The Pro-Trump Internet And The Alt-Right Are Turning On Breitbart

Buzzfeed - On Monday morning, Breitbart News fired staffer Katie McHugh, following a series of incendiary weekend tweets broadcast in the wake of the London Bridge terror attack. On Saturday evening, as word of the incidents spread across social media, McHugh tweeted that "there would be no deadly terror attacks in the U.K. if Muslims didn't live there." Her comments reportedly offended a number of Breitbart staffers, according to a story published by CNN.

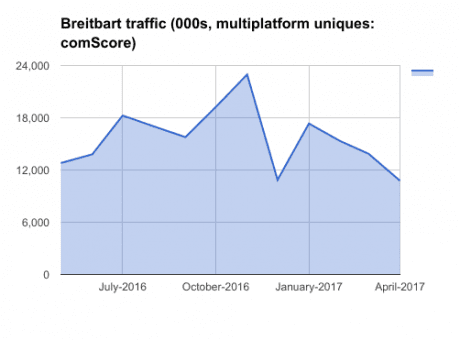

ReadBreitbart sees huge advertising drop in May

TheHill - Breitbart News has experienced almost a 90 percent drop in advertisers in May when compared to March, according to a Tuesday report.

Per Digiday’s MediaRadar, which tracks ads on websites, Breitbart had 242 brands appearing on its website in March, but had just 26 in May.

ReadBreitbart ads plummet nearly 90 percent in three months as Trump’s troubles mount

Digiday - Six months ago, Breitbart was riding the wave of the election, plotting an international expansion to provide a platform to spread far-right, populist views in Europe. But today, Breitbart is facing traffic declines, advertiser blacklists, campaigns for marketers to steer clear and even a petition within Amazon for it to stop providing ad services.

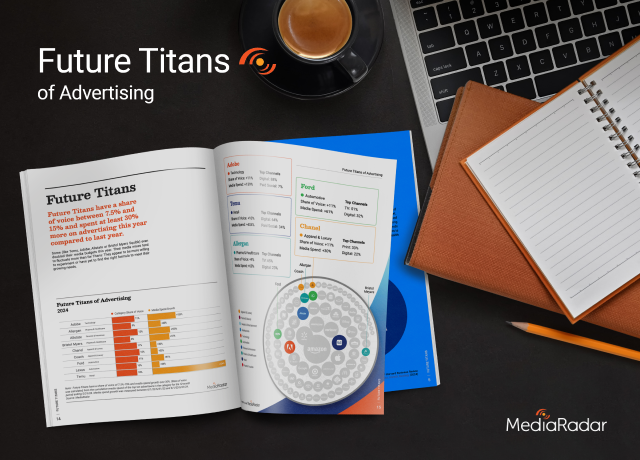

ReadMediaRadar has a new partnership with comScore

Cynopsis Media - PLATFORMS, APPS + DEVICES - MediaRadar, the advertising intelligence platform for media ad sales teams, has a new partnership with comScore in which comScore data will be integrated into MediaRadar’s artificial intelligence engine. More than 1,600 publishers use MediaRadar for ad intelligence, including The New York Times and The Wall Street Journal.

ReadMediaRadar, comScore join for more sophisticated data

IAB Smart Brief - MediaRadar has teamed up with comScore to give customers access to behavioral and demographic data across desktop and mobile. Starting in the second quarter, comScore's North American media metrics will be available to MediaRadar's 1,600 media clients.

ReadNative & Header Bidding: Positive Developments With Real Challenges

Native Advertising Institute - Last year was a good year for digital publishers. Although overall advertising growth slowed overall, according to eMarketer, digital advertising grew more than 15 percent and almost cleared $70 billion. And, by 2020, digital spend is expected to reach $100 billion.

Growth is being driven by a number of factors, starting with mobile technology. But native advertising and new tools like header bidding are delivering greater revenue gains for publishers. But even these very positive developments come with obstacles that threaten to undercut their value and knock publishers off course.

ReadMediaRadar partners with ComScore to provide publishers with smarter data

US Campaign Live - On Monday, ad intelligence platform MediaRadar announced a new partnership with ComScore to further its goal of assisting ad sales professionals cement deals with brands.

Beginning in the second quarter of 2017, MediaRadar will supply the 1,600 publishers and media companies it serves with ComScore’s North America media metrics. Publishers who are customers of both companies will have access to demographic and behavioral data across mobile and desktop at no additional cost.

ReadMediaRadar Integrates Independent comScore Data into its Ad Sales Intelligence Platform

NEW YORK, NY—May 15, 2017—MediaRadar, the leading intelligence platform for media ad sales team, today announced that it will incorporate comScore data into its Ad Sales Intelligence platform. comScore is the cross-platform analytics company that precisely measures audiences, brands and consumer behavior. With the partnership, MediaRadar will analyze independent comScore data and distill key insights that will benefit ads sales professionals. By providing MediaRadar insights and third-party data via one solution, MediaRadar will continue to deliver unparalleled ad sales intelligence to publishers.

ReadDespite Challenges, Native Ad & Header Bidding Opportunities Are on the Rise

Publishing Executive - Last year was a good year for digital publishers. Although overall advertising growth slowed overall, according to eMarketer, digital advertising grew more than 15% and almost cleared $70 billion. And, by 2020, digital spend is expected to reach $100 billion.

A number of factors are driving growth, one of which is mobile technology. But native advertising and new tools like header bidding are delivering greater revenue gains for publishers. Despite these very positive developments, there are obstacles that threaten to undercut their value and knock publishers off course.

ReadHow Publishers Can Increase Sponsored Content Renewal Rates 133%

Native Advertising Institute - On average last year, publishers saw a 33 percent renewal rate for sponsored content (long-form native advertising). The bottom 20 percent saw renewal rates below 20 percent. This is based on data gathered by MediaRadar, a sales intelligence and CRM vendor for publishers. They looked at over 1,600 publishers that sold sponsored content.

The study looked at what similar attributes each quantile had to see if any patterns immerged. Below is a look at the sponsored content renewal rates for some of the top performing publications.

Read