Study: Native ads are soaring as programmatic suffers

MarketingDive - As marketers strive to achieve greater authenticity and produce more narrative-focused content, native advertising is picking up serious traction. Native ads are also popular because the format outperforms traditional ad units, being looked at more frequently than non-native ads, and the clickthrough rate for mobile native ads is 4x higher than non-native mobile ads, Krizelman told MediaPost.

MarketingDive - As marketers strive to achieve greater authenticity and produce more narrative-focused content, native advertising is picking up serious traction. Native ads are also popular because the format outperforms traditional ad units, being looked at more frequently than non-native ads, and the clickthrough rate for mobile native ads is 4x higher than non-native mobile ads, Krizelman told MediaPost.

Given the spike in popularity of native, more major digital players are building out their offerings. Last week, Google rolled out AdSense Native ads that aim to improve the user experience with high-resolution images, along with longer titles and descriptions. Both the MediaRadar findings and the Google news underscore the importance of monetizing mobile content, with native providing opportunity in that area.

ReadReport: Native ads up 74% in Q1, programmatic slows

IAB SmartBrief - Programmatic ad spend dipped 12% in the first quarter compared to the same period last year, per MediaRadar. However, native ad buys jumped 74%, the biggest spike in spend for any ad unit.

ReadReport Says Programmatic Buying Declined In Q1

MediaPost - Media Radar's 2016 Consumer Advertising Report, analyzing ad spend, formats, and ad buying patterns among marketers, found that programmatic ad buying declined 12% in Q1 of 2017 vs. Q1 2016.

According to the ad sales intelligence platform’s data, 45,008 advertisers purchased ads programmatically in Q1 2016, while in Q1 2017, the number of programmatic advertisers dropped 12% year-over-year, down to 39,415.

ReadNew Study Shows That the Number of Native Ad Buyers Increased by 74% in Just One Year

Adweek - While ad spending is down in two key areas, print and programmatic, it’s seen a dramatic increase in native formats.

Adweek - While ad spending is down in two key areas, print and programmatic, it’s seen a dramatic increase in native formats.

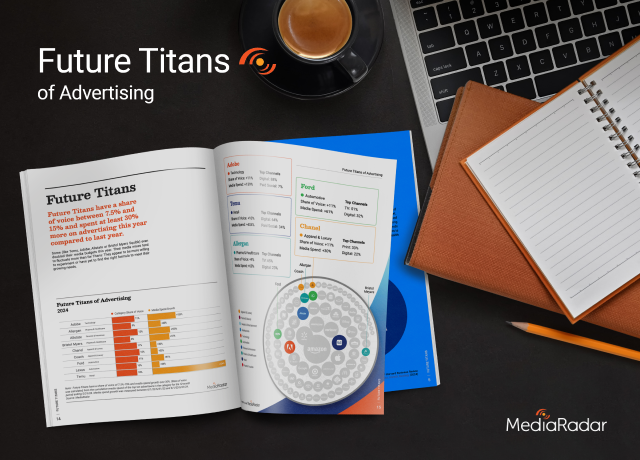

MediaRadar recently analyzed ad spending patterns from print, digital and email advertisers across native, video and mobile campaigns. In its Consumer Advertising Report, the intelligence platform tracked the ad ecosystem through all of 2016 through the first quarter of 2017.

ReadP&G, Unilever scale back digital ad spending

MarketingDive - The news is particularly noteworthy because of the size of the marketers involved — P&G is the world's largest advertiser and Unilever is no slouch when it comes to investing in ads — and therefore could impact the bigger picture if the downturn continues or if other brands follow suit. The development is also a departure from recent forecasts for digital ad spending in 2017, which have mostly painted a rosy picture, At the end of March, Magna predicted slower overall ad revenue growth this year although the company was bullish on digital ad spending. More recently, IAB reported digital ad revenue hit $19.6 billion during Q1, up 23%.

