2023 proved to be a year of evolution for the advertising industry. Coming off the heels of a turbulent few years dealing with the impacts of the COVID-19 pandemic, advertisers showed resilience and adaptation in response to a shifting economic landscape plagued by factors like inflation and global conflict.

However, key beacons of hope like the relaxation of pandemic restrictions and the gradual return to normalcy for many businesses facilitated growth in several sectors. With the rearview mirror now squarely fixed on 2023, the latest advertising data and trends point to new opportunities across industries in 2024, from travel and hospitality to financial services and beyond.

Over the next 12 days, we will report on 12 key markets. Through MediaRadar’s data we’ll recap what each industry has experienced over the past year and what to watch in 2024. Learn key advertising insights from the following categories during the “12 for ’24” blog series:

- Retail Media Networks (RMNs)

- Retail

- Travel

- Non-Alcoholic Beverages

- Technology

- Food

- Beauty

- Automotive

- Alcohol

- Baby & Kids

- Gambling & Casinos

- Fitness & Weight Loss

With MediaRadar, get a look at crucial advertising intelligence and emerging trends across various industries. Whether these sectors are rapidly advancing or gradually rebounding, you’ll gain the knowledge to create strategic proposals and make informed media planning decisions for your clients.

Read on for our exclusive analysis of the categories poised to take flight in 2024 based on the latest national advertising insights.

For more updates like this, stay tuned. Subscribe to our blog for more.

Retail Media Ad Spend is Expanding

Retail media is an increasingly popular form of digital advertising due to its highly targeted audience of shoppers ready to buy and their ability to provide closed-loop attribution. New analysis from MediaRadar shows ad spending on retail media grew by 22% year-over-year (YoY) through November 2023, reaching $5.09 billion. As retailers build robust ad platforms, marketers see retail media providing valuable audiences and a clear return on their investment (ROI).

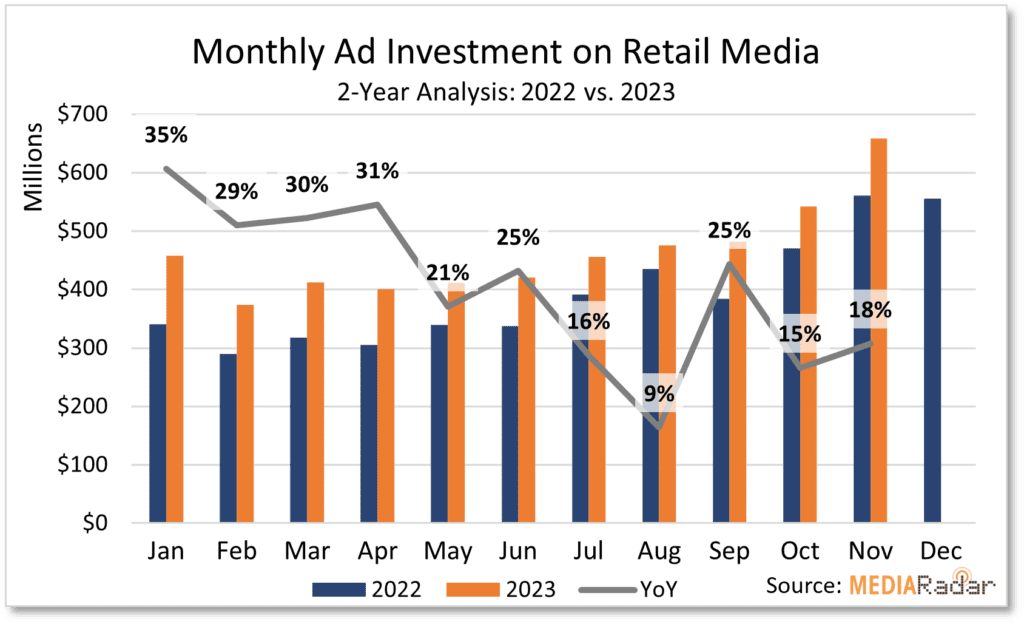

MediaRadar studied ad investments across over 20 top retail media networks (RMN) by analyzing leading general merchandise, pharmacy, electronics, home goods, grocery, and other e-commerce sites. Ad spend increased each quarter, with 31% year-over-year growth in Q1 accelerating to 25% in Q2 and 17% in Q3 2023. Holiday marketing pushes ad investments even higher in Q4.

