Mergers and acquisitions are nothing new to the entertainment industry.

In 1989, Sony Corp. bought Columbia Pictures Entertainment Inc. for $3.4 billion.

Ten years later, Viacom Inc. announced a deal to buy CBS Corp.

In 2022, WarnerMedia and Discovery come together to form Warner Bros. Discovery.

The headlines always catch consumers’ attention, given that most acquisitions have entertainment implications.

The merger between WarnerMedia and Discovery is the perfect example.

With the swift stroke of a pen, two tremendous content catalogs joined forces, including household names like Harry Potter, CNN, HBO, and Cartoon Network.

But mergers and acquisitions have advertising implications, too, and brands need to remain aware of them.

The Shape of TV Mergers and Acquisitions in the 2020s

WarnerMedia and Discovery aren’t the only two household names that have made noise lately.

Let’s take a look at a few more of the mergers and acquisitions that have made headlines:

- Disney bought the rest of Hulu after taking a controlling stake in 2019

- AT&T and Discovery closed the WarnerMedia transaction

- Fox bought Tubi for $440 million

- Netflix bought Animal Logic, an animation studio

Go back a year, and you can add the CBS-Viacom merger to that list.

The rash of purchases comes as media companies fight to position themselves ahead of the competition.

For legacy players that have made hay in broadcast TV, mergers and acquisitions are part of the evolution required to fend off the decline in TV revenue. In fact, pay-TV revenue is expected to fall by $56 billion by 2025.

“There’s been a drastic change among legacy media company executives the last two years,” writes Alex Sherman at CNBC. “Their CEOs won’t say it publicly, but they’re saying it privately: The pay-TV bundle, the lifeblood of the U.S. media ecosystem for decades, is dying.”

While the pivot away from traditional TV is top of mind, the real forcing function is the streaming wars. As of December 2021, 85% of households in the U.S. had access to a video-streaming service.

Even more telling of streaming’s popularity is that the average household uses 4.7 services.

Each player mentioned above (and countless others) has a stake in the streaming war. From a consumer and advertising standpoint, mergers and acquisitions are part of their plan to win.

How the M&A Madness Impacts Advertisers

Mergers and acquisitions are a tactic to woo consumers. At the end of the day, content is king.

Consider this: Netflix’s Stranger Things generated 5.1 billion viewing minutes across the four seasons.

A study following the hit show’s third season found that about 51% of current Netflix users planned to watch Stranger Things. About 5% of consumers who didn’t subscribe to Netflix said they planned to so they can watch the show. Meanwhile, 13% of former subscribers said they planned to return to watch the show.

As every major media company uses M&As as a means to attract consumers, advertisers for some of the world’s biggest brands are paying attention. Content is king for consumers, but the subscription bases reign supreme for advertisers.

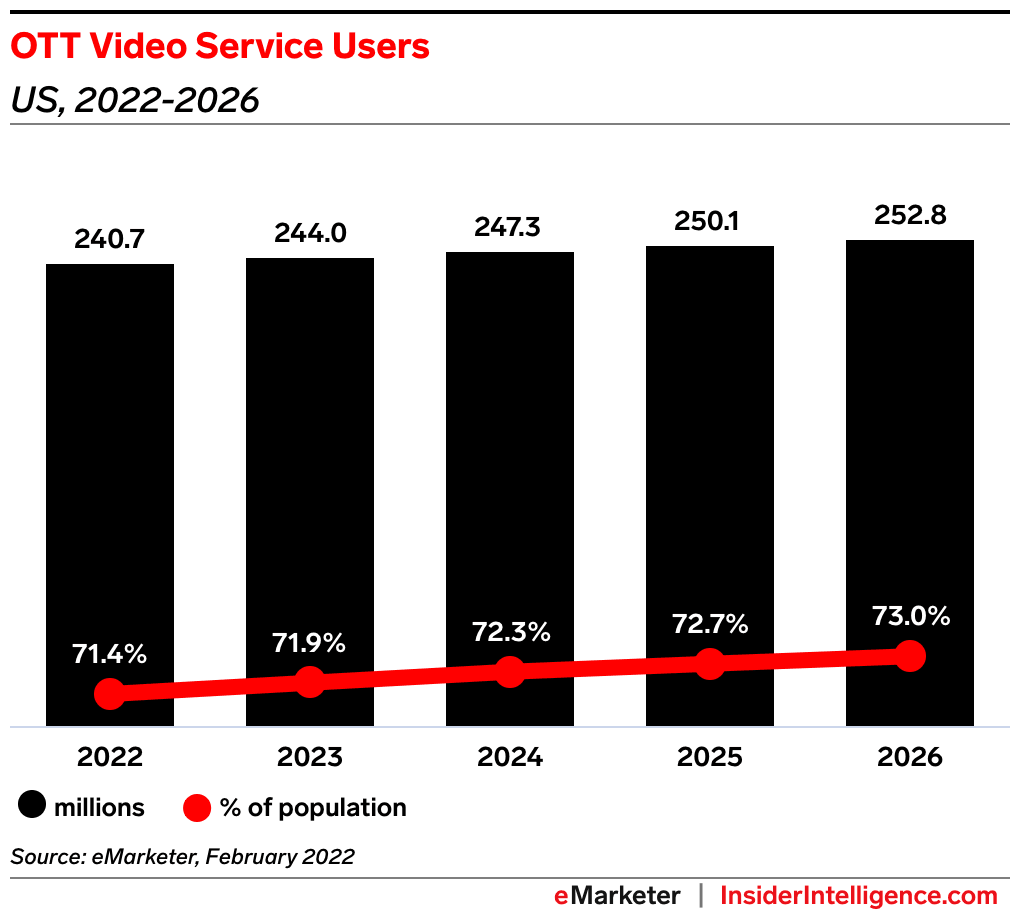

By 2026, 73% of the U.S. or more than 252 million people, will use OTT services, including Netflix, Hulu, Disney+, and HBO Max.

Each of these players is investing in ads.

Netflix is the most recent entrant to the ad-supported OTT world.

In November 2022, the longtime OTT king introduced ads. At the time of the announcement, a source said the company was asking for a $10 million minimum commitment in annual ad spending from agencies.

Fast forward a few months, and the success of Netflix ads is up in the air.

While company executives are excited, adding more than 7 million paid subscribers in Q4 2022 (after losing nearly a million earlier in the year), Netflix is apparently letting advertisers “take back their money” due to a failure to meet viewership expectations.

Still, Netflix’s subscription base is too big for advertisers to ignore. As Netflix irons out the kinks in its new advertising engine, ad dollars will continue to flow.

Other major streaming platforms, like Hulu, are also attracting ad dollars. In 2021, brands collectively spent more than $400 million on Hulu. Top advertisers included Comcast and Berkshire Hathaway.

It will be interesting to see what Disney does with Hulu from both a content and advertising standpoint now that it’s the sole owner of the streaming giant.

The Great Shake Up

The first act of the streaming wars is over. It ended when NBCU launched Peacock, which meant every major media company had a streaming service live.

Will new streaming services arrive in 2023? It’s hard to believe that any big ones will—at least big enough to compete with the major players.

Launches may not be on the horizon, but mergers and acquisitions are inevitable as these companies fight for market share.

As they do, advertisers must pay attention.

For more insights, sign up for MediaRadar’s blog here.