ReadGoogle Likely To Get Its $1 Billion-Plus EU Fine From This Week; Podcast Ad Spend Is Increasing Rapidly

Adexchanger - Sticks And Stones - Google and Facebook have absorbed the abuse of CPG companies on digital measurement standards, but everyone else is absorbing the losses. On top of severe rounds of agency and tech vendor downsizing, Procter & Gamble and Unilever appear to be “materially reducing their budgets as well as the number of sites they buy on,” according to data from analytics firm MediaRadar. In the past year, spending on non-walled garden sites fell 41% at P&G and 59% at Unilever. It’s unclear whether there was a corresponding drop in duopoly dollars, but the fact is that reweighting campaigns to avoid bots or fraud will push more of budgets to big platforms with logged-in users.

Read

Two of the world’s biggest advertisers are cutting back on digital ad spend

Yahoo - Procter & Gamble and Unilever have both aggressively pushed for more transparency in the murky digital media landscape in recent years, even threatening to pull back on digital spending unless the system is cleaned up. And now, it seems like the world’s biggest advertisers are putting their money where their mouths are.

Both P&G and Unilever appear to have pulled back on their digital spending, materially reducing their budgets as well as the number of sites they buy on. According to estimates from MediaRadar, a New York-based advertising intelligence company, P&G’s ad spend dropped 41% year-over-year, while Unilever’s dropped 59%.

ReadTwo of the world’s biggest advertisers are cutting back on their digital ad spend

Business Insider - Procter & Gamble and Unilever have both aggressively pushed for more transparency in the murky digital media landscape in recent years, even threatening to pull back on digital spending unless the system is cleaned up. And now, it seems like the world’s biggest advertisers are putting their money where their mouths are.

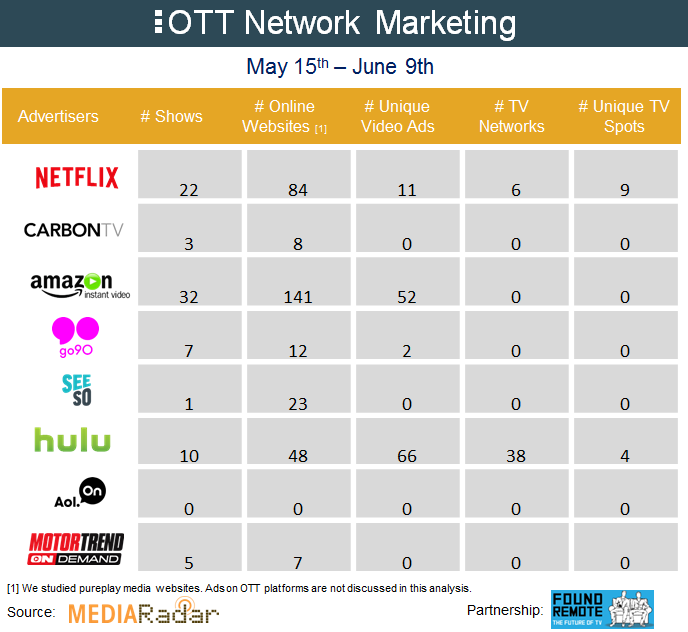

Netflix leads the charge in OTT marketing as the summer heats up

Found Remote is continuing our partnership with MediaRadar, a leading ad-sales intelligence platform to understand how the major OTT platforms are diversifying their marketing efforts. Here are the insights the beginning of the summer.

ReadHere Are 8 Interesting Digital Marketing Stats From This Week – 6/23/2017

AdWeek - Vertical is still nascent - MediaRadar, which uses data science to give ad sales advice on millions of brands, published a trend report on Tuesday that analyzed vertical video advertising by media properties in the first quarter of this year. Looking at more than 100,000 advertisements in Q1, MediaRadar found that only 112 mainstream websites and mobile sites contained vertical video ads. More generally the results from the report are intriguing.

Read