Five Categories Driving the Retail Media Ad Spend

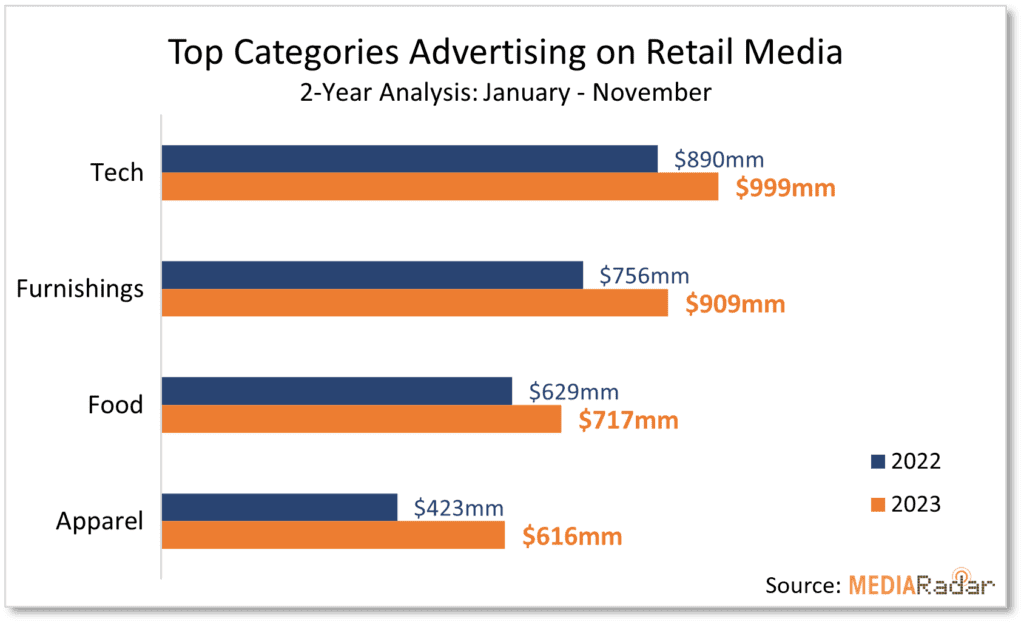

Growth in retail media ad spend comes across key categories like technology, home furnishings, food and beverage, beauty, and apparel. These top five segments contributed over $3.8 billion, representing 76% of all retail media ad investments this year.

All five categories increased ad spending compared to 2022 levels. Beauty and apparel brands saw the largest gains, with ad spend jumping over 45% YoY.

Growth within the technology category was a result of increased ad spend by consumer tech brands. They invested $770 million across electronics and devices. As customers research big-ticket items, brands like HP, Apple, and Samsung prominently advertise everything from laptops to tablets to capture interest.

Food brands increased spend by 14% this year, reaching $717 million through to November. As consumers turn to grocery e-commerce sites to fulfill their shopping lists and recipe inspiration, snacks & desserts, dairy, and breakfast food brands utilize retail media to turn their products into must-have impulse buys for consumers.

Amazon and Walmart Control Majority of Retail Media

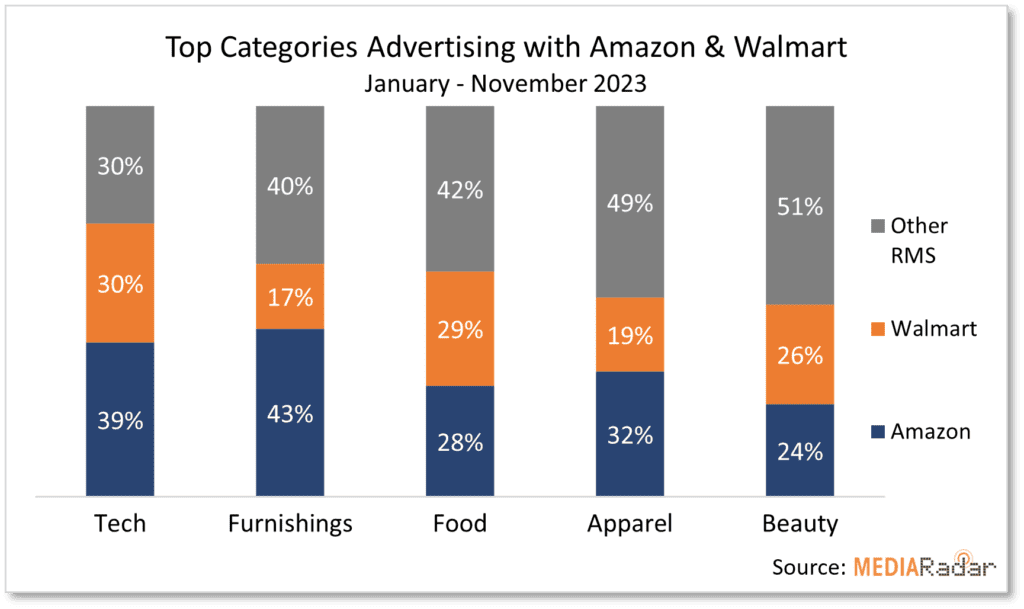

Where are retail media ad investments going? Primarily to the two category leaders – Amazon and Walmart.

According to MediaRadar’s analysis, Amazon captured 37% of total retail media ad spend so far in 2023. Walmart took another 25%, combining to account for over $3.1 billion in ad revenue this year.

