Native Ad Renewals At 33% In 2016

MediaPost - Despite steep advances in the native advertising space, renewal rates for such ads were at 33% in 2016, according to MediaRadar.

Thousands of publishers sold native ad spots in 2016. As users become banner-blind and annoyed at pre-roll ads, novel native advertising initiatives have looked to bridge the gap between secular content and paid or sponsored content (one iteration of native).

ReadReport: Amazon led big retailers in digital ad spend increases during early holiday season

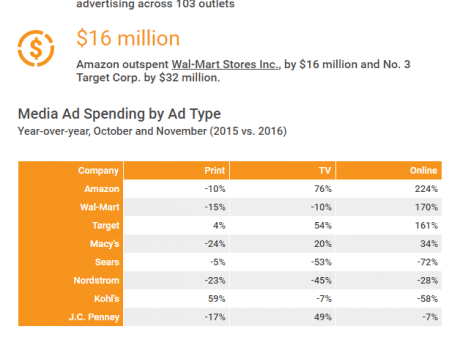

Marketing Land - Amazon led the way among big retailers in increasing their digital holiday advertising spend, according to ad sales intelligence firm MediaRadar, which analyzed sales data from October and November 2016 and 2015. The e-commerce giant increased digital ad spend during the early holiday push by 224 percent year over year. Linear TV ad spend also rose — by 76 percent — while its print investment dropped 10 percent.

ReadAmazon ramps up its holiday TV ad spending

Internet Retailer - Amazon.com Inc., which has not relied heavily on TV advertising in the past, changed course this holiday season and dramatically increased its TV ad spend, according to a study of eight major retailers by ad sales intelligence firm MediaRadar.

Amazon, No. 1 in the Internet Retailer 2016 Top 500, increased its TV advertising by 76% and its digital ad spend by 224% in October and November over the same months in 2015, MediaRadar says. Both year-over-year increases were the largest among the eight retailers studied.

ReadJet.com outpaces rivals when it comes to digital ad spending

Mashable - After a huge TV advertising blitz that lasted through much of the past year, Jet.com removed itself almost entirely from the airwaves this holiday season as it turned its full attention to the digital space.

ReadAs Print Ads Decline, Wal-Mart and Amazon Boost TV, Digital Spending

Women's Wear Daily - MediaRadar’s latest analysis of holiday advertising expenditures by top retailers revealed an overall decline in print ads while spending on digital and TV skyrocketed — especially from Amazon.

The online giant increased its ad spend on TV this season by 76 percent over last year, noted analysts at the advertising sales intelligence platform who added that the retailer “beat out every other top retailer, including Wal-Mart and Target.” Amazon’s digital ad spending was up 224 percent over last year’s holiday shopping season.

ReadAmazon increased holiday TV ad spend in a big way

Amazon beat competitors in a new way this holiday season: Money spent on TV ads

Recode - Amazon hasn’t historically been a big spender on TV commercials for a company of its size. But that has started to change recently, as the company has been more aggressive in pushing its Prime membership program and new gadgets like the Echo voice-controlled speaker.

ReadReport: Amazon Spent $135M in October & November on TV Ads

Android Headlines - According to MediaRadar, Amazon outspent just about all of their competitors in October and November, spending $135 million on TV spots, leading up to the busy holiday season. They outspent Walmart by about $16 million and were $32 million ahead of Target during the same time frame.

ReadAmazon Boosts Holiday TV Spending By 76%

B&C - Online giant Amazon boosted its TV spending during the Christmas shopping season more than any of the other top eight retailers included in a new study by ad tracker MediaRadar. Half of the big retailers reduced their TV spending as holidays approached, while increasing the digital efforts.

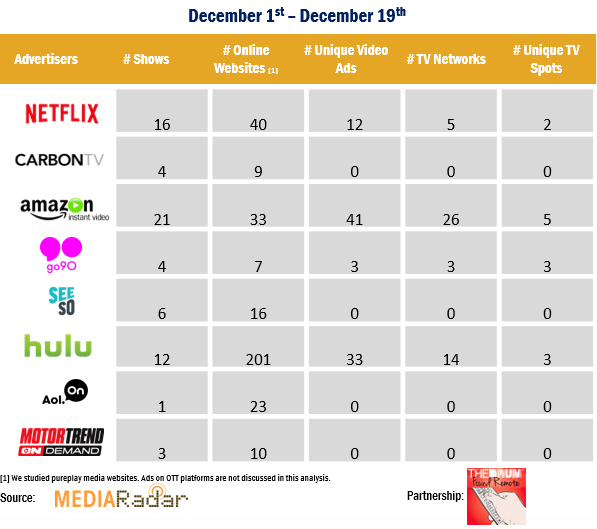

ReadHulu increases marketing in December as Shut Eye premieres

The Drum - In December, Hulu has been dominating, while Netflix is still in the lead. Here are the full insights from MediaRadar.

Insights:

- Hulu dominates December OTT advertising and nearly triples the number of websites they ran across from 68 to 201. Shut Eye (a Hulu original series) was the top promoted show, running across 82% of the 201 sites.