisers Embrace YouTube

Pharma advertisers have historically gravitated to traditional ad formats, so much so that those promoting over-the-counter (OTC) meds and medical devices spent more than $7.9b on TV ads in 2022.

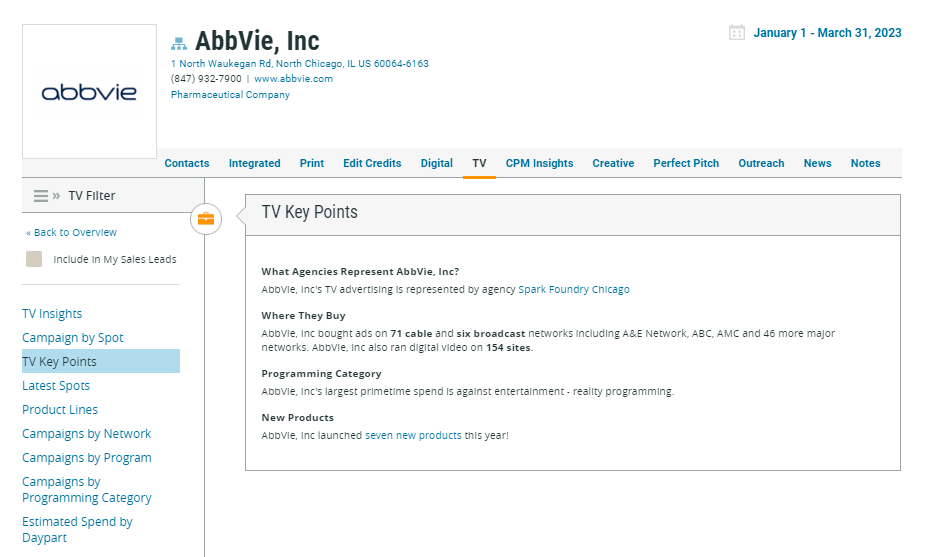

That spending continued into 2023, with advertisers investing heavily in lengthy TV ads. In fact, pharma and medical advertisers invested over half their TV budget on ads between 46-60 seconds in Q1, up from 44% in Q1 2022.

For example, advertisers for AbbVie spent 86% of their budget on 46- to 60-second ads, with the remaining 14% going to commercials of less than 45 seconds.

But as younger generations enter the healthcare world and turn to social media for health-related advice, including YouTube, pharma and medical advertisers are changing their tune.

In Q1, medical and pharma advertisers increased their investment in YouTube by 26% YoY, despite the number of companies investing in them dropping by 29%.

If that doesn’t go enough against their historical grain, this will: Many medical and pharma advertisers are embracing the short-form content people love.

In Q1, almost 40% of the companies in our sample (130 out of 325) bought ads that cut at the 15-second mark, including those promoting hemorrhoids OTC meds, diabetes prescriptions, and dietary supplements.

Meanwhile, more than 40% and 20% of companies spent on ads of 16-30 and 31-45 seconds, respectively.

Not All Advertisers Are Bullish

YouTube is back where it belongs—in the good graces of advertisers—but not everyone was ready to dive back in.

Finance advertisers, for example, decreased their investment in YouTube by 29% YoY to more than $382mm, undoubtedly a reduction driven by the collapse of Silicon Valley Bank (SVB), rising inflation, and the uncertain economy.

At the same time, technology advertisers reduced spending on YouTube by 14% YoY to $647mm, thanks to sizable reductions by cell providers (down 46%), web design & development (down 54%), and financial software (down 47%).

Despite decreases from these advertisers, YouTube will remain a mainstay—it’s too big and reaches too many people to ignore.

Plus, as the platform rolls out commerce-centric features, advertisers in other industries, including retail, will see the world’s biggest video platform in an even brighter light.

For more insights, sign up for MediaRadar’s blog here.