The influence is even more pronounced among the top advertising categories:

- 70% of all technology retail media went to Amazon and Walmart

- 60% of home goods ads targeted Amazon and Walmart sites

- 58% of food retail media focused on Amazon and Walmart

This concentration demonstrates the consolidation of e-commerce power under two retail giants. As more shopping shifts online, gaining product visibility on Amazon and Walmart virtually necessitates significant ad investment.

However, niche and specialty retail media networks still play an important role – especially for beauty advertisers that have products that appeal to very targeted audiences. Brands seem to embrace a portfolio approach, embracing Amazon and Walmart’s mass reach with focused channels matching product positioning.

Brands to Watch Investing in Retail Media

Here are 12 brands that made up the top retail media advertisers so far this year. Each invested more than $9.5 million through November, exceeding a combined $136 million.

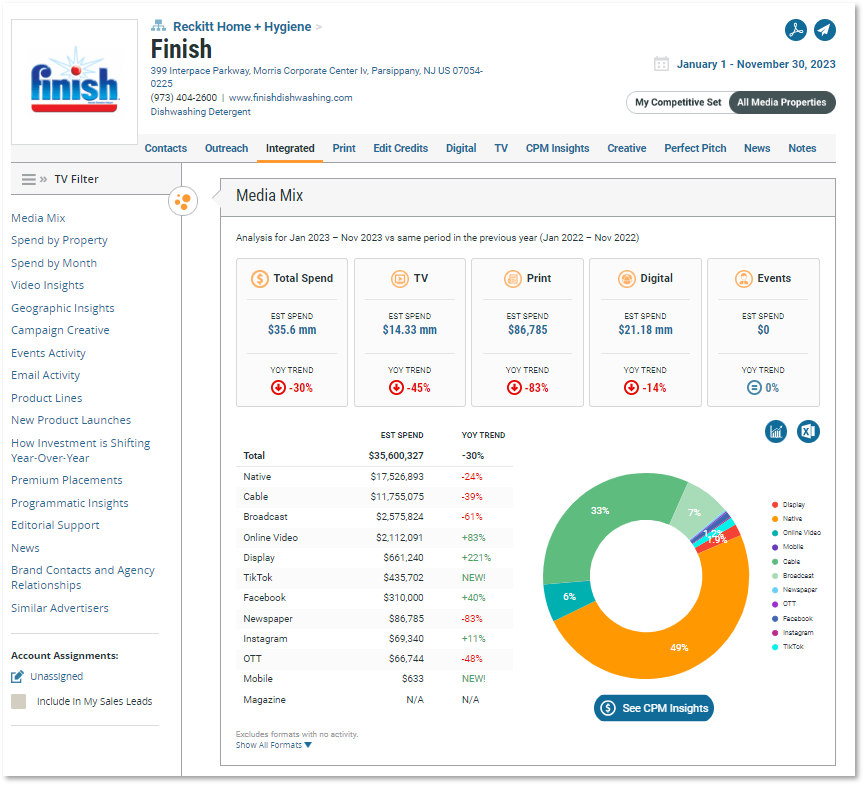

Finish decreased its overall spending by 30% YoY through November 2023, yet still invested more than $35 million. All media was down seeing print outlets taking the steepest YoY decline with 83%, resulting in less than $100k invested in the media. Digital spend topped $21mm, followed by TV capturing $14mm. The dishwashing detergent dedicated nearly 50% toward native advertising, resulting in the brand being a top RMN spender this year.

