According to the Interactive Advertising Bureau (IAB) and Accenture Interactive, programmatic ad spend increased by 14% year-over-year in 2020—and is outpacing other marketing strategies.

However, not all industries are spending more.

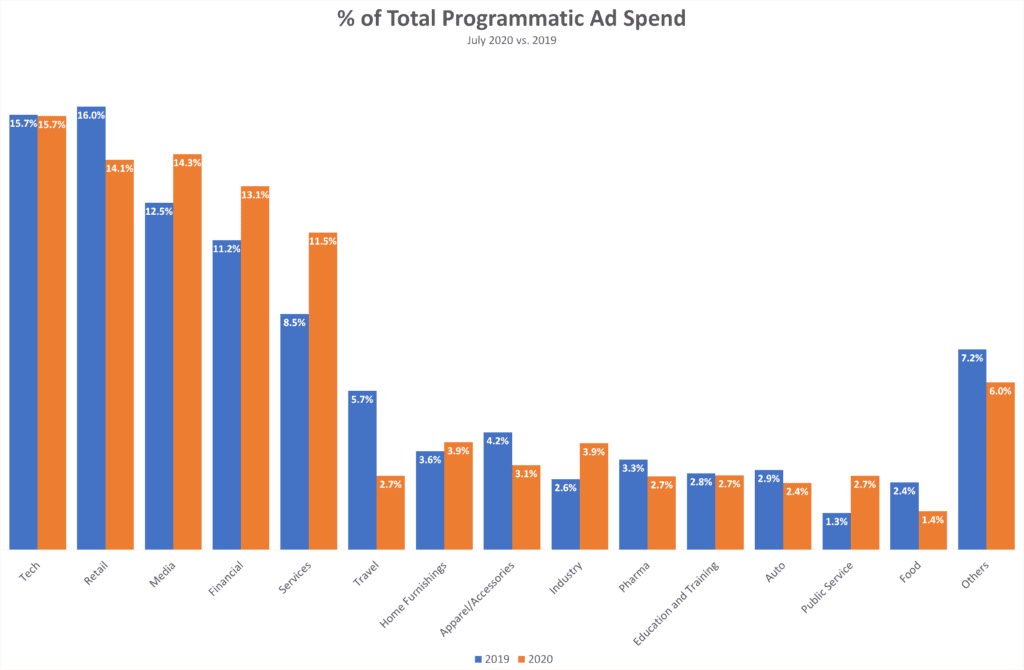

Using our latest data from July, we dive into which industries are increasing—and decreasing—programmatic spending amid the pandemic.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Brands bring programmatic in-house

While programmatic has many benefits—like efficiency, data-driveness, and scalability—it has its downsides. Brands that outsource their programmatic buying often feel that there isn’t enough transparency and giving up full control can create an array of challenges.

Due to this, many brands are bringing programmatic ad buying in-house, rather than relying on an agency. According to the same IAB report, 69% of U.S. brands shifted their programmatic advertising in-house. This gives brands better ability to control their first-party data and adjust their budgets quickly in an unpredictable environment.

“As the industry braces for the loss of third-party cookies and audience identifiers, direct engagement in programmatic advertising matters more than ever,” said VP and head of the IAB Programmatic+Data Center Orchid Richardson. “Brands aren’t generally taking over the whole process, but they are taking over the development of programmatic strategy to strengthen customer connections and to control both first-party data and functions that relate to legal and regulatory compliance.”

CPMs recover

It’s been a stressful summer for digital publishers as they watched online traffic surge, while CPMs for site inventories drop as much as 20%. However, prices are recovering and publishers say they’ve seen programmatic dollars come back.

According to the Ezoic Ad Revenue Index, CPM values in June and July were largely exceeding prices of last year. “We saw some of the best rates we’d seen since the beginning of March in the last two weeks of June,” said chief revenue officer at news and politics publisher Salon, Justin Wohl. Looking at the first twenty-three days of July, Salon’s programmatic revenues were up 25% YoY.

MediaRadar Insights

In both July 2019 and 2020, tech was the largest buyer of programmatic advertising. Their share of the programmatic pie appears unaffected by the outbreak.

Categories that increased their share of the programmatic market were:

- Media

- Financial

- Services

The largest drivers of the media category were streaming services and video game titles.

Streaming services largely increased programmatic ad spend in July, spending twice as much as last year. Part of this may be due to Peacock’s aggressive spending two weeks prior to its launch on July 15th.

Video game titles, another sub-category within media, also increased spending by 280% YoY. Video game usage increased significantly amid shelter-in-place orders, and the ad spend reflects the new consumer habits.

Categories cutting their share of programmatic ad spending include:

- Retail

- Travel

- Apparel

Within the travel category, airlines drastically cut ad spending on programmatic—spending 86% less YoY in July. Travel spending has been turbulent and largely dependent on the rise and fall of new COVID cases. The cuts to business travel advertising were more severe than consumer—as events were cancelled and virtual meetings were normalized.

Retail and apparel are perhaps the most impacted by COVID, with many leaders saying that this will be the death of department stores. Malls were already closing, but are now closing at an accelerated pace.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.