A full-scale advertising boycott of YouTube? A Post Mortem.

Like you, we read those articles last month threatening a full advertiser boycott of YouTube last month (for example, here), fall-out from poor editorial controls. We were curious to see if the list of brands that said they were boycotting actually went through with it. And what impact did that have on YouTube’s overall sales? The results surprised us. Posted below is a quick summary.

ReadShark Week’s Early Run: Bad News for Ads?

It was a dark and stormy night in 1988 when the first Shark Week show premiered: Caged in Fear. Since then, Shark Week has become a major hit with audiences and advertisers alike. According to Nielsen, Shark Week has received up to 2.5 million same-day viewers with a 1.46 rating in primetime.

ReadMore Evidence: Is the Real Estate Market Softening?

Following-up with my recent blog post, Is NYC's Real Estate Bubble Cracking?, where we uncover the decrease in real estate advertisers, I found more revealing evidence about the current state of the real estate market.

ReadSummer Starts Now with Alcohol Advertisers

Summer weather is heating up. It’s shaping up to be a hot season for alcohol advertising. Seasonal advertising has always been a strategic factor in targeting specific audiences. And it’s a great way to promote seasonal cocktails like Pimm’s Cup, matais, daiquiris, or mojitos. From favorites hit songs like Jimmy Buffet’s Margaritaville or Rupert Holmes’ If you Like Pina Coladas to recent top trending hashtag #ThirstyThursday, everyone loves to celebrate summer with cocktails on their patio or a cooler on the beach.

ReadIs NYC’s Real Estate Bubble Cracking?

I read the NY Times article this weekend “Worrisome Pileup of $100 Million Homes” and wondered if the problem was real (or how real). After watching the “The Big Short,” how could you not? Interestingly, the number of advertisers marketing real estate has declined a statistically significant amount in the first four months of the year – online and in print. The dip is most pronounced in NYC and also especially strong with firms selling the most expensive listings. For example, here in NYC the number of real estate advertisers in magazines, newspapers, and online are all down around the same, 10-12%. Major firm advertising is down 26%+ YTD through April. Advertising in the broader tri-state (New York, New Jersey, and Connecticut) market was also down, but much less, just 4-7%.

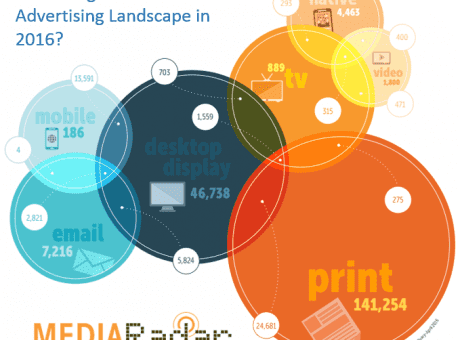

ReadHow Integrated is the Ad Landscape?

Cross-platform is THE new buzzword, but how integrated is advertising really? This infographic shows the strategic overlap of integration for ads across mobile, desktop, online video, email, TV, native and print based on how brands are buying.

ReadThe $80 Billion Sales Opportunity

In October 2006 Google acquired YouTube. Only one year later the firm wrote off the investment, signaling it was a mistake. But this initial difficulty was a false warning. Fast forward 10 years, and investors believe YouTube alone generates $4.9B in video ad revenue. This is encouraging news for every other media company and publisher. Why? Because there is no question that an outsider can come in with compelling content, and sell video advertising. They can completely change the game.

ReadCross-Platform Trends: a changing landscape

After analyzing some of the largest national consumer magazines and their digital properties, we found some interesting trends we’d like to share with you. From desktop domination to mobile maturity, emergence of online video and where print stands – the advertising landscape continues to change. See how marketers are focusing their ad buys and remember to sell across platform. You may find some of the ideas listed below as new opportunities for your business.

ReadTV Spending Moving Over to Digital

Linear TV ad spending is projected at $66B in 2016. With digital stealing away TV ad spending dollars, 2 questions remain; how much money has shifted already from TV to digital and why? As it stands, $1.5B had already shifted from TV to digital in 2015. Despite this being a less than 3% of the projected $66B, this demonstrates how much opportunity is left in this market. But, it's important to understand the factors that contributed to the already present shift from TV to digital amounting to $1.5B:

Read