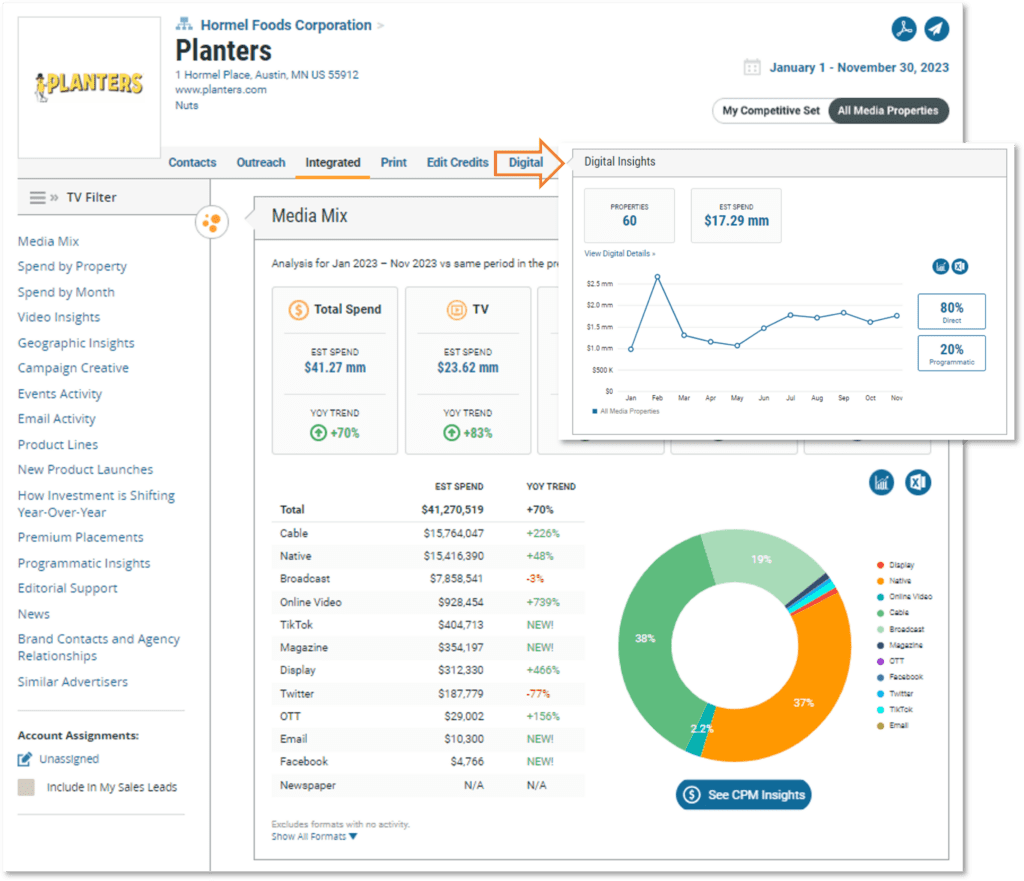

Planters increased spending by 70% YoY to over $41 million, partly thanks to its participation in the big game this year. Cable ads were 38% of the total ad spend after a 226% YoY increase. Native advertising was over $15mm with nearly a 50% increase from the same period last year. Interestingly, 80% of its digital spend was direct buys. MediaRadar’s analysis shows Planters placed retail media ads with Kroger Precision Marketing, Amazon, and Target – all receiving over $2mm each from the brand.

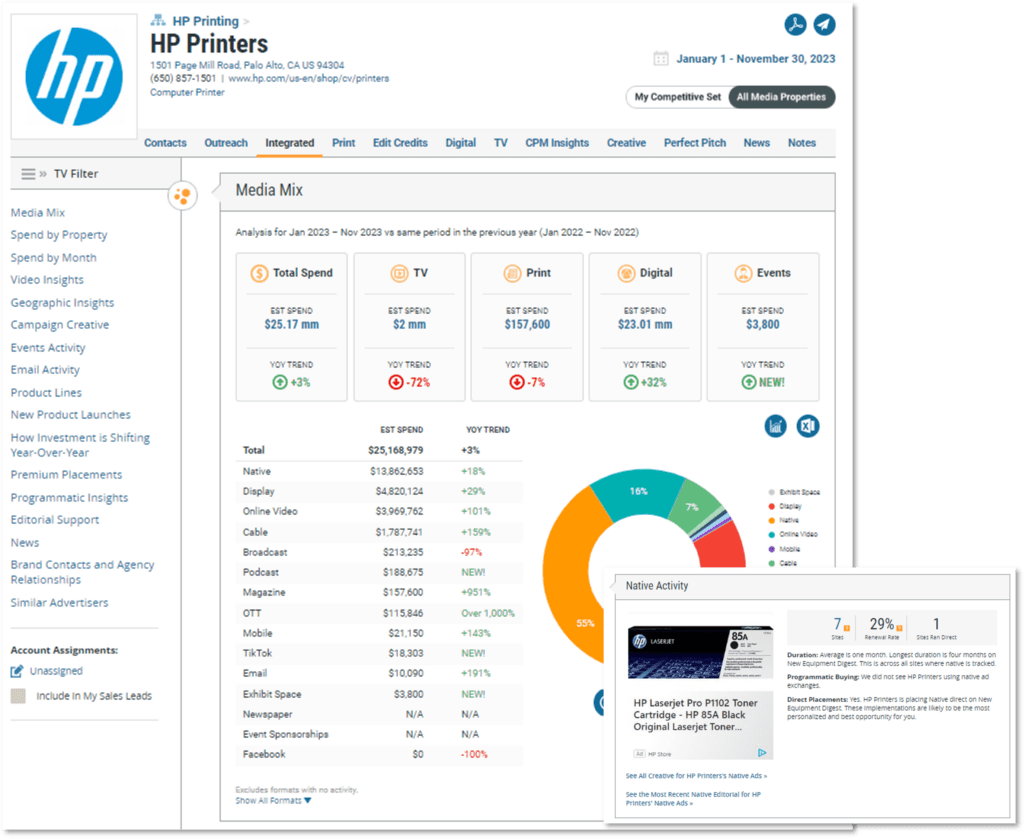

HP Printers increased by 3% YoY to over $25 million spent to reach its consumers so far this year. TV and print both decreased by 72% and 7% YoY respectively, while digital media increased by 32% YoY to $23mm. Over 400 properties showcased digital ads, showing peak spending in July with 73% placed directly. Native ad spend increased by 18% from last year to nearly $14 million, which was 55% of the ads. Amazon and Best Buy captured nearly $8mm of the RMN spend.

