Over-the-top (OTT) technology has gone from a niche streaming option to one of the most popular ways to watch TV in just a few years. In June 2022, streaming video surpassed one-third of all video viewing for the first time, up from 27.4% the year before.

Meanwhile, the shares of broadcast television stood at just 22.4%.

As the global over-the-top (OTT) market continues to enter the living rooms of millions—OTT had a user penetration rate of approximately 42.9% in 2022—significant players like Netflix, Amazon, Apple, HBO Max, and Disney+ have built their media offerings. As a result, advertisers have had to figure programmatic TV out on the fly.

But what, exactly, is programmatic TV advertising?

Is it addressable?

What are its benefits?

The tech is in its early stages, so we’re naturally confused.

What Is Programmatic TV Advertising?

Programmatic TV advertising is a technology-driven way to buy ads across the web, mobile devices, and connected TVs. Programmatic TV advertising extends to linear TV ads and OTT technology like Disney+, Netflix, and HBO Max.

Programmatic Advertising for OTT: Opportunity vs. Capability

OTT distribution channels (or streaming platforms) may have a while before they completely take over traditional television. While user penetration is promising, rising prices could push people back to old-school cable.

Entertainment analyst Paul Erickson says, “Services really see content as their weapon to ensure people subscribe — and they stay subscribed — in this dog-eat-dog environment.” He said the price increases will end when consumers “start leaving the service or stop subscribing.”

Still, there’s enough meat on the bone to warrant a “What’s next for advertising?” type of conversation. Revenue in the OTT video segment is enough to warrant it on its own, which is expected to reach $316b in 2023.

So, why are advertisers flocking to OTT?

Because linear and broadcast TV ads just don’t cut it anymore.

In fact, 94% of TV ads reached just 55% of linear TV audiences in Q1 2022. While impressions rise at times—linear TV impressions were up by 19% in Q4 2021 in tandem with the football season—they’re worthless if no one sees the ads.

Reach is a problem, but so is efficiency, which is why advertisers are eager to go programmatic.

Despite the opportunity, there are several holdups to implementing addressable TV ads.

To start, it’s a complex undertaking.

When you start mixing direct TV ads, popups on mobile video, banner ads on web platforms and more, figuring out pricing, opportunity and targeting can quickly get confusing.

Cross-channel advertising has always been challenging; adding OTT to the equation makes it exponentially harder, given the siloed ecosystems in which these platforms live.

Add to that the intricacy of the marketplace itself, and things may take a while to untangle.

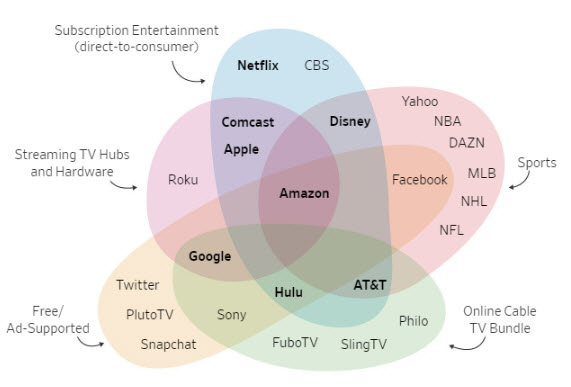

The Wall Street Journal reported that “Silicon Valley heavyweights” with a direct-to-consumer laser focus and “traditional media companies” looking to figuratively keep up with the Kardashians are competing in at least five distinct categories.

These companies are vying for consumer attention in increasingly complicated combinations, replete with subscription entertainment, TV streaming, ad-supported online video, cable/TV bundling, and sports.

The intricacies are hard to handle, and the platforms need help to meet the demand.

Said another way, advertisers follow audiences from traditional TV to streaming, but when they get there, they find there aren’t enough ad slots to go around.

Netflix’s ad-supported under-delivery issue has been notable.

According to an agency executive, “The past few weeks [following the ad-support tier’s launch], it has been okay.”

According to the Digiday article, “the company [Netflix] could have avoided that initial situation altogether if it had had supplementary inventory to offer advertisers to make up for the viewership shortfalls immediately rather than needing to allow advertisers to take their money back in order to achieve their year-end reach goals.”

Disney is navigating that potential hiccup by unifying its ad tech stack behind Disney+ and Hulu to give it more flexibility in juggling advertiser demand.

For example, if Disney can’t deliver an ad on Disney+, it can move those ads to Hulu or ESPN+.

As one agency executive said, “What they are relying on is their ability, as a portfolio media company, to have their own safety net.” Other OTT platforms need to figure out a backup plan as well.

On the Horizon for Programmatic TV Advertising

The multiplex holds promise for both media platforms and media buyers.

For media platforms, programmatic TV allows for better integration across distribution channels, translating into a better experience for the consumer.

For media buyers, the benefit is summarized by Google’s Rany Ng and Anish Kattukaran: It is data-driven and addressable. Media buyers can pinpoint ads based on not only demographics but keywords and potentially browsing history as well.

The opportunity for addressable TV advertising through OTT tech is hard to ignore. We see multiple media and telecommunication companies making moves toward the capability as a core part of their offerings.

In a time reserved for major broadcast and cable networks, data-driven TV advertising may become central to the conversation.

For more insights, sign up for MediaRadar’s blog here.