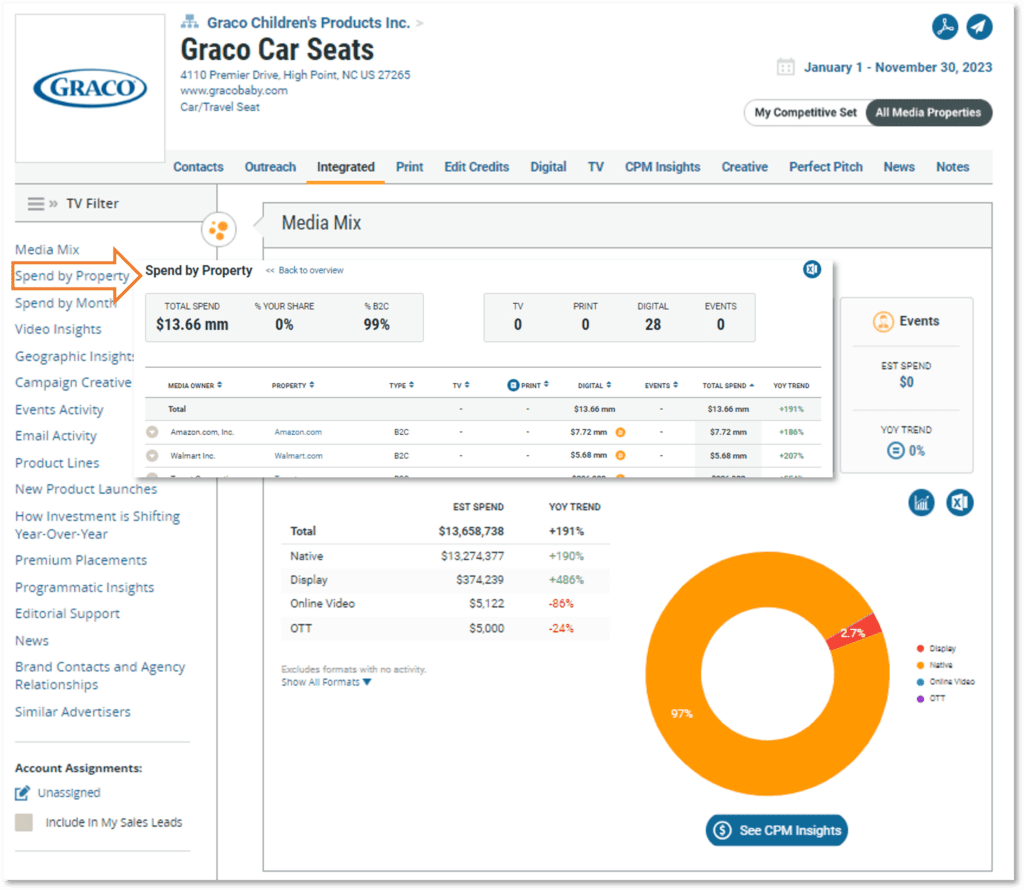

Graco Car Seats upped its spending to date by almost 200% YoY to over $13.6 million, with native capturing $13.3mm (97%) of the investment. Peak spending occurred in January and 99% of the digital ads were direct buys. The longest ad duration was two months with Amazon and Walmart capturing the majority of placements with $11.7mm combined.

Ritz (Brand) invested over $107 million to advertise its cracker after a 90% YoY increase with peak spending in May and November. Digital media was up by over 150% YoY, while TV decreased by 34% YoY. There was around $60k dedicated to magazine ads. Online video was 69% of the ad spend thanks to a 392% YoY increase in the format. Still, the brand invested over $11 million in native advertising with a 13% YoY decrease from last year. Amazon captured over $4.2mm from Ritz.

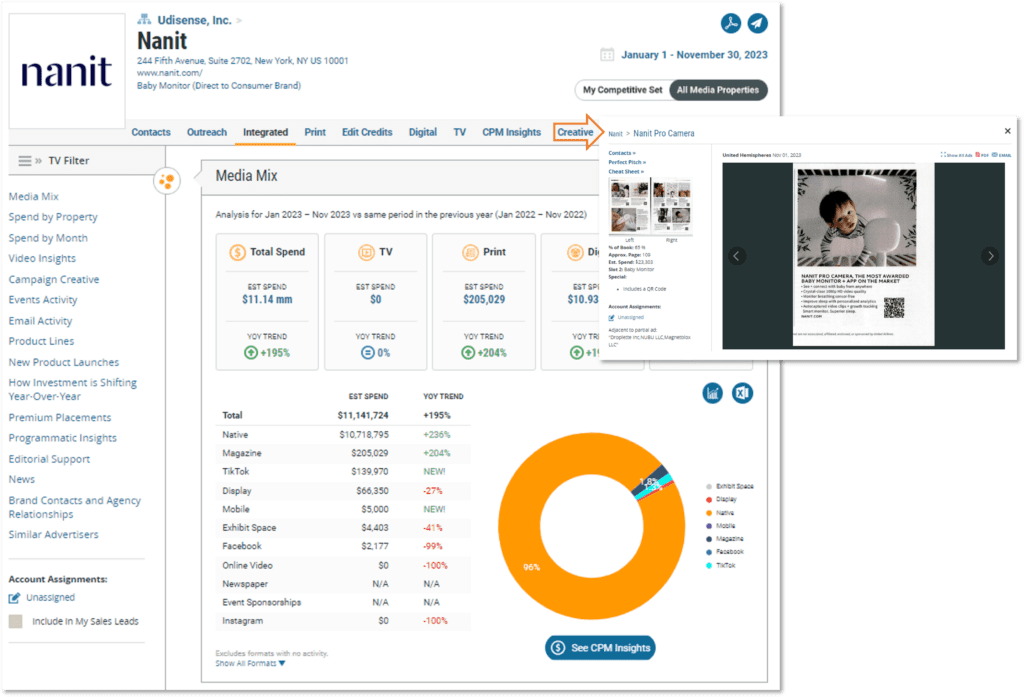

Nanit increased ad investment for its baby monitor by 195% YoY to over $11 million, which was spent through November 2023. The brand’s native ad spend was $10.7mm after a 236% increase from the same period in 2022. June and July were peak spending months with 98% of the buys placed directly. Amazon snagged over $7.6mm of Nanit’s RMN spend. Magazine ads placed in United Hemispheres saw peak spending in November with the creative touting its award accolades in the market.

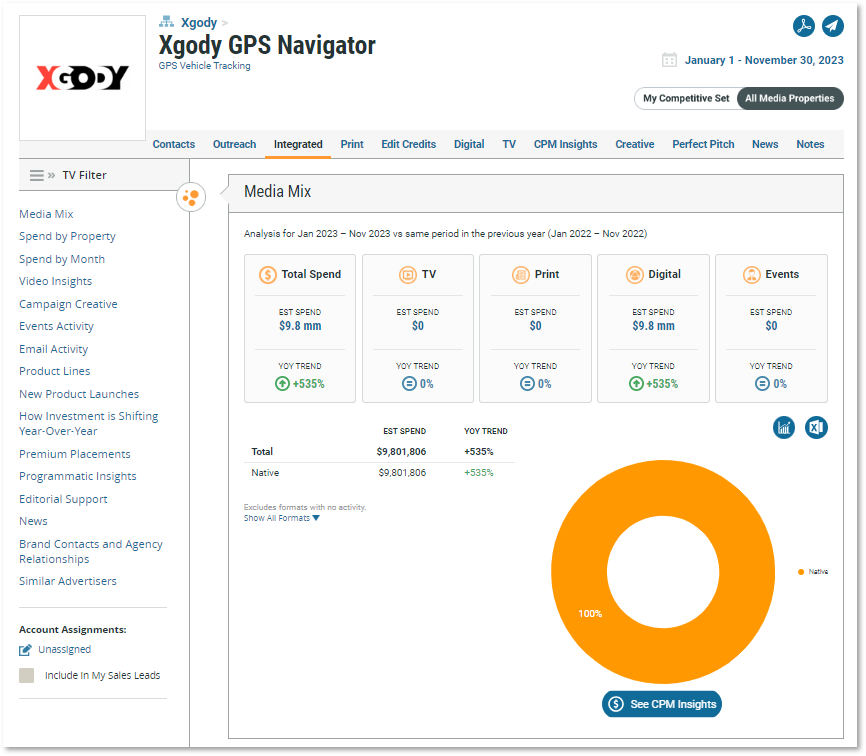

Xgody GPS Navigator increased by 535% to over $9.8 million with 100% native advertising. Diving into retail media sites, Walmart captured over 99% of the brand’s ad spend with over a 1000% YoY increase. There was still investment in Amazon, albeit less than $35,000, after a 97% YoY increase. Monthly spending was fairly consistent around $1mm until a dip in September to less than $600k. November’s spending closed around $565 thousand.

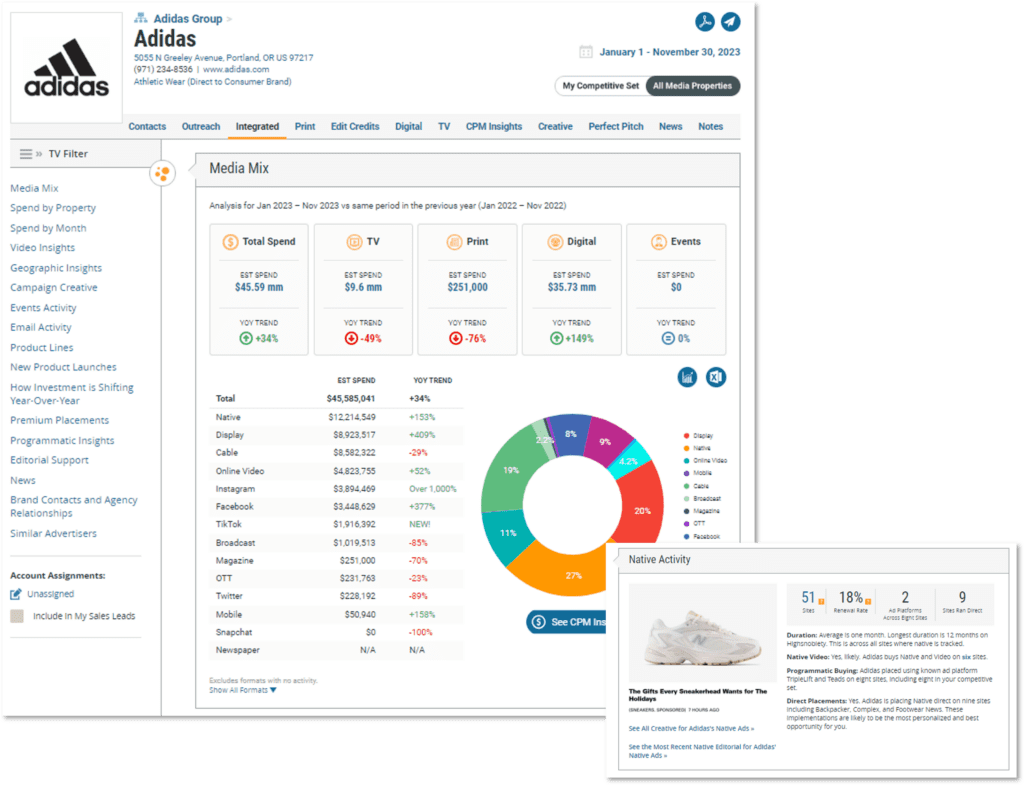

Adidas increased ad spend for its athletic wear by 31% YoY to more than $45.5 million. Digital media increased by nearly 150% YoY, while TV and print were both down by 49% YoY and 76% YoY respectively. Its ad mix was fairly diverse, with native ads capturing the majority at 27% of the investment. Adidas placed direct buys with nine out of the 51 outlets that had native ads. Additionally, the brand dedicated nearly $9mm towards digital display ads so far this year.

HP Laptop, another Hewlett Packard brand, invested $18 million with a 35% YoY increase. Digital media increased by 41% YoY to over $17.6 million. Overall native spend was 67% with nearly $12mm spent towards the media. Costco, Walmart, and Target together captured 71% of the $9.8 million dedicated to retail media sites – that’s $7mm from these three RMN brands alone.

Samsung Tablets had over $14 million invested after a 111% YoY increase this year. Digital spending jumped by over 215% compared to the same period in 2022 and was 100% of the brand spend. Native ad spend increased by nearly 200% YoY to over $9.2mm. The $9.6mm dedicated to RMN had Walmart (53%) and Best Buy (19%) as the top sites capturing 72% of the retail media ads. Additionally, Samsung Tablets increased online video investment by over 1000% YoY.

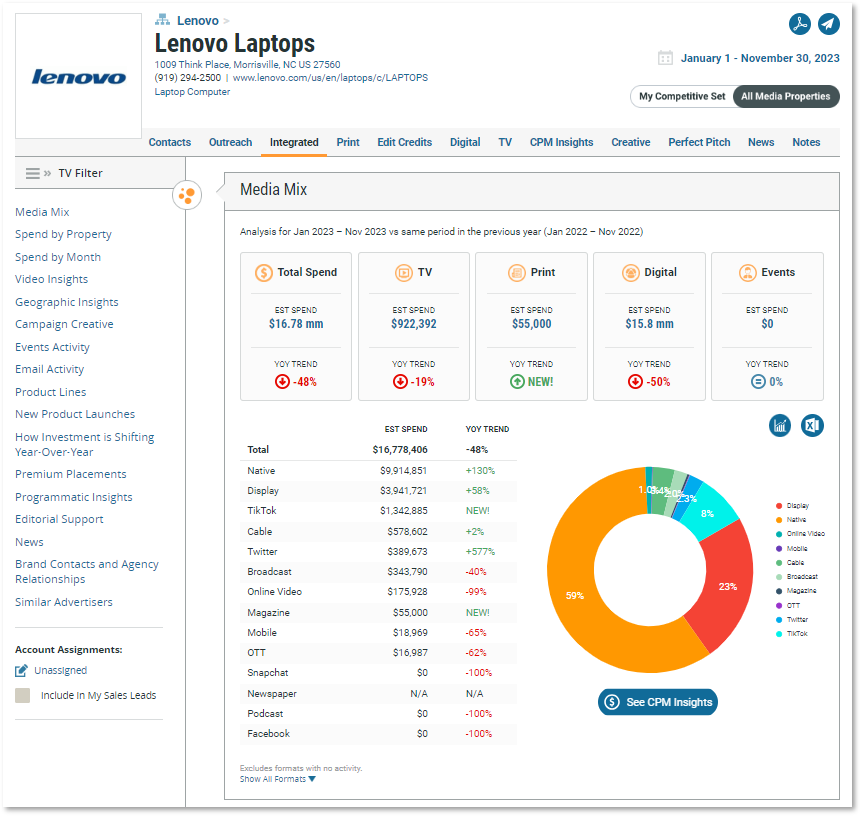

Lenovo Laptops scaled back its overall ad spend by close to 50% YoY to $16.7mm. Digital media was down by 50% YoY while TV also dipped by 19% YoY. However, some formats were increasing such as native and display – both up by over 58% YoY. The brand’s RMN advertising was a Best Buy (37%), Walmart (23%), and Costco (19%) mix for a combined $7.5mm spent to advertise with these sites.

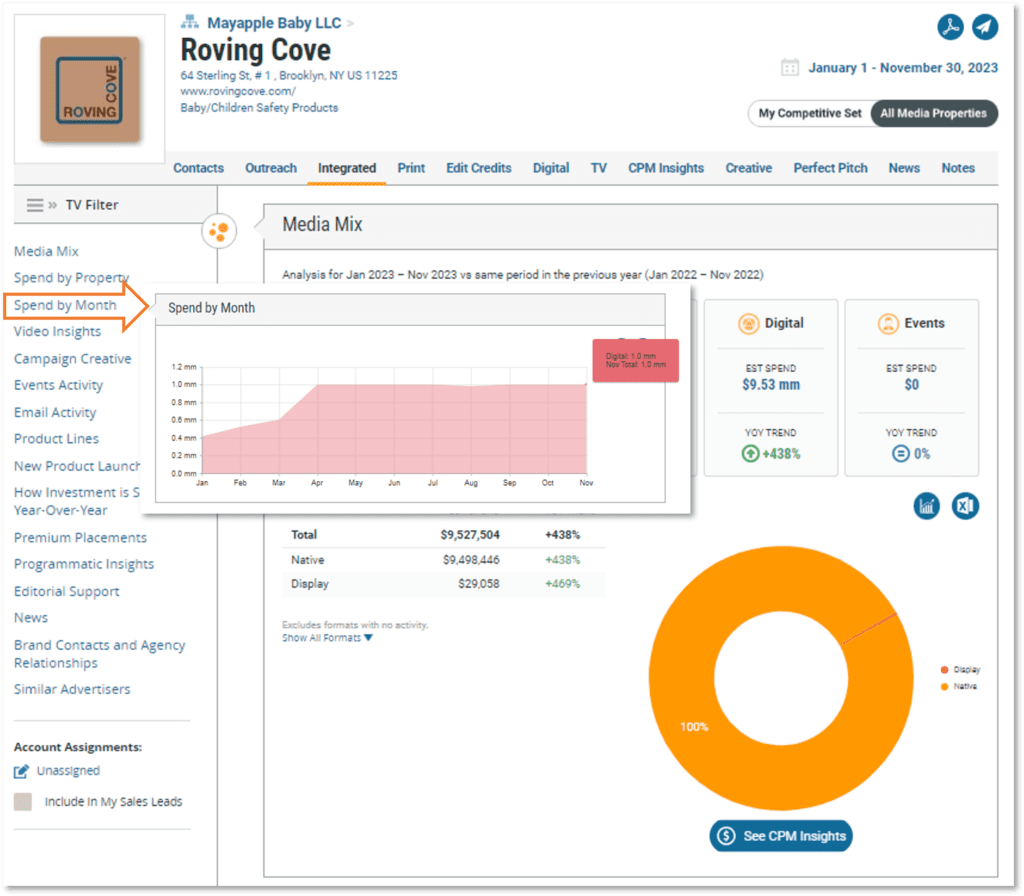

Roving Cove increased by 438% YoY to more than $9.5 million spent through November 2023. The “baby proofing essentials” brand also went 100% (almost, less than $30k in display) with native advertising and 100% were Amazon ads. Spending in April hit $1mm, which has been maintained every month.

MediaRadar Equips You with Ad Intelligence

As a leader in advertising intelligence, MediaRadar’s granular insights equip both advertisers and publishers with the knowledge to capitalize on retail media’s exponential growth. For ad sales professionals, this analysis spotlights the necessity of retail media within modern marketing strategies. Counsel clients to allocate greater portions of budgets to dominant retail media titans like Amazon and Walmart as well as specialized niche platforms.

For publishers seeking revenue opportunities, develop custom ad products and tailored channel partnerships to meet accelerating demand, particularly from high-growth categories like technology, CPG, and apparel. Prioritize retail e-commerce giants boasting vast shopper audiences while crafting attractive inventory offers for emerging retail media networks.

The retail media surge shows no signs of slowing down. By leveraging the right advertising data and intelligence, advertisers can optimize retail media placements driving performance and publishers can monetize this surging ad spend. MediaRadar equips you with actionable insights to stay ahead of rapid retail media developments reshaping the advertising landscape’s competitive edge.